Does fiscal devaluation help Russian economy?

Direct taxes are offered to decrease by means of indirect taxes increase

The Ministry of Finance has repeatedly addressed the issuue of the fiscal devaluation in 2016. New proposals for the tax system are focused on decrease in direct taxes and fees, first of all, social taxes and increase in indirect taxes – VAT and excise duties.

The fiscal devaluation is decrease in direct taxes that have impact on the production cost (insurance payments for emloyees, profit tax), by increasing of the final consumption taxes, set in the form of markup to price or tariff rate such as VAT (such taxes are called indirect). In general, the indirect taxation growth is a tool for achievement of two goals of the fiscal devaluation.

"Chasing two rabbits". First of all, the fiscal devaluation is aimed at supporting of exporters through restructuring of the tax burden in economy – export tax rates are decreasing, final consumption taxes are increasing. In international markets goods are becoming cheaper, export profitability is growing, at the same time import attraction is decreasing. Secondly, with the help of the fiscal devaluation the problem of economy with increased general tax burden can be solved. The Ministry of Finance is going to solve the problem of low competitivity of non-traditional for ¬¬the Russian economy exporter groups as well as the problem of high rate of direct taxes, primarily social fees paid by an employer, through increase in VAT. Burden on the payroll budget in Russia is currently too high and it obviously needs to be decreased. However, its decrease means reduction of budget revenue. That reduction can be compensated with indirect taxes, VAT primarily. There is no solution yet on VAT increase. The Ministry of Finance launches different initiatives, including impose of indirect tax burden on «luxurious consumption», that made by small population group and harmful products consumption (sugar contained drinks, palm oil).

Under the spotlight. The minister of Finance Anton Siluanov pays attention to one more distinct advantage that can be achieved with fiscal devaluation. According to Mr Siluanov, decrease in direct taxation by means of indirect taxation increase will help to find a wayout for grey economy for those who avoid paying taxes. Levelling of the balance between VAT and insurance payments will be profitable not only for business but also for employable population, because it will decrease tax burden on salaries.

An effective tool. Shift of tax burden from economical resources to consumption is a worldwide trend that motivates active usage of capital and labour. Besides, it is worth mentioning that the tax system is extremely sensitive, and any changes should be thought over. Latest claims of Anton Siluanov let us make a conclusion that the Ministry of Finance is not going to abandon the fiscal devaluation idea. However, it is not possible to realize the idea earlier than in 2018, otherwise it will be contrary to the moratorium on increase of business tax burden before the mentioned terms, imposed by Vladimir Putin. The head of state announced discussion for the tax system of the RF on 2017, based on the results possibilities of the system adjustment for long-term perspective will be defined. Increase of indirect taxation is long-term strategy issue that can be developed with the help of time and cooperation of several ministries. Only complex solution based on results of that cooperation could be an effective tool of the economic growth.

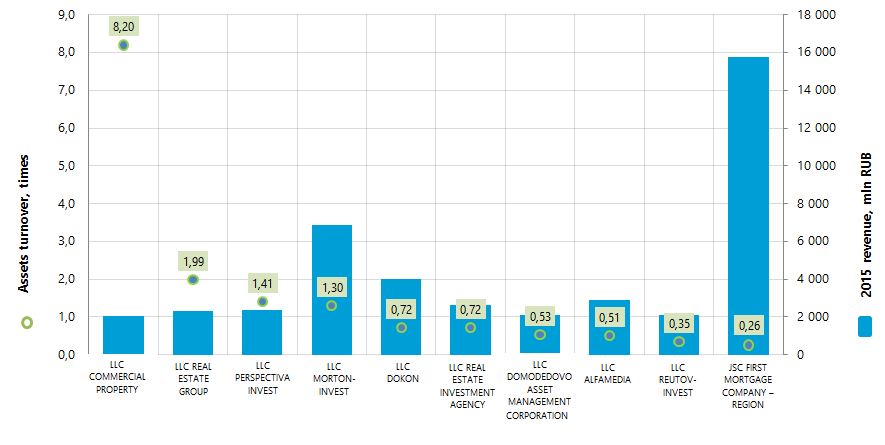

Assets turnover of the largest Russian agencies for operating with real estate

Information Agency Credinform has prepared the ranking of the largest Russian agencies for operating with real estate by assets turnover ratio.

The largest enterprises (TOP-10) in terms of revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2014). Then the companies were ranged by decrease in assets turnover ratio (Table 1).

Assets turnover (times) is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the most full and fair opinion about the company’s financial position, the whole set of financial indicators and ratios should be taken into account.

| Name | 2015 net profit, mln RUB | 2015 revenue., mln RUB | 2015/2014 revenue, +/- % | Assets turnover, times | Solvency index Globas-i |

