Trends in brewing

Information Agency Credinform has prepared the review of trends in brewing.

The largest enterprises (TOP-10 and TOP-800) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2016). The analysis was based on data of the Information and Analytical system Globas.

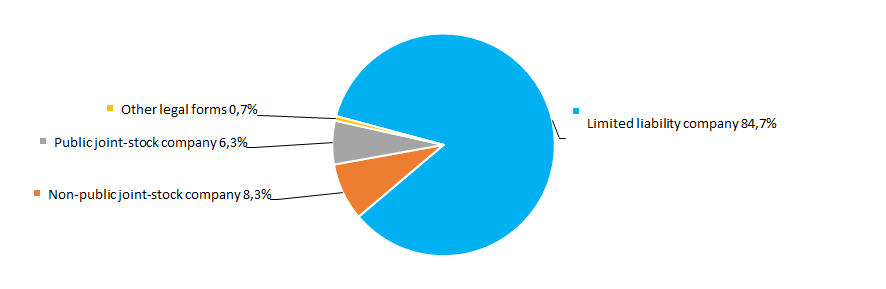

Legal forms and unreliable data

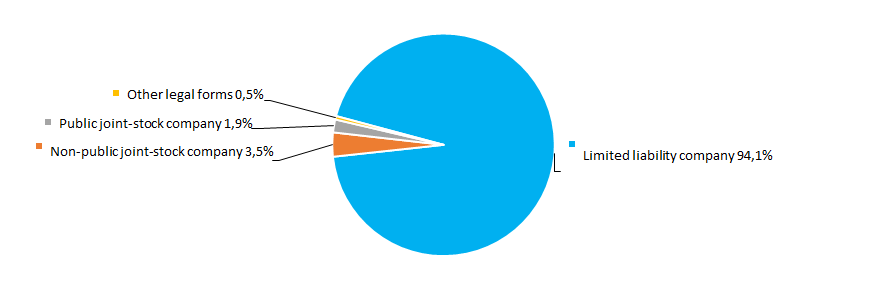

The most popular legal form among companies in the field of brewing is Limited Liability Company. A significant place also take non-public joint stock companies (Picture 1).

Picture 1. Distribution of TOP-800 companies by legal forms

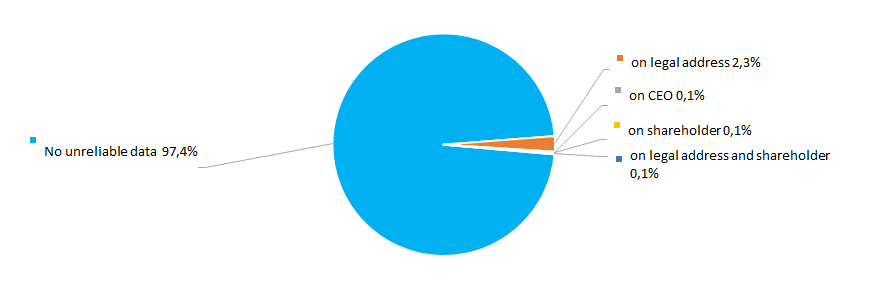

Picture 1. Distribution of TOP-800 companies by legal formsAccording to the results of investigation of the Federal Tax Service of the RF, 2,6% of companies in the industry have records of unreliable data entered into the Unified State Register of Legal Entities (Picture 2).

Picture 2. Shares of TOP-800 companies, having records of unreliable data in the Unified State Register of Legal Entities

Picture 2. Shares of TOP-800 companies, having records of unreliable data in the Unified State Register of Legal EntitiesSales revenue

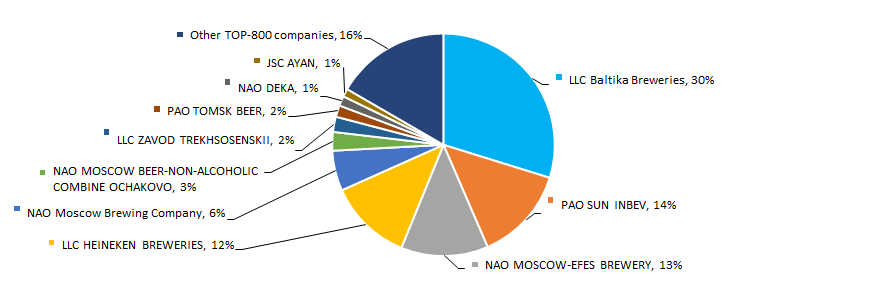

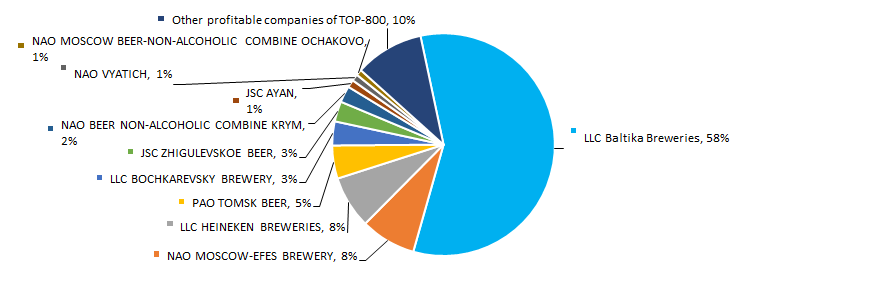

In 2016 total revenue of 10 largest companies amounted to 84% from TOP-800 total revenue. This fact testifies high level of monopolization within the industry. In 2016, the largest company by total revenue is LLC Baltika Breweries (Picture 3).

Picture 3. Shares of TOP-10 companies in TOP-800 total revenue for 2016

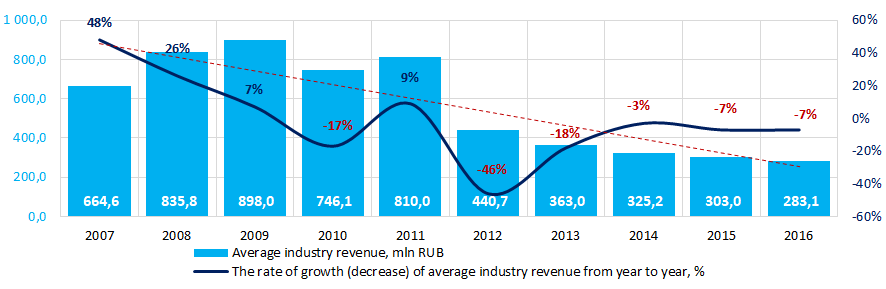

Picture 3. Shares of TOP-10 companies in TOP-800 total revenue for 2016The best results by revenue among the industry for the ten-year period were achieved in 2009. The decrease in average industry indicators was observed within crisis phenomena in the economy in 2010 and 2012-2016. In general, the decrease in sales revenue is observed (Picture 4).

