Enforcement of foreign judgments on confiscation of criminal proceeds on the territory of the Russian Federation

The Federal Law «On amendments to the Federal Law «On enforcement proceedings» as of 05.12.2017 №382-FZ defines the procedure of enforcement of foreign judgments in Russia related to confiscation of criminal proceeds on the territory of the Russian Federation in accordance with international agreements of Russia and procedural law. Thus, the foreign judgments are comprised of judicial verdicts and decrees, including verdicts and decrees of arbitration courts.

Distrained or seized property withdrawn in accordance with judicial decree should be turned into government property by transferring to the relevant authorities on condition that it does not conflict with international agreements of Russia. According to active legislation, seized property refers to property withdrawn or arrested on the basis of judicial decree.

If there are no relevant international agreements, the enforcement of foreign judgments is carried out according to principle of mutuality confirmed by written obligations of foreign States, received by the Ministry of Justice of the Russian Federation in accordance with first part of Article 457 of the Criminal Procedural Code of the Russian Federation.

The amendments to the Criminal Procedural Code of the Russian Federation were made by the Federal Law as of 05.12.2017 №382-FZ by adding new chapter 55.1. «consideration and resolution of issues, related to admission and enforcement of foreign judicial verdicts and decrees in terms of confiscation of criminal proceeds on the territory of the Russian Federation».

The Articles of the chapter from 473.1. to 473.7. defines the following:

- the procedure of admission and enforcement of foreign judgments and the content of relevant requests;

- the courts competence and the order of relevant requests consideration in judicial authority;

- reasons for refusal of admission and enforcement;

- the content part of court decisions upon the results of consideration;

- procedure for issuing writs of execution and their direction on compulsory enforcement.

Trends in manufacturing of medical devices and equipment

Information Agency Credinform presents a review of trends in manufacturing of medical devices and equipment.

The enterprises of the sector with the highest volume of annual revenue (TOP-10 and TOP-800) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 and 2016). The analysis was based on the data from the Information and Analytical system Globas.

Legal forms and unverified data

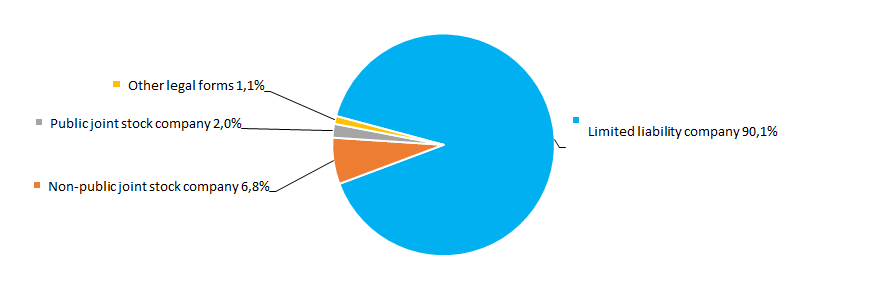

Limited liability company is the prevailing legal form among companies of the sector. Non-public joint stock companies’ fraction is significant too (Picture 1).

Picture 1. TOP-800 companies by legal forms

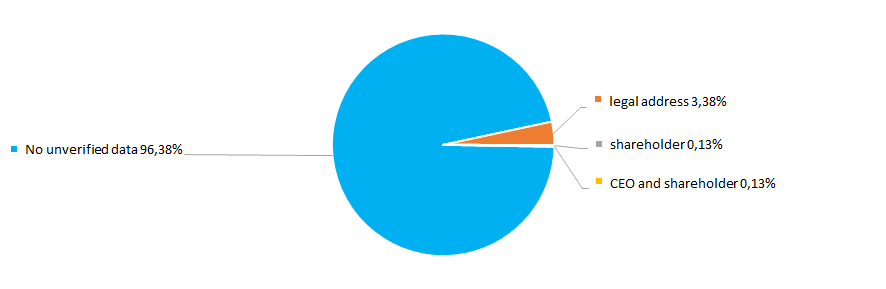

Picture 1. TOP-800 companies by legal formsAs a result of investigations by the Federal Tax Service of Russia, almost 4% of the companies of the sector have faced entries concerning unverified data in the Unified State Register of Legal Entities (Picture 2).

