Profit level of construction companies

Information agency Credinform has prepared a ranking of the largest Russian companies engaged in specialized building activity. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2016-2018). Then the companies were ranged by net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a ratio of net profit (loss) to sales revenue. The ratio reflects the company’s level of sales profit.

The ratio doesn’t have the standard value. It is recommended to compare the companies within the industry or the dynamics of a ratio for a certain company. The negative value of the ratio indicates about net loss. The higher is the ratio value, the better the company operates.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| KORPORATSIYA AKTSIONERNOI KOMPANII ELEKTROSEVKAVMONTAZH INN 2312065504 Krasnodar region |

14876 14876 |

24767 24767 |

1112 1112 |

1872 1872 |

7,48 7,48 |

7,56 7,56 |

176 High |

| MODERN MINING TECHNOLOGIES LLC INN 4205185423 Kemerovo Region - Kuzbass |

12956 12956 |

17510 17510 |

250 250 |

485 485 |

1,93 1,93 |

2,77 2,77 |

214 Strong |

| LSR. STROITELSTVO-SZ LLC INN 7802862265 St. Petersburg |

17772 17772 |

16363 16363 |

720 720 |

438 438 |

4,05 4,05 |

2,68 2,68 |

228 Strong |

| SPETSSTROISERVIS LLC INN 1644040406 Republic of Tatarstan |

15581 15581 |

14762 14762 |

279 279 |

315 315 |

1,79 1,79 |

2,13 2,13 |

204 Strong |

| ESTA KONSTRUCTION LLC INN 7704615959 Moscow |

19367 19367 |

17358 17358 |

174 174 |

284 284 |

0,90 0,90 |

1,64 1,64 |

242 Strong |

| JSC TRUST KOKSOKHIMMONTAZH INN 7705098679 Moscow |

28914 28914 |

27533 27533 |

342 342 |

349 349 |

1,18 1,18 |

1,27 1,27 |

180 High |

| JSC RZDSTROY INN 7708587205 Moscow |

119886 119886 |

107482 107482 |

303 303 |

378 378 |

0,25 0,25 |

0,35 0,35 |

245 Strong |

| ZAPOLYARNAYA STROITELNAYA KOMPANIYA LLC INN 2457061775 Krasnoyarsk region |

22777 22777 |

14012 14012 |

-988 -988 |

-249 -249 |

-4,34 -4,34 |

-1,78 -1,78 |

272 Medium |

| LLC SPECIALIZED CONSTRUCTION COMPANY GAZREGION INN 7729657870 Moscow |

31801 31801 |

26017 26017 |

502 502 |

-481 -481 |

1,58 1,58 |

-1,85 -1,85 |

326 Adequate |

| LLC BRYANSKAGROSTROY INN 3250521869 Bryansk region |

12997 12997 |

19926 19926 |

1 1 |

-562 -562 |

0,01 0,01 |

-2,82 -2,82 |

313 Adequate |

| Average value for TOP-10 companies |  29693 29693 |

28573 28573 |

269 269 |

283 283 |

1,48 1,48 |

1,20 1,20 |

|

| Average industry value |  32 32 |

32 32 |

0,51 0,51 |

0,67 0,67 |

1,60 1,60 |

2,12 2,12 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

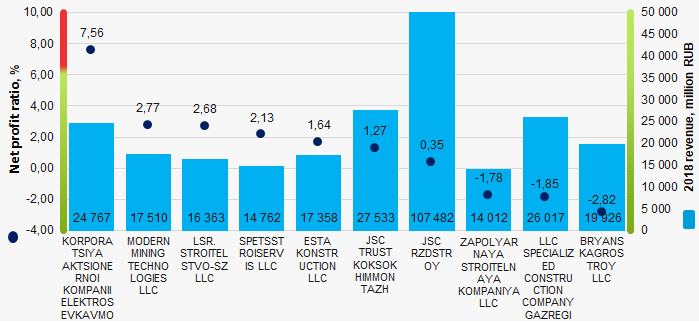

In 2018, the average value of net profit ratio for TOP-10 companies is lower than average industry value: seven companies improved the results.

Picture 1. Net profit ratio and revenue of the largest Russian companies engaged in specialized building activity (ТОP-10)

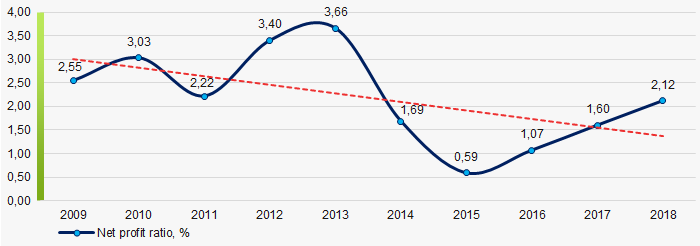

Picture 1. Net profit ratio and revenue of the largest Russian companies engaged in specialized building activity (ТОP-10)Within 10 years, the average industry indicators of the net profit ratio showed the decreasing tendency. (Picture 2).