Picture 4. Change of average industry revenue of the companies in the field of brewing in 2007-2016

Picture 4. Change of average industry revenue of the companies in the field of brewing in 2007-2016Profit and loss

In 2016 profit of the 10 largest companies amounted to 90% from TOP-800 total profit. In 2016, the leading position by profit also takes LLC Baltika Breweries (Picture 5).

Picture 5. Shares of TOP-10 companies in TOP-800 total profit for 2016

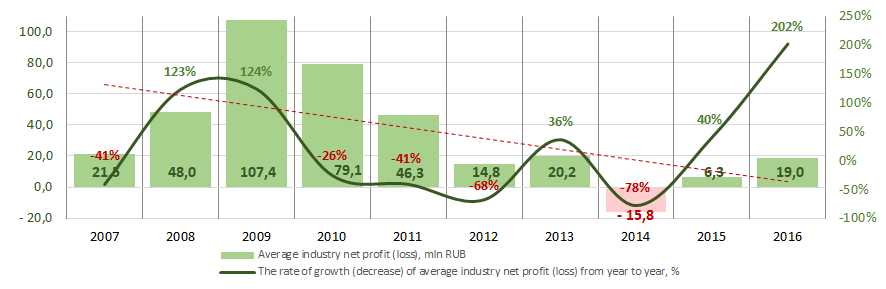

Picture 5. Shares of TOP-10 companies in TOP-800 total profit for 2016For the ten-year period, the average industry revenue values of companies in the field of beer production are not stable. The negative values were observed in 2014 against the background of crisis phenomena in the economy. In recent years, the growth of indicators is observed, however, in general, the revenue ratios demonstrate decreasing tendency. The best results of the industry were observed in 2009 (Picture 6).

Picture 6. Change of average industry profit of the companies in the field of beer production in 2007-2016

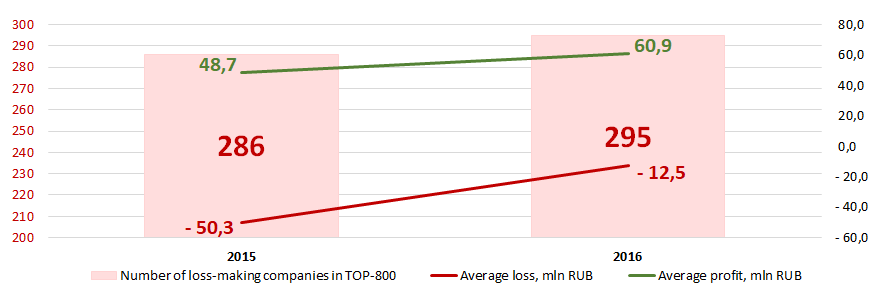

Picture 6. Change of average industry profit of the companies in the field of beer production in 2007-2016In 2015, the TOP-800 list included 286 loss-making companies. In 2016 the number of loss-making companies increased to 295 or by 3%. Meanwhile, their average loss decreased by 75%. The average profit of other companies from TOP-800 list increased by 25% for the same period (Picture 7).

Picture 7. Number of loss-making companies, average loss and profit within TOP-800 companies in 2015 – 2016

Picture 7. Number of loss-making companies, average loss and profit within TOP-800 companies in 2015 – 2016Main financial indicators

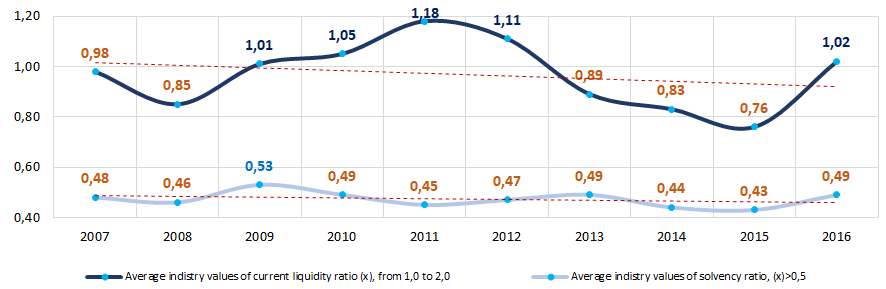

For the ten-year period, the average industry values of current liquidity ratio within five years were lower than recommended values - from 1,0 to 2,0. (yellow color on Picture 8).

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Solvency ratio (ratio of equity capital to total balance) shows the company’s dependence from external borrowings. The recommended value of the ratio is >0,5. The ratio value less than minimum limit signifies about strong dependence from external sources of funds.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. In 2016 the practical value of solvency ratio for the companies in the field of beer production is from -0,12 to 0,41.

For the ten-year period, the average industry values of the ratio within nine years were lower than recommended values and higher than practical values (Picture 8).

In general, the downtrend is observed for both ratios.

Picture 8. Changes of average industry values of current liquidity ratio and solvency ratio of companies in the field of beer production in 2007 – 2016

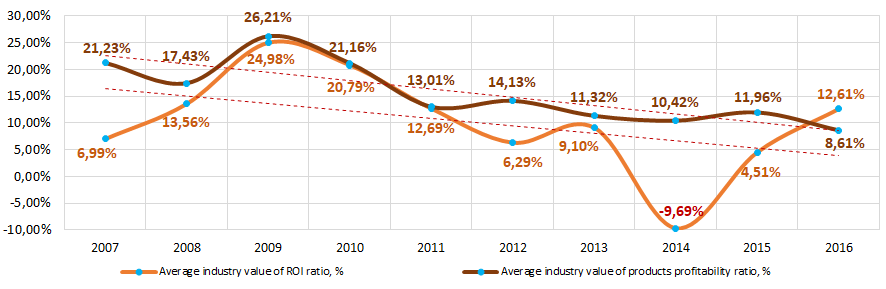

Picture 8. Changes of average industry values of current liquidity ratio and solvency ratio of companies in the field of beer production in 2007 – 2016 For the last ten years, the instability of ROI ratio was observed. In the period of crisis phenomena in the economy in 2014 the ratio decreased to negative values (Picture 9). The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Within the same period, the products profitability ratio was also unstable (Picture 9). Product profitability ratio is a ratio of sales profit to general expenses. In general, the profitability characterizes the production efficiency.

