Return on assets of the largest enterprises of the real economy sector of St. Petersburg

Information agency Credinform offers a ranking of the largest enterprises of the real economy sector of St. Petersburg. The companies with the largest volume of annual revenue (TOP-1000 and TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods from 2007 to 2016. Then (Table 1) they were ranked by the return on assets ratio. The analysis was made on the basis of the data of the Information and Analytical system Globas.

Return on assets (%) is calculated as the relation of the sum of net profit and interest payable to the total assets value of a company and shows how many monetary units of net profit gets every unit of total assets. The ratio characterizes the effectiveness of using by the company of all available resources and financial management. The higher is the ratio value, the more effective is business, that is the higher return per every monetary unit invested in assets.

Dynamics of this indicator should be considered. Its subsequent decrease points to the decline in the efficiency of the use of assets.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, main type of activity | Revenue, mln RUB | Net profit, mln RUB | Return on assets, % | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| PETRO LLC INN 7834005168 Manufacture of tobacco products |

47 274,7 | 64 882,8 | 10 653,1 | 12 515,8 | 34,97 | 26,48 | 199 High |

| Baltika Breweries LLC INN 7802849641 Beer production |

86 608,4 | 90 525,2 | 12 030,9 | 14 308,2 | 11,20 | 11,70 | 183 High |

| Gazprom Neft PJSC INN 5504036333 Wholesale of solid, liquid and gaseous fuels |

1 272 981,1 | 1 233 847,8 | 16 145,8 | 122 462,2 | 1,15 | 8,34 | 180 High |

| AGROTORG LLC INN 7825706086 Other retail sale in non-specialized stores |

228 908,6 | 481 713,4 | 499,0 | 10 567,9 | 0,34 | 5,42 | 212 Strong |

| ROSSIYA AIRLINES NJSC INN 7810814522 Transportation by air passenger transport |

38 754,5 | 73 189,0 | 817,7 | 904,5 | 6,91 | 4,56 | 197 High |

| LENENERGO PJSC INN 7803002209 Transmission of electricity and technological connection to distribution networks |

43 726,7 | 61 260,1 | -5 916,5 | 7 561,3 | -3,04 | 4,01 | 205 Strong |

| GAZPROM TRANSGAZ SAINT-PETERSBURG LLC INN 7805018099 Gas transportation through pipelines |

69 248,9 | 71 687,4 | 1 223,6 | 2 032,5 | 2,43 | 3,97 | 189 High |

| O`KEY LLC INN 7826087713 Retail sale mainly of food products in non-specialized stores |

170 598,6 | 180 587,1 | 448,0 | 2 152,2 | 0,71 | 3,03 | 215 Strong |

| LONG-DISTANCE AND INTERNATIONAL TELECOMMUNICATIONS ROSTELECOM PJSC INN 7707049388 Activity in the field of communication on the basis of wire technologies |

283 169,5 | 282 684,9 | 21 564,5 | 10 902,2 | 3,78 | 1,90 | 260 Medium |

| GAZPROM MEZHREGIONGAZ LLC INN 5003021311 Wholesale of solid, liquid and gaseous fuels |

853 476,4 | 884 803,2 | -29 787,8 | -31 359,5 | -3,51 | -3,61 | 215 Strong |

| Total by TOP-10 companies | 3 094 747,4 | 3 425 180,7 | 27 678,4 | 152 047,4 | |||

| Average value by TOP-10 companies | 309 474,7 | 342 518,1 | 2 767,8 | 15 204,7 | 5,50 | 6,58 | |

| Average value by TOP-1000 companies | 4 583,2 | 4 904,7 | 12,3 | 347,0 | 6,51 | 6,57 | |

The average value of the return on assets ratio of TOP-10 companies is above the average value of TOP-1000 enterprises. Seven from TOP-10 companies increased revenue and net profit indicators in 2016 in comparison with the year 2015. The enterprises, which decreased revenue, profit and return on assets indicators in comparison with the previous periods are marked with red filling in from 2nd up to 7th columns in Table 1.

