Inequality of Russian regions

Dear Madams and Sirs,

Russian regions are quite unequal by the area, population, resources potential, scientific-industrial and trade resources, and social-economic development level. For their comparison various methods and rankings using the set of assessments and the specific feature for ranking were created. Therefore it is interesting to study the territorial entities of Russia in term of ratio of the expenditure regional budget to the population.

Most of the territory of the Russian Federation has the dotation status and treasuries more or less depend on inter-budget transfers from the federal center. The government policy is aimed at fiscal equalization of regional development inequality, which remains to be very high. By far, first spots of the ranking of the regions in terms of budget sufficiency belong to the High North regions rich with natural resources being our export base, as well as economic and political centers – Moscow and Saint-Petersburg.

The Nenets Autonomous District with the population of just over 40 th. people is on top. The expenditure budget of the district is compared with the budget of the Mari El Republic with almost 700 th. people. The district has 425 th. RUB account for head per year, while it is less in the Mari El Republic with its 32 th. RUB for head per year.

Despite of such a high level of the expenditure budget per head, life is very expensive in the Nenets Autonomous District. Moreover, extremely sever climatic conditions and underdeveloped infrastructure are resulted in high migration outflow of the most mobile citizens groups and natural population reduction (except autonomous districts of the Tyumen region). For example, the population of the Magadan region (5th in the ranking) has reduced by 3,7 in the period of 1989 – 2015 (from 542,9 th. to 148,1 th. people). In spite of the quite high living standard, the living attraction of this territory remains extremely low.

Among all regions of Russia, Moscow is reasonably the most attractive place for living both by climatic and social-economic conditions. The capital of Russia with the expenditure budget of 134 th. RUB per head is the 8th in the ranking, having at the same time the largest population among all 85 regions (12,2 mln. people).

Migratory pressure in the Moscow region will remain until neighboring regions approach the city by development. As a comparison, the expenditure budget per head in the Kaluga region is less than in Moscow by 2,9 times. Leveling the imbalance have to be conducted not only by manufacturing and service sector development, but also by changing the rules of business registration - at the place of main activity carrying out. The example is that almost all major fuel and energy companies of Russia are registered in Moscow and Saint-Petersburg, but operate far beyond them. The number of legal entities in both cities is an indirect proof: according to the Information and analytical system Globas®-i of the Credinform information agency, 1102,2 th. legal entities operate in Moscow and 357,6 th. in Saint-Petersburg; that is about 31% of all active enterprises in the country.

Whereas Saint-Petersburg closes the top 10 of the ranking – 91 th. RUB per head. Despite a slight growth of the expenditure budget in 2015, the positive population changes have resulted in spending reduction per head (-0,6%).

The lowest indicators were traditionally recorded in the regions of North Caucasus: the Republics of Dagestan and North Ossetia-Alania with 28 th. RUB per head.

Budgets of the Republic of Crimea and Sevastopol have shown the most impressive growth of the expenditure part due to the federal subsidies: by 230% and 102% respectively (this can be explained by the low base of the previous period, when the treasury was formed as a part of the Ukraine). Sevastopol is 35th and the Republic of Crimea is 57th in the ranking, which is higher than the Krasnodar Territory.

| Rang | Territorial entity | The expenditure budget 2015 (at the time of adoption), th. RUB | The expenditure budget for head per year, th. RUB | Growth (reduction) of the expenditure budget indicator per head to 2014, % |

| 1 | The Nenets Autonomous District | 18 438 763 | 425 | 49,8 |

| 2 | The Chukotka Autonomous District | 21 031 142 | 416 | 15,8 |

| 3 | The Sakhalin region | 129 900 383 | 266 | 13,5 |

| 4 | The Yamal-Nenets Autonomous District | 117 249 240 | 217 | 8,3 |

| 5 | The Magadan region | 27 736 321 | 187 | -2,0 |

| ... | ... | ... | ... | ... |

| 81 | The Karachayevo-Cherkessian Republic | 13 731 547 | 29 | -1,2 |

| 82 | The Republic of Kalmykia | 8 129 643 | 29 | 3,9 |

| 83 | The Saratov region | 72 063 925 | 29 | 1,2 |

| 84 | The Republic of North Ossetia-Alania | 19 928 645 | 28 | -2,5 |

| 85 | The Republic of Dagestan | 84 346 884 | 28 | 4,0 |

Significant inequality in regional development remains in Russia: the difference of the expenditure budget per head among the territories is 15 times. The existing tax allocation system has led to the appearance of several donator regions, while the majority of territories annually obtain donations from the federal budget to flow balance; that results in the reduction of economic growth initiative.

You can obtain all available information on enterprises in different regions of the Russian Federation from daily updating Information and analytical system Globas-i®. For all information on Russian and foreign enterprises, as well as analytical reports on various economic sectors you can refer to our Custom Service Department specialists:

+7 (812) 406 8414 (Saint-Petersburg), +7 (495) 640 4116 (Moscow).