The greatest growth of indicators was observed in 2009. In general, the ratios demonstrate the negative trend.

Picture 9. Changes of average industry values of ROI ratio and products profitability ratio of companies in the field of beer production in 2007 – 2016

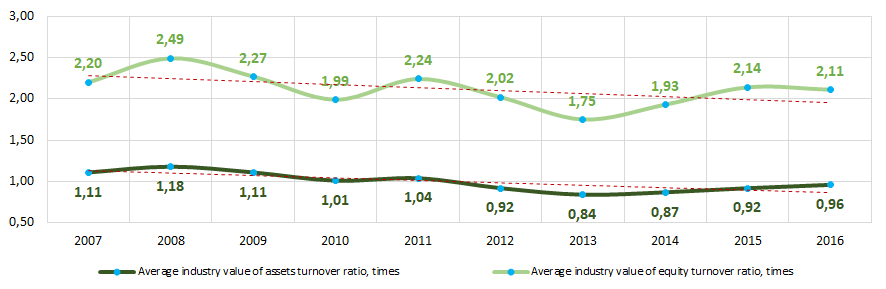

Picture 9. Changes of average industry values of ROI ratio and products profitability ratio of companies in the field of beer production in 2007 – 2016Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Equity turnover ratio is calculated as a ratio of revenue to yearly average sum of equity and demonstrates the company’s usage rate of total assets.

For the ten-year period, both ratios demonstrated relative stability with slight downtrend (Picture 10).

Picture 10. Changes of average industry values of activity ratios of companies in the field of beer production in 2007 – 2016

Picture 10. Changes of average industry values of activity ratios of companies in the field of beer production in 2007 – 2016Dynamics of business activity

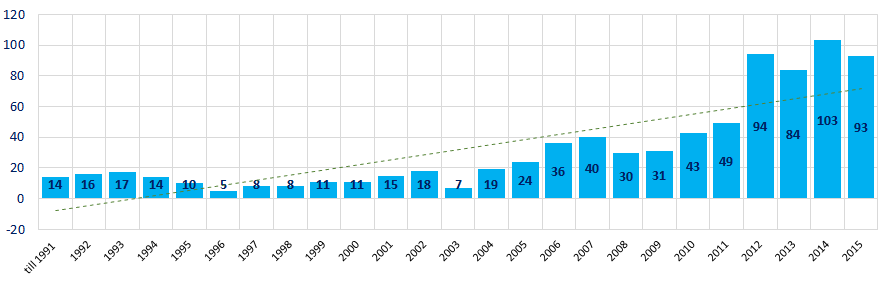

Over a 25-year period, the registered companies from TOP-800 list are unequally distributed by the year of foundation. Most of the companies engaged in beer production were founded in 2014. In general, the increasing tendency is observed (Picture 11).

Picture 11. Distribution of TOP-800 companies by the year of foundation

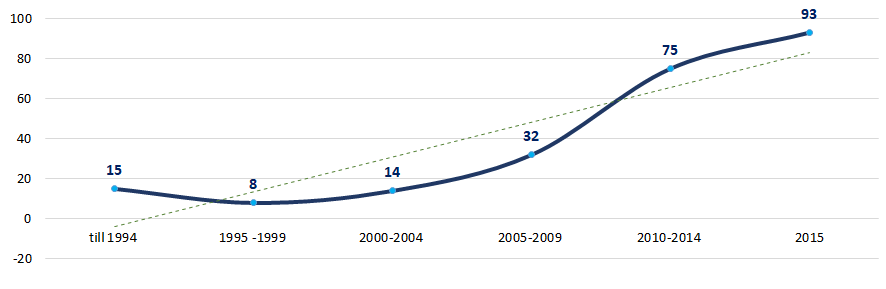

Picture 11. Distribution of TOP-800 companies by the year of foundationThe most outstanding interest of business to beer production is observed after 2010 (Picture 12).

Picture 12. Average number of TOP-800 companies, registered within a year, by year of foundation

Picture 12. Average number of TOP-800 companies, registered within a year, by year of foundation Main regions of activity

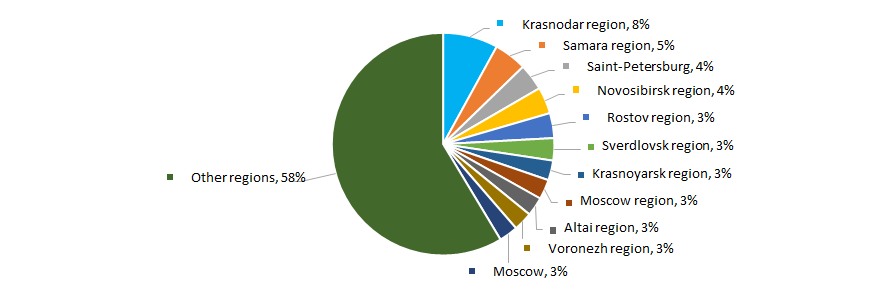

Companies in the field of beer production rather equally distributed across the country. Most of them are registered in Krasnodar region – the region with developed infrastructure of agriculture and food industry (Picture 13).

TOP-800 companies are registered in 78 regions of the Russian Federation.

Picture 13. Distribution of TOP-800 companies by Russian regions

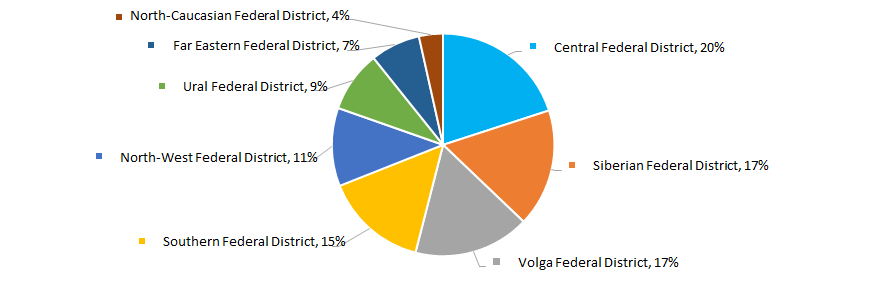

Picture 13. Distribution of TOP-800 companies by Russian regionsMost of the companies of the industry are concentrated in the Central Federal District (Picture 14).

