What to do, if the supplier doesn’t meet its obligations under a contract?

Sometimes there is a situation, when for some reason the supplier, which concluded the contract, violates its terms, motivating it by increase of the prices on materials, which are necessary for his work. The current legislation will help to understand such collisions.

Thus, the 19 part of 34 article of the Federal Law № 44 – FZ "On the contract system in state and municipal procurement of goods, works and services" as of 05.04.2013 includes the right of the supplier to accept the decision of the customer about the unilateral refusal to perform the contract, if such right of the customer was provided in the contract.

In most cases the ability of unilateral contract refuse by the supplier or contractor is caused by the existence of agreement violation by the customer.

On the other hand, it should be taken into account, that according to the 2 part of 34 article of the Law № 44 – FZ, as a general rule, the price of the contract is fixed and is determined for a whole period of its execution. Thereby your contractor does not have the right to make a decision about unilateral refusal to perform the contract because of increased prices on materials, which are necessary for work. In such case the supplier can only ask the customer to cancel a contract by agreement between the parties.

Besides, if meeting the criteria, which are provided by the 2 paragraph of 451 article of The Civil Code of the Russian Federation, the contract can be canceled by court decision in connection with a substantial change of circumstances, in case of numerous violation of delivery terms and also if the contractor doesn’t start the performance of the contract in due time or does the job so slowly that to finish it by the deadline becomes clearly impossible. In such instance the customer has the right to cancel a contact.

In case of contract rescission by court decision or unilateral refusal to perform the contract due to essential violation of contract terms by the contractor, the necessary information should be directed by the customer to The Federal Antimonopoly Service of the Russian Federation to include it in the register of unfair suppliers.

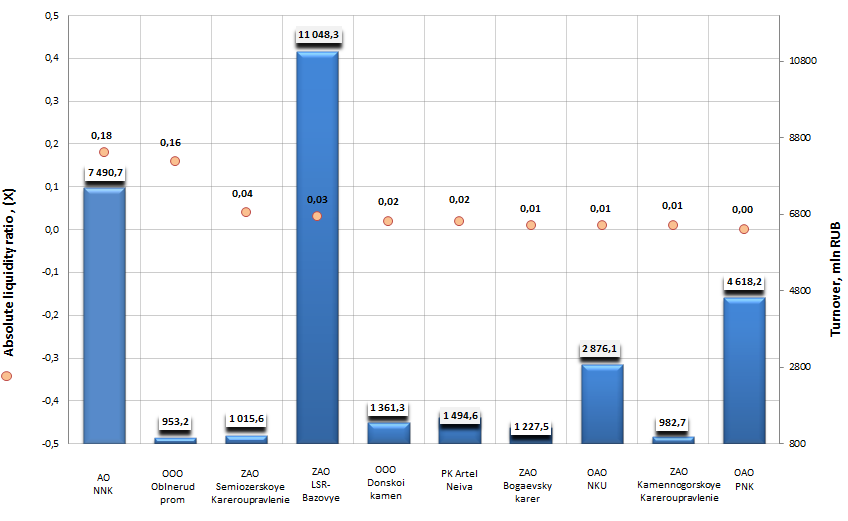

Absolute liquidity ratio of sand and clay manufacturers

Information agency Credinform prepared the ranking of Russian sand and clay manufacturers by absolute liquidity ratio. The companies, taken for the study, are the largest by turnover in this industry in the last available in the Statistical register (2013) period. Further Top-10 companies by turnover were ranked in descending order of absolute liquidity ratio value.

Absolute liquidity ratio is calculated as ratio of monetary assets and short-term financial investments, available for the firm, to short-term liabilities. Thus this ratio shows which share of short-term debt liabilities might be met only by means of absolute liquid assets (monetary assets, cash in hand, on bank accounts, as well as on transaction accounts).

A regulatory restriction (more than 0,2) is adopted for this indicator in international practices of financial analysis. It means that each day no less than 20% of short-term liabilities of company are due to be met. At the same time, in order to analyze Russian companies, it is confirmed to use regulatory value from 0,1 to 0,15, taking into account the special aspects of Russian practices. As too high a value of ratio gives evidence of unreasonably high volumes of free monetary assets, which could have been used for business development.

| № | Name, INN | Region | Turnover 2013, mlnRUB | Absolute liquidity ratio, (х) | Globas-i® solvency index |

|---|---|---|---|---|---|

| 1 | AO Natsionalnaya Nerudnaya Kompaniya (AO NNK) INN 7716614075 |

Moscow | 7491 | 0,18 | 282 (high) |

| 2 | OOOOblnerudprom INN 5007038980 |

Moscow region | 953 | 0,16 | 191 (prime) |

| 3 | ZAO Semiozerskoye Kareroupravlenie INN 4704002570 |

Leningrad region | 1016 | 0,04 | 164 (prime) |

| 4 | ZAO LSR-Bazovye Materialy Severo-Zapad INN 4703124060 |

Leningrad region | 11 048 | 0,03 | 263 (high) |

| 5 | OOO Donskoi kamen INN 6148556263 |

Rostov region | 1361 | 0,02 | 250 (high) |

| 6 | PK Artel Staratelei Neiva INN 6621001424 |

Sverdlovsk region | 1495 | 0,02 | 251 (high) |

| 7 | ZAO Bogaevsky karer INN 5075011344 |

Moscow region | 1227 | 0,01 | 184 (prime) |

| 8 | OAO Novosibirskoye Kareroupravlenie (OAO NKU) INN 5403102519 |

Novosibirsk region | 2876 | 0,01 | 224 (high) |

| 9 | ZAO Kamennogorskoye Kareroupravlenie INN 4704002227 |

Leningrad region | 983 | 0,01 | 230 (high) |

| 10 | OAO Pervaya Nerudnaya Kompaniya (OAO PNK) INN 7708670326 |

Moscow | 4618 | 0 | 259 (high) |

AO Natsionalnaya Nerudnaya Kompaniya is placed on the first line of the ranking. The value of company’s absolute liquidity ratio equals to 0,18. This value slightly exceeds Russian standards; however it corresponds to international recommendations. Experts of Information agency Credinform assign high Globas -i® solvency index to the company, which characterizes it as financially sound one.

Absolute liquidity ratio of sand and clay manufacturers in Russia, Top-10

OOO Oblnerudprom showed the maximum close value of absolute liquidity ratio to domestic standards (0,16). Moreover, the company was assigned the prime Globas-i® solvency index, which bears witness to the high ability to meet debt obligations.

The rest of the companies from ranking showed the bottom values of absolute liquidity ratio, which may speak for lack of quick assets in order to meet short-term obligations. However all the Top-10 companies in this ranking were assigned high and prime Globas-i® solvency index, gives evidence of minimal risk of financial insolvency within 12 months.

In conclusion, it should be mentioned that in order to stay financially sound, it is necessary to strike a balance between the sufficient quantities of liquid assets and adequate amount of short-term loans, i.e. to manage its own debt load efficiently.