Russia is switching to the remote economy

COVID-19 pandemic invaded the global economy. On the background of OPEC+ failed deal and falling indices, the people faced to the new crisis not connected with financial and market conditions.

The Russian companies arrange for their employees to work from home. How this will influence the business? How the state will support entrepreneurs to bridge over the difficulties?

Being the key development model, globalization does not stand the test. Quarantine and self-isolation of the countries force entrepreneurs to resort to technologies and remote office practices. The current crisis will be undoubtedly resulted in financial losses, especially in transport, tourism and production sectors. However, along with obvious challenges, distance working has some advantages.

Challenges and advantages of distance working

| No. | CHALLENGES | ADVANTAGES |

| 1 | In case of global quarantine, smokestack industries will suffer the highest losses due to disability to stop manufacturing, like metallurgy for instance. Transport, tourism, hotel, restaurant and entertainment business, as well as mass market with a significant import share should expect serious difficulties. |

Media, IT companies, marketing, advertising, creative professions, recruiters, personal assistants, and sales managers will be able to switch to the remote economy format more easily than others will. Online platforms for food delivery and provision of services will increase their revenues. |

| 2 | The breaking of traditional economic ties will lead to a long-term decline in industry and services in the USA, EU, China and other countries, which will cause a global recession, undermining world trade and the inevitable search for a new development model. According to the data for January-February 2020, the annual decline in industrial production in China is 13,5%. The decline reached 13% in the service sector, which was a record high over the past 40 years. The Purchasing Managers' Index (PMI) of 19 EU countries in March fell to 31,4 points from February's level of 51,6 points. This indicator is the lowest in history. A value of more than 50 points indicates an increase in business activity, below - a decline. |

Due to the forced curtailment of cooperation between countries and the closure of borders, a number of states can receive certain economic benefits: start reindustrialization, revive local production and the national services sector, and build supply chains within their territory. A quick response to the situation will help to occupy a certain share in foreign markets. Countries with the necessary resource base, scientific and technological potential, and low dependence on imports will take advantage of the crisis. |

| 3 | Current events will strengthen the discussion in the professional community about the need to reduce the human factor in a number of professions. | The remote economy will give a new impetus to the maximum automation of business processes. |

| 4 | In case of protracted crisis, companies with no experience in remote working will begin to downsize. | The transfer of employees to remote work will help reduce the costs of enterprises and avoid wholesale redundancy. |

| 5 | According to the experts, less than half of the Russian employers are ready for complete transferring the employees to remote work. | The following large companies have transferred to remote work: Yandex, Rambler, RT, as well as companies of the real sector such as Gazprom Neft, Igristie vina, etc. |

| 6 | Remote work has no firm schedule for the beginning and the end of the working day. Employees work more often in the evenings and on weekends. The combination of professional and household activities can cause conflicts and affect the results. | Transferring employees to a remote work will reduce rental payments, and specialists themselves will be able to save time and money to get to work. The schedule is becoming more flexible. |

| 7 | Overstaffed companies with no firm job descriptions, when employees do work without scope and timing, will face difficulties to switch to a remote mode. Many employees have never worked outside the office. | Remote work requires a specific setting of goals, objectives and deadlines for employees. This implies their complete independence in planning their time. It is necessary to create a performance management system and evaluate the result of work taking into account the changed working conditions. |

| 8 | The organization of corporate chats, CRM-systems that will allow quickly monitoring the implementation of the plan and discussing working issues will require costs from companies. | The market offers many solutions for remote work. Companies that implemented them will suffer fewer losses under global quarantine. To maintain productivity and involvement in the work, there are modern IT solutions: webinars, messengers, corporate mobile applications and platforms, and much more. |

| 9 | Currently, according to labor laws, an employee can choose any one type of employment: remote or traditional. Laws do not provide for combining remote work and staying in the office, but in practice, it occurs, often with cuts in benefits and material incentives for such specialists. | Changes in the Labor code will allow legalizing the remote work, which many employees are now transferring to because of the outbreak of COVID-19. In February, the co-chair of the All-Russia People's Front central headquarter, Aleksey Komissarov, sent a letter to the Deputy Prime Minister Tatyana Golikova, which was accompanied by a bill to include the item “Temporary remote work” in the Labor code. This form of work is established on the basis of an additional agreement to the employment contract. The employee will be able to choose a place for remote work independently. If an employee complies with established labor standards, salaries should not be reduced. The proposal has not yet been considered, but if it moves to the stage of the bill and is accepted, it will help regulate remote work.The proposal has not yet been considered, but if it moves to the stage of the bill and is accepted, it will help regulate remote work. |

| 10 | Transferring to remote work under the minimizing business contacts with partners both within the country and abroad, there is an increased risk of cooperation with unreliable company. | The increasing need for information resources that allowing to collect and analyze information about the counterparty online. |

The crisis raised the acute question of sustainability in the face of global challenges not only for business, but for the entire countries. The dynamics of the recession and subsequent recovery of GDP in the countries of the world will make it possible to estimate the effectiveness of the state and the incentive supporting measures for the economy.

