Trends in the field of employment services

Information agency Credinform has prepared a review of trends in activity of the recruiting agencies. The largest companies (TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2011 – 2020). The company selection and analysis were based on data of the Information and Analytical system Globas.

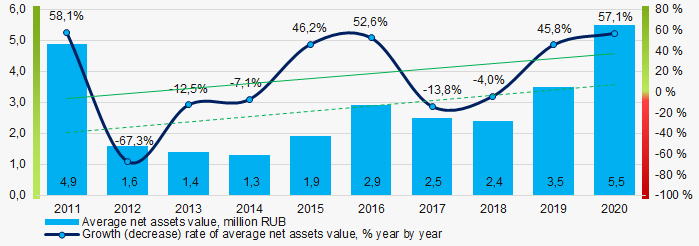

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is LLC EDINYI MIGRATSIONNYI TSENTR, INN 7842421041, St. Petersburg, activities of insurance agents and brokers. In 2020 net assets of the company amounted to more than 4,4 billion RUB.

The smallest size of net assets in TOP-1000 had Exect Partners Group Limited Liability Company, INN 7710734513, Moscow, activities of employment placement agencies. The lack of property of the company in 2020 was expressed in negative terms -387 million RUB.

For the last ten years, the average industry values of net assets and growth rates showed the upward tendency (Picture 1).

Picture 1. Change in average net assets value in 2011 – 2020

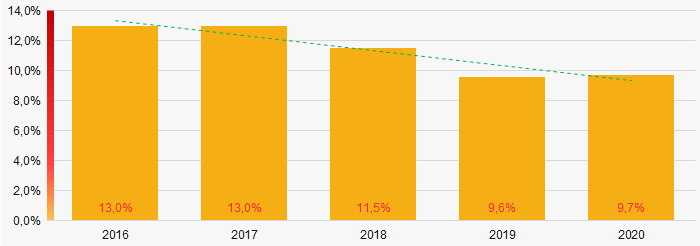

Picture 1. Change in average net assets value in 2011 – 2020For the last five years, the share of ТОP-1000 enterprises with lack of property demonstrated the positive decreasing trend (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000 in 2016-2020

Picture 2. The share of enterprises with negative net assets value in ТОP-1000 in 2016-2020Sales revenue

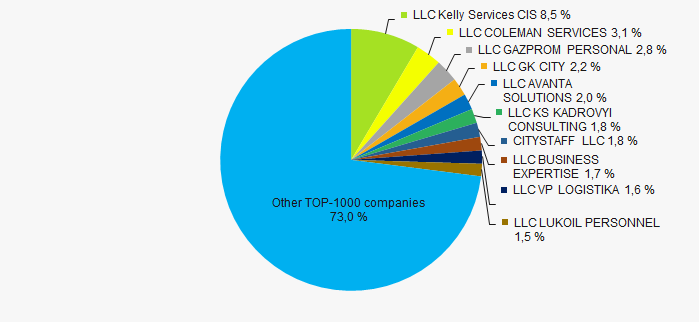

In 2020, the total revenue of 10 largest companies amounted to 27% from ТОP-1000 total revenue (Picture 3). This fact testifies the relatively high level of competition among companies of this type of activity.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2020

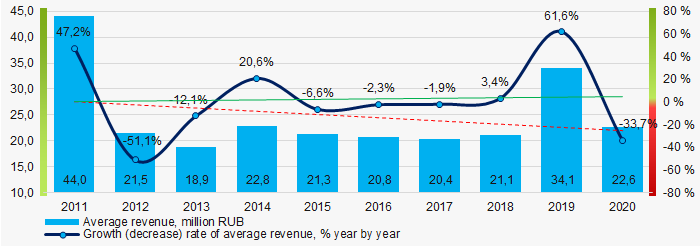

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2020Within the last ten years, the decreasing trend in sales revenue with upward dynamics of growth rates is observed (Picture 4).

Picture 4. Change in average revenue in 2011 – 2020

Picture 4. Change in average revenue in 2011 – 2020 Profit and loss

The largest company in terms of net profit is also LLC EDINYI MIGRATSIONNYI TSENTR, INN 7842421041. The company’s profit amounted to almost 193 million RUB.

