TOP-10 of companies that received support from the government

Information agency Credinform represents a ranking of the largest Russian companies that received support from the government (subsidies, subventions, budget investments, inter-budget transfers, independent guarantees, sureties and training events of the SME Corporation). Companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2019). They were ranked by the liabilities to assets ratio (Table 1). The analysis was based on the data of the Information and Analytical system Globas.

Liabilities to assets ratio shows the share of assets financed by loans. The standard value for this ratio is from 0.2 to 0.5.

Sales revenue and net income show the scale and efficiency of the business activity, and the liabilities to assets ratio indicates the risk of the entity’s insolvency.

Exceeding the upper standard value indicates excessive debt load, which can stimulate development, but negatively affects the stability of the financial position of the company. If the value is below the standard value, this may indicate a conservative strategy of financial management and excessive caution in attracting new borrowed funds.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Liabilities to assets ratio (x), from 0,2 to 0,5 | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| TATNEFT JSC INN 1644003838 Republic of Tatarstan |

793 237 793 237 |

827 027 827 027 |

197 523 197 523 |

156 046 156 046 |

0,22 0,22 |

0,30 0,30 |

173 Superior |

| JSC RUSSIAN RAILWAYS INN 7708503727 Moscow |

1 798 396 1 798 396 |

1 848 123 1 848 123 |

18 363 18 363 |

53 457 53 457 |

0,30 0,30 |

0,32 0,32 |

196 High |

| JSC MAGNITOGORSK IRON&STEEL WORKS INN 7414003633 Chelyabinsk region |

458 218 458 218 |

434 869 434 869 |

73 689 73 689 |

55 563 55 563 |

0,36 0,36 |

0,38 0,38 |

174 Superior |

| JSC SIBUR HOLDING INN 7727547261 Tyumen region |

486 062 486 062 |

462 950 462 950 |

108 439 108 439 |

111 911 111 911 |

0,46 0,46 |

0,43 0,43 |

194 High |

| LLC TOYOTA MOTOR INN 7710390358 Moscow region |

313 242 313 242 |

299 016 299 016 |

12 386 12 386 |

8 651 8 651 |

0,48 0,48 |

0,54 0,54 |

214 Strong |

| JSC SEVERSTAL INN 3528000597 Vologda region |

432 773 432 773 |

457 588 457 588 |

124 269 124 269 |

105 732 105 732 |

0,55 0,55 |

0,64 0,64 |

193 Superior |

| JSC ROSTELECOM INN 7707049388 Saint Petersburg |

305 939 305 939 |

319 726 319 726 |

5 381 5 381 |

-3 363 -3 363 |

0,59 0,59 |

0,64 0,64 |

267 Medium |

| JSC AEROFLOT-RUSSIAN AIRLINES INN 7712040126 Moscow |

504 697 504 697 |

551 767 551 767 |

2 796 2 796 |

5 287 5 287 |

0,65 0,65 |

0,65 0,65 |

195 High |

| LLC VOLKSWAGEN GROUP RUS INN 5042059767 Kaluga region |

289 243 289 243 |

330 882 330 882 |

8 749 8 749 |

17 988 17 988 |

0,79 0,79 |

0,72 0,72 |

210 Strong |

| JSC MEGAFON INN 7812014560 Moscow |

305 426 305 426 |

312 305 312 305 |

16 430 16 430 |

3 645 3 645 |

0,75 0,75 |

0,77 0,77 |

250 Medium |

| Average value for TOP-10 |  568 723 568 723 |

584 425 584 425 |

56 803 56 803 |

51 492 51 492 |

0,51 0,51 |

0,54 0,54 |

|

| Average value for TOP-1000 |  20 374 20 374 |

20 946 20 946 |

1 331 1 331 |

1 559 1 559 |

0,65 0,65 |

0,63 0,63 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period

decrease of indicator to the previous period

The average indicator of the net profit ratio of TOP-10 is below the average one of TOP-1000. In 2019, five companies have increased the value compared to the previous period.