Supporting measures for the Russian economy

- For microenterprises, small and medium-sized businesses, the size of insurance premiums to social funds will be reduced from 30% to 15% for salaries exceeding the minimum wage; for salaries at the minimum wage level or lower, the rate will remain 30%. A reduced rate is entered on an ongoing basis.

- A six-month tax deferral (excluding VAT) is introduced for microenterprises, small and medium-sized businesses having difficult financial situation. In addition to tax deferral, microenterprises have an option not to pay insurance premiums to social funds over the next 6 months.

- A six-month deferral of credit payments for microenterprises, small and medium-sized businesses having difficult financial situation. State subsidized loans.

- Suspension of bankruptcy proceedings (moratorium) at the initiative of creditors for companies from affected sectors for 6 months.

- The list of affected industries will be adjusted and updated by the Government of the Russian Federation.

- A 15% tax is imposed on interest income and dividends received on offshore accounts.

- A 13% tax is imposed on interest income on bank deposits and investment in securities, provided that the total amount of funds exceeds 1 million RUB.

- The government will raise an anti-crisis fund of 300 billion RUB, aimed at supporting the economy.

- Since March 17, restrictions for transport providing deliveries to retail chains have been lifted.

- “Green corridor” at customs for essential goods. The zeroing of import duties for a specific list of goods is discussed.

- Cancellation of control and supervision measures, including tax and customs before May 1. Exception is unscheduled inspections in case of threat to life and health.

- Temporary deferral of payments for the lease of state and municipal property.

- Coverage of damage to transport companies related to non-refundable tariffs for air transportation and transportation of citizens from abroad.

- Deferral of payment of dividends by state-owned companies for up to six months.

- Recapitalization of leasing companies.

- Allocation of additional funds of JSC SME Corporation expand support for small and medium-sized enterprises.

- Informing organizations about anti-crisis measures through the taxpayer’s office on the website of the Federal Tax Service.

- Expanding the list of systemically important companies.

Whether the measures will be effective and sufficient, whether small and medium-sized businesses will be able to take advantage of them, and whether bureaucratic barriers arise for fulfilling the promises of the President, the near future will show.

In conclusion, we would like to wish you good health, and your companies to rebuild business processes quickly and without damage, without difficulty transferring employees to remote work as one of quarantine measures, not stopping the business and experiencing a difficult situation with minimum losses.

Trends in sale of building materials

Information agency Credinform represents an overview of activity trends of the largest Russian wholesalers of building materials.

The wholesalers of timber, construction materials and sanitary equipment with the largest volume of annual revenue (TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 - 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest enterprise of the Central economic region of Russia in terms of net assets is NATIONAL AGGREGATES COMPANY NJSC, INN 7716614075, Moscow. Its net assets amounted to 7 billion rubles in 2018.

The smallest amount of net assets in the TOP-1000 list was hold by LES EXPORT NJSC, INN 2536069294, Primorye territory. The insufficiency of property of this company in 2018 was expressed as a negative value of -6 billion rubles.

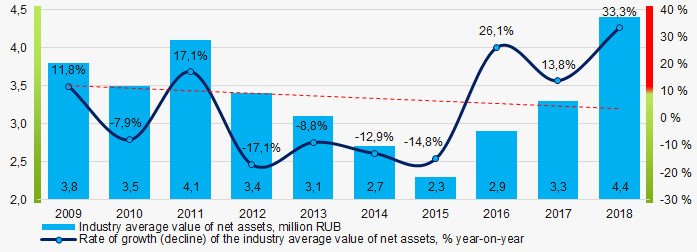

The average values of net assets tend to increase over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net assets value in 2009 – 2018

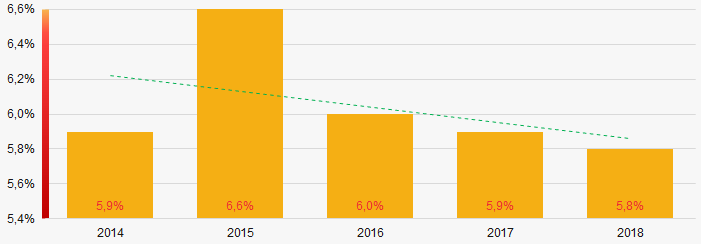

Picture 1. Change in the industry average indicators of the net assets value in 2009 – 2018The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000Sales revenue