Picture 2. Change in average industry values of the net profit ratio of Russian companies engaged in specialized building activity in 2009 – 2018

Picture 2. Change in average industry values of the net profit ratio of Russian companies engaged in specialized building activity in 2009 – 2018TOP-1000 companies of the Central Black Earth Region of Russia

In order to reduce interregional differences in the level and quality of life of people, the Ministry of Economic Development of the RF approved the strategy of spatial development of Russia in February 2019. 12 macro-regions were formed in the strategy. One of them is the Central Black Earth Region, which includes: Belgorod, Voronezh, Kursk, Lipetsk and Tambov regions.

Information agency Credinform represents an overview of activity trends of the largest enterprises of the real sector of the economy in the Central Black Earth economic region of Russia.

Enterprises with the largest volume of annual revenue (TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 - 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest enterprise of the Central Black Earth economic region of Russia in terms of net assets is NOVOLIPETSK STEEL MILL PJSC, INN 4823006703, Lipetsk region. Its net assets amounted to 336,1 billion rubles in 2018.

The smallest amount of net assets in the TOP-1000 list was hold by METALL-GROUP LLC, is in the process of being wound up since 22.03.2018, INN 7811122323, Belgorod region. The insufficiency of property of this company in 2018 was expressed as a negative value of -10,6 billion rubles.

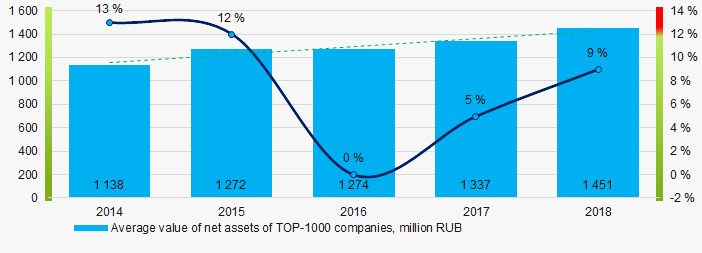

The average values of net assets of TOP-1000 enterprises tend to increase over the five-year period (Picture 1).

Picture 1. Change in the average indicators of the net asset value of TOP-1000 companies in 2014 – 2018

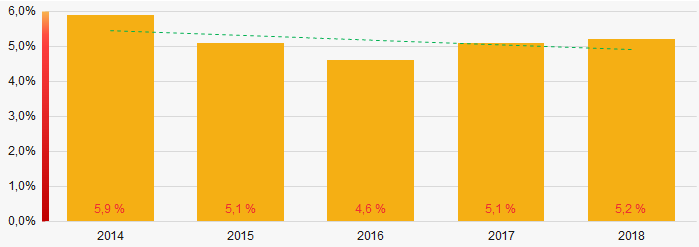

Picture 1. Change in the average indicators of the net asset value of TOP-1000 companies in 2014 – 2018The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000

Picture 2. Shares of enterprises with negative values of net assets in TOP-1000Sales revenue

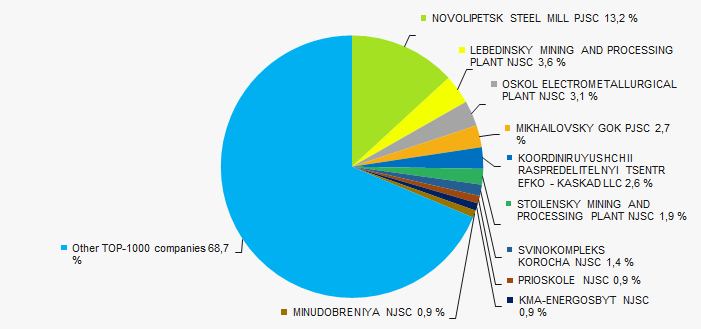

The revenue volume of 10 leading companies of the region made 31,3% of the total revenue of TOP-1000 in 2018 (Picture 3). It points to a relatively high level of capital concentration.

Picture 3. . Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018

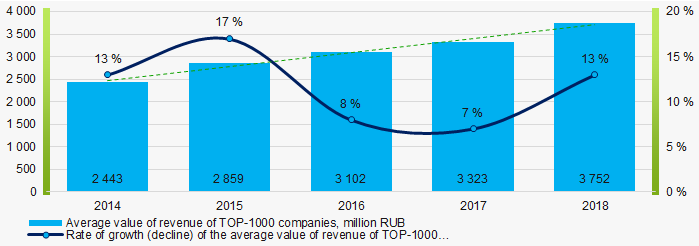

Picture 3. . Shares of participation of TOP-10 companies in the total revenue of TOP-1000 enterprises for 2018 In general, there is a tendency to increase in the revenue volumes (Picture 4).

