Amendments to the Law On Credit History

Amendments to the Federal Law «On credit History» were made in order to include unique identifier of the contract to credit history of physical persons and legal entities. This helps to improve responses accuracy of the data inquiry from several credit history bureaus (CHB).

Rules of assignment of unique identifiers to obligations of lenders, guarantors and principals will be regulated by the Central Bank of the RF.

Records of credit history for subjects of credit history – guarantors, principals, physical persons or legal entities will be formed regarding unique identifiers of contracts and transactions.

Assigned unique identifiers are not subjected to changes in cases of assignment of claim or debt.

Sources of forming of credit history, providing CHB with information on active contracts with lenders, guarantors are obliged to assign unique identifiers to all contracts and provide to CHB not later than one year after validity date of the amendments.

The Federal Law as of May 1, 2019 №77-FL will come into force a hundred and eighty days after its publication on May 8, 2019.

Trends among companies of Primorye territory

Information agency Credinform has prepared a review of trends of the largest companies of real economy in Primorye territory.

The largest enterprises (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2012-2017). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company of Primorye territory in term of net assets is JSC FAR EASTERN ENERGY MANAGEMENT COMPANY, being in process of reorganization in the form of division since 25.03.2019. In 2017, net assets value of the company amounted to almost 59 billion RUB. The lowest net assets volume among TOP-1000 belonged to JSC ROSDORSNAB, the company is in process of being wound up since 30.11.2016. Insufficiency of property of the company was indicated in negative value of 5,6 billion RUB.

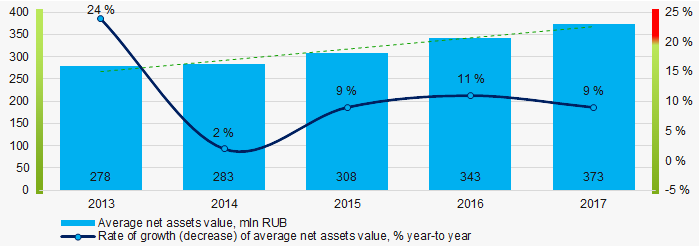

Covering the five-year period, the average net assets values of TOP-1000 companies has a trend to increase (Picture 1).

Picture 1. Change in average net assets value in 2013 – 2017

Picture 1. Change in average net assets value in 2013 – 2017The shares of TOP-1000 companies with insufficient property have trend to decrease over the past five years (Picture 2).

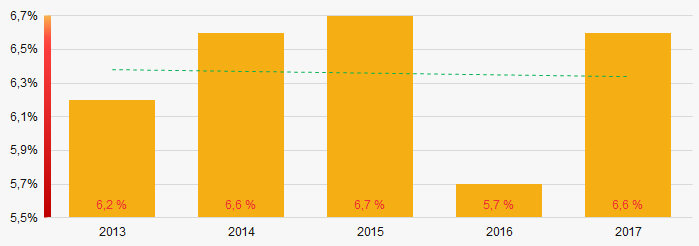

Picture 2. Shares of companies with negative net assets value in TOP-1000

Picture 2. Shares of companies with negative net assets value in TOP-1000Sales revenue

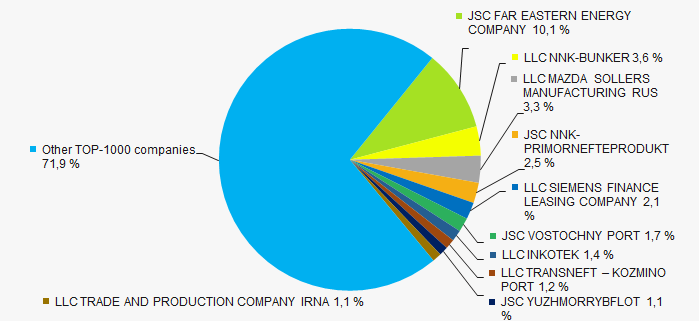

In 2017, total revenue of 10 largest companies of Primorye territory was 28% of TOP-1000 total revenue (Picture 3). This testifies relatively low level of concentration of production in the region.

Picture 3. Shares of TOP-10 companies in TOP-1000 total profit for 2017

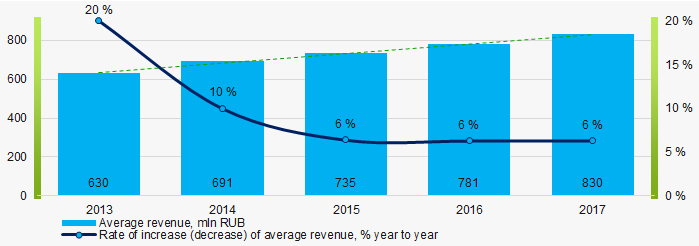

Picture 3. Shares of TOP-10 companies in TOP-1000 total profit for 2017In general, there is a trend to increase in revenue (Picture 4).