Picture 14. Distribution of TOP-800 companies by Federal Districts of Russia

Picture 14. Distribution of TOP-800 companies by Federal Districts of RussiaThe share of companies from TOP-800 list with branches or representative offices amounted to 2,4%.

Participation in arbitration proceedings

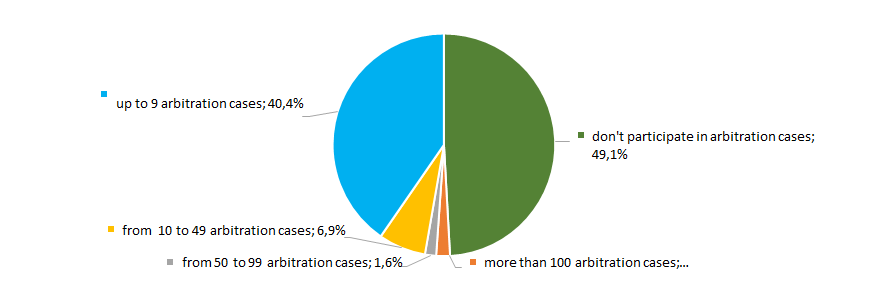

Most companies of the sector either do not participate in arbitration proceedings, or participate in a small number of cases (Picture 15).

Picture 15. Distribution of TOP-800 companies by participation in arbitration proceedings

Picture 15. Distribution of TOP-800 companies by participation in arbitration proceedingsReliability index

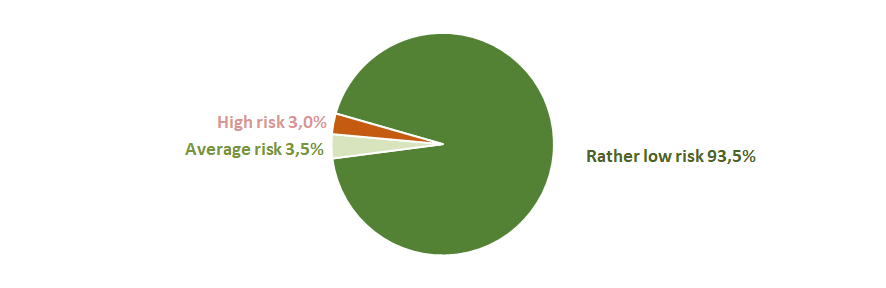

The risk of meeting a fly-by-night company or an unreliable company is extremely low for the most companies of the sector (Picture 16).

Picture 16. Distribution of TOP-800 companies by reliability index

Picture 16. Distribution of TOP-800 companies by reliability indexFinancial position score

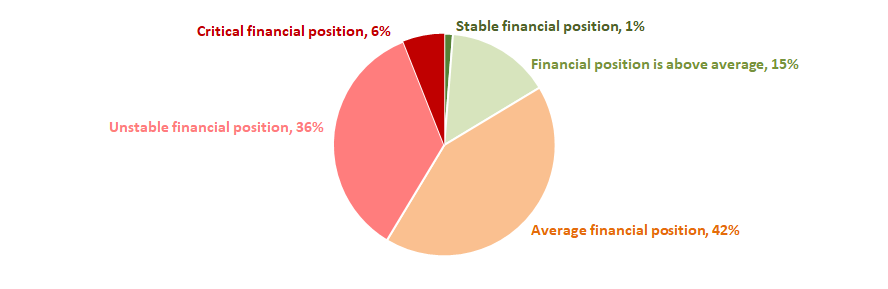

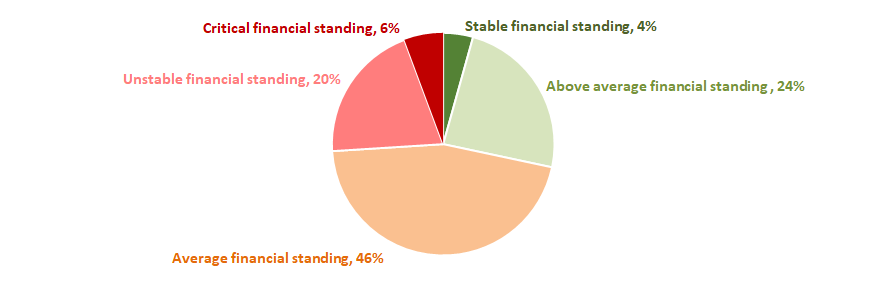

The assessment of company’s financial position shows that more than one third of companies are in unstable and critical financial position and the same number of companies have average financial position (Picture 17).

Picture 17. Distribution of TOP-800 companies by financial position score

Picture 17. Distribution of TOP-800 companies by financial position scoreLiquidity index

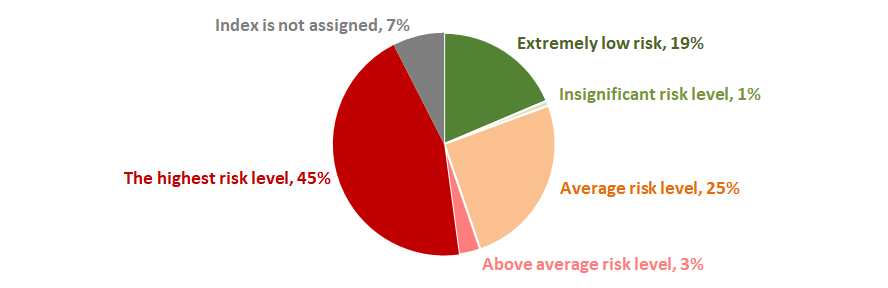

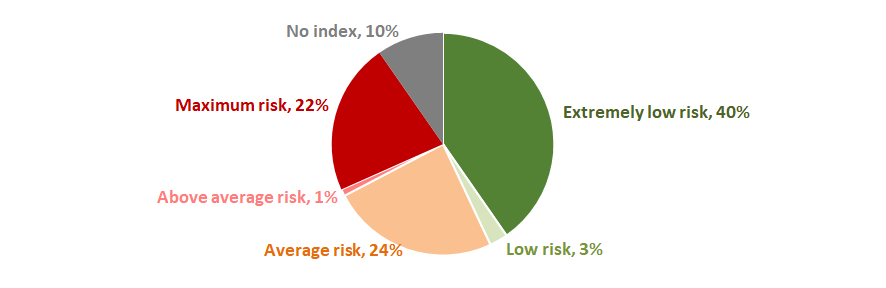

Almost more than a half of industry companies have the highest or above average level of bankruptcy risk in the short-term period (Picture 18).

