Dependence on loans of mining companies

Information agency Credinform has prepared a ranking of the largest Russian mining companies. The largest enterprises (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the last accounting periods (2014 - 2017). Then the companies were ranged by solvency ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Solvency ratio (x) is calculated as a ratio of shareholders’ equity to total assets and shows the dependence of the company on external loans. The recommended value of the ratio is >0.5. The ratio value less than minimum limit demostrates strong dependence on external sources of funds; such dependence may lead to liquidity crisis, unstable financial position in case of economic downturn.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of the Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. In 2016 the practical value of solvency ratio for extracting companies is from 0,01 to 0,83 at average (look for details at Table 1).

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region, main activity | Revenue, bln RUB | Net profit, bln RUB | Solvency ratio (x), >0,5 | Solvency index Globas 2017-2018 | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC SURGUTNEFTEGAS INN 8602060555 Khanty-Mansiysk Autonomous District - Yugra Crude oil mining |  993 993 |

1144 1144 |

-105 -105 |

150 150 |

0.95 0.95 |

0.94 0.94 |

182 High |

| LUKOIL-WEST SIBERIA LIMITED INN 8608048498 Khanty-Mansiysk Autonomous District - Yugra Crude oil mining |  9602 9602 |

665 665 |

77 77 |

70 70 |

0.80 0.80 |

0.78 0.78 |

172 Superior |

| JSC ALROSA INN 1433000147 The Sakha (Yakutia) Republic Diamonds mining |  250 250 |

200 200 |

149 149 |

17 17 |

0.64 0.64 |

0.67 0.67 |

200 Strong |

| ALROSA-NURBA COMPANY INN 1419003844 The Sakha (Yakutia) Republic Diamonds mining |  47 47 |

41 41 |

18 18 |

13 13 |

0.58 0.58 |

0.51 0.51 |

202 Strong |

| JSC APATIT INN 5103070023 Vologda region Mining of mineral raw materials for chemical industry and manufacture of mineral fertilizers |  103 103 |

104 104 |

37 37 |

21 21 |

0.53 0.53 |

0.49 0.49 |

216 Strong |

| JSC MIKHAILOVSKY GOK INN 4633001577 Kursk region Open pit mining of iron ores |  57 57 |

79 79 |

15 15 |

27 27 |

0.46 0.46 |

0.51 0.51 |

160 Superior |

| JSC COAL COMPANY KUZBASSRAZREZUGOL INN 4205049090 Kemerovo region Open pit coal mining, except for anthracite, close-burning coal and brown coal |  69 69 |

86 86 |

3 3 |

10 10 |

0.37 0.37 |

0.39 0.39 |

212 Strong |

| JSC SUEK-KUZBASS INN 4212024138 Kemerovo region Coal mining, except for anthracite, close-burning coal and brown coal by underground method |  106 106 |

134 134 |

22 22 |

30 30 |

0.30 0.30 |

0.25 0.25 |

203 Strong |

| ROSNEFT OIL COMPANY INN 7706107510 Moscow Crude oil mining |  3930 3930 |

4893 4893 |

99 99 |

139 139 |

0.15 0.15 |

0.15 0.15 |

195 High |

| JSC LEBEDINSKIY MINING AND PROCESSING PLANT INN 3127000014 Belgorod region Open pit coal mining of iron ores |  74 74 |

105 105 |

101 101 |

51 51 |

0.12 0.12 |

0.05 0.05 |

224 Strong |

| Total for TOP-10 companies |  6231 6231 |

7451 7451 |

416 416 |

527 527 |

|||

| Average value for TOP-10 companies |  623 623 |

745 745 |

42 42 |

53 53 |

0.49 0.49 |

0.47 0.47 |

|

| Average value for TOP-1000 companies |  14 14 |

2 2 |

0.27 0.27 |

||||

| Average industry value for coal mining |  1.7 1.7 |

0.2 0.2 |

0.14 0.14 |

||||

| Average industry value for oil and gas mining |  13.1 13.1 |

1.2 1.2 |

0.44 0.44 |

||||

| Average industry value for metallic ores mining |  1.5 1.5 |

0.5 0.5 |

0.46 0.46 |

||||

| Average industry value for other minerals mining |  0.128 0.128 |

0.041 0.041 |

0.54 0.54 |

||||

| Average industry value for mining industry |  4.107 4.107 |

0.485 0.485 |

0.40 0.40 |

||||

| Average industry practical value for coal mining | from -0.15 to 0.62 | ||||||

| Average industry practical value for oil and gas mining | from -0.11 to 0.80 | ||||||

| Average industry practical value for metallic ores mining | from 0.00 to 0.95 | ||||||

| Average industry practical value for other minerals mining | from -0.05 to 1.00 | ||||||

| Average industry practical value for mining industry | from -0.08 to 0.84 | ||||||

— growth of indicator in comparison with prior period,

— growth of indicator in comparison with prior period,  — decline of indicator in comparison with prior period.

— decline of indicator in comparison with prior period.

Average value of solvency ratio for TOP-10 companies is lower than recommended value and higher than average industry value and is within the interval of practical value.