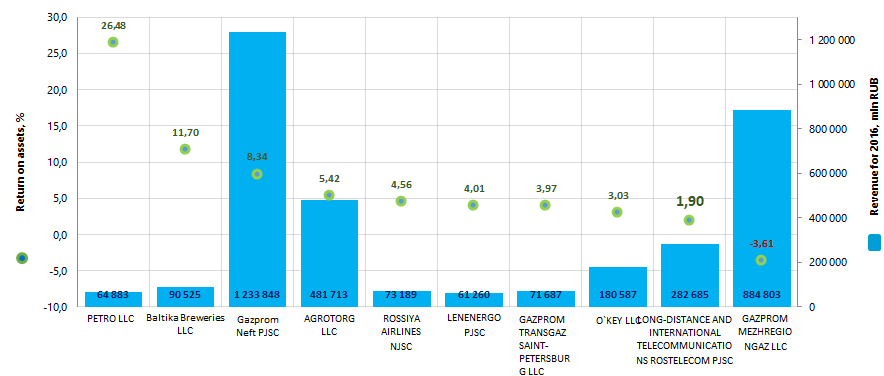

Picture 1. Return on assets ratio and revenue of the largest enterprises of the real economy sector of St. Petersburg (TOP-10)

Picture 1. Return on assets ratio and revenue of the largest enterprises of the real economy sector of St. Petersburg (TOP-10)The industry average values of the return on assets ratio tended to increase over the past three years (Picture 2).

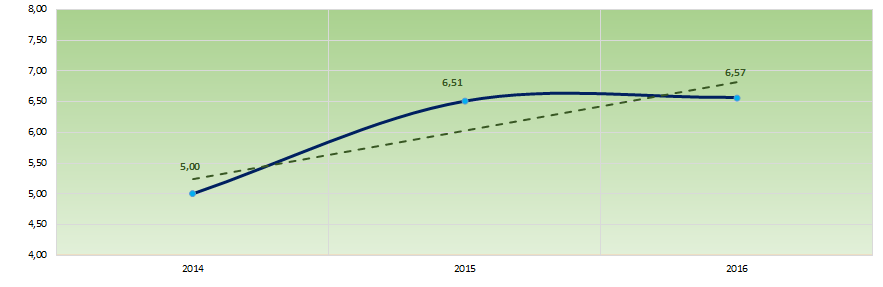

Picture 2. Change in the average industry values of the return on assets ratio of the largest enterprises of the real economy sector of St. Petersburg in 2014 – 2016

Picture 2. Change in the average industry values of the return on assets ratio of the largest enterprises of the real economy sector of St. Petersburg in 2014 – 2016All TOP-10 companies got High or Strong/Medium solvency index Globas, that testifies to their ability to repay their debt obligations timely and fully.

Trends in production, distribution and of motion pictures, video films and television broadcasts

Information agency Credinform observes tendencies in the sphere of production, distribution and release of motion pictures, video films and television broadcasts.

The companies with the highest volume of revenue (TOP-10 and TOP-3000) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2015 and 2016). Analysis was based on the data from the Information and Asnalytical system Globas.

Legal forms and unreliable data

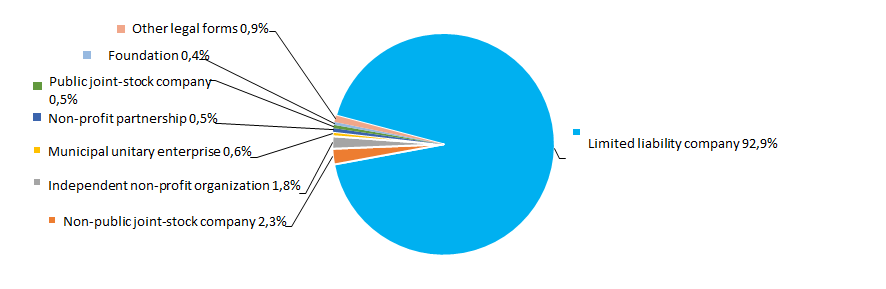

The most widespread legal form in the industry is a Limited liability company. Significant shares make non-public joint-stock companies (Picture 1).

