Deposit Insurance Agency will contest transactions with affiliated persons

Deposit Insurance Agency («ASV») offers to amend a law about bankruptcy of credit organizations for the purpose of changing of the approach to challenging of shady transactions, made shortly before the recall of a license by a bank. According to the opinion of the representatives of «ASV», the amendments, which they suggest, will let replenish bankrupt's assets, from which the funds to creditors of a bankrupt bank are disbursed.

According to the Director of Expert and analytical department of «ASV» Julia Medvedeva, as of today, in the pre-bankruptcy period, all Russian banks violate the Article 855 of the Civil Code of the RF, under which in the absence of finances a bank has to satisfy claims according to priority.

In most cases the banks satisfy claims of specific category of customers upon availability of files of defaulted payments and negative capital. It should be noted, that as of today the lion’s share of similar transactions accrues to the reimbursement of interbank credits the day before the recall of a license by a bank. According to words of Medvedeva, sometimes the interbank credit is provided to banks, about which it is known that they are in bad shape, but for which the limit for the attraction of financial resources was not closed for inexplicable reasons. The representatives of «ASV» are of the opinion, that in similar situations the funds within such transactions have to be returned to bankrupt's assets.

It should be noted, that before 2013 the Agency successfully contested similar transactions, however, the situation changed in 2013. The Plenum of the Supreme Arbitration Court stated that «ASV» infringes the rights for business activity of legal entities by its actions (returning funds to bankrupt's assets). Besides that, the Supreme Arbitration Court is of the opinion, that when considering the transactions, made one month before the recall of a license, the evidences, that a client was informed about bankruptcy indicators of a bank, should be offered to «ASV».

In light of recent developments of banking sector, connected with the recall of licenses of credit institutions, the Agency offered to amend a law about bankruptcy of credit organizations.

Proposed amendments have nothing to do with business transactions of a bank and expenses, connected with its functioning (withholding of employees' salaries, taxes etc.). Within new amendments the Agency offers to contest transactions, made with the disturbance of priority in the files of defaulted payments, without preliminary evidences.

Besides that, the Agency offers to contest transactions against banks without files, but having negative capital, and made with interested and informed persons. When considering similar situations the Agency proceeds on the basis that all insiders of a bank are informed about its pre-bankruptcy status, that's exactly why all transactions with affiliated persons will be contested. If a transaction was made with an unaffiliated person, then its/his/her awareness will be proved in court.

The Agency also intends to challenge the scheme of re-crediting in court, when a bank provides a credit for the repayment of already existing one.

According to the opinion of the representatives of ASV, the proposed measures will promote the increase of credit mass and chances for money refund to creditors of the third priority.

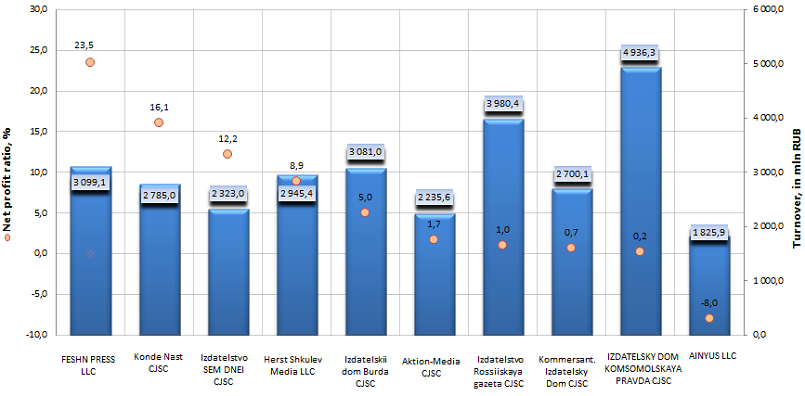

Net profit ratio of the largest publishers of newspapers and magazines in Russia

Information agency Credinform prepared a ranking of publishers of newspapers and magazines in Russia.