Picture 2. TOP-800 companies by entries concerning unverified data in EGRUL

Picture 2. TOP-800 companies by entries concerning unverified data in EGRULSales revenue

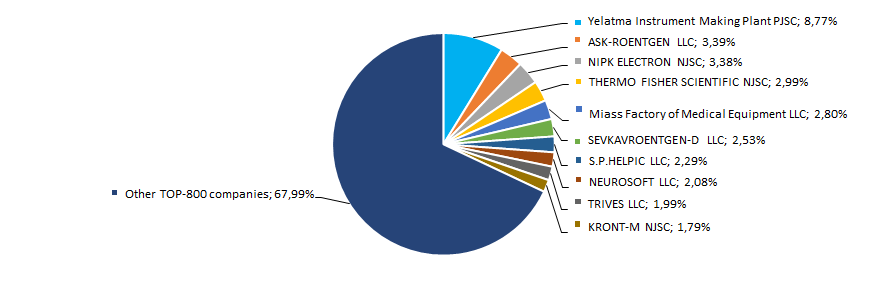

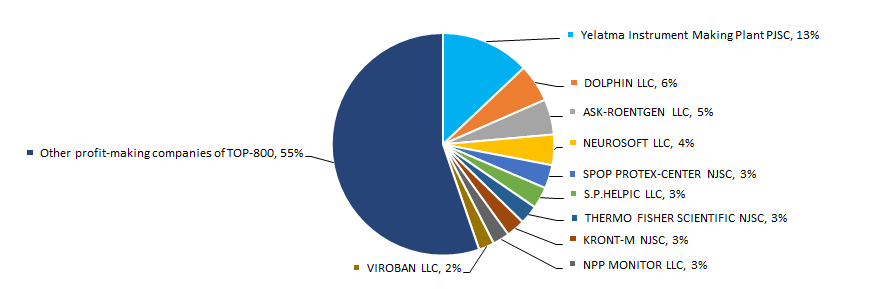

In 2016 sales revenue of TOP-10 companies amounted to 18% of total revenue of TOP-5000 companies. This points to a high degree of business competition within the industry. PJSC Yelatma Instrument Making Plant is the largest company in 2016 by revenue. It is one of the largest Russian company that produces medical devices, therapy equipment for home and hospital usage, disinfection equipment, medical furniture, and disposables (Picture 3).

Picture 3. TOP-10 companies by their share in 2016 total revenue of TOP-800

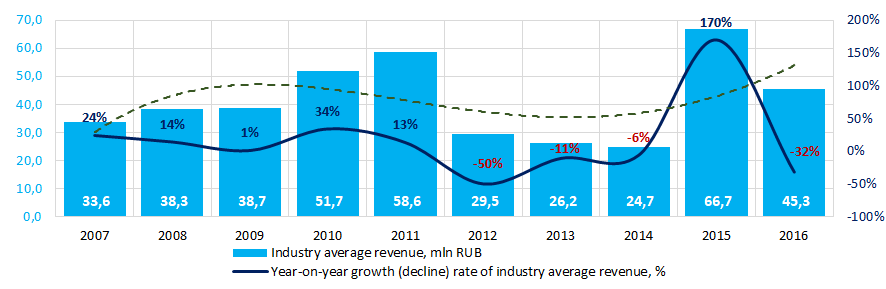

Picture 3. TOP-10 companies by their share in 2016 total revenue of TOP-8002015 witnessed the best revenue results in the decade for the industry in general. Crisis periods in economy of 2012-2014 resulted in decrease in industry average values. In general, revenue demonstrates revenue increase (Picture 4).

Picture 4. Change in industry average revenue of medical devices and equipment manufacturers in 2007 – 2016

Picture 4. Change in industry average revenue of medical devices and equipment manufacturers in 2007 – 2016Profit and loss

In 2016 profit of 10 industry leaders amounted to 45% of total profit of TOP-800 companies. PJSC Yelatma Instrument Making Plant is also the leading company by profit in 2016 (Picture 5).

