New preferences for import substitution

Information agency Credinform in its publications of 2015 several times addressed to the import substitution theme. The list of potential manufacturers of products for import substitution is prepared by Credinform and placed in the Information and Analytical System Globas-i®. The list is based on data of the Ministry of Industry and Trade of the Russian Federation on more than 760 enterprises.

The problem of import substitution, or replacement on the Russian market of foreign made goods with national ones, first of all, is connected with economic diversification of the country as one of the important points. However, development of program in this area began only after Russian and anti-Russian economic sanctions were imposed that limited access of Russian business to foreign credits. With falling prices on raw hydrocarbons and exchange-value of rouble in relation to main foreign currencies import substitution is becoming ever more relevant issue.

It was said in the President of the RF`s message to the Federal Assembly in 2014 on necessity to overcome critical dependence of foreign technologies and industrial products. That was once more emphasized in the President`s message in 2015 in the context of necessity to increase amount of successful enterprises in industry, agriculture, in small and medium business.

The plan of top-priority measures on maintenance of sustainable economic growth and social stability in 2015 was enacted by order of the Government of the RF of January 27, 2015 №98-r. One of key directions in the plan realization was support of import substitution and export on wide classification of non-raw materials which includes high-tech goods. That is regulated by the Government decree of August 4, 2015 №785 «On the establishment of the Government Commission on Import Substitution». The Commission consists of two sub-commissions: on the civilian economy and on the defense industry.

On the Meeting of the State Councilor on November of 2015 in Nizhny Tagil provisional results on import substitution were resumed. The minister of industry and trade of the RF Denis Manturov stated accomplishment of setting the support system basis for import substitution. As part of 19 branch programs 570 projects are realized. Major efforts were made by the Fund of industry development founded in 2014 at the initiative of the Ministry of Industry and Trade of the RF by means of transformation of the Russian fund of technological development. For realization of industrial-technological projects focused on new high-tech products development, technical modernization and competitive production Fund provided special-purpose loans on competitive basis at the rate of 5% for the period till 7 years at the sum from 50 till 700 mln RUB. In 2015 Fund almost completely used capital in 20 bln RUB. 56 projects on the sum 19,2 bln RUB were approved.

Positive movements of investments in industries that involved in import substitution are confirmed by the Central Bank of the RF data on foreign direct investments in Russia. While reducing net investments volume in oil-product manufacture, services sector, trade, housing and utility sector, electro energetics, information and communication in the first half-year period of 2015 growth of investments in agriculture, food production, transport and equipment manufacture and chemical production is observed.

Further, investors could get new benefits in the frame of special investment contracts with regions. Such conditions are provided by the Federal Law No. 488-FZ "On industrial policy". Participants of such agreements get guarantees of stable business running rules up to ten years, benefits on property tax and profit tax. Currently 5 such agreements are signed and 170 requests are under consideration. Moreover, the Ministry of Industry and Trade of the RF suggests that companies can take part in government procurement out of competition in a volume not more than 30% of declared.

Another important way of support can be benefits for so called «green fields», that is new business started from nothing. Main preference can be reduction of profit tax till 10% within capital investments. Such bill was introduced to the State Duma on May, 2015 and needs to be improved aiming further decrease of limits for potential investors.

Further development of import substitution will depend on how successful Russian Government can overcome difficulties connected with business credit, lack of skilled personnel, obligations of the country as part of World Tourism Organization (WTO) membership. At the same time, such factors can be successful as availability of primary resources and its relative cheapness, technological potential accumulated in defense industry and in space exploration that can be used in civil industries.

Quick ratio of the largest pharmaceutical companies of Russia

Information agency Credinform prepared a ranking of the largest pharmaceutical companies of Russia.