Picture 4. Change in industry average net profit in 2013-2017

Picture 4. Change in industry average net profit in 2013-2017Profit and loss

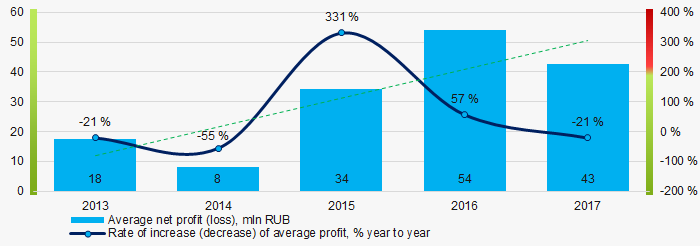

The largest company of TOP-1000 in term of net profit is JSC VOSTOCHNY PORT. The company’s profit for 2017 amounted to 7,2 billion RUB. In general, over the five-year period, there is a trend to increase in average profit of TOP-1000 companies (Picture 5).

Picture 5. Change in industry average profit values n 2013-2017

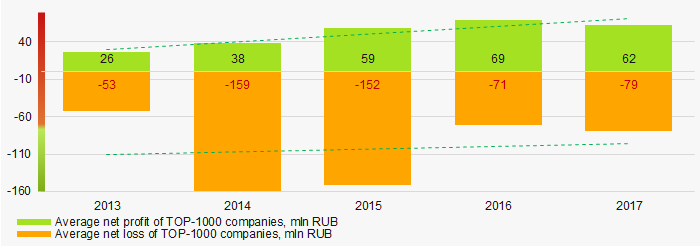

Picture 5. Change in industry average profit values n 2013-2017For the five-year period, the average net profit values of TOP-1000 companies increased with the average net loss value having the decreasing trend (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2013 – 2017

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2013 – 2017Key financial ratios

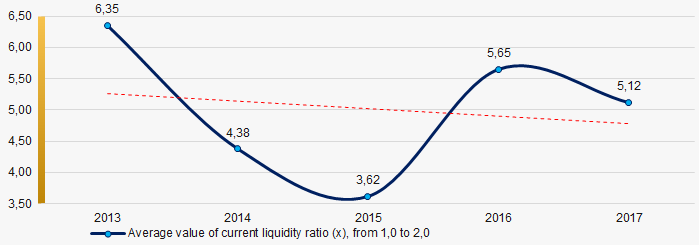

For the five-year period, the average values of the current liquidity ratio were above the recommended one - from 1,0 to 2,0 with a trend to decrease (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2013 – 2017

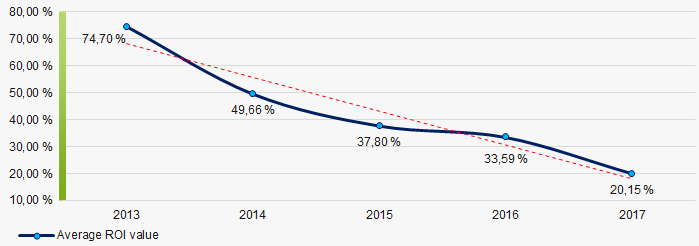

Picture 7. Change in industry average values of current liquidity ratio in 2013 – 2017For the five-year period, the average values of ROI ratio have the trend to decrease (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2013 – 2017

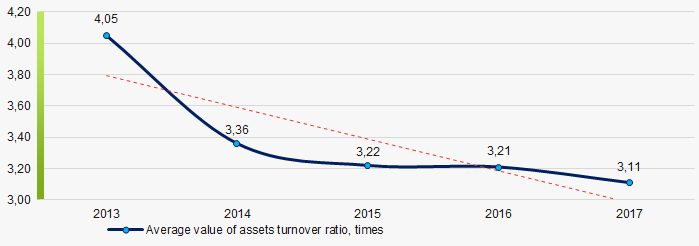

Picture 8. Change in average values of ROI ratio in 2013 – 2017Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the five-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2013 – 2017

Picture 9. Change in average values of assets turnover ratio in 2013 – 2017Small enterprises