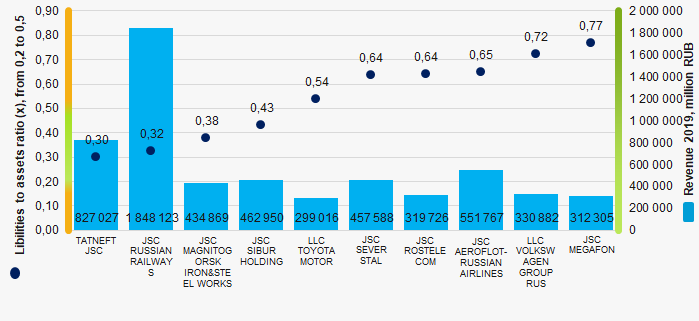

Picture 1. Liabilities to assets ratio of the largest Russian companies that received support from the government (TOP-10)

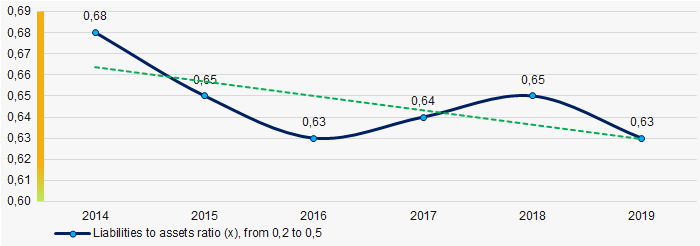

Picture 1. Liabilities to assets ratio of the largest Russian companies that received support from the government (TOP-10)During six years, the average values of the liabilities to assets ratio of TOP-1000 have a positive trend to decrease (Picture 2).

Picture 2. Change in the average values of the liabilities to assets ratio of TOP-1000 largest Russian companies that received support from the government, 2014 - 2019

Picture 2. Change in the average values of the liabilities to assets ratio of TOP-1000 largest Russian companies that received support from the government, 2014 - 2019ТOP-1000 of Western Siberia companies

In order to reduce the interregional differences in the level and quality of life of the population, to accelerate economic growth and technological development and to ensure the national security of the country, in February 2019 the Russian Government approved the Strategy of Spatial Development of the Russian Federation until 2025. It consists of 12 macro-regions; one of them is West-Siberian region, which includes Altai Territory, Kemerovo region - Kuzbass, Novosibirsk, Omsk, Tomsk, Tyumen regions, Altai Republic, Khanty-Mansiysk Autonomous Region - Yugra and Yamalo-Nenets Autonomous District.

Information agency Credinform has prepared a review of activity trends of the largest companies of the real economy sector in the West-Siberian Region of Russia.

The largest companies (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014 - 2019). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is JSC SURGUTNEFTEGAS, INN 8602060555, Khanty-Mansiysk Autonomous Region - Yugra. In 2019 net assets of the company amounted to 4305 billion RUB.

The smallest size of net assets in TOP-1000 had JSC ANTIPINSKY REFINERY, INN 7204084481, Tyumen region. The legal entity is declared insolvent (bankrupt) and bankruptcy proceedings are initiated, 04.01.2020. The lack of property of the company in 2019 was expressed in negative terms -223 billion RUB.

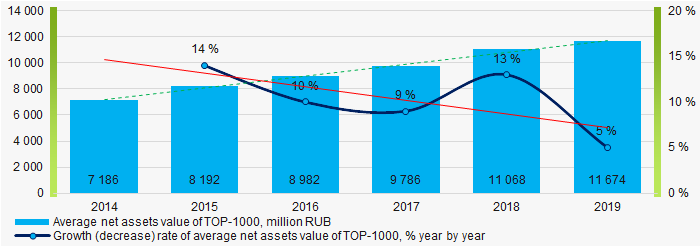

For the last six years, the average values of TOP-1000 net assets showed the growing tendency with negative dynamics of growth rates (Picture 1).

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2019

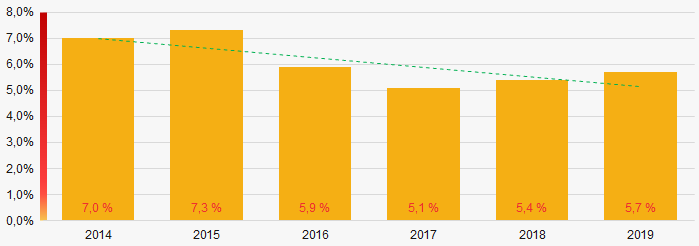

Picture 1. Change in average net assets value of ТОP-1000 companies in 2014 – 2019For the last six years, the share of ТОP-1000 enterprises with lack of property is decreasing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000

Picture 2. The share of enterprises with negative net assets value in ТОP-1000Sales revenue

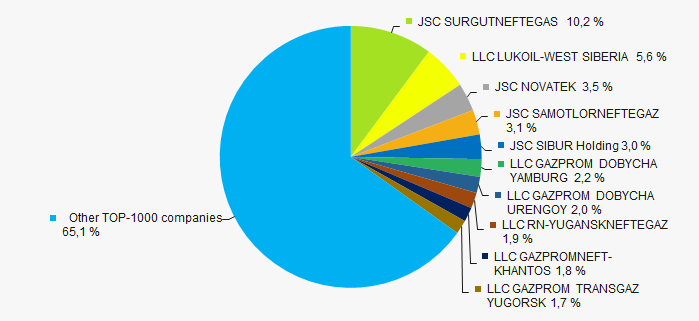

In 2019, the total revenue of the 10 largest companies amounted to 35% from ТОP-1000 total revenue (Picture 3). This fact testifies the high level of capital concentration.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2019