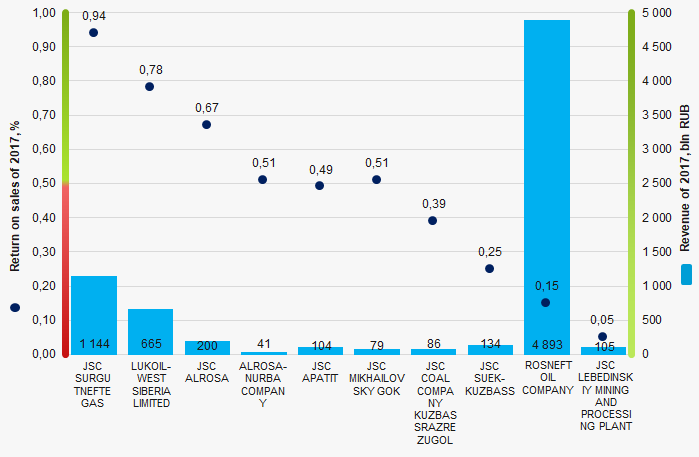

Picture 1. Solvency ratio and revenue of the largest Russian mining companies (ТОP-10)

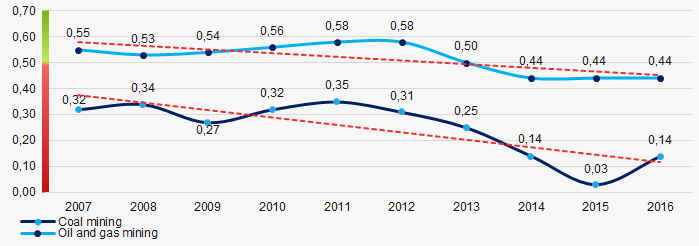

Picture 1. Solvency ratio and revenue of the largest Russian mining companies (ТОP-10)For the last 10 years, the average values of solvency ratio in mining industry showed the decreasing tendency in general. Particular growth of indicators is observed only in the sphere of other minerals mining (Picture 2 and 3).

Picture 2. Change in average industry values of solvency ratio of Russian companies engaged in coal, oil and gas mining in 2007 — 2016

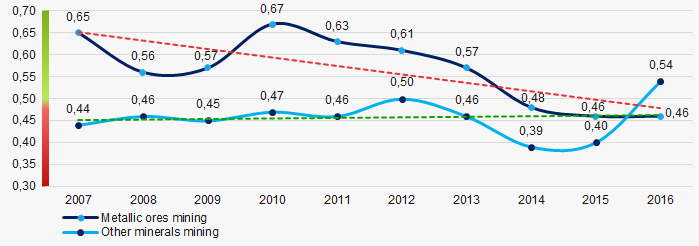

Picture 2. Change in average industry values of solvency ratio of Russian companies engaged in coal, oil and gas mining in 2007 — 2016 Picture 3.Change in average industry values of solvency ratio of Russian companies engaged in metallic ores and other minerals mining in 2007 – 2016

Picture 3.Change in average industry values of solvency ratio of Russian companies engaged in metallic ores and other minerals mining in 2007 – 2016 Legal status of international business entity

The Federal Law №292-FZ from August 3, 2018 with the amendments to the article 1202 of part three of the Civil Code of the Russian Federation clarified the definition «personal law of the legal entity».

It was defined, that the personal law of the legal entity is the legal system of the country, where it was established, unless contrary to provisions of this Federal Law and the Federal law №290-FZ "On international business entities" which entered into force on August 3, 2018.

In turn, this Federal Law defined the legal status of business companies with the status of an international company registered in the Unified State Register of Legal Entities (EGRUL) due to the change of personal law in the procedure of replacement of the legal address from one jurisdiction to another, maintaining the legal status and corporate structure (redomiciliation), the rights and obligations of the participants, operation features, as well as due to the reorganization or liquidation.

Thus, according to the language of Law, an International business entity is a foreign legal entity, commercial corporate organization, that has changed its personal law in accordance with the established legislative procedure.

The location of international business entities is the territory of special administrative regions - the Russian island in Primorsky Territory and и the Oktyabrskiy island in Kaliningrad region. The development of such regions is regulated by the Federal Law №291-FZ from August 3, 2018 «On special administrative regions in the territories of Kaliningrad region and Primorsky Territory» and is carried out in order to create an attractive investment environment for Russian and foreign investors.

The conditions for obtaining the status of an international company are as follows:

- establishment in the State – the member or observer of the Financial Action Task Force on Money Laundering (FATF) or the member of the Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism (MONEYVAL);

- operating on the territory of several States, including Russia;

- the adoption of investment obligations on the territory of the Russian Federation, with a minimum investment amount of 50 mln RUB for a period no less than 6 months from the date of state registration of an international company.

The short legal name of international business entity in Russian should include the full or short name of international business entity or the abbreviation «IBE» and for public joint stock companies the abbreviation «IBE public joint stock company».

The new Law also regulates the following:

- results of changes in the personal law by foreign legal entities;

- features of state registration in status of international entities and acquisition of this public status by joint-stock companies;

- provisions on securities and other financial instruments;

- registration features of rights on shares;

- procedure for status termination without change of personal law or change of personal law under change of jurisdiction.

According to the Information and Analytical system Globas at the present time, a little more than 500 of active commercial entities and joint-stock companies are registered on the Russian island in Primorsky Territory and on Oktyabrskiy island in Kaliningrad. Detailed information about activities of the registered companies is available by subscription to the system Globas.