Picture 5. TOP-10 companies by their share in 2016 total profit of TOP-800 companies

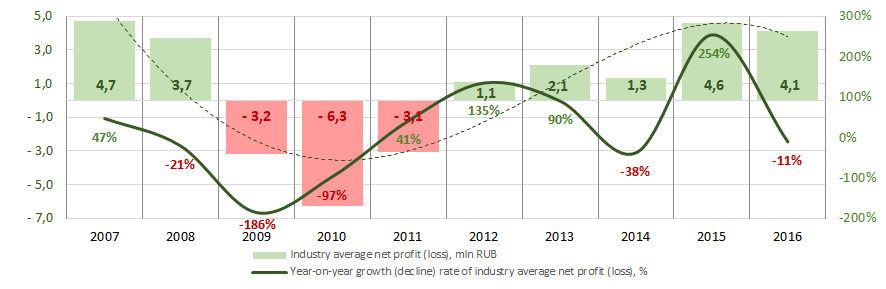

Picture 5. TOP-10 companies by their share in 2016 total profit of TOP-800 companiesAverage profit values of the companies of the sector are not stable within the decade. There were negative values in 2009 – 2011. In general, profit tends to increase since 2012. The industry has performed its best in 2007 (Picture 6).

Picture 6. Change in industry average profit of medical devices and equipment manufacturers in 2007 – 2016

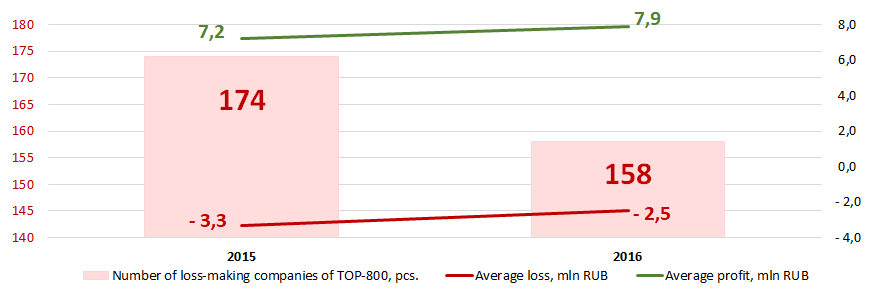

Picture 6. Change in industry average profit of medical devices and equipment manufacturers in 2007 – 2016There were 174 loss-making enterprises (or 22%) among TOP-800 companies in 2015. In 2016 the number decreased to 15 or by 20% for TOP-800. Moreover, their average loss decreased by 24%. Average profit of other TOP-800 companies has increased by 10% for the same period (Picture 7).

Picture 7. Number of loss-making companies, average values of loss and profit of TOP-800 companies in 2015 – 2016

Picture 7. Number of loss-making companies, average values of loss and profit of TOP-800 companies in 2015 – 2016Key financial ratios

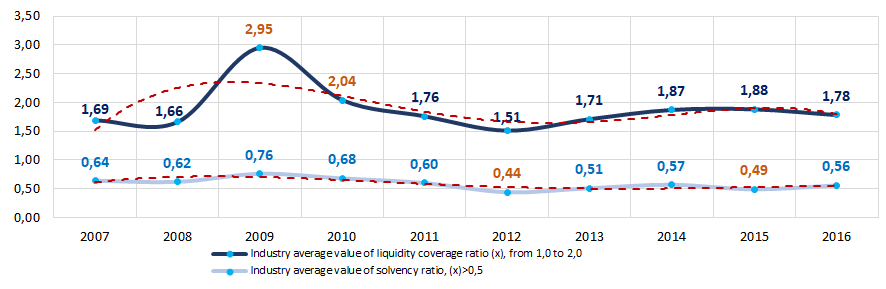

During the decade industry average values of liquidity coverage ratio were within the recommended value – from 1,0 to 2,0, excluding 2012 and 2015 (Picture 8). In general, the ratio value tends to decrease.

