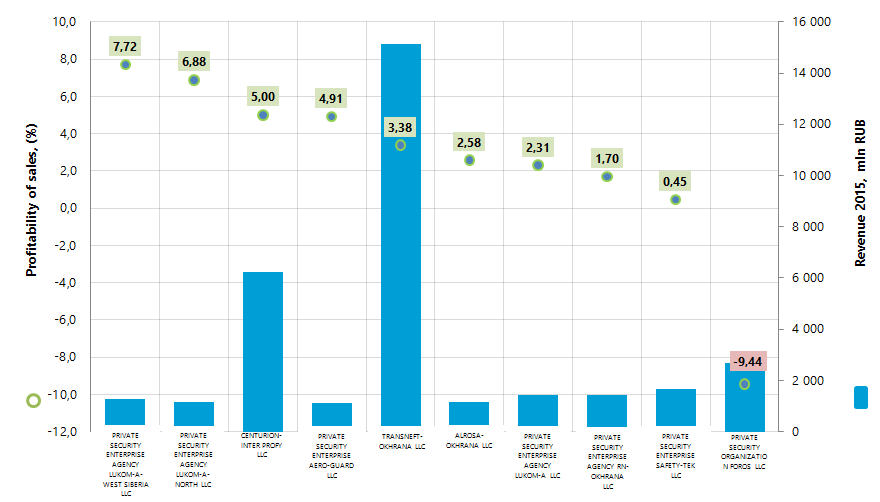

Profitability of sales of the largest Russian security providers

Information agency Credinform prepared a ranking of profitability of sales of the largest Russian security providers. Companies with the highest volume of revenue (TOP-10) were selected for this ranking according to the data from the Statistical Register for the latest available periods (2015 and 2014). The enterprises were ranked by decrease in profitability of sales (Table 1).

Profitability of sales (%) is calculated as a share of operating revenue in total sales of the company. Sales profitability ratio indicates the efficiency of production and commercial activity, and shows funds volume resulting from sales of products after production costs, taxes and loan interests.

Profitability of sales presents the efficiency of pricing policy and management’s ability to control costs. Difference in competitive strategies and product ranges defines the variety of sales profitability values of companies within the industry. That is why it should be noted that profitability of sales of two different companies at equal values of revenue, operating costs and profit before tax could vary influenced by interest payments on net profit value.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention to the complex of presented ratios, financial and other indicators of the company.

| Name, INN, region | Net profit for 2015, mln RUB | Revenue for 2015, mln RUB | Revenue for 2015, mln RUB | Profitability of sales, (%) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| PRIVATE SECURITY ENTERPRISE AGENCY LUKOM-A-WEST SIBERIA LLC INN 8608051652 the Khanty-Mansi autonomous district - Yugra |

83,54 | 1 285,64 | 4,28 | 7,72 | 158 The highest |

| PRIVATE SECURITY ENTERPRISE AGENCY LUKOM-A-NORTH LLC INN 1106015062 the Republic of Komi |

71,24 | 1 139,38 | 8,70 | 6,88 | 187 The highest |

| CENTURION-INTER PROFY LLC INN 7724006715 Moscow |

312,00 | 6 238,55 | 11,81 | 5,00 | 171 The highest |

| PRIVATE SECURITY ENTERPRISE AERO-GUARD LLC INN 7709871219 Moscow |

23,39 | 1 094,79 | 5,34 | 4,91 | 237 High |

| TRANSNEFT-OKHRANA LLC INN 7728881149 Moscow |

249,27 | 15 150,69 | 274,77 | 3,38 | 246 High |

| ALROSA-OKHRANA LLC INN 1433018056 the Republic of Sakha (Yakutia) |

1,04 | 1 161,69 | 7,78 | 2,58 | 251 High |

| PRIVATE SECURITY ENTERPRISE AGENCY LUKOM-A LLC INN 7708234591 Moscow |

494,28 | 1 427,83 | 3,58 | 2,31 | 159 The highest |

| PRIVATE SECURITY ENTERPRISE AGENCY RN-OKHRANA LLC INN 7708105476 Moscow |

201,91 | 1 434,09 | 3,16 | 1,70 | 177 The highest |

| PRIVATE SECURITY ENTERPRISE SAFETY-TEK LLC INN 0277104063 the Republic of Bashkortostan |

