Trends in heat power industry

Information agency Credinform represents an overview of activity trends of the largest Russian thermal power enterprises.

Enterprises with the largest volume of annual revenue (TOP-1000), producing steam and hot water, were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 - 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

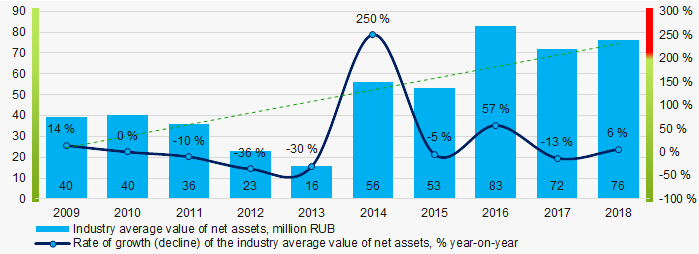

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest thermal power enterprise in terms of net assets is MOSCOW INTEGRATED POWER COMPANY PJSC, NN 7720518494. Its net assets amounted to more than 132 billion rubles in 2018.

The smallest amount of net assets in the TOP-1000 list was hold by REMONTNO-EKSPLUATATSIONNOE UPRAVLENIE NJSC, INN 7714783092, (process of being wound up, 20.10.2015). The insufficiency of property of this company in 2018 was expressed as a negative value of -60,5 billion rubles.

The industry average values of net assets tend to increase over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net asset value in 2009 – 2018

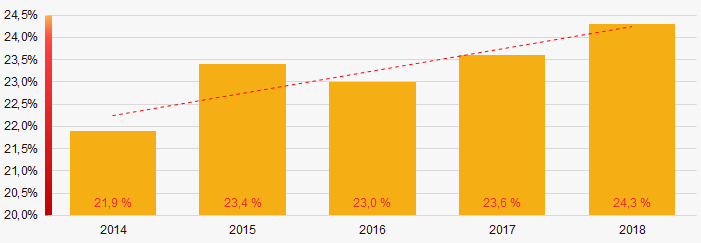

Picture 1. Change in the industry average indicators of the net asset value in 2009 – 2018The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to increase in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP -1000

Picture 2. Shares of enterprises with negative values of net assets in TOP -1000Sales revenue

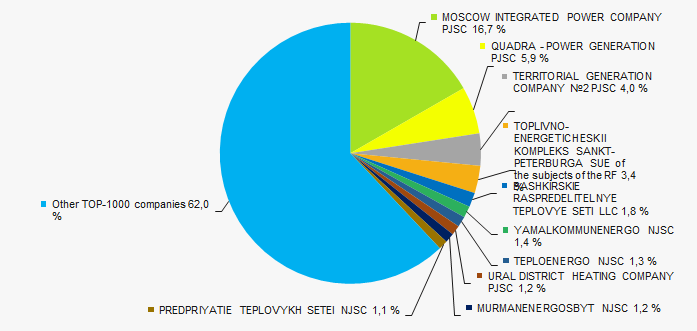

The revenue volume of 10 leading companies of the industry made 38% о of the total revenue of TOP-1000 in 2018. (Picture 3). It points to a relatively high level of monopolization.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018

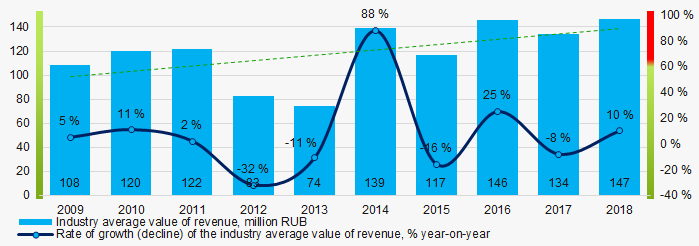

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018In general, there is a tendency to increase in the revenue volumes (Picture 4).

