Problems of 223-FZ application in practice of procurements pursuing

At the moment a number of legal entities follow the federal law №223-FZ “On procurements of goods, works, services by certain legal entities” as of 18.07.2011 (as in force on 13.07.2015) in order to purchase goods, works and services for their own needs.

These entities include: state corporations, state companies, natural monopoly holders, state and municipal enterprises, companies with state share exceeding 50%, as well as enterprises operating regulated types of activity in the fields of power, gas, heat and water supply, water disposal, wastewater treatment, processing, utilization, treatment and burial of municipal solid waste. This category includes as well subsidiary companies of all the listed entities providing participation in equity exceeding in total 50%.

The analysis of state companies’ procurements by 223-FZ carried out by the Ministry of Economic Development of the Russian Federation showed the following statistics: the total sum amounted to 23,1 trillion RUB, number of placed procurements - 1,4 mln. The Top-5 largest players are (see Table 1): Rosneft, RZhD, Gazprom pererabotka Blagoveshchensk, Gazprom and Uralsevergaz. More than 50% of procurements are accounted for by these companies. In the whole the increase of order volume amounted to 23% and the deal volume is close to 30% of GDP. According to the primary estimation of the Rosstat (Federal State Statistics Service) following the results of 2015, the GDP equals to 80,412 trillion RUB.

| Name of the company | Procurement volume, trillion RUB |

|---|---|

| AO NK Rosneft | 4,6 |

| AO RZhD | 3,4 |

| OOO Gazprom pererabotka Blagoveshchensk | 1,6 |

| PAO Gazprom | 1,5 |

| NAO Uralsevergaz-nezavisimaya gazovaya kompaniya | 1,3 |

Several negative factors were identified in the course of the 223-FZ application analysis carried out by the Ministry of Economic Development:

- an oversize amount of electronic trading platforms (ETP) complicates accounting of deals, control over compliance with procurement requirements and doesn’t provide the sufficient level of their transparency;

- slackening of competition in the sphere of procurements – in particular, more than 95% of procurements were carried out on the non-competitive basis, 40% - with a single supplier;

- procurements of the large customers for small and medium business (SME) are not attractive on the one hand, on the other – the SME is unable to provide the fulfillment of the large order;

- application of procedures masking the single supplier procurements, due to lack of the procurement methods list and competitive requirements to carrying out of procurements in 223-FZ;

- limited terms for applying to take part in the procurements in electronic format;

- about quarter of tenders in the total amount of executed contracts are “arranged”;

- less-than-full information in the contract register, discrepancy in procurement plans and their results – there is only information about the half of the executed contracts, the total sum is lowered;

- termination of tenders typical for certain industries in order to eliminate the unwanted parties,;

- the number of reasonable complaints within 223-FZ in 2015 equaled to about the half of the total amount of the filed complaints;

etc.

The identified trends lead to increase of cooperation risks and might adversely reflect on the customer and procurement parties. The business is suffering in any case. The Information and Analytical system Globas-i makes it possible to manage (reduce) these risks. Together with an aim to check the contractor’s reliability, the System gives an opportunity to study and analyze the contracts by 44(94)-FZ and procurements by 223-FZ and 44-FZ and to solve other business problems.

Return on sales of the largest Russian manufacturers of railway rolling stock

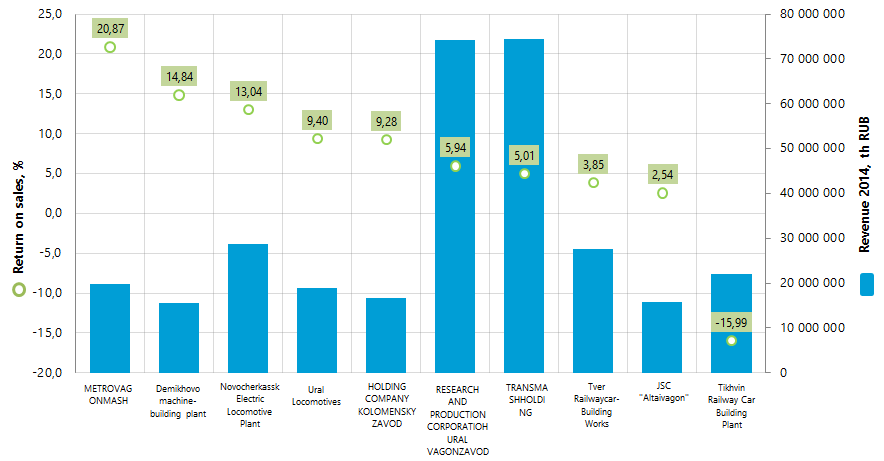

Information agency Credinform prepared a ranking of the major Russian manufacturers of railway rolling stock.