Picture 1. Distribution of TOP-3000 companies by legal forms

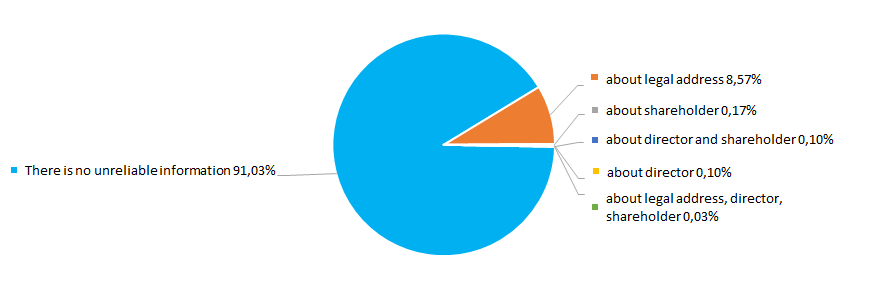

Picture 1. Distribution of TOP-3000 companies by legal formsFollowing the results of the investigations of the Federal Tax Service of the RF, almost 9% of companies in the industry are entered records about unreliable data to the Unified state register of legal entities (EGRUL) (Picture 2).

Picture 2. Shares of TOP-3000 companies, with records in the EGRUL about unreliable data

Picture 2. Shares of TOP-3000 companies, with records in the EGRUL about unreliable dataSales revenue

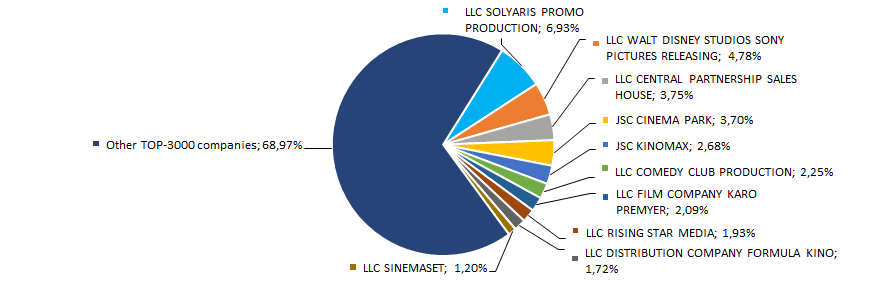

Revenue of 10 leaders of the industry in 2016 was 31% from the total revenue of the 3000 largest companies. This demonstrates relatively high level of competition in the industry. The largest company in terms of revenue volume in 2016 was LLC SOLYARIS PROMO PRODUCTION – enterprise involved in filming and television content production for Russian and foreign TV channels; production and producing of feature films; entitling Russian TV channels with rights for foreign films exhibition; managing of music TV channel TNT MUSIC; developing of promising projects in the sphere of Internet and mobile technologies; launching premium-class restaurants (Picture 3).

Picture 3. Shares of TOP-10 companies in the total revenue of 2016 of TOP-3000

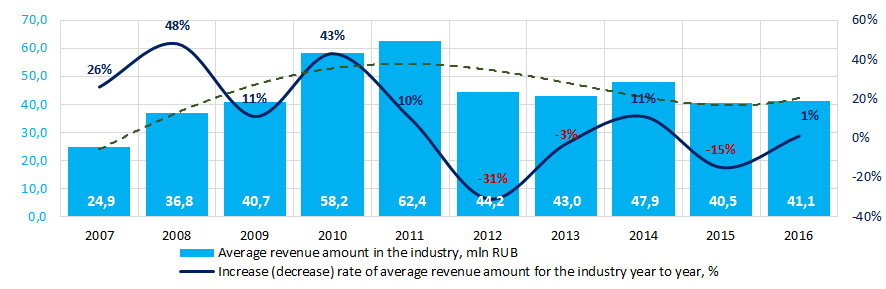

Picture 3. Shares of TOP-10 companies in the total revenue of 2016 of TOP-3000The best results in the industry in terms of revenue volume for a ten-year period were reached in 2011. During crisis periods in the economy in 2012, 2013 and 2015 average industrial values have decreased. In general, the tendency for increasing of revenue volume is observed (Picture 4).

