Low global oil price – Russia only wins

The continuing trend of decrease in Brent oil price is marked at the moment. The cheapening of black gold is marked during the last 8 weeks. The quotation of Russian oil brand Urals is close to Brent’s, which is traded on London Stock Exchange. That’s why the experts are focused on the Brent brand price.

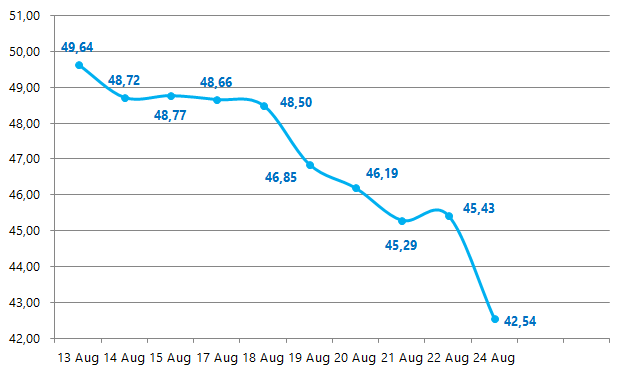

Thus, on 13 August 2015 the oil price amounted to 49,64 USD per barrel. The decline is 1,19% in comparison with previous day's trades. On 24 August 2015 the oil price decreased to 42,54 USD per barrel. This is 6,36% lower than the trade level as of 22 August 2015. The negative dynamics of oil price within 10 days is represented at picture 1.

Picture 1. The dynamics of oil prices for a period of 13-24 August 2015, USD/ barrel

According to Information Agency Credinform experts, the strongest influence on price reduction still have the following factors:

- surplus inventory of oil is daily marked at the level of 3 mln. barrels;

- decrease in global oil consumption;

- continuing increase of global oil production;

- the expectation of the Iran oil on the global market after lifting of sanctions;

- politicized and speculative price trends on the oil market.

In the short term period the decrease of oil price is the negative factor for Russia. As almost a half of Russian budget is formed on the base of oil and gas revenues, the decrease of oil price will influence on its profitable part and, as a result, the budget deficit is possible. Against this background, the following things are happen: the ruble become weak towards hard currencies, increase of the capital outflow, promotion of the next inflation round, decrease of investment volumes into economy etc.

Under the circumstances the opinions of the market experts of oil price forecast are quite different: starting from the statements of inability to predict in numbers up to the worst case, when the oil will be traded at the level of 25 USD per barrel. Some experts argue that the oil price will be within the limits of 40 - 70 USD/barrel.

The most analysts don’t believe in decrease of oil price below 40 USD per barrel or consider such situation, but for a short time. Thus in terms of the "price war" it is believed, that Russia does not need to reduce the production and sale of oil. This period must be overcome by increasing of its production and sale and thereby to deprive competitors’ initiatives. The analysis of the stress-testing results shows the ability of the Russian oil and gas companies to withstand the low oil prices. According to the management statements, the companies have enough safety margin, they generate stable cash flow to serve its financial obligations and to cover financial needs.

It also should be noted, that according to Russian and some international experts, Russia can safely live at the level of 40 USD per barrel. The budget revenues were taken into account with the annual average oil price of 50 USD per barrel and 2015 annual average ruble rate at the level of 60 RUB per dollar. Therefore, with decrease in oil price the exchange rate of the ruble against hard currencies will increase. For example, today, when the oil price is 44 USD per barrel, the exchange rate is more than 70 RUB per dollar, and this trend will continue in the future. However, according to the State anti-crisis strategy, lost incomes of the Russian budget will also be covered by the Reserve Fund and increase in prices on domestic gasoline, diesel fuel, kerosene, fuel oil and petroleum products within the country.

In the medium and long term period experts believe, that low global oil price will positively influence on the development of Russia. Firstly, a serious blow to the market of shale oil, which is a competitive product of Russian oil, is applied. As a result, the shale industry in the USA bears the multi-billion dollar losses, since October 2014 about a half of the rigs is frozen, thousands of workers are fired.

Secondly, the situation with low oil price forces the management to be more focused and find the way out of the crisis. Much has been already done: active work with such organizations as BRICS, SCO, EurAsEC is carried out; the cooperation in Eastern direction with specific countries, first of all with China, is expanding. Thus, in March 2015, Rosneft and CNPC (China) signed a new agreement. It assumes the increase of supply in three directions, at the peak up to 31 mln. tons of oil, in accordance with infrastructure capabilities. Currently 15 mln. tons of Russian oil per year are supplied to China.

Thirdly, if the weakening ruble trend continues under the pressure of oil prices, Russian economy as a whole will win. Russian export becomes more attractive and the demand on foreign products decreases because of high prices. On the other hand, Russian products will be more in demand in the domestic market, that will be the push to production development and, correspondingly, local manufacturers will have greater opportunities for business expansion.

Also the current economic situation may be the incentive for diversify of the economy. In that case the investment will be also directed on the development of other industries, connected with import substitution, new technologies, agriculture etc. As a result, all that will help to get away from the dependence on oil price.

Administrative Pressure on Small business in Russia will Decline

Credinform Information Agency in its previous publications several times touched on the small business theme.

Global business practice shows that the role of SMEs is of key importance for the economic stability and growth. The efficiency of small and medium business mostly depends on the governmental approach as confirmed in practice by successful economic development in many countries. While the government in Russia traditionally occupies a dominant position in all spheres of social relations, business in particular, the governmental policy in the area of regulation and support of entrepreneurship can dramatically influence the SMEs business development.

To grant domestic small business more freedom the Federal Law No. 294-FZ “On protection of legal entities and sole entrepreneurs by the state and municipal control implementation” came into effect December 26, 2008. In conjunction with the Federal Law No. 246-FZ as of July 13, 2015 amendments were passed to minimize the administrative pressure on the SMEs to facilitate their positive economic output in the today’s complex business environment.

There are the following improvements:

- Within 2016 – 2018 small business entities will not be inspected by the state control bodies. Exception for riskier business areas: manufacturer of hazardous products with a negative environmental impact, companies operating hydro-engineering structures, involved in activities on providing radiation security, state secrets protection, use of nuclear energy, apartment building administration, auditing;

- SMEs have the right to dispute their inclusion into the annual inspection plan;

- A risk-based approach: process, duration, frequency of control measures will depend on the potential hazard of negative consequences if a SME subject avoids to comply with the obligatory requirements/standards and a probability of the subject violating them;

- Federal laws or governmental acts will regulate terms attributing specific risk category or hazard rating to the corporations.

The Federal Law No. 246-FZ as of July 13, 2015 has come into effect on its publication date; sections related to the implementation of the risk-based approach will come into effect as of January 1, 2018.

According to statistics data, during the period 2012-2015 over 2 million inspections were planned, 20 % for 2015 showing a favorable trend in reduced inspections by the State. Further efforts will lead to more positive results, both in the SMEs business development and in the inhibition of the negative trends in Russian economy.

Subscribing for the Information and Analytical system Globas-i®, you may learn about inspections plan according to the summary plan of the RF Prosecutor General’s Office, including the information about monitoring authorities` control concerning specific contractor.