Picture 18. Distribution of TOP-800 companies by liquidity index

Picture 18. Distribution of TOP-800 companies by liquidity indexSolvency index Globas

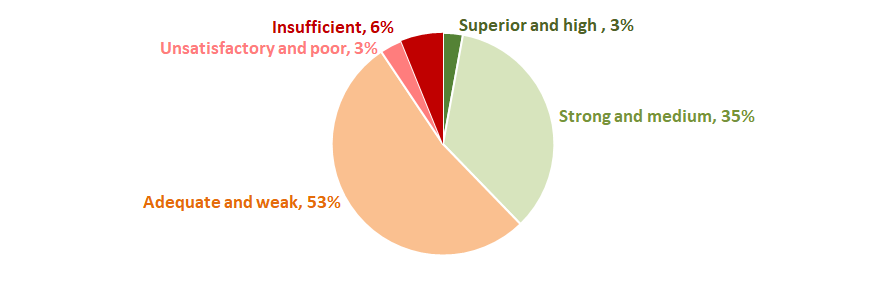

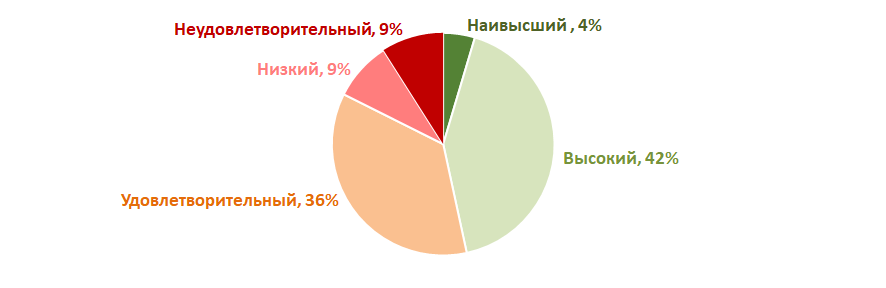

More than a half of TOP-800 companies have adequate and weak solvency index Globas. Thus, almost more than one third of companies have superior, high or strong, medium solvency index Globas (Picture 19).

Picture 19. Distribution of TOP-800 companies by solvency index Globas

Picture 19. Distribution of TOP-800 companies by solvency index Globas Hereby, the complex assessment of beer production companies, taking into account main indexes, financial ratios and indicators, shows negative trends in this field of activity. However, in the last two years, the industry situation started to stabilize.

Trends in the field of shipbuilding

Information agency Credinform observes tendencies in the sphere of shipbuilding.

The companies with the highest volume of revenue (TOP-10 and TOP-300) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2015 and 2016). Analysis was based on the data from the Information and Analytical system Globas.

Legal forms and unreliable data

The most widespread legal form in the industry is a Limited liability company. Significant shares make non-public and public joint-stock companies. (Picture 1).

Picture 1. Distribution of TOP-300 companies by legal forms

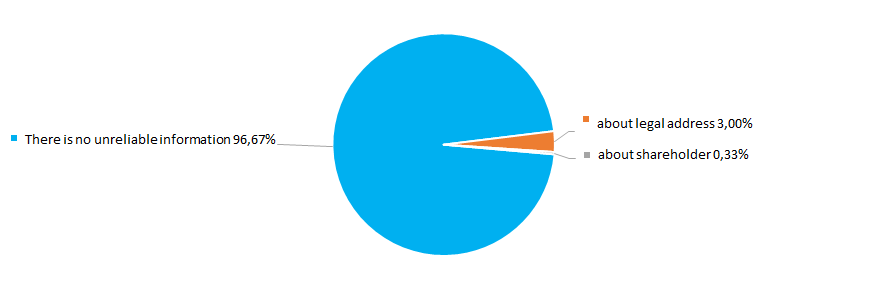

Picture 1. Distribution of TOP-300 companies by legal formsFollowing the results of the investigations of the Federal Tax Service of the RF, 3,33% of companies in the industry are entered records about unreliable data to the Unified state register of legal entities (EGRUL) (Picture 2).

Picture 2. Shares of TOP-300 companies, with records in the EGRUL about unreliable data

Picture 2. Shares of TOP-300 companies, with records in the EGRUL about unreliable data Sales revenue

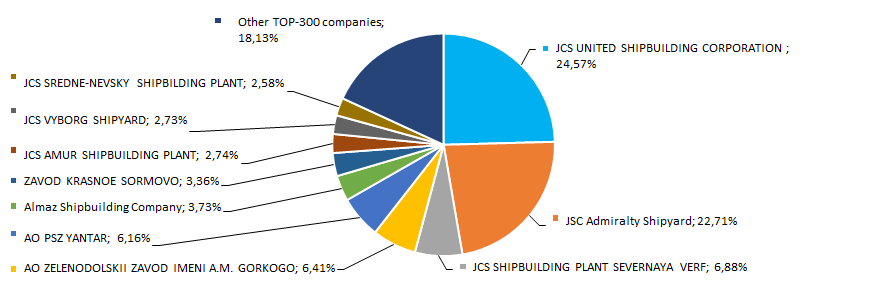

Revenue of 10 leaders of the industry in 2016 was 82% from the total revenue of the 300 largest companies. This shows high level of monopolization in the industry. The largest company in terms of revenue volume in 2016 was JCS UNITED SHIPBUILDING CORPORATION - the largest shipbuilding holding in Russia, uniting about 40 planning and design offices and specialized scientific and research centers, shipyards, shipbuilding and enterprises. Major part of the national shipbuilding complex was consolidated on the basis of the above mentioned enterprises. (Picture 3).

Picture 3. Shares of TOP-10 companies in the total revenue of 2016 of TOP-300

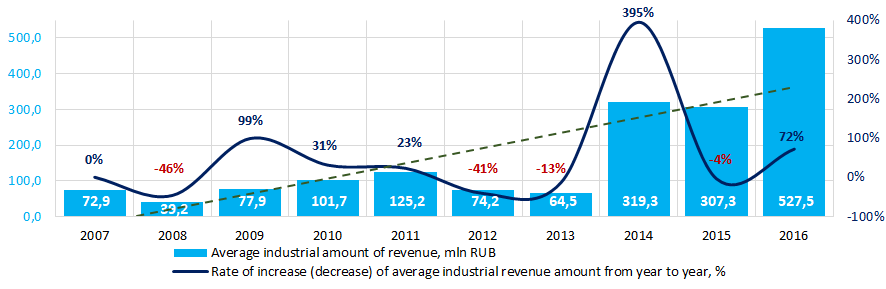

Picture 3. Shares of TOP-10 companies in the total revenue of 2016 of TOP-300The best results in the industry in terms of revenue volume for a ten-year period were reached in 2016. During crisis periods in the economy in 2008, 2012 and 2013 average industrial values have significantly decreased. In general, the tendency for increasing of revenue volume is observed. (Picture 4).

