New Debt Collection Regulations Introduced in Russia

The legitimacy of debt collection agencies activity has been discussed in the State Duma of the RF for a long time. This situation was finally brought to a conclusion on March 23rd, 2016 with a new law regulating the activities of the debt collection industry.

On February 18, 2016 at the initiative of the Chairmen of both Chambers of the Federal Assembly, a number of bills concerning the protection of citizens from unfair practices by debt collection companies were introduced to the State Duma. On 23th of March, 2016 the Bill № 999547-6 «On protection of rights and legitimate interests of individuals in the implementation of activities on debts collection» was discussed at the meeting of the Property Committee and was subsequently recommended for consideration at the plenary meeting, which was held on April 12, 2016. After discussion the Bill was passed by deputies at the first reading.

According to the Bill, the Government of Russia must appoint a regulator vested with rights of maintaining the register of collectors and enforce compliance. The interaction order of a collector with the debtor, concerning banks, microfinance organizations, other creditors and individuals providing debts collection is now regulated.

- For violations of this regulation penalty at the rate of US$30 thousand is fixed.

- The limitations on interaction with debtor are imposed on collectors: on amount of calls – not more than twice a week; on personal meetings – not more frequently than once a week. Interaction with the disqualified, citizens hospitalized in health care institutions, the disabled, individuals under the legal age is forbidden. Interaction outside the borders of Russia and the use of facilities concealing its telephone and e-mail address, and also interaction with debtor at nighttime are also forbidden.

- A debtor has the right to appoint a representative, or any other individual or legal entity authorized to act on behalf of the debtor throughout the debt collection process. A debtor can refuse any interaction with a debt collection agency. In this case, when the discretionary payment period has passed, only legal action will be possible.

- Disclosure of personal data about debtor to collector, gained by means of the debt claim from a credit organization, is only allowed with the written consent of the debtor.

- Individuals having a criminal record for crimes in the sphere of economic and public security, and also managers with a bad business reputation cannot be involved in debts collection.

- Legal entities can be engaged in this activity only with the authorized capital in the amount not less than US$ 154 thousand providing that it is their primary activity.

Backgound: In March of 2010 a State Duma Committee on Property organized a round-table discussion of legislative aspects of introducing the personal bankruptcy concept in Russia. In the course of discussion legislators criticized the absence of regulations of collection agencies. The absence of regulations governing the activities of credit organizations with debtors-individuals meant that the companies operated in a legal void. On the 6th of April, 2012 hearings were held by the Property Committee on the subject: «Legislative aspects regarding regulation of rehabilitation procedures applicable to citizens-debtors». Participants in the hearing were the State Duma Deputies, the Council of the Federation members, representatives of the Ministry of Economic Development and Trade of the RF, the Federal Bailiff’s Service, Russian Bankers’ Association and the RF Presidential National Association of Professional Collection Agencies.

Furthermore round-table discussions on the debt collection bill were held by the Committee for Economic Policy, Innovative Development and Entrepreneurship on October 8, 2015. At the center of discussions were unsavory collection practices. In the course of plenary meetings of the State Duma on December 18, 2015 and on January 20, 2016 several deputies suggested restrictions or legislative limitations for collection activity in Russia.

According to the experts of the Information agency Credinform, the new regulations will lead to fundamental changes of the collection services market in Russia. According to the Information and analytical system Globas-i®, there are more than 890 active organizations registered specifying in their company name the definition «collection agency». Only three of them registered for their primary activities the OKVED 74.87.1 («Collection of payments, solvency assessment in relation to the financial condition or business practices of an individual or a legal entity») according to the Russian National Classification of Economic Activities. The authorized capital of these three organizations ranges from US$150 to 300.

Is it necessary to review bank, while checking the counterparty?

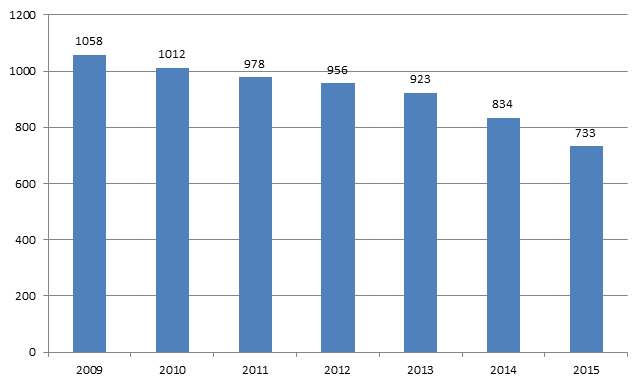

Over the last few years the number of active credit institutions (banks and non-bank credit institutions) has reduced from 1058 in 2009 to 733 in 2015. The increase trend of liquidated organizations became especially noticeable after 2013: 89 companies were liquidated in 2014, 101 companies – in 2015; in most cases the reason of liquidation is revocation of a license.

Diagram 1. Active credit institutions (banks and non-bank credit institutions) with the right to carry out banking operations (as of the end of the year)

- Among the reasons of revocation of credit institutions’ banking licenses are:

- non-execution of the Federal Laws and the Bank of Russia statutory enactments, regulating banking activity;

- numerous violation of requirements, established by articles 6 and 7 of the Federal Law № 115-FZ «On countering the legislation of illegal earnings (money laundering) and the financing of terrorism»

- inability to satisfy requirements of creditors under monetary obligations within 14 days from the date of their satisfaction;

- decrease in own funds (capital) below the minimum value of authorized capital (as of the date of state registration of the credit institution);

- ascertainment of the facts of substantial unreliability in reporting data;

- capital adequacy ratio (standard value Н1.0) is lower than 2% etc.

Among main reasons of license’s revocation are: money laundering, loss of capital and swindling. Frequent cases of identifying of unreliable banks confirm the necessity to check the bank, which holds the counterparty’s accounts, while it’s reviewing. If worse comes to worst, in case of bank’s liquidation the counterparty may completely lose its money funds. This case will lead to failure of contractual obligations and may cause the significant damage to a business.

Information and analytical system Globas-i® may check the counterparty’s bank, in particular: license availability, participation in S.W.I.F.T. and deposit insurance systems; to estimate the development of branch network; to compare bank’s indicators with mandatory standards, established by the Central Bank of Russia; to review the cash flows, assets value, cases of nonfulfillment of obligations, participation as a defendant in arbitration cases, negative information.

Based on the analysis of available information, Globas-i® System generates «Financial stability index of a credit institution». This is an independent assessment of the reliability and financial stability of a credit institution; it takes into account key performance indicators, regulatory compliance, established by the Central Bank of Russia, and quality indicators.