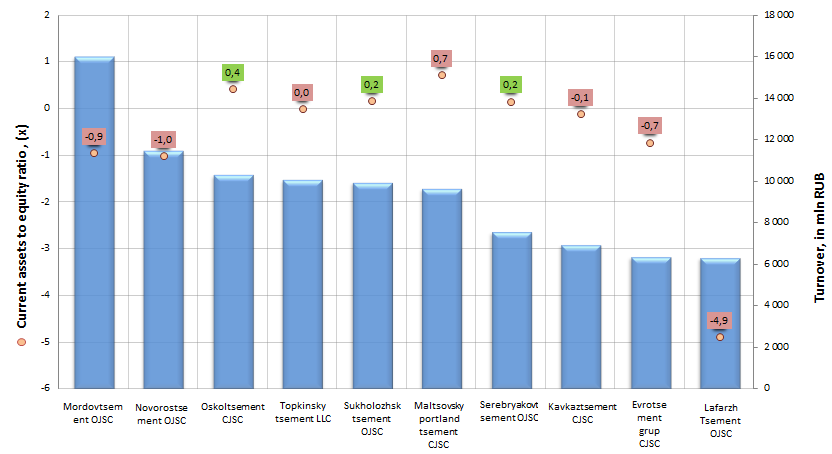

Current assets to equity ratio of manufacturers of concrete

Information agency Credinform prepared a ranking of main manufacturers of concrete in the RF.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013), for each of them the current assets to equity ratio was calculated.

Current assets to equity ratio (х) – is the relation of own current assets to total value of equity. It shows the ability of an enterprise to maintain the level of own capital and to finance current assets in case of need with internal sources.

The recommended value is: from 0,2 to 0,5.

This indicator is interesting first of all for long-term investors, because it characterizes company’s ability to satisfy its long-term obligations, without resort to borrowings in financial market.

However, it should be understood that recommended values differ essentially as well for enterprises of different branches, as for organizations of the same industry, consequently, these values are exclusively of informational character.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all available combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Increase (reduction) of turnover for the year, % | Current assets to equity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Mordovtsement OJSC | Republic of Mordovia | 15 994 | 4,5 | -0,9 (below the standard) | 233 high |

| 2 | Novorostsement OJSC | Krasnodar territory | 11 432 | -9,7 | -1,0 (below the standard) | 239 high |

| 3 | Oskoltsement CJSC | Belgorod region | 10 282 | -10,0 | 0,4 (standard) | 201 high |

| 4 | Topkinsky tsement LLC | Kemerovo region | 10 050 | 12,5 | 0,0 (below the standard) | 153 the highest |

| 5 | Sukholozhsktsement OJSC | Sverdlovsk region | 9 930 | 17,0 | 0,2 (standard) | 145 the highest |

| 6 | Maltsovsky portlandtsement CJSC | Bryansk region | 9 631 | -3,4 | 0,7 (above the standard) | 158 the highest |

| 7 | Serebryakovtsement OJSC | Volgorod region | 7 531 | -13,0 | 0,2 (standard) | 182 the highest |

| 8 | KavkaztsementCJSC | Karachayevo-Cherkessian Republic | 6 930 | -6,2 | -0,1 (below the standard) | 238 high |

| 9 | Evrotsement grup CJSC | Moscow | 6 337 | 21,6 | -0,7 (below the standard) | 235 high |

| 10 | Lafarzh Tsement OJSC | Moscow | 6 298 | -20,4 | -4,9 (below the standard) | 317 satisfactory |

Picture 1. Turnover and current assets to equity ratio of the largest manufacturers of concrete in Russia (TOP-10)

The turnover of the largest companies engaged in concrete manufacture (TOP-10) made 94 416 bln RUB, according to the latest published annual financial statement (for the year 2013).

Only three participants of the TOP-10 list showed the current assets to equity ratio being within recommended values: Oskoltsement CJSC (0,4), Sukholozhsktsement OJSC (0,2) and Serebryakovtsement OJSC (0,2).

In other words, enterprises will able to conduct their business activities and make necessary payments to creditors, contractors, personnel without resort to borrowings in external market, what points to good financial stability of these organizations.

- It is also necessary to mention expressly the industry leaders on total revenue:

- Mordovtsement OJSC - is one of the largest enterprises on concrete manufacture in the RF. Plant capacity - 6,8 mln tons of concrete per annum. For 10 months of the current year it was produced 4 327,8 th tons of concrete, the gain to the relevant period of 2013 made 3,2%. In January-October 2014 it was sold 4 329,5 th tons of concrete, what is by 1,6 % more than the indicator of sales for January-October 2013.

- Novorostsement OJSC – is the oldest concrete enterprise of Russia. In December of the current year it will celebrate the 139th anniversary. It is one of the largest domestic manufacturers of concrete. Company’s output capacities let it produce more than 4 mln tons of high-quality concrete annually.

- Oskoltsement CJSC – is one of five the largest concrete enterprises of Russia on factory load. It was founded on the basis of Starooskolsky concrete plant built for integrated use of mineral resources of Kursky magnetic anomaly. Since 1969 the plant has been producing above 100 mln tons of high-quality concrete.

Taken as a whole, according to the independent estimation of the Information agency Credinform, all organizations of the TOP-10 list (except Lafarzh Tsement OJSC) got a high and the highest solvency index, what points to their investment attractiveness.

The standing of the branch will be determined to a large extent by speed of housing construction: for 9 months of 2014 the volume of new housing supply countrywide has increased by 24,6% to the relevant period of 2013 – up to 48,2 mln sq. m.

However, the increased value of credit and mortgage programs, as well as unstable macroeconomic situation, could have a negative impact on the dynamics of building sector next year.

Central Bank raises key interest rate on 150 basis points

On October 31st of the current year the Central Bank announced about the increase of the key interest rate on 150 basis points from 8 to 9.5% at once. The Bank of Russia explains such decision with the sharpening of external conditions in September and October 2014. Reduction of prices on oil and the toughening of sanctions against a number of large Russian companies were accompanied by the ruble depreciation that has led to a growth acceleration of consumer prices together with the food embargo.

According to the expectations of the Central Bank, the inflation in Russia will rise beyond 8% until the end of the first quarter of 2015 and the economic growth rate will be close to zero. So, the Bank of Russia estimates the annual GDP growth rate in the third quarter of the current year was 0.2%. At the same time, the banking regulator notes that deceleration in economic growth has no significant restraining influence on inflation changes yet. The Central Bank also notes that these phenomena have structural character.

At the same time, representatives of the Central Bank point out that absorption of the production factors (labor force and competitive manufacturing capacity) is on a high level. However, labor capacity decelerates due to the decrease in supply of labor force because of long-term demographic changes of previous years.

The Bank of Russia notes a disinvestment in fixed capital among the external factors that have a negative impact on economic activity. That happened because of the restricted availability of long-term financial resources and the requirement toughening for quality to credited parties of Russian banks. In such a case there is a cooling of consumer demand resulting from the growth slowdown of real wages and retail lending.

In addition to this, the banking regulator raised the rates of the following instruments for bank liquidity extension: continuous operations (fixed interest rates) from 9% to 10.5%, and the three month auctions for credit extension provided by non-market assets from 8.25 to 9.75% and deposit operations from 7 to 8.5%.

It bears reminding that it is not the first increase of the key interest rate this year. The same resolution was carried in March by the banking regulator with the raising of interest rate from 5.5% to 7%. Then the interest rate was increased twice on 50 basis points. However, for the first time the banking regulator announced its readiness to move to the quantitative monetary easing in the case of external conditions improvement and the formation of a stable trend to the decline in inflation.