Picture 4. Change in the industry average revenue in 2009 – 2018

Picture 4. Change in the industry average revenue in 2009 – 2018Profit and loss

The largest company of the industry in terms of net profit value is SIBERIAN GENERATING COMPANY LLC, INN 7709832989. The company's profit amounted to 20,8 billion rubles in 2018.

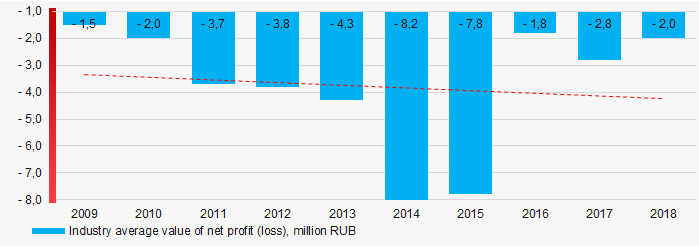

Over a ten-year period, the indicators of industry average profit were in the area of negative values. Thus, there were losses with a tendency to their increase (Picture 5).

Picture 5. Change in the industry average indicators of profit (loss) in 2009 – 2018

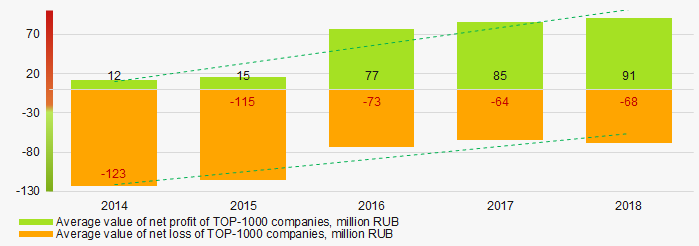

Picture 5. Change in the industry average indicators of profit (loss) in 2009 – 2018 Average values of net profit’s indicators of TOP-1000 enterprises increase over a five-year period, at the same time the average value of net loss decreases. (Picture 6).

Picture 6. Change in the industry average indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018

Picture 6. Change in the industry average indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018Key financial ratios

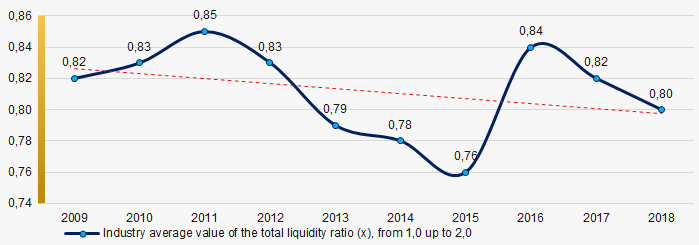

Over the ten-year period the industry average indicators of the total liquidity were below the range of recommended values - from 1,0 up to 2,0, with a tendency to decrease. (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio in 2009 – 2018

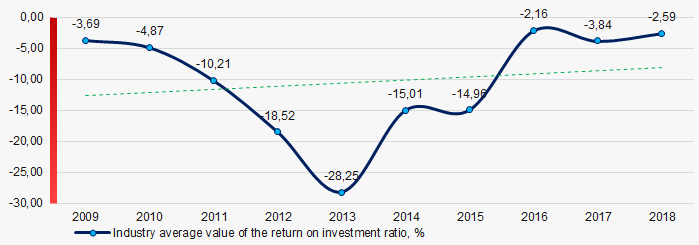

Picture 7. Change in the industry average values of the total liquidity ratio in 2009 – 2018Over the course of ten years, a negative level of industry average indicators of return on investment ratio has been observed, with a tendency to increase. (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the industry average values of the return on investment ratio in 2009 – 2018

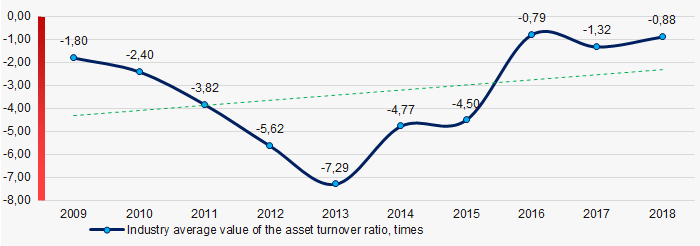

Picture 8. Change in the industry average values of the return on investment ratio in 2009 – 2018Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Over a ten-year period, indicators of this ratio of business activity were in the zone of negative values with a tendency to increase (Picture 9).

