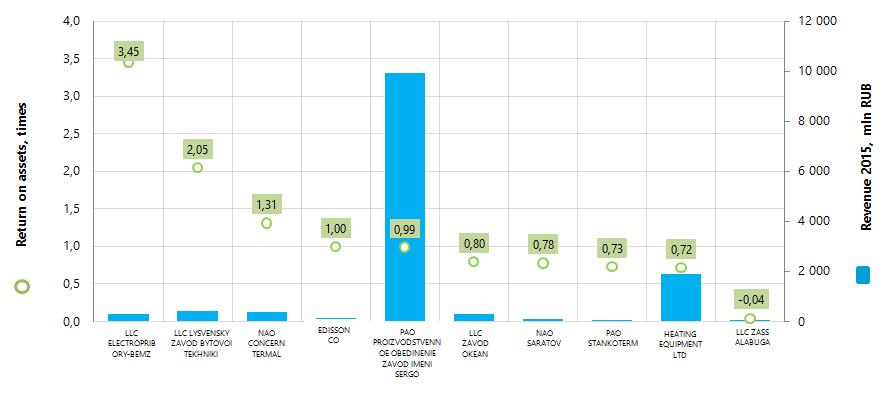

Return on assets of the largest household electrical appliances’ manufacturers in Russia

Information agency Credinform presents the ranking of household electrical appliances manufacturers on return on assets.

The largest by revenue manufacturers of household electrical appliances (TOP-10) for the last available in the Statistical register period (2015) were taken for the ranking. Further the companies were ranked in the descending order of return on assets indicator.

Return on assets (times) is calculated as a ratio of sales revenue to the average value of company’s total assets for the period. The indicator characterizes the efficiency of using all the available resources by the company, without reference to the sources of its raising. This ratio shows how many times the full production and access cycle, producing profit take place during the year.

In order to get the full and fair picture of the company’s financial situation, it is necessary to pay attention not only to the level of products profitability, but also to all the available combination of financial ratios and other indicators.

| Name, tax number, region | Net profit 2015, mln RUB. | Revenue 2015, mln RUB. | Revenue 2015 to 2014,% | Return on assets 2014, times | Return on assets 2015, times | Solvency index Globas-i ® |

|---|---|---|---|---|---|---|

| LLC ELECTROPRIBORY-BEMZ Tax number 5445115284 Novosibirsk region |

26,84 | 303,10 | 123 | 3,14 | 3,45 | 233 High |

| LLC LYSVENSKY ZAVOD BYTOVOI TEKHNIKI Tax number 5918839110 Perm Territory |

0,11 | 407,35 | 126 | 1,95 | 2,05 | 303 Satisfactory |

| NAO CONCERN TERMAL Tax number 5261017382 Nizhny Novgorod region |

-1,44 | 383,53 | 134 | 0,99 | 1,31 | 261 High |

| EDISSON CO Tax number 7810252827 Leningrad region |

3,46 | 135,08 | 80 | 1,21 | 1,00 | 233 High |

| PAO PROIZVODSTVENNOE OBEDINENIE ZAVOD IMENI SERGO Tax number 1648032420 Republic of Tatarstan |

415,69 | 9 941,87 | 169 | 0,70 | 0,99 | 213 High |

| LLC ZAVOD OKEAN Tax number 2511058935 Primorsky Territory |

-5,96 | 290,71 | 72 | 1,00 | 0,80 | 259 High |

| NAO SARATOV Tax number 6453001204 Saratov region |

-15,13 | 86,76 | 96 | 0,78 | 0,78 | 318 Satisfactory |

| PAO STANKOTERM Tax number 2632047092 Stavropolsky Territory |

0,68 | 33,72 | 103 | 0,96 | 0,73 | 231 High |

| HEATING EQUIPMENT LTD Tax number 4716025405 Leningrad region |

48,15 | 1 913,96 | 110 | 0,81 | 0,72 | 255 High |

| LLC ZASS ALABUGA Tax number 1646014828 Republic of Tatarstan |

-13,24 | 6,75 | 4 | 0,58 | 0,04 | 317 Satisfactory |

The best return on assets is shown by LLC ELECTROPRIBORY-BEMZ both in 2014 and 2015. PAO PROIZVODSTVENNOE OBEDINENIE ZAVOD IMENI SERGO took the fifth place of the ranking, having the largest revenue for 2015. The company’s share in the total revenue volume of the TOP-10 amounted to 73%.

The worst return on assets is shown by LLC ZASS ALABUGA. This enterprise is among five companies from the TOP-10, which tolerated profit decrease or loss in comparison with the previous period. Besides, the revenue of the company in 2015 amounted to only 4% of the level in 2014.

Three companies from the TOP-10 have decreased the return on assets in 2015 in comparison with the previous period.

Seven companies of the TOP were given high solvency indices Globas-i® by the combination of financial and other indicators. This gives evidence to their ability to meet their debt obligations timely and in full.

LLC LYSVENSKY ZAVOD BYTOVOI TEKHNIKI, NAO SARATOV and LLC ZASS ALABUGA were given satisfactory solvency indices Globas-i® due to information about being a defendant in debt collection arbitration proceedings.

The average value of return on assets in the group of companies TOP-10 amounted to 1,19 times in 2015 against 1,21 times in 2014. The industry-average value in 2014 amounted to 1,56 times.

The total revenue of the TOP-10 for 2015 amounted to 13,5 billion RUB, which is by 45% more than in 2014. At the same time, four companies of this group are unprofitable. Following the results of 2014, 22 companies are unprofitable in the TOP-100 group.