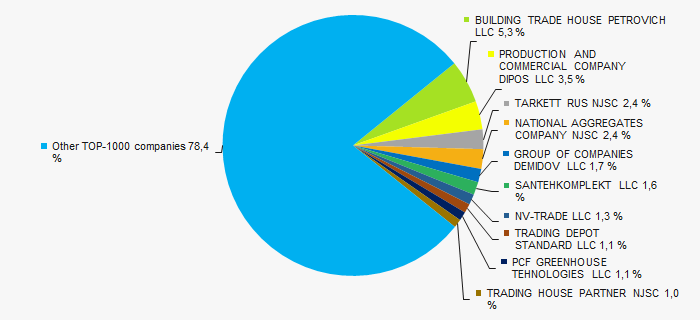

The revenue volume of 10 leading companies of the region made more than 21% of the total revenue of TOP-1000 in 2018 (Picture 3). It points to a high level of intraindustry competition.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018

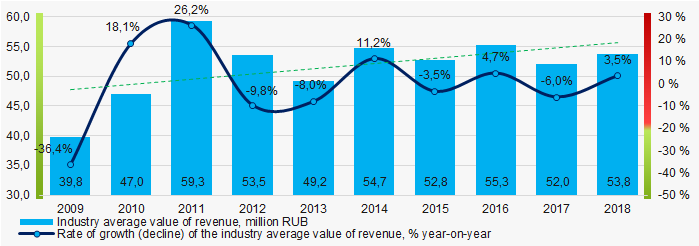

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018 In general, there is a tendency to increase in the revenue volumes (Picture 4).

Picture 4. Change in the industry average revenue in 2009 – 2018

Picture 4. Change in the industry average revenue in 2009 – 2018 Profit and losses

The largest company in terms of net profit value is NATIONAL AGGREGATES COMPANY NJSC, INN 7716614075, Moscow. Company's profit amounted 2,6 billion rubles in 2018.

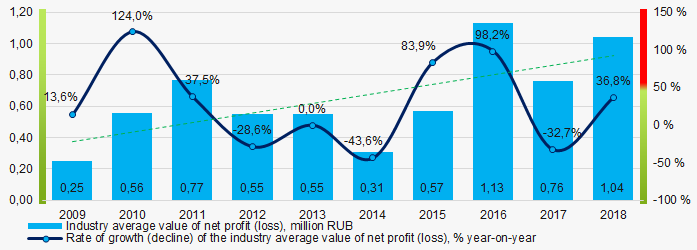

Industry average indicators of net profit trends to increase over a ten-year period (Picture 5).

Picture 5. Change in the industry average indicators of net profit (loss) in 2009 – 2018

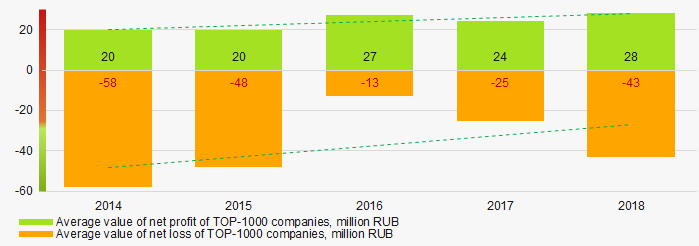

Picture 5. Change in the industry average indicators of net profit (loss) in 2009 – 2018Average values of net profit’s indicators of TOP-1000 companies increase for the five-year period, at the same time the average value of net loss decreases (Picture 6).

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018Key financial ratios

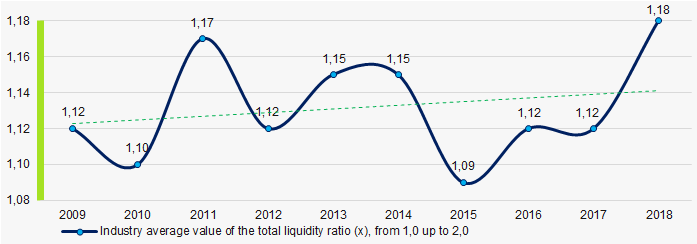

Over the ten-year period the industry average indicators of the total liquidity ratio were in the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio in 2009 – 2018

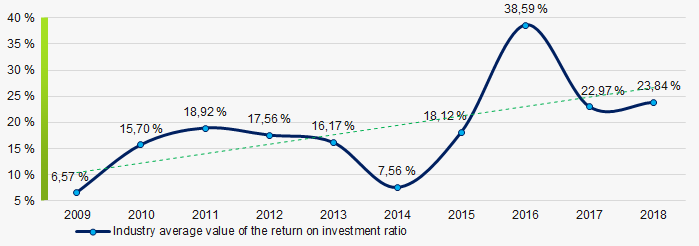

Picture 7. Change in the industry average values of the total liquidity ratio in 2009 – 2018 The industry average values of the return on investment ratio trend to increase for ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the industry average values of the return on investment ratio in 2009 – 2018