Liquidity coverage ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Solvency ratio (a ratio of shareholders’ equity to total assets) shows the dependence of the company on external loans. Its recommended value: >0,5. A value less than a minimum one is indicative of a strong dependence on external sources of funds.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas-i by the experts of Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of solvency ratio for medical devices and equipment manufacturers in 2016 is from 0,13 to 0,95.

During the decade industry average values of the ratio were within the recommended value, and higher than the practical value (Picture 8).

In general, the ratio tends to decrease.

Picture 8. Change in industry average values of liquidity coverage ratio and solvency ratio of medical devices and equipment manufacturers in 2007 – 2016

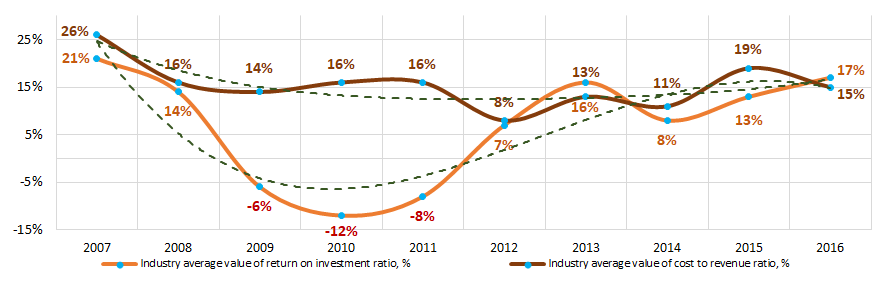

Picture 8. Change in industry average values of liquidity coverage ratio and solvency ratio of medical devices and equipment manufacturers in 2007 – 2016The return on investment ratio was not stable during the decade, however, tending to increase since 2012. Ratio values became negative in 2009 – 2011 (Picture 9). It is a ratio of net profit to shareholders’ equity and noncurrent liabilities, and it demonstrates benefit from shareholders’ equity engaged in business activity and long-term raised funds of the company.

Cost to revenue ratio was more stable, and tended to increase since 2013 (Picture 9). The ratio is calculated as a ratio of sales profit to operation costs. In general, it reflects production efficiency.

Picture 9. Change in industry average values of return on investment ratio and cost to revenue ratio of medical devices and equipment manufacturers in 2007 – 2016

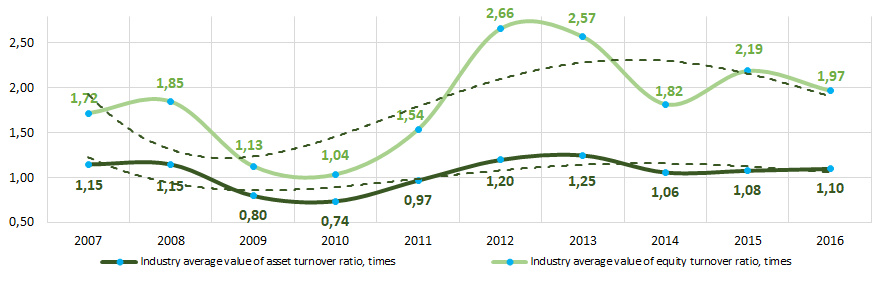

Picture 9. Change in industry average values of return on investment ratio and cost to revenue ratio of medical devices and equipment manufacturers in 2007 – 2016Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

Shareholders’ equity turnover ratio is a ratio of revenue to annual average shareholders’ equity, and indicates total assets usage rate.

During the decade both activity showed an increasing trend (Picture 10).

