Quick ratio of footwear manuracturers

Information agency Credinform has prepared a ranking of the largest Russian footwear manufacturers. Companies with the largest annual revenue (Top-10) were selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 - 2017). Then they were ranked by quick ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Quick ratio (x) characterizes company’s solvency in the short and medium term. The indicator is illustrative of the possibility of an enterprise to repay its short-term liabilities by its most liquid assets: cash, short-term receivables and short-term financial investment. Recommended value of the ratio is from 0,5 to 0,8.

Too high ratio value may indicate irrational capital structure. It may be connected with a slow turnover of funds invested in stocks and an increase in accounts receivable. A low level of the indicator means that the funds and the upcoming income from current operations do not cover company’s current liabilities.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all indicators and financial ratios.

| Name, INN, region | Sales revenue, million RUB | Net profit (loss), million RUB | Quick ratio (x), from 0,5 to 0,8 | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| NJSC EGORJEVSK-SHOES INN 5011017647 Moscow region |

3289,9 3289,9 |

2910,1 2910,1 |

541,1 541,1 |

436,6 436,6 |

3,44 3,44 |

4,28 4,28 |

156 Superior |

| NJSC PTK MODERAM INN 7816057195 Saint Petersburg |

1323,8 1323,8 |

1165,8 1165,8 |

2,8 2,8 |

3,3 3,3 |

0,16 0,16 |

0,23 0,23 |

214 Strong |

| STEPTRADE LLC INN 6901034920 Tver region |

1072,5 1072,5 |

1130,6 1130,6 |

10,9 10,9 |

8,8 8,8 |

0,10 0,10 |

0,15 0,15 |

273 Medium |

| NJSC PARITET INN 5020080885 Moscow region |

825,3 825,3 |

2110,7 2110,7 |

3,1 3,1 |

10,5 10,5 |

0,04 0,04 |

0,13 0,13 |

236 Strong |

| NJSC Moscow Footwear Factory Paris Commune INN 7705032967 Moscow |

1839,4 1839,4 |

1994,5 1994,5 |

11,8 11,8 |

9,4 9,4 |

0,06 0,06 |

0,08 0,08 |

237 Strong |

| NJSC Ralf Ringer INN 7718160370 Moscow |

4911,7 4911,7 |

5578,0 5578,0 |

570,5 570,5 |

224,1 224,1 |

0,02 0,02 |

0,04 0,04 |

205 Strong |

| AVANGARD SAFETY GROUP LLC INN 7721753959 Moscow |

1909,7 1909,7 |

1948,5 1948,5 |

95,9 95,9 |

41,3 41,3 |

0,01 0,01 |

0,03 0,03 |

249 Strong |

| PF LEL LLC INN 4329004775 Kirov region |

1050,6 1050,6 |

1157,7 1157,7 |

139,2 139,2 |

114,9 114,9 |

0,06 0,06 |

0,01 0,01 |

175 High |

| NJSC FOOTWEAR FIRM UNICHEL INN 7448008453 Chelyabinsk region |

2992,7 2992,7 |

3137,9 3137,9 |

109,9 109,9 |

126,1 126,1 |

0,00 0,00 |

0,01 0,01 |

184 High |

| BRIS-BOSFOR LLC INN 7705344035 Krasnodar territory Bankruptcy claim was filed against the company |

2472,9 2472,9 |

2473,2 2473,2 |

12,7 12,7 |

14,1 14,1 |

0,01 0,01 |

0,00 0,00 |

350 Adequate |

| Total for Top-10 companies |  21688,3 21688,3 |

23606,9 23606,9 |

1498,0 1498,0 |

989,0 989,0 |

|||

| Average for Top-10 companies |  2168,8 2168,8 |

2360,7 2360,7 |

149,8 149,8 |

98,9 98,9 |

0,39 0,39 |

0,50 0,50 |

|

| Average industry value |  59,8 59,8 |

70,9 70,9 |

4,2 4,2 |

3,4 3,4 |

0,17 0,17 |

0,16 0,16 |

|

— improvement compared to prior period,

— improvement compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

Average value of quick ratio of Top-10 companies is much higher than the average industry one. In 2017 no company had this ratio within the recommended values.

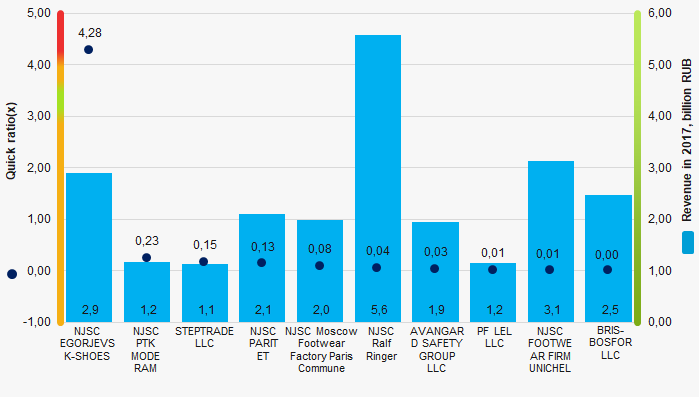

Picture 1. Quick ratio and revenue of the largest Russian footwear manufacturers (Top-10)

Picture 1. Quick ratio and revenue of the largest Russian footwear manufacturers (Top-10)During the decade average industry quick ratio tended to decrease (Picture 2).