Picture 4. Change in average industrial values of revenue in the sphere of film making companies in 2007 – 2016

Picture 4. Change in average industrial values of revenue in the sphere of film making companies in 2007 – 2016Profit and loss

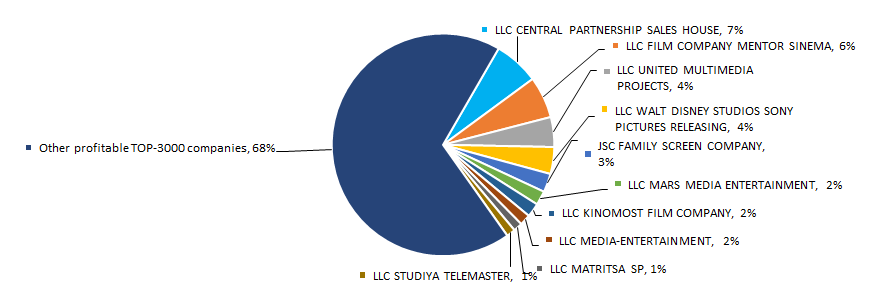

Profit volume of 10 leaders of the industry in 2016 was 32% of the total profit of TOP-3000 companies. LLC CENTRAL PARTNERSHIP SALES HOUSE takes lead in 2016 in terms of profit volume – one of the largest television and film distributors in Russia (Picture 5).

Picture 5. Shares of TOP-10 companies in the total profit volume of TOP-3000 companies in 2016

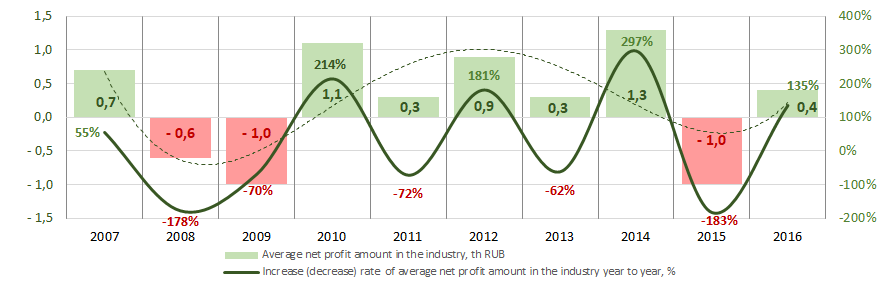

Picture 5. Shares of TOP-10 companies in the total profit volume of TOP-3000 companies in 2016Average industrial values of the companies` profit indicators for ten years are not stable. Negative values of the indicator were observed in 2008 – 2009 and 2015. In general, profit indicators have increasing tendency. The best results in the industry were shown in 2014 (Picture 6).

Picture 6. Change of the average industrial indicators of profit for film making companies in 2007 – 2016

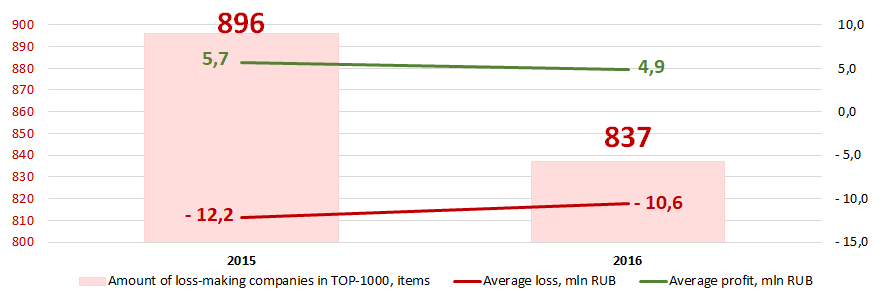

Picture 6. Change of the average industrial indicators of profit for film making companies in 2007 – 2016Among the TOP-3000 group 896 loss-making companies or 30% were observed in 2015. The amount increased to 837 companies or by 28% in 2016. Besides, average amount of loss has 13% increased. For the rest of TOP-300 companies, average amount of profit has 14% decreased for the same period (Picture 7).

Picture 7. Amount of loss-making companies, average values of loss and profit for TOP-3000 companies in 2015 – 2016

Picture 7. Amount of loss-making companies, average values of loss and profit for TOP-3000 companies in 2015 – 2016Key financial ratios