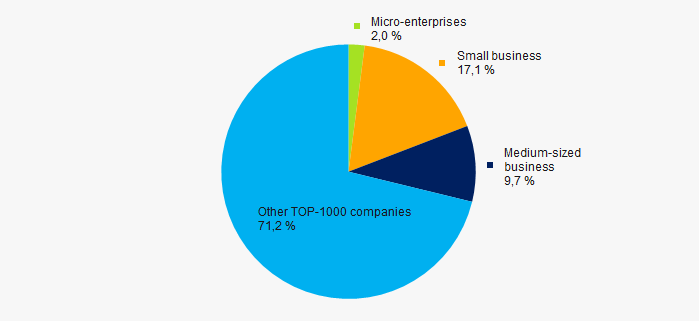

78% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. At the same time, their share in total revenue of TOP-1000 amounted to 29% that is higher than the national average figure (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-1000, %

Picture 10. Shares of small and medium-sized enterprises in TOP-1000, %Main regions of activity

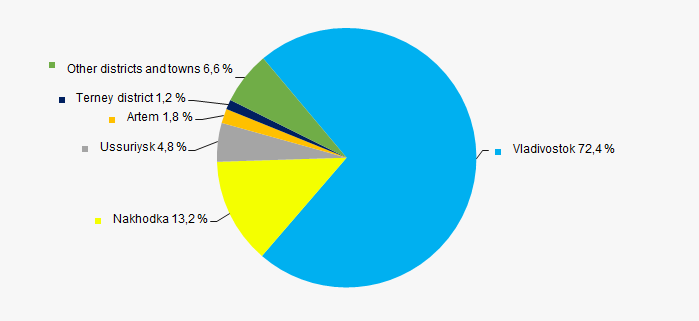

Companies of TOP-1000 are registered in 31 districts of Primorye territory and located across quite unequally. Almost 86% companies largest in term of turnover are concentrated in Vladivostok and Nakhodka (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by districts of Primorye territory

Picture 11. Distribution of TOP-1000 revenue by districts of Primorye territoryFinancial position score

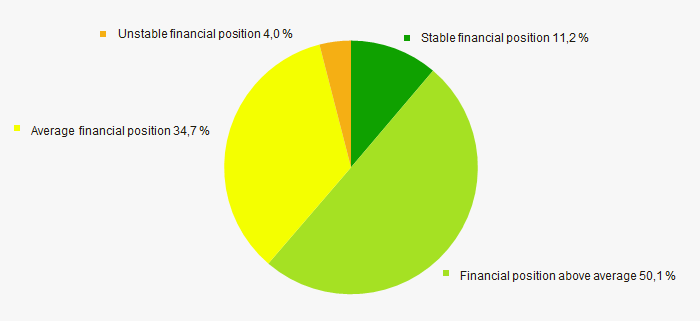

Assessment of the financial position of TOP-1000 companies shows that more than a half of them have stable financial position and financial position above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

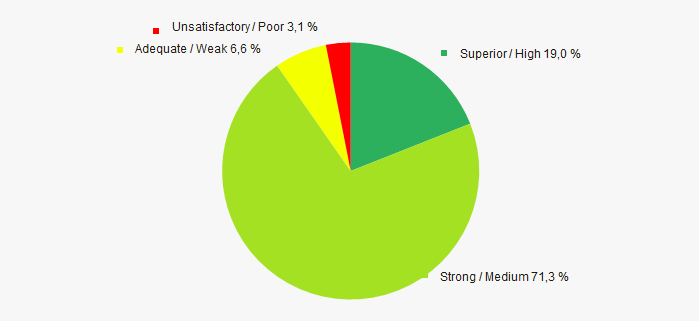

Most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasIndex of industrial production

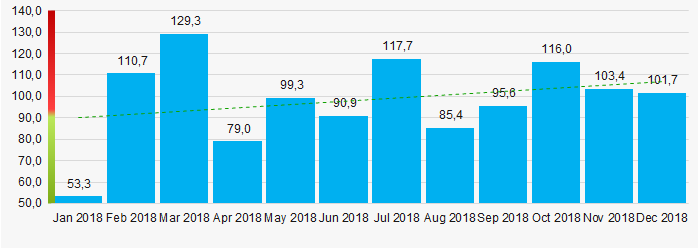

According to the Federal State Statistics Service (Rosstat), during 12 months of 2018, the trend to decrease of industrial production indexes is observed in Primorye territory (Picture 14). The average month-to-month figure was 98,5%.

Picture 14. Index of industrial production in Primorye territory in 2018, month-to-month (%)

Picture 14. Index of industrial production in Primorye territory in 2018, month-to-month (%)According to the same data, the share of companies of Primorye territory in the volume of revenue from sales of products, goods, works and services in 2018 was 0,68% countrywide.

Conclusion

Complex assessment of activity of the largest companies of real economy sector in Primorye territory, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Concentration level of capital |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  -5 -5 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in the region in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  5 5 |

| Average value of relative share of factors |  5,0 5,0 |

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).