Picture 10. Change in industry average values of activity ratios of medical devices and equipment manufacturers in 2007 – 2016

Picture 10. Change in industry average values of activity ratios of medical devices and equipment manufacturers in 2007 – 2016Production structure

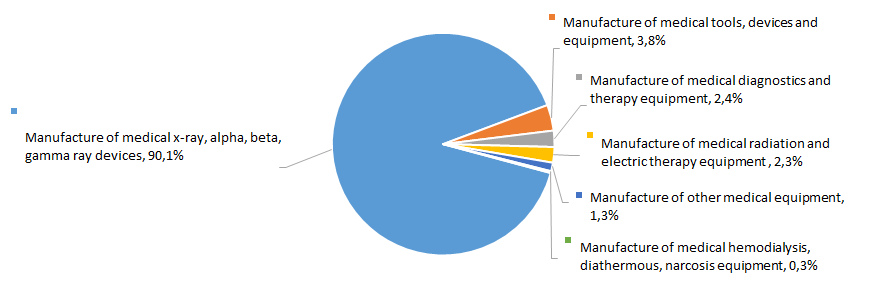

Most of TOP-800 companies specializes in manufacturing of medical x-ray, alpha, beta and gamma ray equipment (Picture 11).

Picture 11. TOP-800 companies by types of production, %

Picture 11. TOP-800 companies by types of production, %Business activity trends

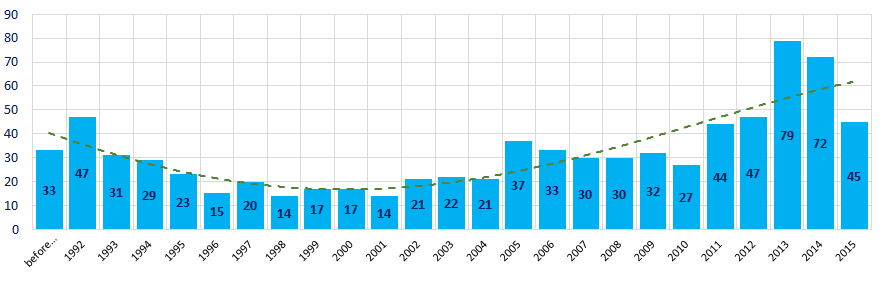

There is a diversity in distribution of registered TOP-800 companies by the year of their foundation within a 25-year period. Most of the companies were founded in 2013. In general, there is a trend of increase in the amount of companies being registered (Picture 12).

Picture 12. TOP-800 companies by the year of foundation

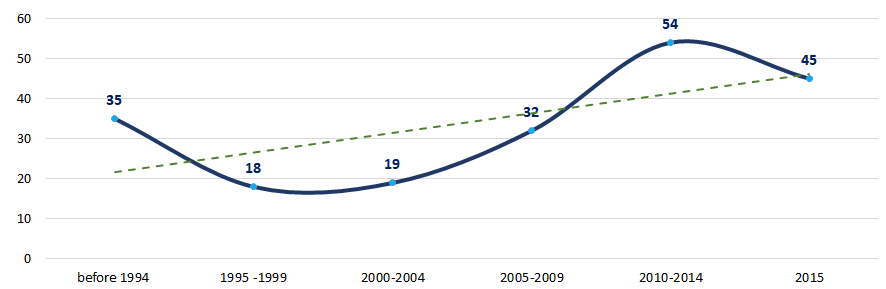

Picture 12. TOP-800 companies by the year of foundationPrivate sector has shown the strongest interest in medical devices and equipment manufacturing in 2010 – 2014 (Picture 13).

Picture 13. Average number of TOP-800 companies registered per year, by their foundation periods

Picture 13. Average number of TOP-800 companies registered per year, by their foundation periodsKey home regions

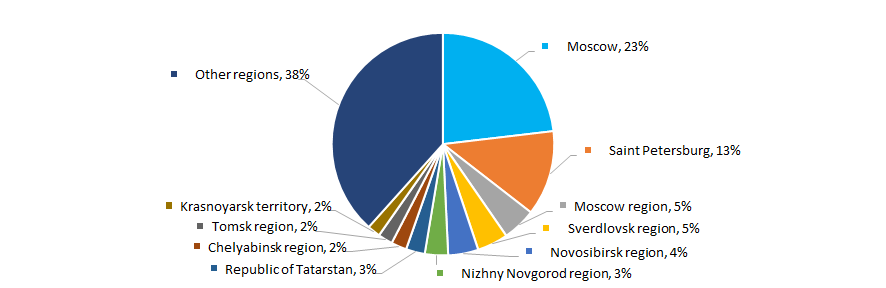

Companies of the sector are unevenly distributed throughout Russia. Most of them are registered in Moscow and Saint Petersburg, which are the regions with the most extensive infrastructure for high-tech manufacturing (Picture 14).