The companies with the highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in net profit ratio.

Net profit ratio (%) is the ratio of net profit (loss) of a company to net sales. It shows how profitable were sales of a company.

There is no specified value, that’s way it is recommended to compare companies of the same branch or ratio's change with time in one specific organization. If indicators are negative, it means that company has net loss. The higher is the net profit ratio, the more effective is finally company’s activity.

| № | Name | Region | Turnover for 2012, in mln RUB | Net profit ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Feshn Press LLC INN: 7743002018 |

Moscow | 3 099,1 | 23,5 | 165(the highest) |

| 2 | Konde Nast KCJSC INN: 7709244433 |

Moscow | 2 785,0 | 16,1 | 170(the highest) |

| 3 | Izdatelstvo SEM DNEI CJSC INN: 7703038770 |

Moscow | 2 323,0 | 12,2 | 157(the highest) |

| 4 | Herst Shkulev Media LLC INN: 7708183322 |

Moscow | 2 945,4 | 8,9 | 180(the highest) |

| 5 | Izdatelsky dom Burda CJSC INN: 7705056238 |

Moscow | 3 081,0 | 5,0 | 254(high) |

| 6 | Aktion-Media CJSC INN: 7702189092 |

Moscow | 2 235,6 | 1,7 | 268(high) |

| 7 | Izdatelstvo Rossiiskaya gazeta CJSC INN: 7714010896 |

Moscow | 3 980,4 | 1,0 | 220(high) |

| 8 | Kommersant.Izdatelsky Dom CJSC INN: 7707120552 |

Moscow | 2 700,1 | 0,7 | 203(high) |

| 9 | IZDATELSKY DOM KOMSOMOLSKAYA PRAVDA CJSC INN: 7714037217 |

Moscow | 4 936,3 | 0,2 | 211(high) |

| 10 | AINYUS LLC INN: 7743814193 |

Moscow | 1 825,9 | -8,0 | 299(high) |

Picture 1. Net profit ratio and turnover of the largest publishers of newspapers and magazines in Russia (TOP-10)

Cumulative turnover of the first 10 largest publishers of newspapers and magazines made 29 911,8 mln RUB at year-end 2012, that adds up to 47% of the revenue of TOP-100 companies. The average value of the net profit ratio of TOP-100 is 5,6%.

All publishers of TOP-10 are located in Moscow; the capital keeps lead in this segment without doubt.

The highest value of the net profit ratio was shown by FESHN PRESS LLC (23,5%), which puts out such magazines as: «Cosmopolitan», «Men's Health», «Esquire», «Populyarnaya mehanika», «Robb Report Rossiya» etc.

The indicator value, being higher, than branch average, was reached also by following publishers: Konde Nast CJSC (16,1%), magazines «Vogue», «Glamour», «GQ» etc, Izdatelstvo SEM DNEI CJSC (12,2%), magazine «7 Dnei», as well as Herst Shkulev Media LLC (8,9%), magazines «ELLE», «PSYCHOLOGIES», «MAXIM», «Marie Claire» etc. The mentioned companies are the most efficient and profitable in terms of final financial result. Moreover, according to the independent estimation of solvency, developed by the Information agency Credinform, all companies showed the highest rating, that excludes the financial inability in the foreseeable future. Now therefore, the publishers with the highest solvency index are the most attractive for the investment of funds for the purpose of profit earning.

Other participants of the ranking occurred to be less profitable publishers, in spite of large turnover, there are big expenses; AINYUS LLC (newspapers «Izvestiya», «Zhizn», «Tvoi den», magazine «Bubble»), and in any case, has net loss. But along with this their solvency is at a high level, what minimizes the bankruptcy risk.

It is clear, that the field of so called «glamour» is financially more profitable, than general interest media. The brands recognizable in the whole world have successfully become naturalized in Russia and are in great demand by people, keeping an eye on fashion trends and the life of stars.