Total liquidity ratio of oil and gas companies

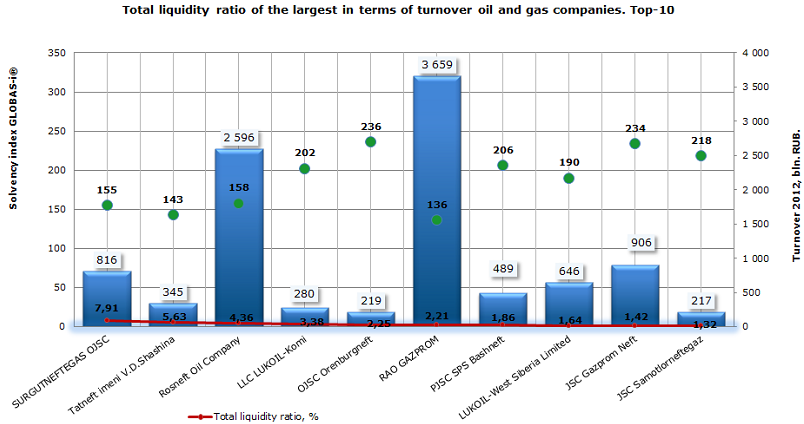

Information agency Credinform prepared a ranking of total (current) liquidity ratio for oil and gas companies. The ranking list includes industry’s largest Russian companies with mentioned activity type and is based on turnover as stated in the Statistics register, with the reference period of 2012. The selected companies were ranked first in terms of turnover, then the total liquidity ratio.

Total liquidity ratio is calculated as the ratio of current assets to current liabilities of the company. This reflects the company's ability to put out its short-term liabilities from current assets only. In Russian practice a normal range of 2 to 3 is considered.

| № | Name, INN | Region | Total (current) liquidity ratio, % | Turnover 2012, bln. RUB. | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | SURGUTNEFTEGAS OJSC, INN 8602060555 | Khanty-Mansijsk Autonomous District | 7,91 | 815,57 | 155 (top) |

| 2 | Tatneft imeni V.D.Shashina, INN 1644003838 | Republic of Tatarstan | 5,63 | 344,56 | 143 (top) |

| 3 | Rosneft Oil Company, INN 7706107510 | Moscow | 4,36 | 2595,67 | 158 (top) |

| 4 | LLC LUKOIL-Komi, INN 1106014140 | Komi Republic | 3,38 | 279,88 | 202 (high) |

| 5 | OJSC Orenburgneft, INN 5612002469 | Orenburg region | 2,25 | 218,52 | 236 (high) |

| 6 | RAO GAZPROM, INN 7736050003 | Moscow | 2,21 | 3659,15 | 136 (top) |

| 7 | PJSC SPS Bashneft, INN 0274051582 | Republic of Bashkortostan | 1,86 | 489,21 | 206 (high) |

| 8 | LUKOIL-West Siberia Limited, INN 8608048498 | Khanty-Mansijsk Autonomous District | 1,64 | 645,72 | 190 (top) |

| 9 | JSC Gazprom Neft, INN 5504036333 | St. Petersburg | 1,42 | 905,51 | 234 (high) |

| 10 | JSC Samotlorneftegaz, INN 8603089934 | Khanty-Mansijsk Autonomous District | 1,32 | 217,41 | 218 (high) |

The role of the oil and gas sector in the economy remains high. Thus, according to the data of the Ministry of Energy, the share of oil revenues in the national budget in 2012 was 50 %, while the contribution to GDP was about 1/3, and in exports - about 2/3.

The top three is represented by the following companies: SURGUTNEFTEGAS OJSC with total liquidity ratio of 7.91 %, Tatneft imeni V.D.Shashina (5.63 %) and Rosneft Oil Company (4.36 %). All three companies have total liquidity ratio exceeding the standard values, which may indicate the unsustainable capital structure. But at the same time, according to the year-end 2012, these companies have demonstrated excellent financial results, and the three leaders got the highest solvency index GLOBAS -i ®, which characterizes them as financially stable.

Total liquidity ratio of the largest in terms of turnover oil and gas companies. Top-10

Only two companies can boast of overall liquidity ratios in the terms of standard: OJSC Orenburgneft (the value is 2.25 %) and industry leader in terms of 2012 turnover - RAO GAZPROM (2.21 %). Companies were assigned the high index and the highest solvency index GLOBAS -i ®.