Picture 9. Change in the industry average values of the asset turnover ratio in 2009 – 2018

Picture 9. Change in the industry average values of the asset turnover ratio in 2009 – 2018Small business

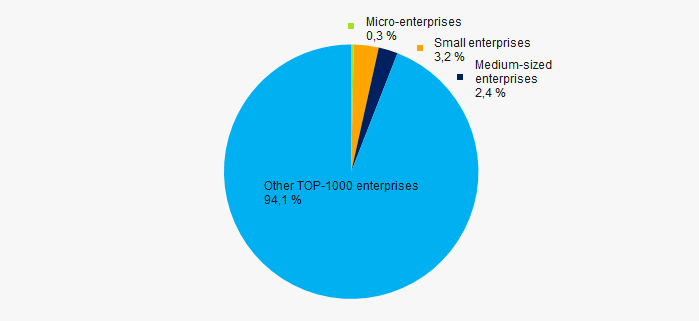

33% of TOP-1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 enterprises mounts to 5,9%, that is significantly lower than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companiesMain regions of activity

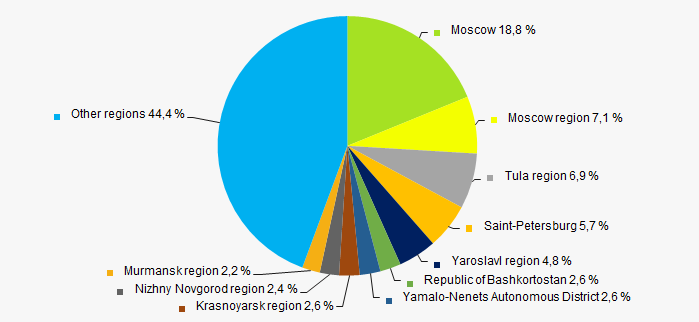

The TOP-1000 companies are registered in 83 regions and distributed unequal across Russia, taking into account geographical position and climatic characteristics. Almost 56% of the largest enterprises in terms of revenue are concentrated in 10 regions (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regions

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regionsFinancial position score

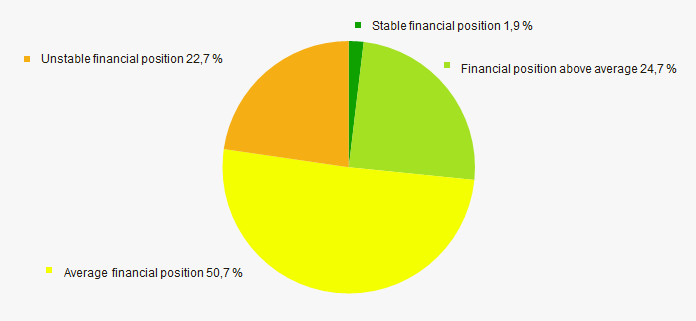

An assessment of the financial position of TOP-1000 companies shows that most of them are in average financial position. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

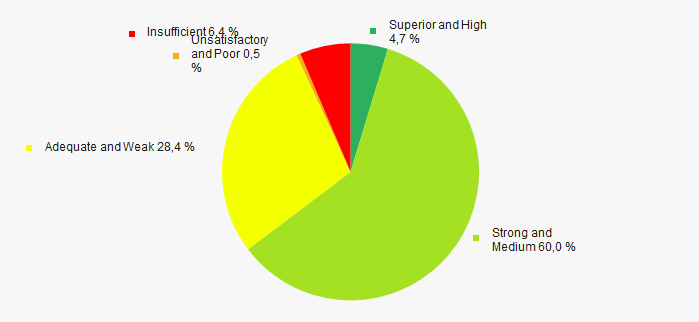

The vast majority of TOP-1000 enterprises got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