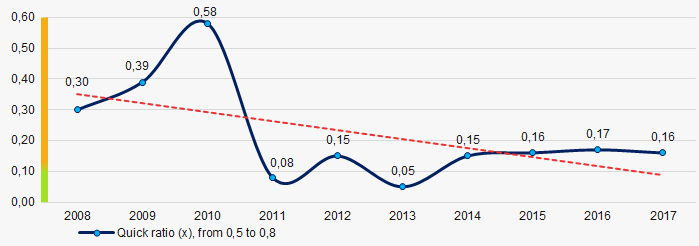

Picture 2. Change in average industry quick ratio of Russian footwear manufacturers in 2008 – 2017

Picture 2. Change in average industry quick ratio of Russian footwear manufacturers in 2008 – 2017 TOP-10 regions by the total profit of companies

An universal indicator, by which one can judge the scale of a business, is the volume of revenue. How efficiently the company operates in the market is indicated by the derived index from revenue - profit or loss. Revenue is demonstrated by any operating firm, but not all of them are profitable. The number of profitable companies, as well as their total profit can show the concentration ratio of Russian business in a regional level, the attractiveness of one or another territory for the development of entrepreneurship.

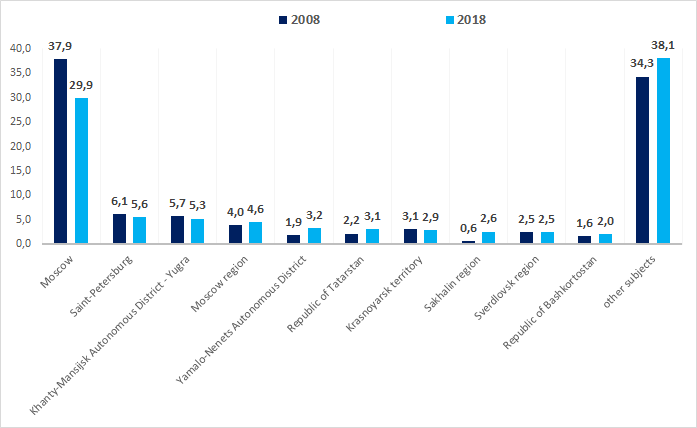

Moscow is the center of country's economic life, the city where the largest, most competitive and successful enterprises are located, which sometimes not conduct production activities directly in the capital. It’s hard to argue against this thesis, namely in Moscow, according to the results of 2018, 29,9% of the total profit of Russian companies were formed. St. Petersburg is in the second place with a noticeable lag: only 5,6% of total corporate profit were earned in the city on the Neva. The third place is occupied by Khanty-Mansijsk Autonomous District - Yugra – 5,3%.

In total, almost 62% of profit are accounted for by TOP-10 regions, the remaining 75 regions - a little over a third - 38%. This indicates the maintaining of a high degree of concentration of entrepreneurial activity in a small group of economically significant subjects to the detriment of the rest.

Picture 1. TOP-10 regions in terms of the maximum share of companies’ total profit, % of the total profit of enterprises in the country; comparison of indicators of 2008 and 2018

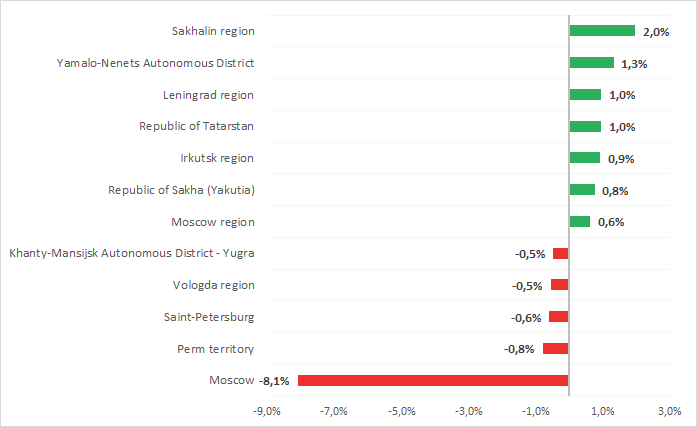

Picture 1. TOP-10 regions in terms of the maximum share of companies’ total profit, % of the total profit of enterprises in the country; comparison of indicators of 2008 and 2018However, if we consider the dynamics of the distribution of companies’ profit by regions over the past 10 years, we can make an interesting conclusion: the total share of profitable organizations of Moscow in the total profit of Russian companies decreased by a substantial 8,1% (s. Picture 2). This was the maximum decrease among all the subjects of the RF.

On the other hand, the share in the total profit of companies of the Sakhalin region increased by 2%, of the organizations of the Yamalo-Nenets Autonomous District - by 1,3%, of the enterprises of Leningrad region - by 1%.

In other words, there is a slow, gradual flow of business from the capital to regions. This process can be considered exclusively as a boon for the country as a whole.

Picture 2. The maximum decrease / increase in the share of total profit of regional companies from the total profit of all companies of the country in 2018 compared to 2008, %

Picture 2. The maximum decrease / increase in the share of total profit of regional companies from the total profit of all companies of the country in 2018 compared to 2008, %