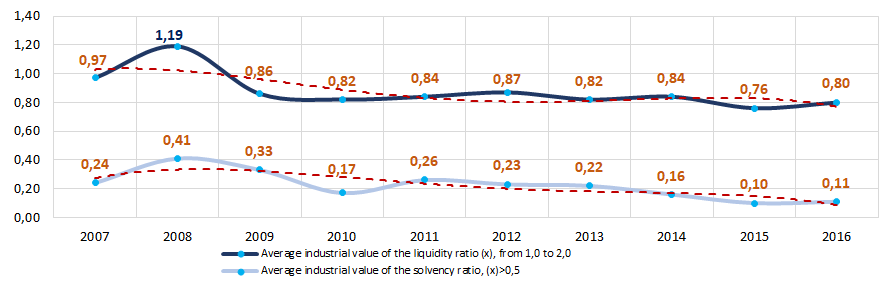

For ten years average indicators of current liquidity ratio in the industry were below the interval of the recommended values – from 1,0 to 2,0 and higher, except for 2008 (Picture 8).

In general, indicator of the ratio has decreasing tendency.

Current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Solvency ratio (equity to balance sheet amount) shows the dependence of the company on external loans. The recommended value: >0,5. A value less than a minimum one indicates high dependence on external sources of funds.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. For shipbuilding industry practical value of the solvency ratio is from 0,02 to 0,85 in 2016.

For a ten-year period average indicators of the ratio were lower than recommended values for eight years and in the interval of practical values for the whole period (Picture 8).

In the whole, indicator of the ratio has decreasing tendency.

Picture 8. Change of average industrial values of the current liquidity and solvency ratios for film-making companies in 2007 – 2016

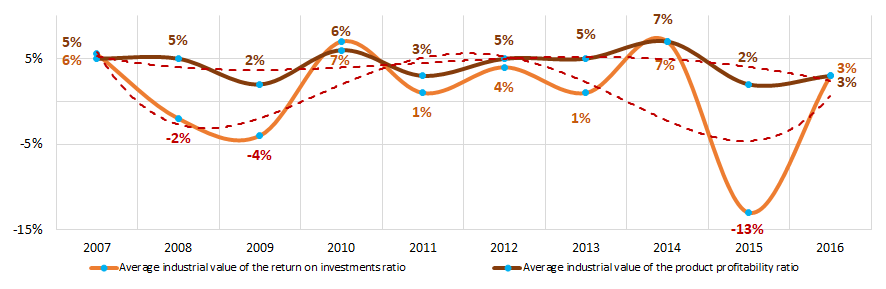

Picture 8. Change of average industrial values of the current liquidity and solvency ratios for film-making companies in 2007 – 2016During ten years unstable indicators of the return on investments ratio with decreasing tendency were observed. In 2008 – 2009 and 2015 indicators decreased to negative values (Picture 9). The ratio is net profit to the total equity and long-term liabilities and demonstrates profit from the equity involved into commercial activities and long-term external funds of the company.

Indicators of the product (service) profitability ratio were relatively stable with decreasing tendency (Picture 9).

The ratio is sales revenue to expenses from ordinary activities. Totally, profitability indicates the economic efficiency of production.

Picture 9. Change of average industrial values of the return on investments and the product profitability ratios for film-making companies in 2007 – 2016

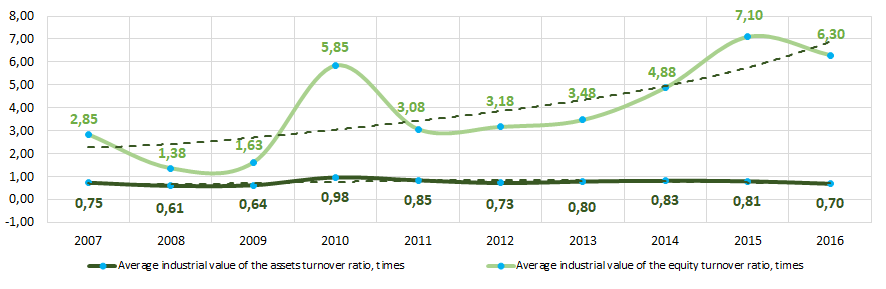

Picture 9. Change of average industrial values of the return on investments and the product profitability ratios for film-making companies in 2007 – 2016The assets turnover ratio is sales revenue to average total assets for a period and characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating profit.

The equity turnover ratio is calculated as a ratio of revenue to yearly average sum of equity and demonstrates the company’s usage rate of total assets.

For ten years both ratios of business activity demonstrated increasing tendency (Picture 10).