Picture 13. Distribution of TOP-50 companies by solvency index GlobasIndustrial production index

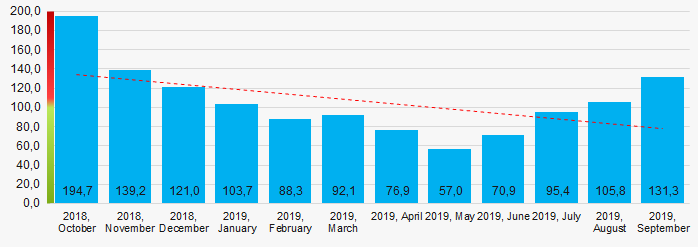

According to the Federal State Statistics Service, there is a tendency towards a decrease in indicators of the industrial production index in the field of the thermal power during 12 months of 2018 - 2019 (Picture 14). At the same time, the average index month-over-month was 106,4%.

Picture 14. Industrial production index in thermal power in 2018 - 2019, month-over-month (%)

Picture 14. Industrial production index in thermal power in 2018 - 2019, month-over-month (%)Conclusion

A comprehensive assessment of activity of the largest Russian thermal power enterprises, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  5 5 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  -10 -10 |

| Growth / decline in average values of net profit of TOP-1000 companies |  10 10 |

| Growth / decline in average values of net loss of TOP-1000 companies |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  -10 -10 |

| Increase / decrease in average values of return on investment ratio |  -5 -5 |

| Increase / decrease in average values of asset turnover ratio, times |  -5 -5 |

| Share of small and medium-sized enterprises in the region in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  5 5 |

| Average value of the specific share of factors |  0,7 0,7 |

positive trend (fact),

positive trend (fact),  negative trend (factor).

negative trend (factor).

Return on investments in the heat power industry

Information agency Credinform has prepared a ranking of the largest Russian heat power companies. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2016-2018). Then the companies were ranged by ROI ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Return on investments (%) is the ratio of net profit (loss) and net assets value. It demonstrates the return level from each ruble, received from the investments. In other words it shows how many monetary units the company used to obtain one monetary unit of net profit. The ratio is used for the assessment of fund raising at interest.

In general, normative values for ROI ratio are not set as they are changing due to the industry in which company operates.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

<

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | ROI ratio, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| NAO TEPLOENERGO INN 5257087027 Nizhny Novgorod region |

11426,19 11426,19 |

12006,04 12006,04 |

975,09 975,09 |

1060,66 1060,66 |

43,28 43,28 |

31,68 31,68 |

211 Strong |

| PJC Territorial Generation Company No.2 INN 7606053324 Yaroslavl region |

36382,36 36382,36 |

36355,07 36355,07 |

3012,16 3012,16 |

3013,59 3013,59 |

16,21 16,21 |

16,02 16,02 |

204 Strong |

| Bashkir Heat Distribution System LLC INN 0277072661 Republic of Bashkortostan |