Picture 4. Change in average industrial values of revenue in the sphere of shipbuilding companies in 2007 – 2016

Picture 4. Change in average industrial values of revenue in the sphere of shipbuilding companies in 2007 – 2016 Profit and loss

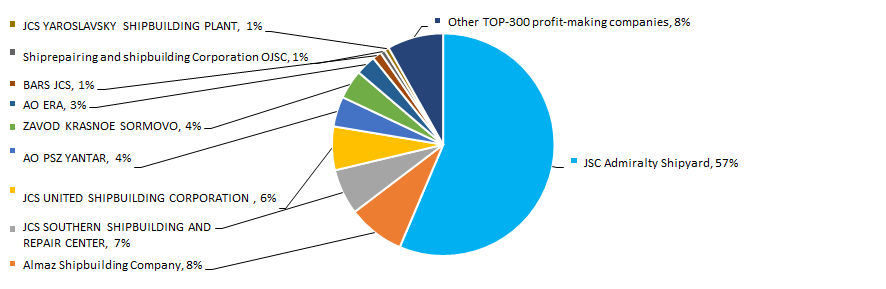

Profit volume of 10 leaders of the industry in 2016 was 92% of the total profit of TOP-300 companies. JSC ADMIRALTY SHIPYARD takes lead in 2016 in terms of profit volume - basic enterprise of the shipbuilding industry that is a part of JCS UNITED SHIPBUILDING CORPORATION and specializes in manufacture of demersal marine equipment, building of submarines, demersal facilities and knowledge intensive high technology ships for military and civilian usage. (Picture 5).

Picture 5. Shares of TOP-10 companies in the total profit volume of TOP-300 companies in 2016

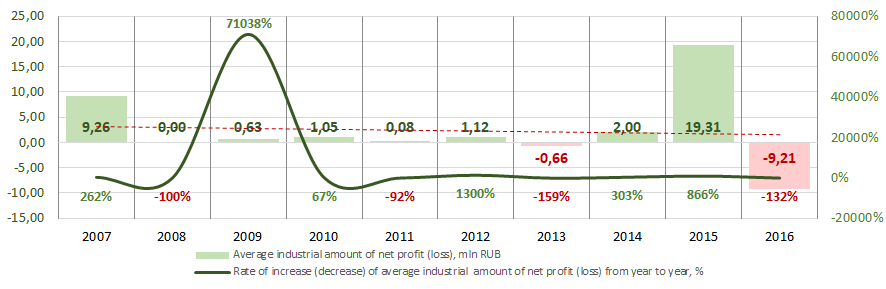

Picture 5. Shares of TOP-10 companies in the total profit volume of TOP-300 companies in 2016Average industrial values of the companies` profit indicators for ten years are not stable. Negative values of the indicator were observed in 2013 and 2016. In general, profit indicators have decreasing tendency. The best results in the industry were shown in 2015. (Picture 6).

Picture 6. Change of the average industrial indicators of profit for shipbuilding companies in 2007 – 2016

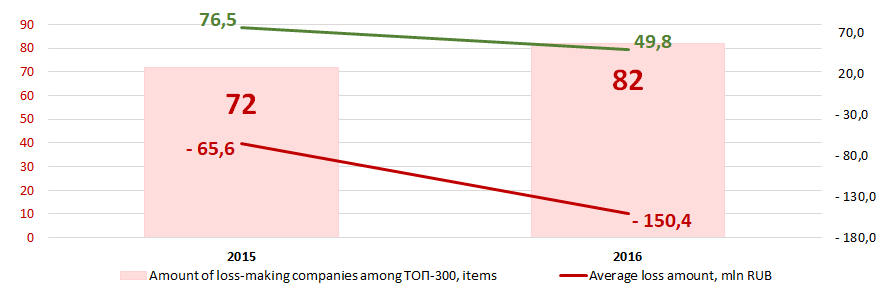

Picture 6. Change of the average industrial indicators of profit for shipbuilding companies in 2007 – 2016 Among the TOP-300 group 72 loss-making companies were observed in 2015. The amount increased to 82 companies or by 14% in 2016. Besides, average amount of loss has 129% increased. For the rest of TOP-300 companies, average amount of profit has 35% decreased for the same period (Picture 7).

Picture 7. Amount of loss-making companies, average values of loss and profit for TOP-300 companies in 2015 – 2016

Picture 7. Amount of loss-making companies, average values of loss and profit for TOP-300 companies in 2015 – 2016 Key financial ratios

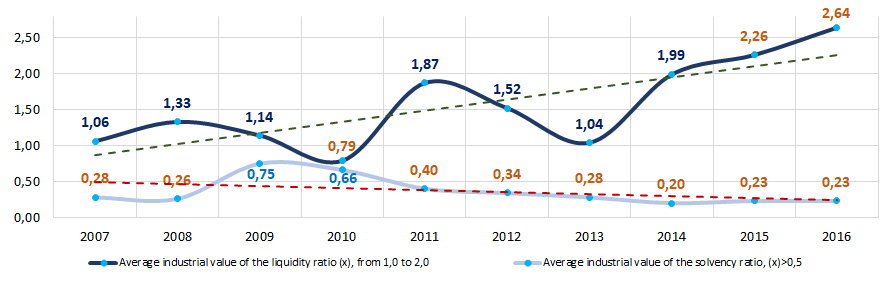

For ten years average indicators of the current liquidity ratio in the industry were in the interval of the recommended values - from 1,0 to 2,0 and higher, except for 2010. In general, indicator of the ratio has increasing tendency.

Current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Solvency ratio (equity to balance sheet amount) shows the dependence of the company on external loans. The recommended value: >0,5. A value less than a minimum one indicates high dependence on external sources of funds.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. For shipbuilding industry practical value of the solvency ratio is from 0,02 to 0,85 in 2016.

For a ten-year period average indicators of the ratio were lower than recommended values for eight years and in the interval of practical values for the whole period (Picture 8).