Picture 10. Change of average industrial values of the business activity ratios for film making companies in 2007 – 2016

Picture 10. Change of average industrial values of the business activity ratios for film making companies in 2007 – 2016Production and services structure

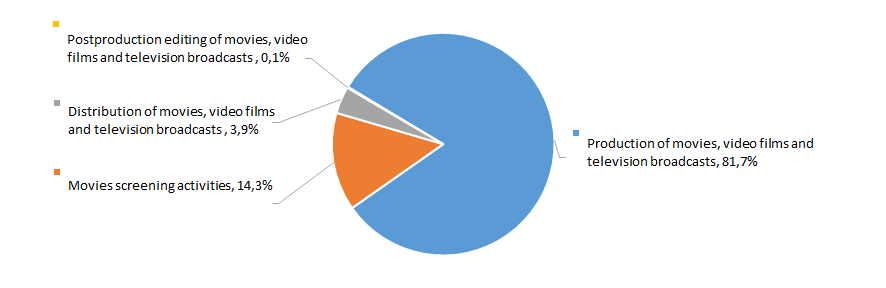

Major part of TOP-3000 companies specializes in production of motion pictures, video films and television broadcasts (Picture 11).

Picture 11. Distribution of TOP-3000 companies by types of output, %

Picture 11. Distribution of TOP-3000 companies by types of output, %Dynamics of business activity

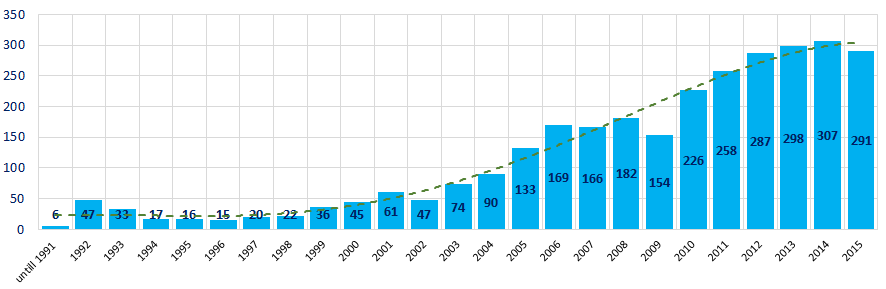

Over a 25-year period, the registered companies from TOP-3000 list are unequally distributed by the year of foundation. Most of companies in the industry were founded in 2014. In general, increasing tendency for amount of registered companies is observed (Picture 12).

Picture 12. Distribution of TOP-3000 companies by years of foundation

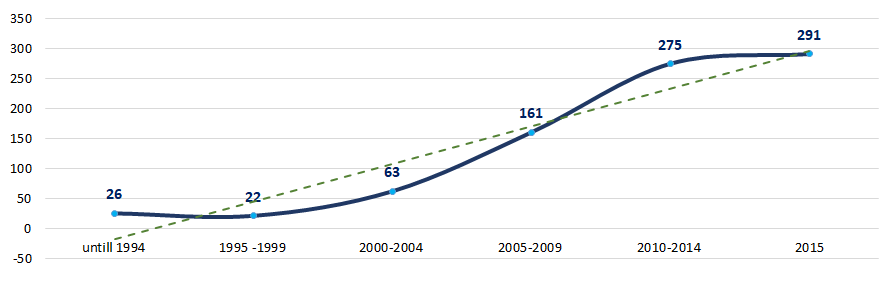

Picture 12. Distribution of TOP-3000 companies by years of foundationOutstanding interest for production, distribution and release of motion pictures, video films and television broadcasts was paid after 2010 (Picture 13).

Picture 13. Average amount of TOP-3000 companies, registered per year, in terms of foundation periods

Picture 13. Average amount of TOP-3000 companies, registered per year, in terms of foundation periodsMain regions of activity

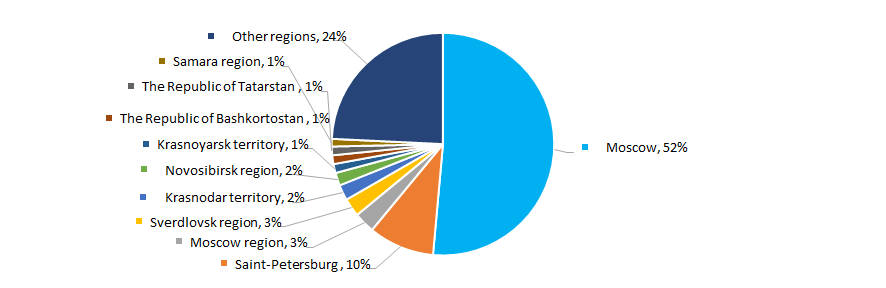

Film making companies are distributed unequally on the territory of the country. Most of the companies are registered in Moscow – the largest financial center of the country (Picture 14).