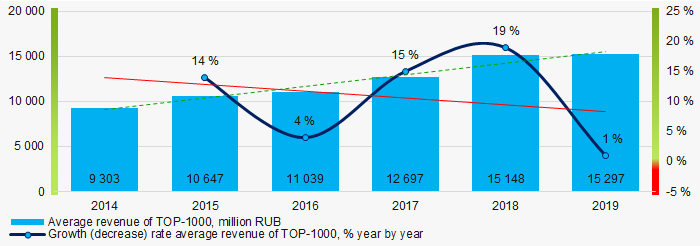

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2019In general, the growing trend in sales revenue with negative dynamics of growth rates is observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2019

Picture 4. Change in average revenue of TOP-1000 in 2014 – 2019Profit and loss

The largest company in terms of net profit is JSC YAMAL LNG, INN 7709602713, Yamalo-Nenets Autonomous District. In 2019, the company’s profit amounted to almost 252 billion RUB.

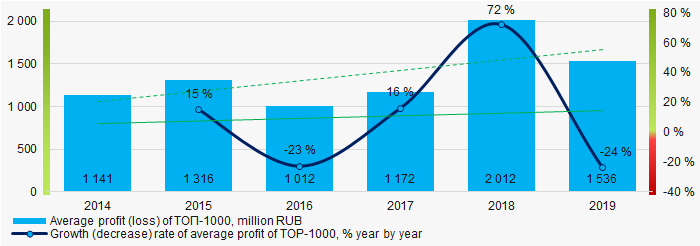

For the last six years, the average profit values of TOP-1000 show the growing tendency with positive dynamics of growth rates (Picture 5).

Picture 5. Change in average profit (loss) in 2014 – 2019

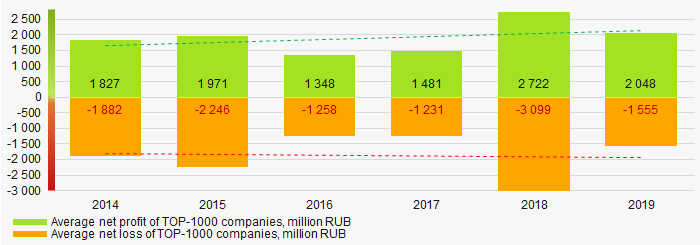

Picture 5. Change in average profit (loss) in 2014 – 2019Over a six-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is growing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2019

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2014 – 2019Main financial ratios

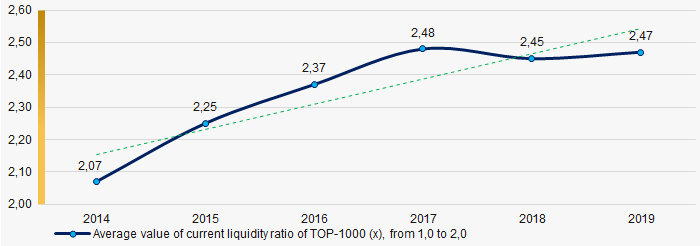

For the last six years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2014 – 2019

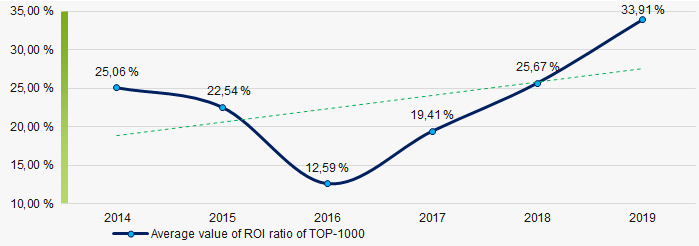

Picture 7. Change in average values of current liquidity ratio in 2014 – 2019Within six years, the growing trend of the average values of ROI ratio is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2019

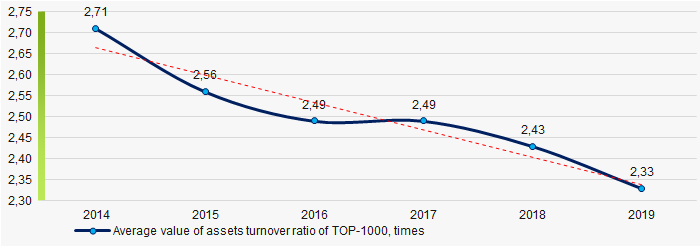

Picture 8. Change in average values of ROI ratio in 2014 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last six years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019Small businesses

