Shipbuilding enterprises of Saint Petersburg

Saint Petersburg is one of the largest shipbuilding centers in Russia, where more than 50 ships and vessels were built in October 2021. By 2025, 4 submarines, 22 ships and vessels for military purposes, 3 nuclear icebreakers, 1 scientific and 2 passenger ships will be delivered to customers. However, the analysis of liabilities to assets ratio of the largest shipbuilding enterprises of the city indicates their excessive debt load in 2019-2020.

Information agency Credinform has selected for this ranking in Globas the largest enterprises of Saint Petersburg engaged in construction of ships, vessels, floating structures, pleasure and sports boats. Companies with the largest volume of annual revenue (TOP 10) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). They were ranked by liabilities to assets ratio (Table 1).

Liabilities to assets ratio shows the proportion of assets financed by the company through loans. The standard value for this indicator is from 0.2 to 0.5.

Sales revenue and net income show the scale and efficiency of a company’s business and liabilities to assets ratio indicates the risk of insolvency.

Exceeding the upper standard value indicates excessive debt load, which can stimulate development, but negatively affects the stability of the financial position. The value of the indicator below the standard one may indicate a conservative strategy of financial management and excessive caution in attracting new borrowed funds.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN | Revenue, million RUB | Net profit (loss), million RUB | Liabilities to assets ratio.(x), from 0,2 to 0,5 | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC ELEKTRORADIOAVTOMATIKA INN 7812018283 |

3 594,1 3 594,1 |

3 574,6 3 574,6 |

157,1 157,1 |

181,2 181,2 |

0,45 0,45 |

0,60 0,60 |

168 Superior |

| JSC UNITED SHIPBUILDING CORPORATION INN 7838395215 |

68 832,0 68 832,0 |

85 665,0 85 665,0 |

509,7 509,7 |

1 501,2 1 501,2 |

0,74 0,74 |

0,74 0,74 |

223 Strong |

| JSC ADMIRALTY SHIPYARDS INN 7839395419 |

35 011,1 35 011,1 |

39 156,6 39 156,6 |

1 774,0 1 774,0 |

3 494,6 3 494,6 |

0,70 0,70 |

0,754 0,754 |

204 Strong |

| LLC MARINE COMPLEX SYSTEMS INN 7801304758 |

723,1 723,1 |

1 009,4 1 009,4 |

52,0 52,0 |

4,5 4,5 |

0,87 0,87 |

0,87 0,87 |

273 Medium |

| JSC SREDNE-NEVSKY SHIPYARD INN 7817315385 |

10 459,0 10 459,0 |

11 137,5 11 137,5 |

952,4 952,4 |

189,3 189,3 |

0,86 0,86 |

0,89 0,89 |

189 High |

| JSC ALMAZ SHIPBUILDING COMPANY INN 7813046950 |

6 536,3 6 536,3 |

6 366,7 6 366,7 |

2,7 2,7 |

262,0 262,0 |

0,87 0,87 |

0,91 0,91 |

204 Strong |

| LLC PLANT SPORTSUDPROM INN 7802567252 |

261,2 261,2 |

682,5 682,5 |

7,9 7,9 |

1,3 1,3 |

0,96 0,96 |

0,95 0,95 |

292 Medium |

| LLC SK SEVERNAYA GAVAN INN 7728859070 |

927,8 927,8 |

674,4 674,4 |

155,6 155,6 |

27,0 27,0 |

0,69 0,69 |

0,95 0,95 |

270 Medium |

| JSC SEVERNAYA SHIPYARD INN 7805034277 |

20 736,6 20 736,6 |

14 929,5 14 929,5 |

-534,5 -534,5 |

173,4 173,4 |

0,99 0,99 |

0,99 0,99 |

240 Strong |

| JSC BALTIC PLANT INN 7830001910 |

20 654,3 20 654,3 |

18 929,8 18 929,8 |

-6 444,2 -6 444,2 |

-7 878,8 -7 878,8 |

1,03 1,03 |

1,09 1,09 |

293 Medium |

| Average value for TOP 10 |  16 773,6 16 773,6 |

18 212,6 18 212,6 |

-336,7 -336,7 |

-204,4 -204,4 |

0,82 0,82 |

0,87 0,87 |

|

| Average value for TOP 100 in Saint Petersburg |  1 737,9 1 737,9 |

1 889,0 1 889,0 |

-31,2 -31,2 |

-18,2 -18,2 |

0,76 0,76 |

0,75 0,75 |

|

| Industry average value |  386,6 386,6 |

427,1 427,1 |

-10,2 -10,2 |

-9,4 -9,4 |

0,86 0,86 |

0,88 0,88 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The average 2020 value of liabilities to assets ratio of TOP 10 and TOP 100 was above the standard one. Six of TOP 10 companies had decrease in 2020, while in 2019 the decrease was recorded for four companies.

Five of ten companies gained revenue and/or net profit in 2020. At the same time, the increase in the average revenue of TOP 10 and TOP 100 amounted to almost 9% each; the industry average value grew by more than 10%. The average loss of TOP 10 decreased by 39%, and by 42% for TOP 100. On average in the industry, the loss was reduced by almost 8%.

The decrease in average revenue was 10%, and there was 33% fall of the industry average value.

The average profit of TOP 10 have increased almost 9%. However, on average in the industry, the decrease was recorded by almost 26%.

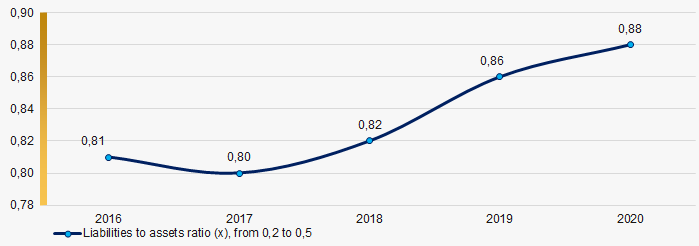

The industry average values of liabilities to assets ratio have raised ones during the past 5 years. The highest value was recorded in 2017 and the lowest one was in 2020 (Picture 1).

Picture 1. Change in the average values of liabilities to assets ratio in shipbuilding in 2016 - 2020

Picture 1. Change in the average values of liabilities to assets ratio in shipbuilding in 2016 - 2020Changes in legislation

The Federal Tax Service of the Russian Federation (FTS of Russia) will operate with more detailed data on immovables of the taxpayers. The Order of the FTS of Russia as of 05.07.2021 №YeD-7-21/632@ on provision of additional data from the Unified State Register of Immovable Property (EGRN) to the tax authorities is come into force starting from November 1st, 2020.

The following information will be available:

- on inclusion of the immovable object in the Unified State Register of Cultural Heritage Sites;

- on land plot orientation within the boundaries of an object of cultural heritage;

- function of a building (residential house, garage etc.)

- on limitation of an immovable property title due to arrest, charge as a preventive measure in accordance with the criminal procedure legislation of Russia, mortgage, prohibition on certain types of activity.

Users of the Information and Analytical system Globas can get the extracts from EGRN, using the searching box in the section «Cadastral map».