TOP-3000 companies are registered in 80 regions of Russia.

Picture 14. Distribution of TOP-3000 companies throughout regions of Russia

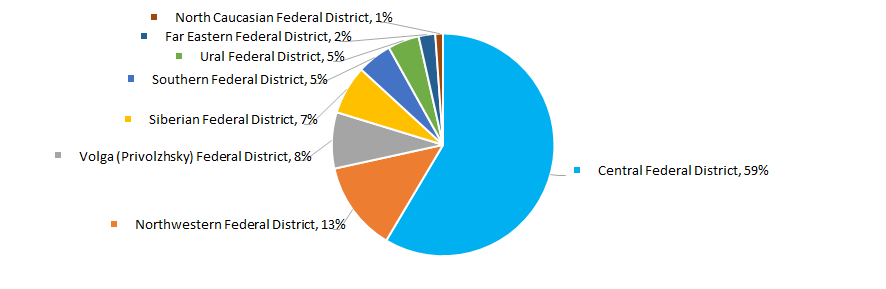

Picture 14. Distribution of TOP-3000 companies throughout regions of RussiaThe majority of film making companies is centered in the Central Federal District of the RF (Picture 15).

Picture 15. Distribution of TOP-3000 companies throughout federal districts of Russia

Picture 15. Distribution of TOP-3000 companies throughout federal districts of RussiaShare of companies from the TOP-3000 group, having branches or representative offices, amounts to 1,2%.

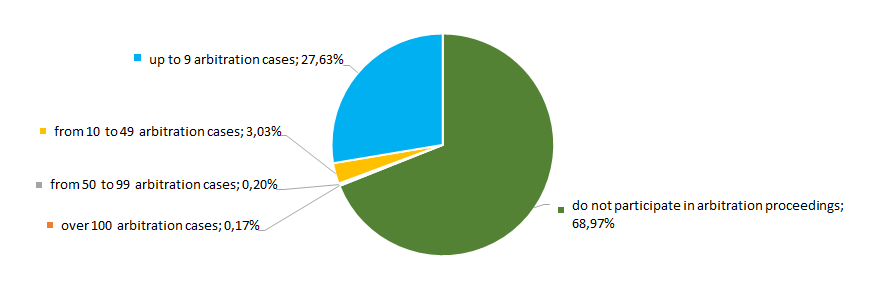

Participation in arbitration proceedings

Overwhelming majority of companies in the industry does not participate in arbitration proceedings or participate inactively (Picture 16).

Picture 16. Distribution of TOP-3000 companies by participation in arbitration proceedings

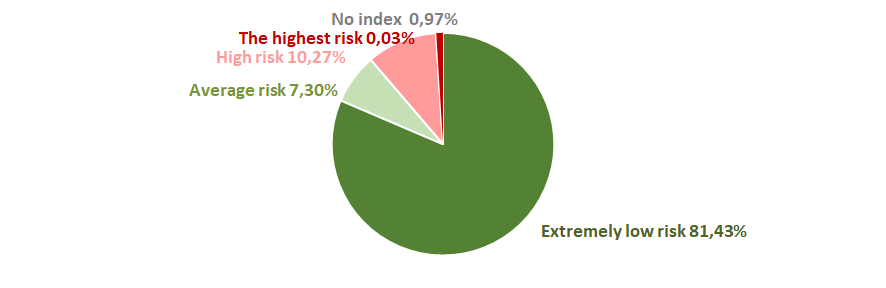

Picture 16. Distribution of TOP-3000 companies by participation in arbitration proceedingsReliability index

In terms of signs of «fly-by-night» or unreliable companies the majority of companies demonstrate extremely low risk of cooperation (Picture 17).