Top-10 companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by decrease in return on sales ratio. Moreover, data on revenue dynamics in accordance with the previous financial year and the solvency index GLOBAS-i are presented (see table 1).

Return on sales (%) is the share of operating profit in the company's sales volume. Return on sales ratio characterizes the most important indicators of the company - the efficiency of industrial and commercial activity. The ratio shows residual funds from the sale of products after covering its costs, loans interest’s expense and taxes.

Return on sales is an indicator of the pricing policy of the organization and its ability to control costs. Differences in competitive strategies and product lines cause considerable diversity of return on sales values in the companies. Therefore, it should be noted that at equal values of revenues, operating expenses and pre-tax profit in two different organizations the return on sales can vary greatly under the influence of the volume of interest payments on the net profit.

| Name, INN | Region | Revenue, 2014, th RUB | Revenue 2014 to 2013, %% | Return on sales, % | Solvency index Globas-i® |

|---|---|---|---|---|---|

| JOINT STOCK COMPANY METROVAGONMASH INN 5029006702 |

Moscow region | 19 844 427 | 69 | 20,87 | 157 the highest |

| Joint Stock Company Demikhovo machine-building plant INN 5073050010 |

Moscow region | 15 533 683 | 171 | 14,84 | 307 satisfactory |

| Novocherkassk Electric Locomotive Plant LLC INN 6150040250 |

Rostov region | 28 650 564 | 96 | 13,04 | 234 high |

| Ural Locomotives Limited Liability Company INN 6606033929 |

Sverdlovsk region | 18 895 879 | 97 | 9,40 | 254 high |

| PUBLIC JOINT STOCK COMPANY HOLDING COMPANY KOLOMENSKY ZAVOD INN 5022013517 |

Moscow region | 16 719 039 | 101 | 9,28 | 212 high |

| OPEN JOINT STOCK COMPANY RESEARCH AND PRODUCTION CORPORATIOH URALVAGONZAVOD INN 6623029538 |

Sverdlovsk region | 74 127 622 | 118 | 5,94 | 272 high |

| TRANSMASHHOLDING CJSC INN 7723199790 |

Moscow | 74 471 370 | 93 | 5,01 | 183 the highest |

| JOINT-STOCK COMPANY Tver Railwaycar-Building Works INN 6902008908 |

Tver region | 27 582 034 | 78 | 3,85 | 258 high |

| JSC "Altaivagon" INN 2208000010 |

Altai territory | 15 679 902 | 82 | 2,54 | 303 satisfactory |

| Tikhvin Railway Car Building Plant JSC INN 4715019631 |

Leningrad region | 22 093 005 | 307 | -15,99 | 340 satisfactory |

Average return on sales of the largest manufacturers of railway rolling stock (TOP-10) amounted to 6,88% in 2014. The highest value of the indicator: 20,87% (JOINT STOCK COMPANY METROVAGONMASH) and the lowest negative value: -15,99 (Tikhvin Railway Car Building Plant JSC).

TRANSMASHHOLDING CJSC, the leader in the industry in term of the annual revenue, shows the return on sales of 5,01%, that is higher than the industry average value of 4,95%.

TRANSMASHHOLDING CJSC is a leading enterprise in the Russian transport machine-building. Enterprises of the holding manufacture mainline and industrial locomotives, mainline and shunting locomotives, locomotive and marine diesel engines, freight and passenger cars, electric cars and the subway, rail buses, wagon castings and other products. JOINT STOCK COMPANY METROVAGONMASH and JOINT-STOCK COMPANY Tver Railwaycar-Building Works are also included in the holding.

According to the results 2014, the total annual revenue of the Top-10 companies amounted to almost 316 bln RUB. Revenue growth was 2%, that is quite a good result against the background of the GDP growth rate by 0,6% compared to 2013, and reduction in manufacture by 9,1% at the industry average (Rosstat data).

According to the experts, the total production capacity of car-building enterprises in Russia is about 100 - 120 th cars per year. In 2012 there was a peak of cars output, when about 70 th units were manufactured. In 2014, the production amounted to 54 th units. In future, further decline in production to 30 - 40 th cars per year is possible.

7 companies of the Top-10 list were given high and the highest solvency index Globas-i.

Tikhvin Railway Car Building Plant JSC, JSC "Altaivagon", Joint Stock Company Demikhovo machine-building plant have got satisfactory index. Solvency level of these companies does not guarantee full and timely repayment of debt.