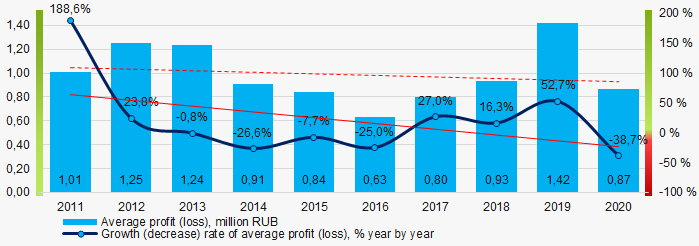

For the last ten years, the average profit values and growth rates show the decreasing tendency (Picture 5).

Picture 5. Change in average profit (loss) in 2011 – 2020

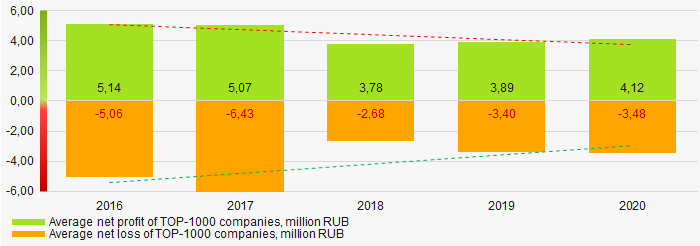

Picture 5. Change in average profit (loss) in 2011 – 2020Over a five-year period, the average net profit (loss) values of ТОP-1000 show the negative tendency (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2016 – 2020

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2016 – 2020Main financial ratios

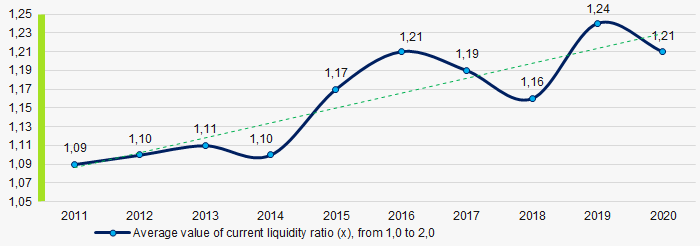

For the last ten years, the average values of the current liquidity ratio were within the recommended values - from 1,0 to 2,0, with growing trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2011 - 2020

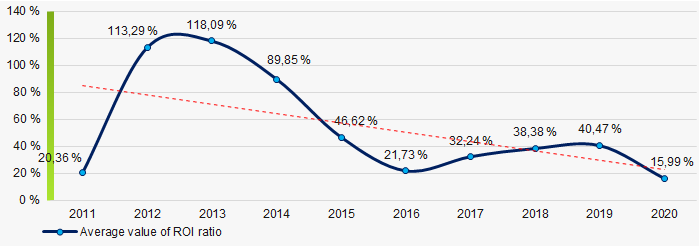

Picture 7. Change in average values of current liquidity ratio in 2011 - 2020Within ten years, the decreasing trend of the average values of ROI ratio is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2011 – 2020

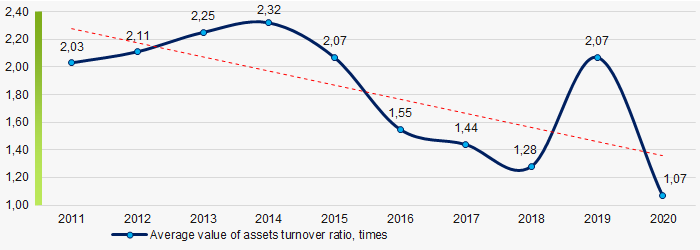

Picture 8. Change in average values of ROI ratio in 2011 – 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last ten years, this business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2011 – 2020

Picture 9. Change in average values of assets turnover ratio in 2011 – 2020Small businesses