15322,09 15322,09 |

16254,08 16254,08 |

230,88 230,88 |

458,85 458,85 |

7,01 7,01 |

12,23 12,23 |

235 Strong |

| NAO YAMALKOMMUNENERGO INN 8901025421 Yamalo - Nenets Autonomous Okrug |

12419,97 12419,97 |

13001,33 13001,33 |

738,99 738,99 |

218,06 218,06 |

31,13 31,13 |

9,23 9,23 |

278 Medium |

| JSС MOSCOW INTEGRATED POWER COMPANY INN 7720518494 Moscow |

134982,07 134982,07 |

152149,97 152149,97 |

6093,14 6093,14 |

11207,99 11207,99 |

5,05 5,05 |

8,48 8,48 |

160 Superior |

| JSC QUADRA - POWER GENERATION INN 6829012680 Tula region |

51390,85 51390,85 |

53364,23 53364,23 |

602,30 602,30 |

969,16 969,16 |

1,82 1,82 |

2,84 2,84 |

235 Strong |

| GUP TEK SPB INN 7830001028 Saint Petersburg |

29565,93 29565,93 |

30899,01 30899,01 |

273,53 273,53 |

285,98 285,98 |

0,53 0,53 |

0,49 0,49 |

208 Strong |

| NAO MURMANENERGOSBYT INN 5190907139 Murmansk region |

9441,59 9441,59 |

10749,62 10749,62 |

-220,59 -220,59 |

1,90 1,90 |

-5,11 -5,11 |

0,04 0,04 |

288 Medium |

| JSC URAL DISTRICT HEATING COMPANY INN 7203203418 Tyumen region |

12461,15 12461,15 |

10939,64 10939,64 |

418,35 418,35 |

-132,44 -132,44 |

8,85 8,85 |

-2,88 -2,88 |

278 Medium |

| NAO PTS INN 6315530348 Samara region |

9923,41 9923,41 |

10376,44 10376,44 |

-1197,47 -1197,47 |

-810,41 -810,41 |

45,19 45,19 |

-31,31 -31,31 |

274 Medium |

| Total for TOP-10 companies |  323315,60 323315,60 |

346095,42 346095,42 |

10926,38 10926,38 |

16273,33 16273,33 |

|||

| Average value for TOP-10 companies |  32331,56 32331,56 |

34609,54 34609,54 |

1092,64 1092,64 |

1627,33 1627,33 |

15,39 15,39 |

4,68 4,68 |

|

| Average industry value |  133,86 133,86 |

146,50 146,50 |

-2,77 -2,77 |

-1,98 -1,98 |

-3,84 -3,84 |

-2,59 -2,59 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period.

decline of indicator in comparison with prior period.

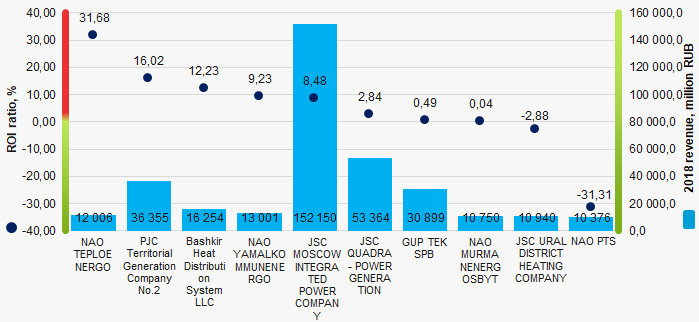

In 2018, the average value of ROI ratio for TOP-10 companies is higher than average industry value. Four companies improved the results.

Picture 1. ROI ratio and revenue of the largest heat power companies (ТОP-10)

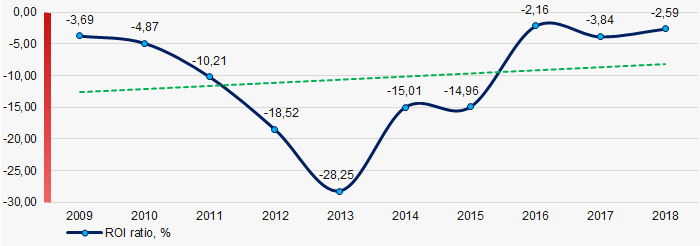

Picture 1. ROI ratio and revenue of the largest heat power companies (ТОP-10)Within 10 years, the average industry indicators of ROI ratio are in the zone of negative values with the growing tendency. (Picture 2).

Picture 2. Change in average industry values of ROI ratio of heat power companies in 2009 – 2018

Picture 2. Change in average industry values of ROI ratio of heat power companies in 2009 – 2018