-12,83 | 1 677,12 | -0,16 | 0,45 | 310 Satisfactory |

| PRIVATE SECURITY ORGANIZATION FOROS LLC INN 6382026930 Samara region |

-415,20 | 2 688,30 | 83 647,66 | -9,44 | 291 High |

| Total for TOP-10 | 1 008,64 | 33 298,07 | *80,17 | *2,55 | |

| Total for TOP-100 | 2 995,07 | 67 881,51 | *48,81 | **11,19 |

*) - average value for the group of companies

**) – average value for the industry

Average value of sales profitability ratio for the TOP-10 in 2015 is lower than for the industry average. PSO FOROS LLC has negative value. Speaking about TOP-100, 5 companies also have negative values for 2015 and 9 companies are loss-making.

Net profit of TOP-10 companies in 2015 reduced by 24% to the previous period and increased by 27% in TOP-100.

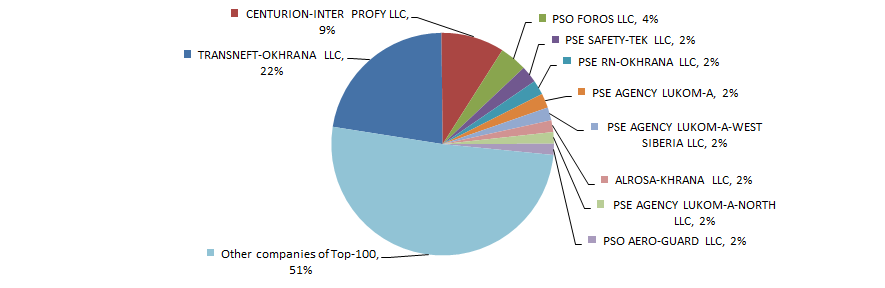

Revenue volume of the largest 10 companies is 49% of total volume of the largest 100 companies. This indicates higher level of monopolization in the sector. At the same time it is necessary to consider that due to the specifics of activities security providers cooperates with the main Russian holdings such as PJSC TRANSNEFT, PJSC ROSNEFT OIL COMPANY, PJSC LUKOIL, PJSC ALROSA.

The share of TRANSNEFT-OKHRANA LLC, the largest company in term of revenue for 2015, amounted to 22% in total revenue of TOP-100 companies (Picture 2).

Nine companies in TOP-10 got the highest and high solvency index Globas-i® that indicates their ability to timely and fully fulfill debt liabilities.

PSE SAEFTI-TEK LLC has got satisfactory solvency index Globas-i® due to information about being a defendant in arbitration cases on debt collection, and loss in balance sheet figures. Index development trend is stable.

Four companies in TOP-10 (filled with red in Table 1) have reduced revenue volume or net profit in 2015, or have loss.

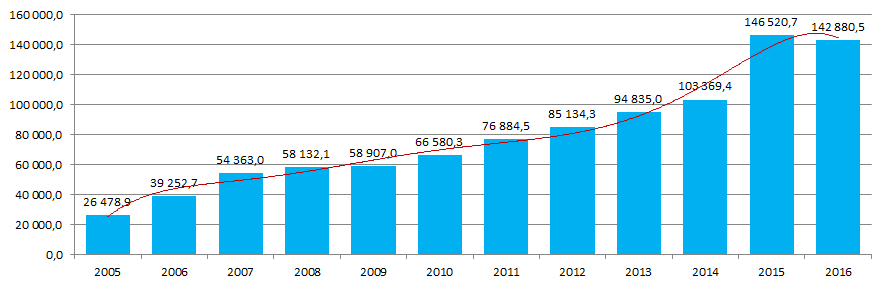

In general, figures of security providers from 2005 to 2016 are characterized with increase in revenue from services that is proved by the Federal State Statistics Service (Picture 3).