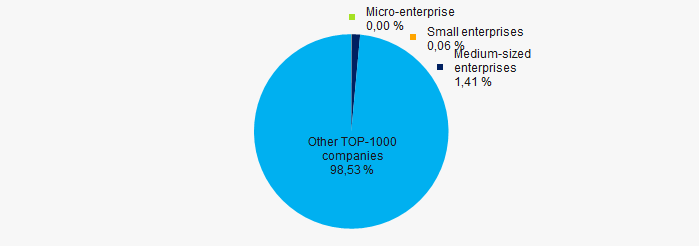

17% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue is only 1,5%, which is significantly lower than the national average value in 2018 – 2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

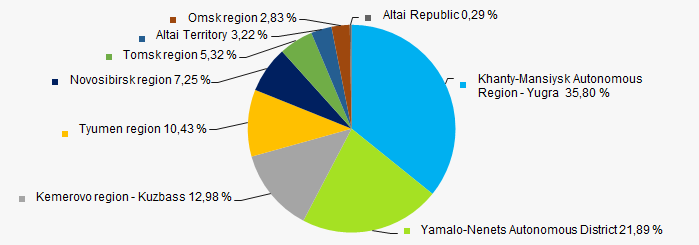

TOP-1000 companies are registered in 9 regions of Russia and are unequally located across the country. Almost 58% of the largest enterprises in terms of revenue are located in Khanty-Mansiysk Autonomous Region - Yugra and Yamalo-Nenets Autonomous District (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the territories of the West-Siberian Region of Russia

Picture 11. Distribution of TOP-1000 revenue by the territories of the West-Siberian Region of RussiaFinancial position score

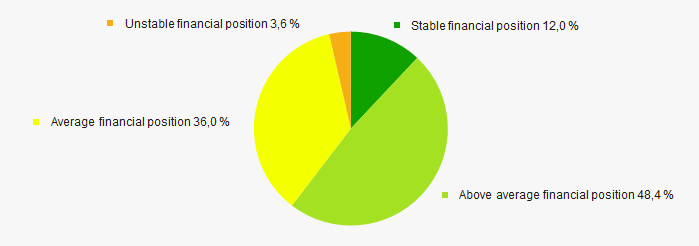

An assessment of the financial position of TOP-1000 companies shows that the half of the companies has above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

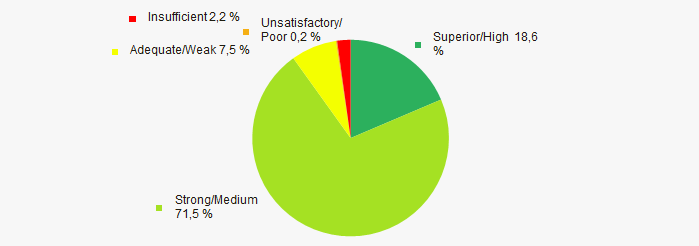

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasIndustrial production index

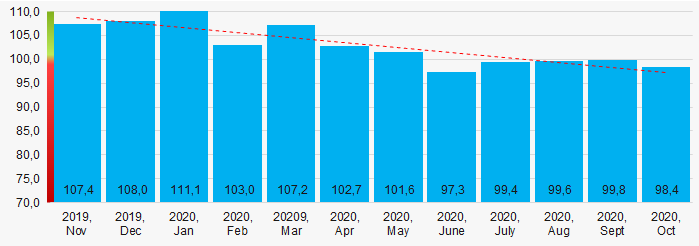

According to the Federal Service of State Statistics, there is a downward trend in the industrial production index in the West-Siberian Region of Russia during 12 months of 2019 – 2020 (Picture 14). Herewith the average index from month to month amounted to 103%.

Picture 14. Average industrial production index in the West-Siberian Region of Russia in 2019-2020, month by month (%)

Picture 14. Average industrial production index in the West-Siberian Region of Russia in 2019-2020, month by month (%)Conclusion

A complex assessment of activity of the largest companies of the real economy sector in the West-Siberian Region of Russia, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Dynamics of average net assets value |  10 10 |

| Growth/drawdown rate of average net assets value |  -10 -10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| The level of competition / monopolization |  -5 -5 |

| Dynamics of average revenue |  10 10 |

| Growth/drawdown rate of average profit |  -10 -10 |

| Dynamics of average profit |  10 10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  10 10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 20% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  -5 -5 |

| Average value of factors |  1,4 1,4 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).