Credit protection of enterprises, producing knitted goods

Information agency Credinform prepared a ranking of companies, manufacturing knitted wear.

The companies with the highest volume of revenue were selected for the ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in turnover.

Credit protection index (x) is the relation of profit before taxes and interests on loans to the amount of interest payable. It characterizes the security degree of creditors from non-payment of interests on provided credit and shows how many times during the reporting period a company earned funds for interest payment on loans. The recommended value of the ratio is >1. If the index is not calculated (line is drawn), this indicates that a company has no interest obligations towards creditors. But if the ratio has a negative value - this, in its turn, testifies to that there is loss from the main activity.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all available combination of financial data.

| № | Name | Region | Revenue, in mln RUB, for 2013 | Credit protection index, х | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | Trikotazhnoe predpriyatie Krasny Vostok CJSC INN 7719044264 |

Moscow | 1 023 | 75,0 | 225 high |

| 2 | TTO Klinvolokno LLC INN 5020054074 |

Moscowregion | 966 | - | 315 satisfactory |

| 3 | Smolenskaya chulochnaya fabrika CJSC INN 6731008327 |

Smolensk region | 732 | -5,3 | 274 high |

| 4 | Gamma OJSC INN 5752006640 | Orel region | 706 | - | 245 high |

| 5 | Almetevskaya chulochno-nosochnaya fabrika Alsu OJSC INN 1644023111 |

Republic of Tatarstan | 448 | 4,3 | 229 high |

| 6 | Fabrika Trikotazha Zareche LLC INN 3703043765 |

Ivanovo region | 432 | 30,3 | 248 high |

| 7 | Tverskaya chulochno-nosochnaya fabrika LLC INN 6905059107 |

Tver region | 394 | - | 220 high |

| 8 | Borisoglebsky trikotazh OJSC INN 3604002599 |

Voronezh region | 324 | 2,1 | 227 high |

| 9 | Lysvenskaya chulochno-perchatochnaya fabrika OJSC INN 5918002152 |

Perm terrotiry | 291 | 2,1 | 271 high |

| 10 | Osko Produkt LLC INN 7708096599 |

Moscow region | 269 | 9,2 | 229 high |

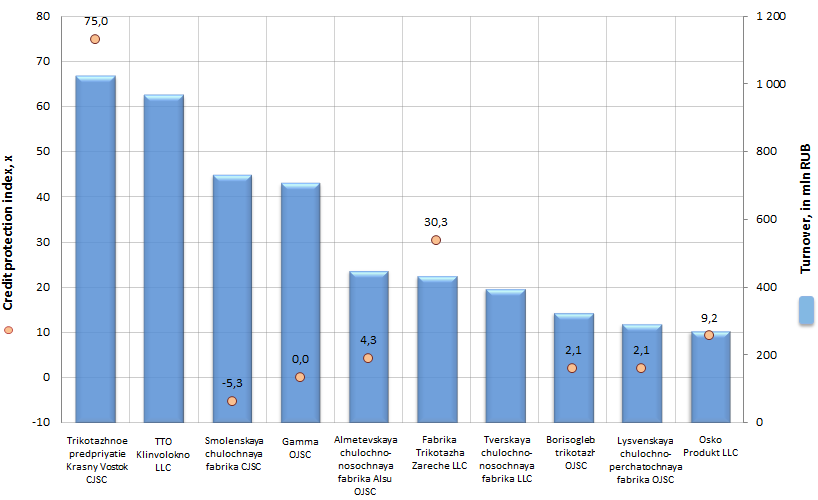

Picture. Credit protection index and revenue of the largest companies, producing knitted goods (TOP-10)

The revenue of the largest manufacturers engaged in output of knitted wear (TOP-10), according to the latest published annual financial statement, made 5,6 bln RUB.

Two companies showed the highest values of the credit protection index (above 10): Trikotazhnoe predpriyatie Krasny Vostok CJSC (75,0) and Fabrika Trikotazha Zareche LLC (30,3); the profit significantly exceeds the available interest payable.

Three organizations from the TOP-10 list (TTO Klinvolokno LLC, Gamma OJSC, Tverskaya chulochno-nosochnaya fabrika LLC) did not have interest payable, that, on the one hand, explains the desire of enterprises to develop due to their own sources, and, on the other hand – points out to the danger of losing the competition for the market to those players, who invests heavily in technical re-equipment of its production and intelligent marketing, when it is very difficult to go without borrowed funds.

According to the independent estimation of the Information agency Credinform, nine from ten participants of the TOP-10 list got high solvency index, this fact points to that the enterprises can pay off their debts in time and fully, while risk of default is minimal.

TTO Klinvolokno LLC has satisfactory solvency index. Such fact signals as well to the management as to potential investor that there are certain financial difficulties (retaining of net loss) by the existing business model of development and that it is necessary to attract additional guarantees for the purpose of possible credit granting and cooperation.

The Central Bank has developed new rules of capital calculation

The Central Bank (the CB) has implemented new rules of capital calculation. It is suggested to take into account the assessed value of securities, have been recorded in the depository, as well as reliability index of the person involving in rights record keeping where the account of deposit was opened. In the explanatory note the CB marks that change in the capital calculation will not be resulted in increase of load upon capital of depositories not using the practice of creating an “endless” chain of owning, as well as for those who open accounts of deposit only in highly reliable accounting organizations, such as the Central Securities Depository, Settlement Depository or Registrar.

The measurers offered are aimed to prevent the withdrawal of clients’ money. Today there is a possibility of creating the “endless” chains of owning, that means not only the significant increase of operating risks for securities market’s participants, but also the possible loss of securities by their holders. The CB representatives note that non-transparency of the securities rights accounting makes the supervision on market’s participants complicate.

The Central Bank is overly concerned with the problem of depositories’ qualification after the bankruptcy of five banks controlled by Matvey Urin. The bankruptcy cost 10,3 bln. RUB for the Deposit insurance agency. Back then the established pattern of fictitious securities purchase was used to siphon the deposits off “Urin’s banks”. After the uncovering of that system, the CB management decided to increase reserves for securities, accounted in doubtful depositories.

The experts note, that the adopted requirements of keeping securities in small depositories (with the capital up to 350 mln. RUB) appear to be blocking-off, because of the necessity to reserve 50% of the assets value in the nominee account. The blocking-off is significantly lower (0,01% of the assets value) for depositories with the capital of 350 mln. to 1 bln. RUB. But it also can be sensitive for some participants.

At the same time, the document is not obliged to keep all securities in major depositories. In case someone decides to keep securities in small little-known depository, there must be capital to cover potential losses. Therefore, the experts agree that the submitted document is a try to limit cases of securities keeping simulation.