Picture 4. Change in the average revenue of TOP-1000 companies in 2014 – 2018

Picture 4. Change in the average revenue of TOP-1000 companies in 2014 – 2018 Profit and losses

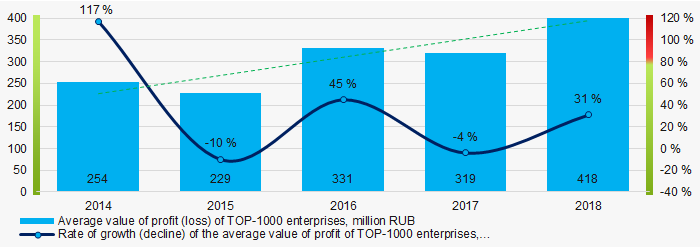

The largest company in terms of net profit value is also NOVOLIPETSK STEEL MILL PJSC, INN 4823006703, Lipetsk region. Company's profit amounted to 117,9 billion rubles in 2018.

Over a five-year period, TOP-1000 enterprises showed a tendency to growth of profits (Picture 5).

Picture 5. Change in the average indicators of profit of TOP-1000 companies in 2014 – 2018

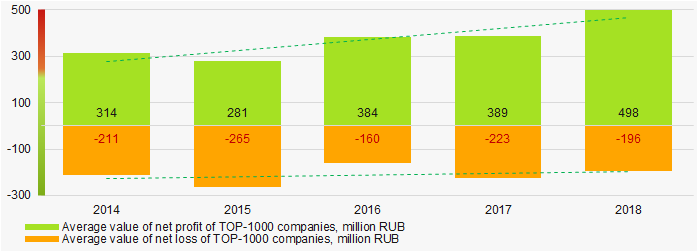

Picture 5. Change in the average indicators of profit of TOP-1000 companies in 2014 – 2018Average values of net profit’s indicators of TOP-1000 enterprises have a tendency increase over a five-year period, at the same time the average value of net loss decreases. (Picture 6).

Picture 6. Change in the average indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018

Picture 6. Change in the average indicators of net profit and net loss of TOP-1000 companies in 2014 – 2018 Key financial ratios

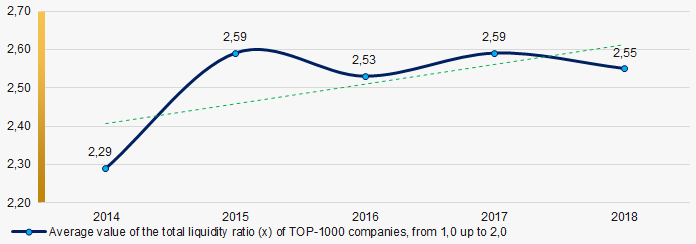

Over the five-year period, the average indicators of the total liquidity of TOP-1000 enterprises were above the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the total liquidity ratio of TOP-1000 companies in 2014 – 2018

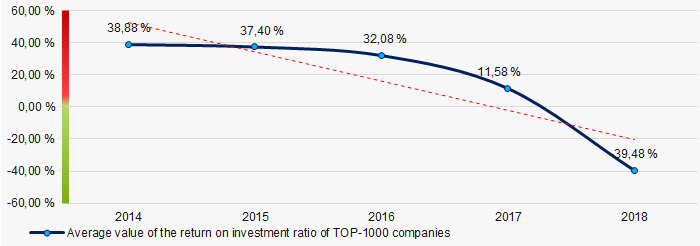

Picture 7. Change in the average values of the total liquidity ratio of TOP-1000 companies in 2014 – 2018 Over the course of three years out of five years, there is a high level of average indicators of return on investment ratio, with a tendency to decrease (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2014 – 2018

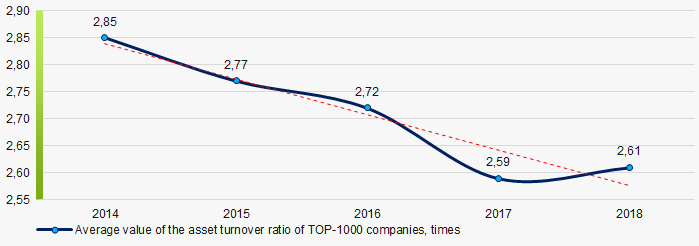

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2014 – 2018 Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Over a five-year period, this indicator of business activity showed a tendency to decrease (Picture 9).