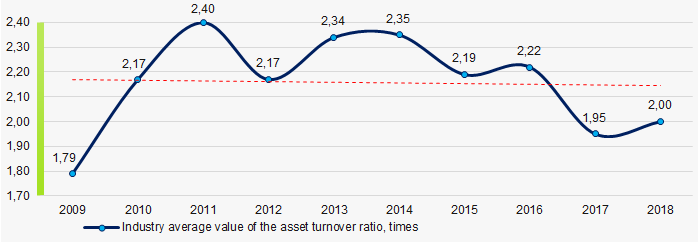

Picture 8. Change in the industry average values of the return on investment ratio in 2009 – 2018 Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity trends to decrease over ten-year period (Picture 9).

Picture 9. Change in the industry average values of the asset turnover ratio in 2009 – 2018

Picture 9. Change in the industry average values of the asset turnover ratio in 2009 – 2018 Small business

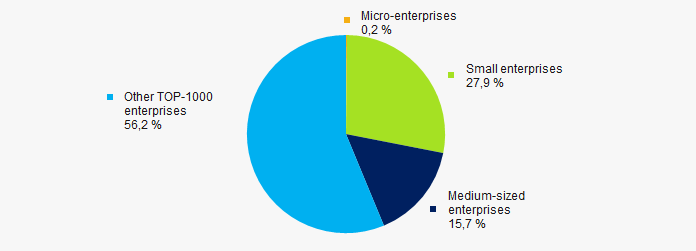

81% of TOP-1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 amounted to 44%, that twice as high as the national average one (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companiesMain regions of activity

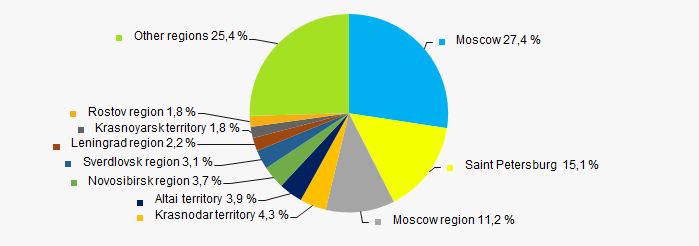

TOP-1000 companies are registered in 72 regions and distributed unequal across Russia. Almost 54% of the largest enterprises in terms of revenue are concentrated in metropolitan area – Moscow and its region, as well as in Saint Petersburg (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regions

Picture 11. Distribution of the revenue of TOP-1000 companies by Russian regionsFinancial position score

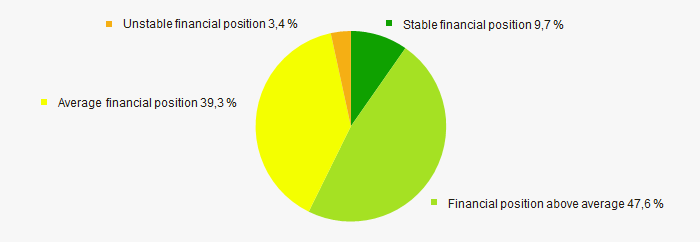

An assessment of the financial position of TOP-1000 companies shows that the financial position of the most of them is above average. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

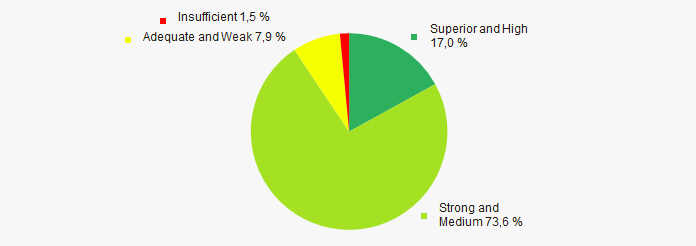

The most of TOP-1000 enterprises got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

Picture 13. Distribution of TOP-50 companies by solvency index GlobasAccording to the Federal State Statistics Service, the share of enterprises of the industry in the total amount of revenue from the sale of goods, products, works, services made 0,34% countrywide for 2018, that is lower than the indicator for 2019, which amounted to 0,347%.

Conclusion

A comprehensive assessment of activity of the largest Russian wholesalers of building materials, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  10 10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of net profit of TOP-1000 companies |  10 10 |

| Growth / decline in average values of net loss of TOP-1000 companies |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized enterprises in terms of revenue being more than 21% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Dynamics of the share of proceeds of the industry in the total revenue of the RF |  10 10 |

| Average value of the specific share of factors |  0,6 0,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).