The largest increase in revenue from year to year was observed in 2006 and 2015 – by 48% and 42% respectively. In 2016 decrease by 2% was recorded.

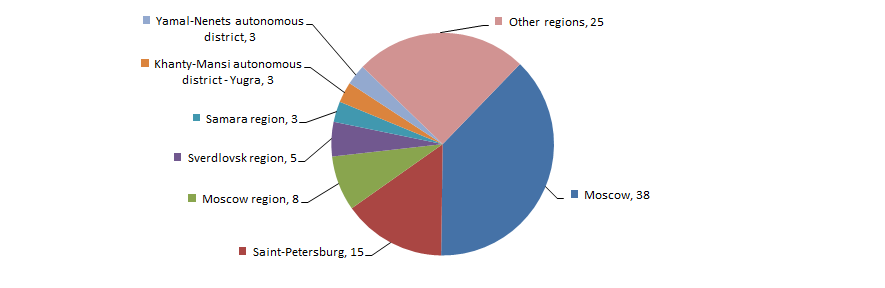

Security enterprises are dotted across the country. This is confirmed by the data from the Information and Analytical system Globas-i: 100 companies with the highest revenue for 2015 are registered in 24 regions of Russia (Picture 4).

Russia has acceded to the Multilateral Competent Authority Agreement on automatic exchange of Country-by-Country Reporting

According to the Russian Government executive order №2608-r as of 7 December 2016, the Multilateral Competent Authority Agreement on automatic exchange of Country-by-Country Reporting was signed by the Federal Tax Service of Russia on 26 January 2017.

The agreement was signed during the meeting of the Inclusive Body for implementation of the Plan on counteract erosion of tax base and withdrawal of profits from taxation (BEPS Plan); the Plan was approved by top public officials of "G-20 Group".

Russia's accession to the Agreement conforms to the standard, formulated under paragraph 13 of the BEPS Plan «Transfer Pricing Documentation and Country-by-Country Reporting».

Country-by-Country Reporting is the formalized document, reflecting financial, tax and other ratios of the international group of companies in States or territories where the members carry out their activities.

The subjects of the standard - are the largest transnational group of companies consolidated proceeds of which are more than 750 mln EUR per year.

According to general rule of the Agreement, the Country-by-Country Reporting is submitted by group's parent company to the tax authority of the State, in which the subject is a tax resident. The tax authority is obligated to share reports with tax authorities of the States, where other members of the group are located.

Currently more than 50 States have adopted the legislation on implementation of automatic exchange of Country-by-Country Reporting and acceded to the Multilateral Agreement.

Russia's accession to the Agreement as well as Convention on Mutual Administrative Assistance in Tax Matters (entered into force on 01.07.2015) create a world-class legal basis, which allow Russian tax authorities to share Country-by-Country Reporting with the relevant authorities of foreign States and use this information for analysis before inspections. Whereas, for Russian taxpayers it gives the opportunity to submit Country-by-Country Reporting centrally, including members of the group – the tax residents of other States, without threat of double taxation.

However, the relevant domestic law on Country-by-Country Reporting is required for complete actual use of the Agreement. The Ministry of Finance of the Russian Federation is already preparing such draft law. In case of adoption of the law until the end of 2017 the exchange of Country-by-Country Reporting (from 2016) may start in 2018.

According to the experts, the list of group companies, which are obligated to submit the Country-by-Country Reporting, may include the largest Russian commodity, industrial and financial holdings. Thus, according to the Information and Analytical system Globas-i®, there are more than 70 companies, the consolidated proceeds of which meet the requirements of the Agreement on the exchange of Country-by-Country Reporting. Among these companies are: Public Joint Stock Company Gazprom, PAO LUKOIL, Joint stock Company Mining and Metallurgical Company NORILSK NICKEL, PAO TRANSNEFT, PAO SEVERSTAL, PAO AFK SYSTEMA, PAO AEROFLOT.