TOP-800 companies are registered in 72 regions of Russia.

Picture 14. TOP-800 companies by regions of Russia

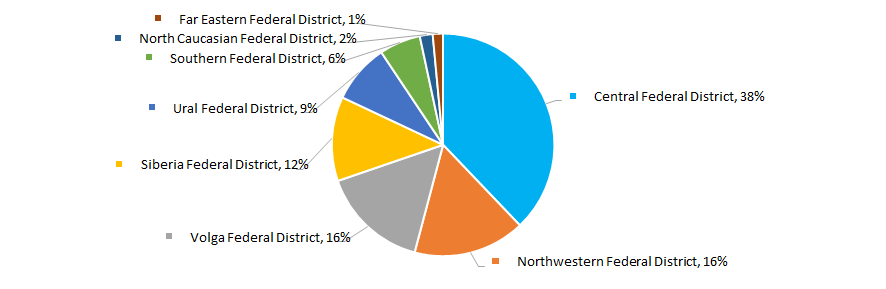

Picture 14. TOP-800 companies by regions of RussiaMost companies of the sector are accumulated in the Central Federal District of Russia (Picture 15).

Picture 15. TOP-800 companies by federal districts of Russia

Picture 15. TOP-800 companies by federal districts of Russia3% of TOP-800 companies have branches or representative offices.

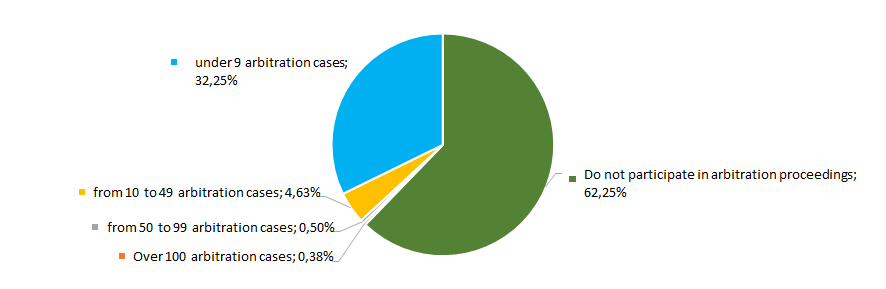

Participation in arbitration proceedings

Most companies of the sector either do not participate in arbitration proceedings or participate in a small number of proceedings (Picture 16).

Picture 16. TOP-800 companies by their participation in arbitration proceedings

Picture 16. TOP-800 companies by their participation in arbitration proceedingsReliability index

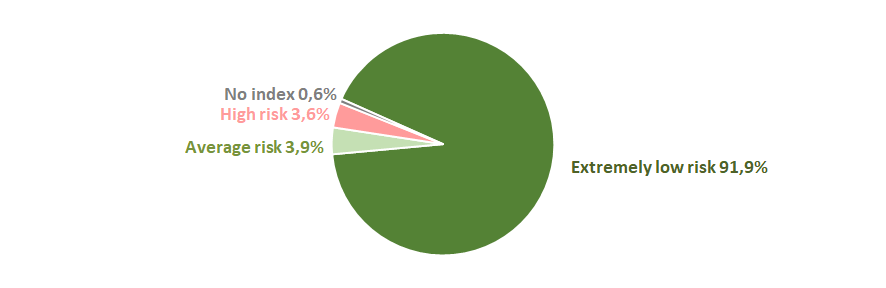

The risk of meeting a fly-by-night company or an unreliable company is extremely low for the most companies of the sector (Picture 17).