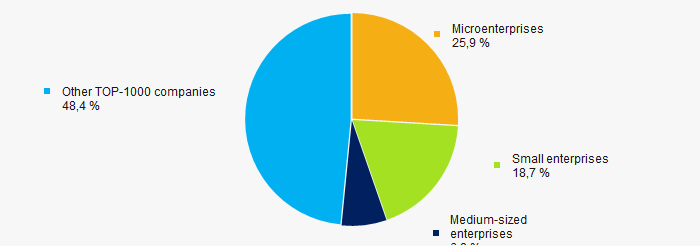

89% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue amounted to more than 51%, which is 2,5 times higher than the national average value in 2018 – 2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

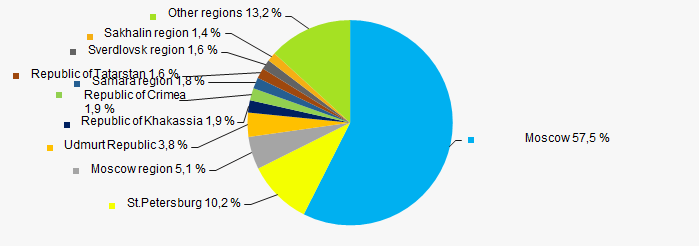

TOP-1000 companies are registered in 66 regions of Russia (this is 78% of territorial subjects of the Russian Federation) and are unequally located across the country. Almost 68% of the largest enterprises in terms of revenue are located Moscow and St.Petersburg (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the regions of Russia

Picture 11. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

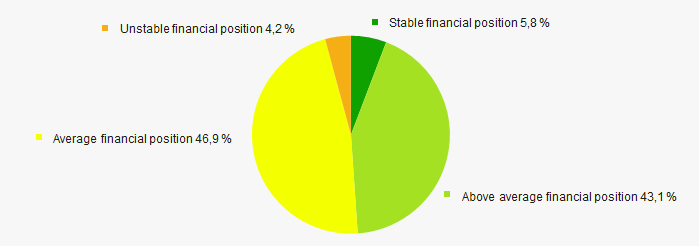

An assessment of the financial position of TOP-1000 companies shows that the largest part has the average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

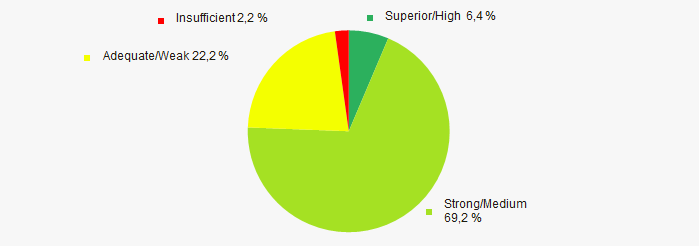

Most of TOP-1000 companies got superior/high and strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasConclusion

A complex assessment of the largest recruiting agencies demonstrates the presence of positive trends within 2011-2020 (Table 1).

| Trends and assessment factors | Relative share, % |

| Dynamics of average net assets value |  10 10 |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| The level of monopolization / competition |  10 10 |

| Dynamics of average revenue |  -10 -10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Dynamics of average profit (loss) |  -10 -10 |

| Growth/drawdown rate of average profit (loss) |  -10 -10 |

| Increase / decrease in average net profit |  -10 -10 |

| Increase / decrease in average net loss |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  10 10 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  1,2 1,2 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor)

unfavorable trend (factor)

Legislative changes

When conducting on-site inspections, the supervisory authorities need to take samples of products or goods. The Decree of the Russian Federation Government No. 1299 dated 03.08.2021 establishes the rules for compensating costs of such products.

The conditions for compensation of lost products' cost seized during on-site inspections are:

- no violations of mandatory requirements for safety or product quality based on results of the inspection;

- products cannot be returned due to the loss of their consumer properties or according to the rules of their sale;

- cost of lost products is more than 10 thousand rubles.

To compensate the cost, it is necessary to send the following documents to the supervisory authority using its official website (information system) on the Internet or by e-mail no later than 3 months from the date of drawing up on-site inspection report:

- statement indicating name of the lost product, its cost and bank details;

- images or scanned copies of documents in electronic form (if there are any) confirming legality of ownership of lost products and their cost price.

Users of the Information and Analytical system Globas have the opportunity to access the information about all inspections of economic entities in the section "Inspections' plan of supervisory authorities" in company's report.