In the whole, indicator of the ratio has decreasing tendency.

Picture 8. Change of average industrial values of the current liquidity and solvency ratios for shipbuilding companies in 2007 – 2016

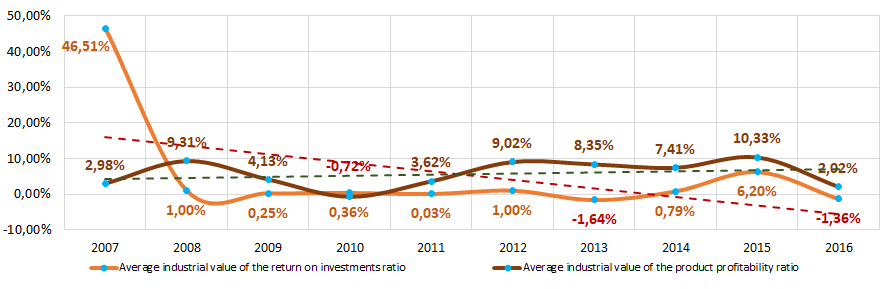

Picture 8. Change of average industrial values of the current liquidity and solvency ratios for shipbuilding companies in 2007 – 2016 During ten years unstable indicators of the return on investments ratio with decreasing tendency were observed. In 2013 and 2016 indicators decreased to negative values (Picture 9). The ratio is net profit to the total equity and long-term liabilities and demonstrates profit from the equity involved into commercial activities and long-term external funds of the company.

For the same period indicators of the product profitability ratio were also unstable (Picture 9).

The ratio is sales revenue to expenses from ordinary activities. Totally, profitability indicates the economic efficiency of production.

In general, indicator of the ratio demonstrates increasing tendency.

Picture 9. Change of average industrial values of the return on investments and the product profitability ratios for shipbuilding companies in 2007 – 2016

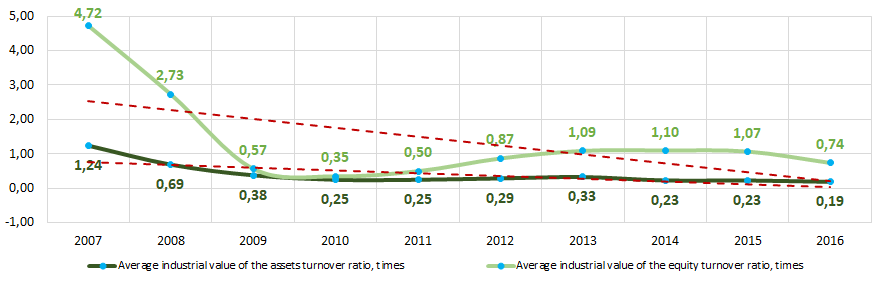

Picture 9. Change of average industrial values of the return on investments and the product profitability ratios for shipbuilding companies in 2007 – 2016 The assets turnover ratio is sales revenue to average total assets for a period and characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating profit.

The equity turnover ratio is calculated as a ratio of revenue to yearly average sum of equity and demonstrates the company’s usage rate of total assets.

For ten years both ratios of business activity demonstrated were instable with decreasing tendency (Picture 10).

Picture 10. Change of average industrial values of the business activity ratios for shipbuilding companies in 2007 – 2016

Picture 10. Change of average industrial values of the business activity ratios for shipbuilding companies in 2007 – 2016 Production structure

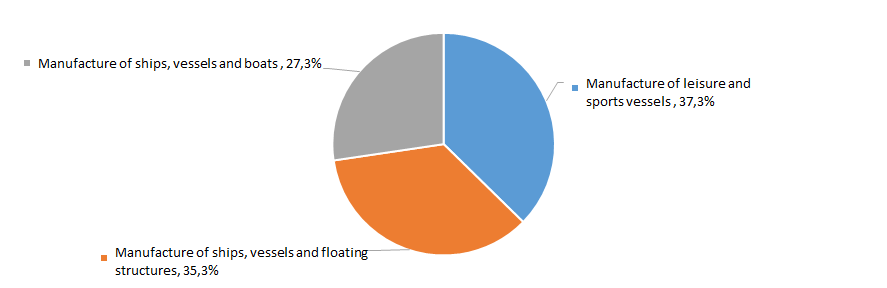

Major part of TOP-300 companies specializes in manufacture of leisure and sports vessels (Picture 11).

Picture 11. Distribution of TOP-300 companies by types of output, %

Picture 11. Distribution of TOP-300 companies by types of output, %Dynamics of business activity

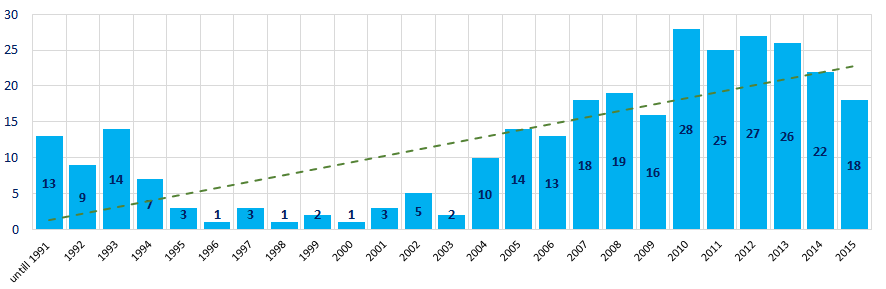

Over a 25-year period, the registered companies from TOP-300 list are unequally distributed by the year of foundation. Most of companies in the industry were founded in 2010. In general, increasing tendency for amount of registered companies is observed. (Picture 12).

Picture 12. Distribution of TOP-300 companies by years of foundation

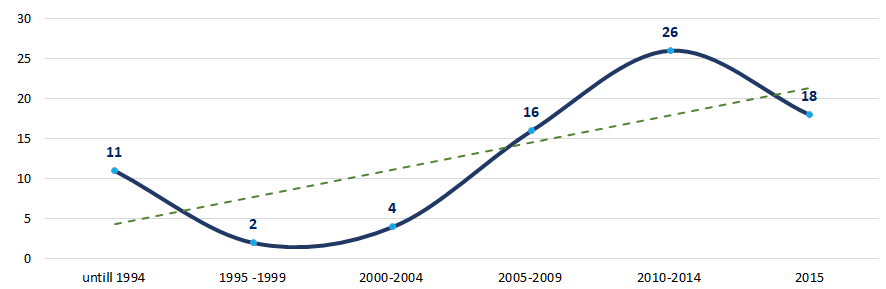

Picture 12. Distribution of TOP-300 companies by years of foundation Outstanding interest for shipbuilding industry was paid in 2010 - 2014. (Picture 13).