The companies PJSC SPS Bashneft, LUKOIL-West Siberia, JSC Gazprom Neft and JSC Samotlorneftegaz have the value slightly less than the norm, but higher than zero, that is why it is nothing to speak of the high financial risk. All four companies were assigned a high index and the highest solvency index GLOBAS -i ®, which is also characterized their ability to repay the debts timely and fully.

In international practice, the standard values for total liquidity ratio slightly deviate from Russian ones. Depending on the industry, the normal value of the index is from 1.5 to 2.5. The Top-10 oil companies in terms of 2012 turnover in the world, ranked by the current liquidity ratio are below.

| № | Name | Country | Total (current) liquidity ratio, % | Turnover 2012, bln. RUB. |

|---|---|---|---|---|

| 1 | RAO GAZPROM | Russia | 2,21 | 3 659 |

| 2 | PETROLEO BRASILEIRO S.A. | Brazil | 1,7 | 4 183 |

| 3 | ENI SPA | Italy | 1,43 | 5 160 |

| 4 | TOTAL S.A. | France | 1,38 | 7 310 |

| 5 | ROYAL DUTCH SHELL PLC | Germany | 1,18 | 14 194 |

| 6 | JX HOLDINGS, INC. | Japan | 1,13 | 3 619 |

| 7 | STATOIL ASA | Norway | 1,12 | 3 935 |

| 8 | PETROLEOS DE VENEZUELA S A | Venezuela | 1,05 | 3 780 |

| 9 | PETROCHINA COMPANY LIMITED | China | 0,72 | 10 611 |

| 10 | SAUDI ARABIAN OIL COMPANY (ARAMCO) | Saudi Arabia | no data | 9 719 |

It should be noted the Russian leader, RAO GAZPROM, is also included in the world Top-10. Moreover, the domestic manufacturer tops the list, having the maximum value of the total liquidity ratio among the represented companies, satisfying both domestic and international regulations. Gazprom also holds the ninth place in terms of turnover among the largest oil and gas companies in the world by the end of 2012.

Brazilian company PETROLEO BRASILEIRO SA with the current ratio of 1.7% and Italian company ENI SPA with 1.43 %, which is slightly smaller than the existing international standards, are also included in top three of the list. Both companies are ahead of Gazprom in terms of turnover, ranking 6th and 5th positions in the world respectively.

Rosneft Oil Company is on the 11th place in terms of turnover. However, due to the purchase of TNK-BP in 2012, the company's position may change. As a result of this transaction, Rosneft has become the largest company in the world in terms of oil extraction.

The government plans to start economizing

The government of Russian Federation resorts to economizing measures, as a result of stagnation of industrial production and rise in the budget deficit under increased social expenditures for pre-election promises of the President. The stagnation is observable in the world financial market for several quarters running.

In the preparation of the draft budget for the nearest three years, the Minister of Finance of Russian Federation Anton Siluanov outlined specific steps, focused on encouragement of receipts to budget revenues and its deficit reduction by MET increase and VAT revocation refund for several manufacturing sectors.

It is said that orderly MET increase under simultaneously reducing of export tax on oil and oil products allows getting to budget 35 billion rubles in 2014, 67 billion rubles in 2015 and 72 billion rubles in 2016. Obviously, with such an act the Cabinet intends to refill the budget using excise tax, due to the fact that oil products prime cost will rise with high probability within Russian market. This step is a controversial one, for the appreciation of fuel will perform a price escalation in other economic sectors. It will lead to accelerating the inflation dynamics, the decline of which is declared by the President as a strategic target.

In addition, plans call for cancel of VAT refund for exporters of primary production in wood processing and fishing industries. On the one hand this step aimed to replenish the budget, on the other – it is declared that this measure is focused on encouragement of domestic processing of the primary raw material. But it is also necessary to take into account that many companies stay up by means of privileged export of primary production abroad, considering that domestic buyers offer incomparably smaller price. Is there a chance for wood processing and fishing enterprises to ensure profitability under appreciation of export, or to build manufactures in the country, is questioned. Moreover, due to our recent accession to the WTO, we hit Russian export by these steps.

Thus, we are forced to state that innovating growth of economics and industrial diversification are again being put off indefinitely. It is planned to patch budget holes by means of increase of total tax burden for companies and citizens.