Picture 17. Distribution of TOP-3000 by Reliability index

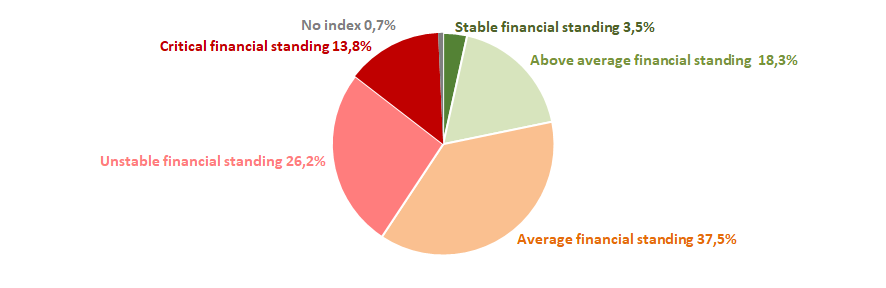

Picture 17. Distribution of TOP-3000 by Reliability indexFinancial position score

Assessment of financial state of the sector’s companies indicates that the most of the companies have an average financial standing. However, share of companies that have unstable or critical financial standing amounts to significant amount of 40% (Picture 18).

Picture 18. Distribution of TOP-3000 companies by Financial position score

Picture 18. Distribution of TOP-3000 companies by Financial position scoreLiquidity index

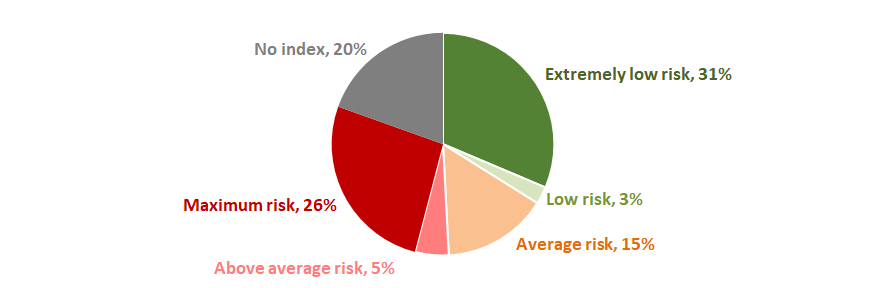

31% of the sector`s companies demonstrate an extremely low levels of bankruptcy risk in the short-term period. Companies with maximum and above average levels of risk make the same share (Picture 19).

Picture 19. Distribution of TOP-3000 companies by Liquidity index

Picture 19. Distribution of TOP-3000 companies by Liquidity indexSolvency index Globas

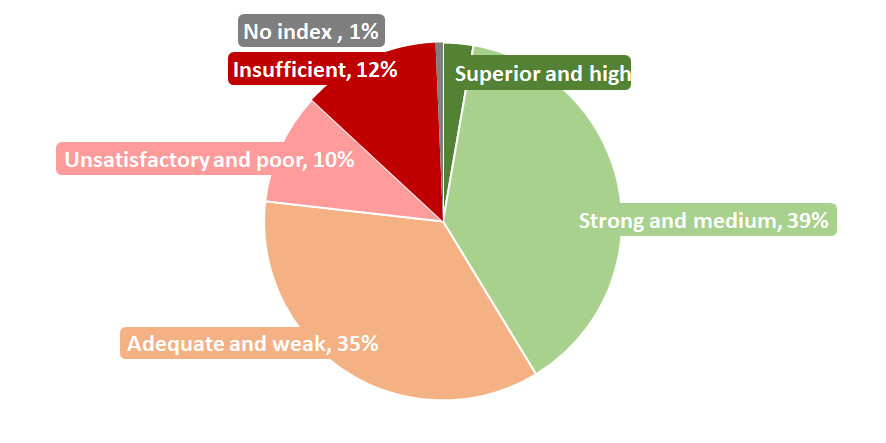

Most of the TOP-3000 companies have got from superior to medium Solvency index Globas that shows their ability to pay debts in time and to the full extent (Picture 20).

Picture 20. Distribution of TOP-3000 by Solvency index Globas

Picture 20. Distribution of TOP-3000 by Solvency index GlobasTherefore, complex assessment of film making companies, taking into accounts key indexes, financial figures and ratios, demonstrate relatively favorable trends within the industry.