Products cost of enterprises engaged in processing and preserving of fish and seafood

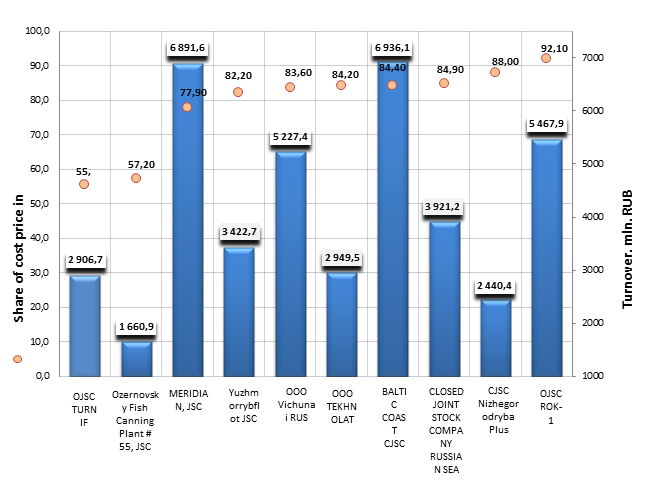

Information agency Credinform prepared a ranking of companies engaged in processing and preserving of fish and seafood in terms of products cost. Companies with the mentioned activity type and the highest volume of turnover were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). The enterprises of the Top-10 were ranked by increase in the share of manufactured products cost in the company's turnover.

The cost price is a cost (expenses) for production, works or services. It is an important qualitative indicator reflecting how much the company costs on production and marketing. The lower is the cost price, the higher are profit and profitability. Normative values for this indicator are not specified. For evaluating the effectiveness of cost management, it is necessary to look through the percentage of the cost price in the company's turnover.

| № | Name, INN | Region | Turnover 2013, mln. RUB | Products cost, mln. RUB | Cost price share in turnover, (%) | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| 1 | OPEN JOINT - STOCK COMPANY PACIFIC DEPARTMENT OF FISH SURVEY AND RESEARCH FLEET TURNIF INN 2536053382 |

Primorsky Krai | 2907 | 1616 | 55,6 | 184 (the highest) |

| 2 | Ozernovsky Fish Canning Plant # 55, JSC INN 4108003484 |

Kamchatka Krai | 1661 | 950 | 57,2 | 240 (high) |

| 3 | Meridian, JSC INN 7713016180 |

Moscow | 6892 | 5369 | 77,9 | 181 (the highest) |

| 4 | Yuzhmorrybflot JSC INN 2508098600 |

Primorsky Krai | 3423 | 2814 | 82,2 | 269 (high) |

| 5 | OOO Vichunai RUS INN 3911008930 |

the Kaliningrad region | 5227 | 4370 | 83,6 | 248 (high) |

| 6 | ООО TEKHNOLAT INN 3906145113 |

the Kaliningrad region | 2949 | 2483 | 84,2 | 600 (unsatisfactory) |

| 7 | BALTIC COAST CJSC INN 7826059025 |

the Leningrad region | 6936 | 5856 | 84,4 | 217 (high) |

| 8 | CLOSED JOINT STOCK COMPANY RUSSIAN SEA INN 5031033020 |

the Moscow region | 3921 | 3328 | 84,9 | 292 (high) |

| 9 | CJSC Nizhegorodryba Plus INN 5260072045 |

the Nizhniy Novgorod region | 2440 | 2148 | 88,0 | 262 (high) |

| 10 | OPEN JOINT-STOCK COMPANY ROK-1 INN 7805024462 |

Saint-Petersburg | 5468 | 5033 | 92,1 | 195 (the highest) |

The average cost price share in the turnover of the Russian fish processing enterprises exceeds 70%. That shows high expenses on production and can be an indicator of an outdated industrial base.

Last year, the Russian enterprises engaged in processing and preserving of fish and seafood, have faced with serious problems due to the introduction of the food embargo. According to the experts, only in the Kaliningrad region about 40% of raw material for canned fish were delivered from countries, came under the Russian countersanctions. Thus, enterprises urgently had to find new suppliers of raw materials. The already difficult situation was exacerbated by serious competition from foreign producers, since the import of canned fish wasn’t under the embargo.

As a reminder, in August 2014 Russia imposed an embargo on the supply of food products from the EU, US, Australia, Canada and Norway. In particular, the ban was imposed on the import of fish. However, Moscow restrictions were not applied at canned fish.

Products cost of the major enterprises engaged in processing and preserving of fish and seafood in Russia, Top-10

The Top-3 is presented with the following companies: OPEN JOINT - STOCK COMPANY PACIFIC DEPARTMENT OF FISH SURVEY AND RESEARCH FLEET TURNIF (55,6%), Ozernovsky Fish Canning Plant # 55, JSC (57,2%) and Meridian, JSC (77,9%). The companies have shown quite high values of products cost against turnover. This result demonstrates the high production costs. However, the enterprises got high and the highest solvency index Globas-i® in terms of financial and non-financial factors set; that characterizes them as financially stable.

The rest of the Top-10 companies have shown the value of the index above the average (70%), that indicates that enterprises of the industry should be more rational in approach to their own costs management to improve competitiveness.