Picture 9. Change in the average values of the asset turnover ratio of TOP-1000 companies in 2014 – 2018

Picture 9. Change in the average values of the asset turnover ratio of TOP-1000 companies in 2014 – 2018Small business

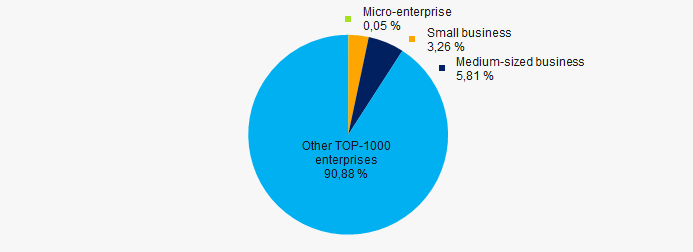

38% enterprises from TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-1000 amounts only to 9,1%, that is significantly lower than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-1000 companiesMain regions of activity

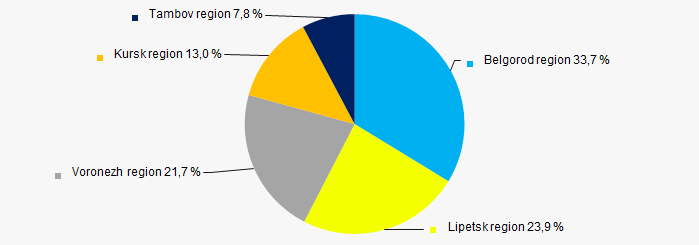

TOP-1000 companies are registered in all 5 regions and distributed unequal across the territory. Almost 58% of the largest enterprises in terms of revenue are concentrated in Belgorod and Lipetsk regions (Picture 11).

Picture 11. Distribution of the revenue of TOP-1000 companies by regions of the Central Black Earth economic region of Russia

Picture 11. Distribution of the revenue of TOP-1000 companies by regions of the Central Black Earth economic region of RussiaFinancial position score

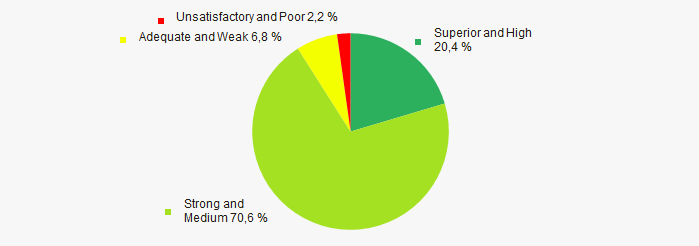

An assessment of the financial position of TOP-1000 companies shows that the financial position of the most of them is above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

The vast majority of TOP-1000 enterprises got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

Picture 13. Distribution of TOP-50 companies by solvency index GlobasIndustrial production index

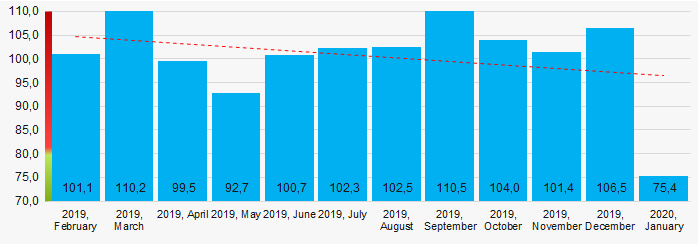

According to the Federal State Statistics Service, there is a tendency towards a decrease in indicators of the industrial production index in the Central Black Earth economic region of Russia during 12 months of 2019 – 2020 (Picture 14). At the same time, the average index month-over-month made 100,6%.

Picture 14. Averaged industrial production index in regions of the Central Black Earth economic region of Russia in 2019 - 2020, month-over-month (%)

Picture 14. Averaged industrial production index in regions of the Central Black Earth economic region of Russia in 2019 - 2020, month-over-month (%)According to the same data, the share of enterprises of the Central Black Earth economic region of Russia in the total amount of revenue from the sale of goods, works, services made 2,577%, countrywide for 2018, and for 9 months of 2019 – 2,528%, that is lower than the indicator for the same period of 2018, which amounted to 2,587%.

Conclusion

A comprehensive assessment of activity of the largest enterprises of the real sector of the economy in the Central economic region of Russia, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors of TOP-1000 | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  5 5 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of net profit of companies |  10 10 |

| Growth / decline in average values of net loss of companies |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized enterprises in the region in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  5 5 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  5 5 |

| Dynamics of the share of proceeds of the region in the total revenue of the RF |  -10 -10 |

| Average value of the specific share of factors |  3,8 3,8 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).