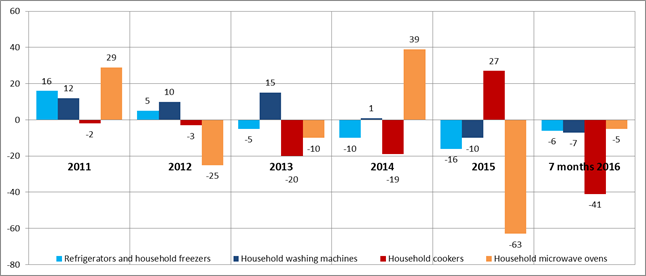

In the whole, the industry has been suffering from the certain difficulties lately, as it in many ways depends on effective public demand owing to specific of the manufactured products. It is reflected in the data of the Federal State Statistics Service (Rosstat) (Table 2, Figure 2).

| 2010 г. | 2011 г. | 2012 г. | 2013 г. | 2014 г. | 2015 г. | 7 months 2016 | |

|---|---|---|---|---|---|---|---|

| Refrigerators and household freezers | 3 556 | 4 102 | 4 316 | 4 114 | 3 723 | 3 118 | 1 711 |

| Household washing machines | 2 700 | 3 030 | 3 336 | 3 830 | 3 880 | 3 485 | 1 886 |

| Household cookers | 1 540 | 1 517 | 1 463 | 1 166 | 947 | 1 195 | 414 |

| Household microwave ovens | 1 066 | 1 379 | 1 031 | 925 | 1 285 | 464 | 262 |

| Electric grinders | 724 | 682 | 553 | 480 | 294 | 377 | 273 |

| Electric shavers | 582 | 491 | 301 | 239 | 293 | 297 | 168 |

| Household kitchen stationery electric cookers | 489 | 426 | 340 | 285 | 312 | 389 | 234 |

| Household vacuum cleaners | 232 | 111 | 61 | 52 | 55 | 18 | 13 |

| Kettles | 165 | 261 | 256 | 265 | 81 | 153 | 25 |

*) – in the table the production increase from year to year (for 2016 – to the corresponding period of 2015) is highlighted with the green shading, production decrease – with red one.

The relative rates of changes (%) of average monthly production from year to year by the largest goods groups are reflected in the Figure 2 listed below.

Companies manufacturing household electrical appliances spread relatively equally within the country’s regions and gravitate to the most developed industrial centers.

Thus, according to Information and Analytical system Globas-i®, 100 companies largest by the revenue volume for 2014 are registered in 36 regions. The biggest number of them is registered in the following regions (TOP-8 Regions):

| Region | Number of companies |

|---|---|

| Chelyabinsk region | 18 |

| Moscow | 12 |

| Saint-Petersburg | 8 |

| Saint-Petersburg | 8 |

| Moscow region | 7 |

| Leningrad region | 3 |

| Nizhny Novgorod region | 3 |

| Smolensk region | 3 |

Strategic plans of Russia, Azerbaijan and Iran

In August 2016 a trilateral meeting of the heads of Russia, Azerbaijan and Iran was held. This meeting was contributed, on the one hand, by formed neighborhood and partnership relations as a result of the general geography and close economic ties, on the other hand, by the remaining problems, global challenges, tension on the borders of the countries mentioned above.

On the agenda of the summit the issues were brought up, which are related to the multi-faceted co-operation in trade, transport, energy, culture, tourism; cooperation in financial, banking and insurance sectors; participation in projects of other countries; countering the global economic crisis; fight against terrorism; ensuring regional stability and security.

Among the scale projects discussed during the summit the experts have singled out the following:

- work on a convention on the legal status of the Caspian Sea,

- development and exploration, first of all in the Caspian region,

- a project of the construction of a railway line Rasht (Iran) - Astara (Azerbaijan) – the unit of the international transport corridor «North - South»,

- energy corridor development, due to the connection of Azerbaijani power lines with Iran and Russia,

- schemas of the shared use of the pipeline infrastructure for the transportation of raw materials etc.

The Special Working Group (SWG) on the level of deputy foreign ministers has been working on the development of the Convention since 1996. Five states have the coastline with the Caspian Sea, also Kazakhstan and Turkmenistan except the mentioned above. Already much has been done, in particular, an agreement on the delimitation of a part of the bottom of the Caspian Sea was made, the Framework convention for the protection of the marine environment, the Declaration on common approaches to the development of a convention on the legal status of the Caspian Sea were signed etc. At the summit it was underlined the necessity and importance to finish such work.

Completion of the specific section of the corridor Rasht (Iran) - Astara (Azerbaijan) will allow to organize a direct railway link from the Persian Gulf to Europe. The line «North - South» will help Russia to intensify the goods turnover with the Gulf countries, India and supply grain, equipment, medicines, fertilizers and agricultural machinery to these regions. Iran, in its turn, gets an opportunity to enter new markets, Azerbaijan - to increase the volumes and reduce the cost of supplies of fruits and vegetables to Russia. Europe, using such a corridor, will be able to provide diversification of trade flows. If this direction is efficient, Chinese exporters will include it with pleasure in the part of the Silk Road.

Today, Azerbaijan has turned from a country, importing electricity, to the country, exporting it. The connection of power lines of Azerbaijan with Iran and Russia opened even more opportunities. The power system of Azerbaijan functions in the parallel operating mode with the Unified Energy System of Russia in accordance with the existing agreement. In the future, joint efforts should contribute to form a reliable energy corridor for the energy exchange between the three countries and to enter new markets.

Following the results of the summit the leaders of the three countries signed the declaration, covering almost all areas of co-operation. New projects in the Caspian Sea, including in trade, transport, energy, will be able to diversify the trilateral trade and economic relations. According to the experts, the meeting in Baku may become a new and independent format of interstate co-operation, that allowed to consider it as a historical event.