|---|---|---|---|---|---|

| LLC COMMERCIAL PROPERTY INN 5047101035 Moscow |

9,8 | 2 049,8 | -3,5 | 8,20 | 275 High |

| LLC REAL ESTATE GROUP INN 7713612658 Moscow |

1,7 | 2 306,9 | -2,1 | 1,99 | 235 High |

| LLC PERSPECTIVAINVEST INN 7722803063 Moscow |

321,4 | 2 354,4 | 8,0 | 1,41 | 253 High |

| LLC MORTON-INVEST INN 7714611150 Moscow |

139,6 | 6 887,7 | -25,9 | 1,30 | 220 High |

| LLC DOKON INN 7743609405 Moscow |

1 287,2 | 4 003,8 | -19,1 | 0,72 | 217 High |

| LLC REAL ESTATE INVESTMENT AGENCY INN 5902190905 Perm region |

3,7 | 2 639,1 | -35,5 | 0,72 | 253 High |

| LLC DOMODEDOVO ASSET MANAGEMENT CORPORATION INN 5009096987 Moscow region |

-906,1 | 2 118,8 | 2,3 | 0,53 | 311 Satisfactory |

| LLC ALFAMEDIA INN 7724522886 Moscow |

4,4 | 2 874,8 | -20,5 | 0,51 | 206 High |

| LLC REUTOV-INVEST INN 7709918555 Moscow |

162,8 | 2 076,0 | -76,6 | 0,35 | 292 High |

| JSC FIRST MORTGAGE COMPANY – REGION INN 7729118074 Moscow region |

3 489,4 | 15 759,0 | -15,2 | 0,26 | 252 High |

In 2015 the average assets turnover ratio of TOP-10 companies amounted to 1,6 times. The average ratio of TOP-100 companies amounted to 992,07 times with the industry average value of 0,42 times.

9 out of 10 participants have high solvency index Globas-i. This fact shows the ability of the companies to meet their obligations in time and fully.

LLC DOMODEDOVO ASSET MANAGEMENT CORPORATION has the satisfactory solvency index Globas-i due to its participation as a defendant in debt collection arbitration proceedings and loss in balance sheet ratio structure.

In 2015 total revenue of TOP-10 companies amounted to 43 bln RUB, that is 26% lower than in 2014. Herewith total net profit of the group increased almost by 6%.

LLC PERSPECTIVAINVEST is the only company, which preserved the increment in profit as well as in revenue in 2015. Other participants of TOP-10 list (red color in Table 1) have decline in net profit or loss in comparison with previous period or decline in revenue.

Total revenue of TOP-100 companies for the same period increased by 12%, although total net profit declined almost by 6%.

Over recent years the industry as a whole due to macroeconomic circumstances faces hard times with deterioration in consumer demand and decline in construction speed. This testifies the estimated data from the Federal State Statistics Service.

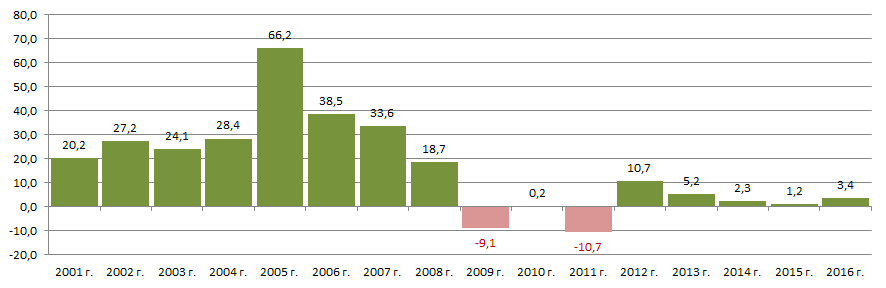

Thus, according to the results of 3 quarter 2016 the average price of the apartments’ square meter on the primary housing market has reached the absolute peak for the last 15 years and amounted to 53 476 RUB against 8 225 RUB in 2000. In addition to the above, the rates of price growth from year to year almost directly dependent on the general economic situation in the country (Picture 2).

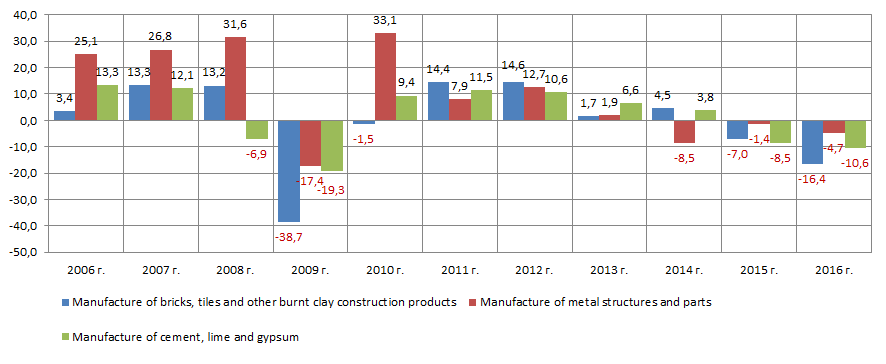

This is accompanied by reduction in construction; this fact is confirmed by data from the Federal State Statistics Service on production index of basic building materials (Picture 3).

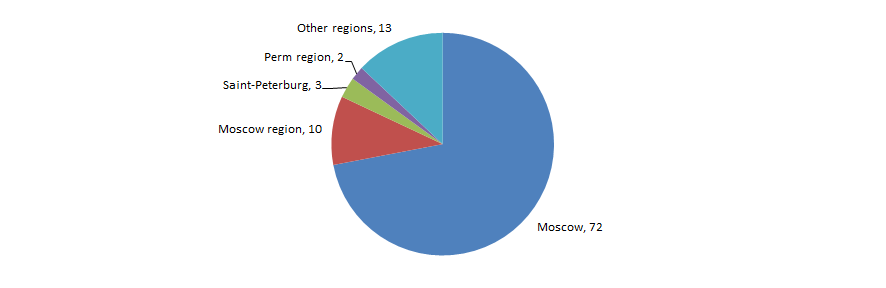

Agencies for operating with real estate are significantly concentrated in Moscow and Moscow region – the largest financial center of the country. This fact is confirmed by data from the Information and analytical system Globas-i, according to which 100 largest companies of the industry in terms of 2015 revenue are concentrated in 17 Russian regions (Picture 4).