Picture 13. Average amount of TOP -300 companies, registered per year, in terms of foundation periods

Picture 13. Average amount of TOP -300 companies, registered per year, in terms of foundation periods Main regions of activity

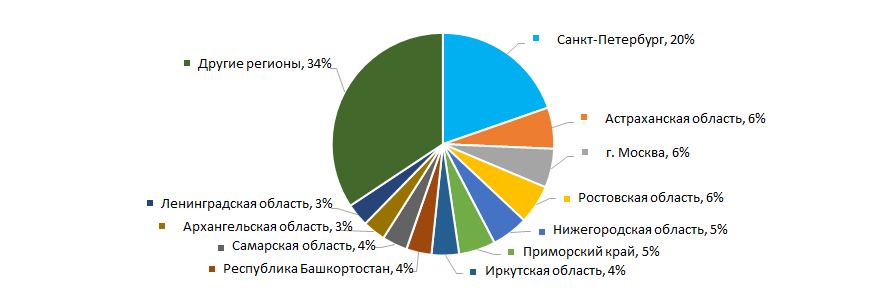

Marine fishery companies are distributed unequally on the territory of the country. Most of the companies are registered in Saint-Petersburg – historically developed, the largest center of shipbuilding industry in the country (Picture 14).

TOP-300 companies are registered in 41 regions of Russia.

Picture 14. Distribution of TOP -300 companies throughout regions of Russia

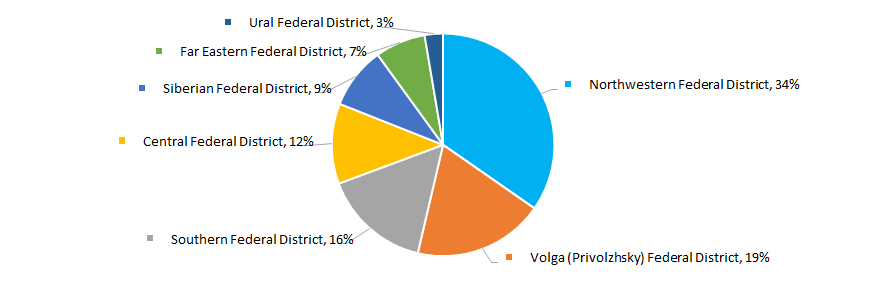

Picture 14. Distribution of TOP -300 companies throughout regions of RussiaThe majority of shipbuilding companies is centered in the Northwestern Federal District of the RF (Picture 15).

Picture 15. Distribution of TOP-300 companies throughout federal districts of Russia

Picture 15. Distribution of TOP-300 companies throughout federal districts of RussiaShare of companies from the TOP -300 group, having branches or representative offices, amounts to 6%.

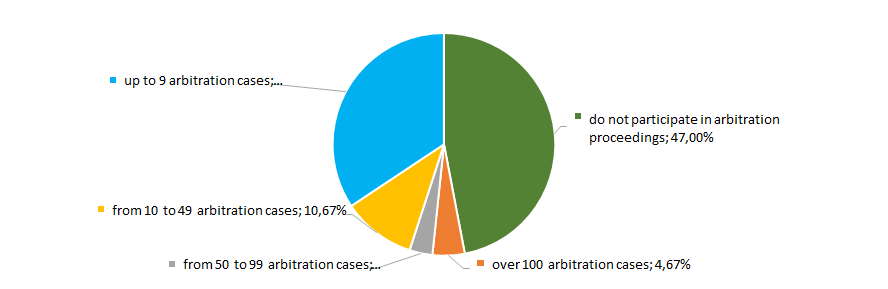

Participation in arbitration proceedings

Overwhelming majority of companies in the industry does not participate in arbitration proceedings or participate inactively (Picture 16).

Picture 16. Distribution of TOP -1000 companies by participation in arbitration proceedings

Picture 16. Distribution of TOP -1000 companies by participation in arbitration proceedingsReliability indexи

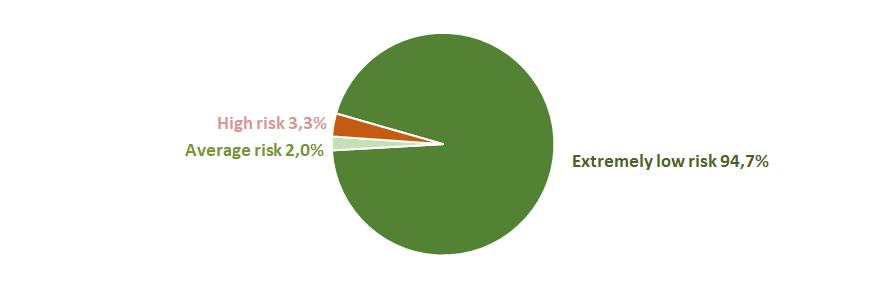

In terms of signs of «fly-by-night» or unreliable companies the majority of companies demonstrate extremely low risk of cooperation (Picture 17).

Picture 17. Distribution of TOP -300 by Reliability index

Picture 17. Distribution of TOP -300 by Reliability indexFinancial position score

Assessment of financial state of the sector’s companies indicates that the most of the companies have an average financial standing (Picture 18).

Picture 18. Distribution of TOP-300 companies by Financial position score

Picture 18. Distribution of TOP-300 companies by Financial position scoreLiquidity index

Almost half of the sector`s companies (48%) demonstrate an extremely low or insignificant levels of bankruptcy risk in the short-term period. However, more than 20% of enterprises have the highest level of risk. (Picture 19).

Picture 19. Distribution of TOP-300 companies by Liquidity index

Picture 19. Distribution of TOP-300 companies by Liquidity indexSolvency index Globas

Most of the TOP-300 companies have got from superior to medium Solvency index Globas (Picture 20). Besides, more than a third of companies have got adequate and weak Solvency index Globas

Picture 20. Distribution of TOP -300 by Solvency index Globas

Picture 20. Distribution of TOP -300 by Solvency index GlobasTherefore, complex assessment of shipbuilding companies, taking into accounts key indexes, financial figures and ratios, demonstrate unfavorable trends within the industry. However, the situation has recently begun stabilizing.