Picture 17. TOP-800 companies by Reliability index

Picture 17. TOP-800 companies by Reliability indexFinancial position score

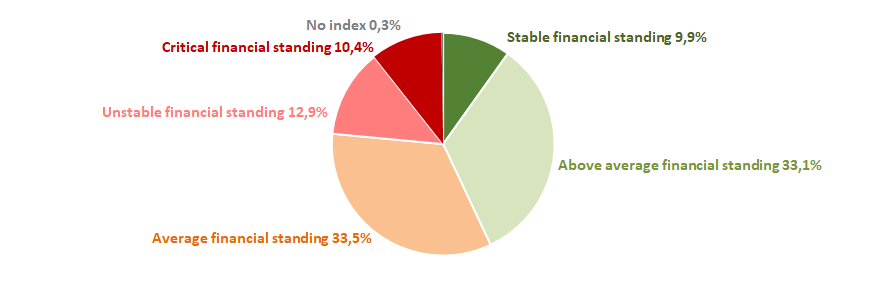

Assessment of financial state of the sector’s companies indicates that most of the companies have an average or unstable financial standing (Picture 18).

Picture 18. TOP-800 companies by Financial position score

Picture 18. TOP-800 companies by Financial position scoreLiquidity index

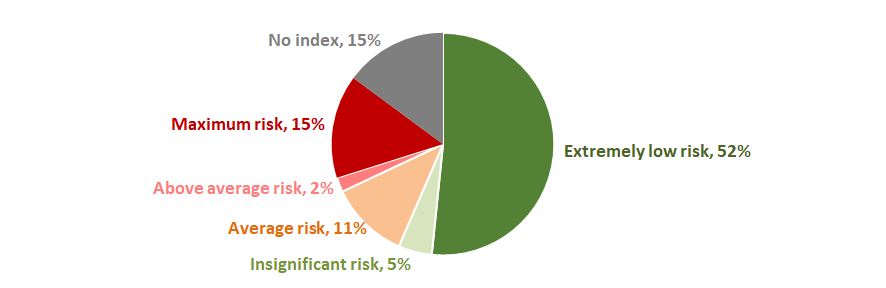

There is an extremely low risk of bankruptcy in the short term for over a half of the companies of the sector (Picture 19).

Picture 19. TOP-800 companies by Liquidity index

Picture 19. TOP-800 companies by Liquidity indexSolvency index Globas

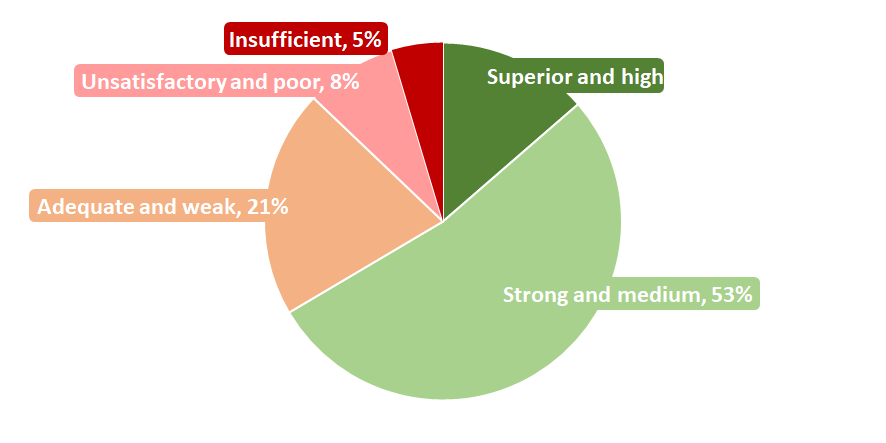

Most TOP-800 companies have got a superior, high, strong and medium Solvency index Globas, which indicates their ability to meet debt obligations timely and in full (Picture 20).

Picture 20. TOP-800 companies by Solvency index Globas

Picture 20. TOP-800 companies by Solvency index GlobasTherefore, a comprehensive assessment of medical devices and equipment manufacturers that considers key indexes, financial figures and ratios, is indicative of positive trends in the sector.