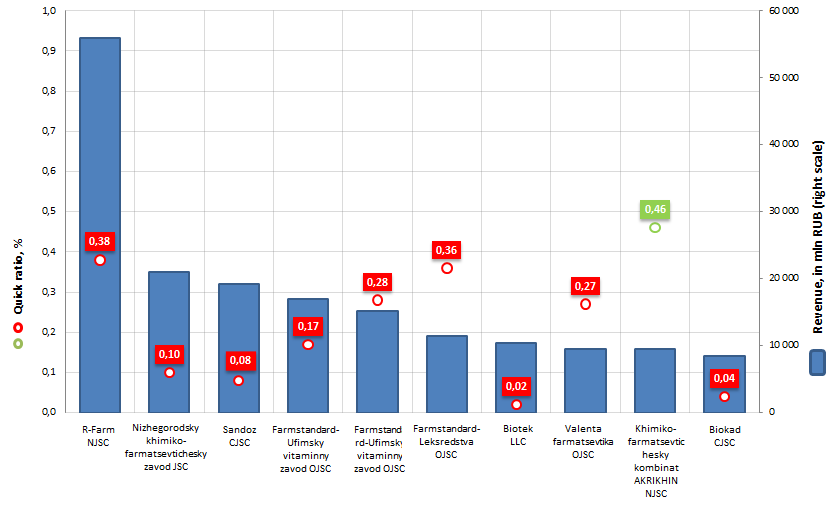

The TOP-10 list of enterprises was drawn up for the ranking on the volume of revenue, according to the data from the Statistical Register for the latest available period (for the year 2014). These enterprises were ranked by decrease in turnover; the data on the dynamic of revenue related to the previous period, quick ratio and solvency index GLOBAS-i® are represented (see the Table 1).

Quick ratio is an indicator, which characterizes the solvency of a company in the short/medium term; the ratio makes it possible to determine whether an enterprise will be able to repay its short-term liabilities due to the most liquid assets: cash, short-term receivables, short-term investments.

Recommended value is from 0,5 up to 0,8.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to the average value of indicators in the industry, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Region | Revenue, in mln RUB, for 2014 | Increase of revenue,% | Quick ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | R-Farm NJSC INN 7726311464 |

Moscow | 55 918,8 | 21,2 | 0,4 below standard | 208 high |

| 2 | Nizhegorodsky khimiko-farmatsevtichesky zavod JSC INN 5260900010 |

Nizhny Novgorod region | 20 925,3 | 13,2 | 0,1 below standard | 219 high |

| 3 | Sandoz CJSC INN 7717011640 |

Moscow | 19 158,8 | 7,5 | 0,1 below standard | 285 high |

| 4 | Farmstandard-Ufimsky vitaminny zavod OJSC INN 0274036993 |

Republic of Bashkortostan | 16 925,0 | -32,9 | 0,2 below standard | 193 the highest |

| 5 | FarmstandardPJSC INN 0274110679 |

Moscow region | 15 216,6 | -32,5 | 0,3 below standard | 255 high |

| 6 | Farmstandard-Leksredstva OJSC INN 4631002737 |

Kursk region | 11 477,3 | -27,7 | 0,4 below standard | 208 high |

| 7 | Biotek LLC INN 7713053544 |

Moscow | 10 340,1 | -10,4 | 0,0 below standard | 307 satisfactory |

| 8 | Valenta farmatsevtika OJSC INN 5050008117 |

Moscow region | 9 534,0 | 38,4 | 0,3 below standard | 174 the highest |

| 9 | Khimiko- farmatsevtichesky kombinat AKRIKHIN NJSC INN 5031013320 |

Moscow region | 9 440,9 | 16,4 | 0,5 standard | 196 the highest |

| 10 | Biokad CJSC INN 5024048000 |

Saint Petersburg | 8 387,8 | 180,3 | 0,0 below standard | 214 high |

The quick ratio of the largest pharmaceutical manufacturers (except Khimiko- farmatsevtichesky kombinat AKRIKHIN NJSC) does not stay within the recommended lower limit interval: current liabilities of companies exceed the most liquid part of the balance, that, under certain conditions, could lead them to a non-payments crisis.

Picture 1. Quick ratio and revenue of the largest pharmaceutical companies of Russia (TOP-10)

The annual revenue of the participants of the TOP-10 list amounted to 177,3 bln RUB at the end of 2014, that is higher by the symbolic 1,0% than the consolidated figure of the same enterprises in the previous reporting period (mainly this is due to a drop in revenue of the group of companies Pharmstandard). Taking into account the inflation, the industry is stagnating. The policy of import substitution, which is realized via imitative «shake-out» from the market of foreign players, has to change the trend of the development of the pharmaceutical industry.

Since the 10th of December the restrictions on the public procurement of imported drugs come into force. The new rules will affect purchases «for provisioning governmental and municipal needs with drugs included in the list of vital and essential medicines». If an imported drug can be replaced by Russian equivalent (generic) or analogs from the member countries of the Eurasian Economic Union, a customer shall reject all applications, containing proposals for the supply of drugs, which come from foreign countries. The list includes 608 medicines.

It is said also in the document, that before the end of 2016 the restrictions do not apply to medicines, for which the package is made in the territories of the states - members of the Eurasian Economic Union.

Earlier, it was pointed out in the Cabinet of Ministers, that the measure «is aimed at the development of domestic production of drugs». According to the officials, two-thirds of essential medicines have already been produced in Russia.

However, any restrictions are of problematic nature: it is noticed, that the Russian equivalents have more side effects and less quality than original imported drugs. Moreover, there is a risk that during public procurement our suppliers will split the difference and dictate the prices. And the «elimination» of unnecessary competitors will not contribute to investments in developments.