The largest manufacturers of urban transport in Russia

Public service vehicles are strategically important for the urban infrastructure and plays an important role in people’s life. Total passenger flow in buses and trolleybuses have been reaching 11 billion people and more annually for ten years. In early 2019, the length of all-purpose roads in Russia exceeded 1,5 million kilometers, and the length of trolley lines in use were 5 thousand kilometers.

According to the Federal State Statistics Service for early 2019, there are about 116 thousand buses and 9 thousand trolleybuses in Russia. The share of foreign buses and trolleybuses and the country’s ability to manufacture own public service vehicles are the points of interest of many people. The Information Agency Credinform represents a ranking of the largest manufacturers of public service vehicles in Russia. Using the Information and Analytical system Globas, the experts of the Agency have selected enterprises engaged in buses (excluding public minibus taxis) and trolleybuses manufacturing by 2019 revenue, and analyzed the results..

| No | Name | Revenue for 2019, billion RUB | Line of production |

| 1 | Pavlovsky Bus Plant (PAZ) Nizhniy Novgorod region |

19,2 | Buses |

| 2 | Likinsky Bus Plant (LIAZ) Moscow region |

17,4 | Buses |

| 3 | Volgabas Volzhsky Volgograd region |

8,0 | Buses |

| Volgabas Volgograd region |

|||

| Bakulin Motors Group Vladimir region |

|||

| 4 | Kurgan Bus Plant Kurgan region |

2,6 | Buses |

| 5 | Trans-Alfa Vologda region |

1,6 | Trolleybuses, electric buses |

| 6 | Trolza Saratov region |

No data | Trolleybuses, electric buses |

The Top leaders are Pavlovsky (19,2 billion RUB) and Likinsky (17,4billion RUB) bus plants. Aggregate revenue of these enterprises exceeds 36 billion RUB and forms 75% of the market. 9 457 buses were manufactured in 2019.

According to the Information and Analytical system Globas, Pavlovsky, Likinsky and Kurgan plants are linked through the managing company GAZ Group, which is owned by Gorky Automobile Plant (GAZ).

The 5th and 6th in the ranking are manufacturers of trolleybuses and electric buses. The company Trans-Alfa (1,6 billion RUB) has the largest increase in 2019 revenue (+228,9% to the previous period). Electric buses in use made the enterprise’s turnover successfully increase.

Trolza was unable to recover after sever challenges. Interdistrict inspection of the Federal Tax Service in Saratov region filed to the Arbitration court an application for bankruptcy of the enterprise. The case is under consideration at the first instance.

| Rank | Country | Volume, units | Share, % | Cost, million USD |

| Export, 2019 | ||||

| 1 | Kazakhstan | 634 | 18,1 | 19,9 |

| 2 | Republic of Belarus | 555 | 15,8 | 10,8 |

| 3 | Uzbekistan | 419 | 11,9 | 7,2 |

| 4 | Mongolia | 360 | 10,3 | 3,4 |

| 5 | Vietnam | 357 | 10,2 | 7,3 |

| Total for TOP-5 | 2325 | 66,3 | 48,6 | |

| Total exports | 3506 | 100,0 | 82,1 | |

| Import, 2019 | ||||

| 1 | China | 1434 | 50,9 | 108,0 |

| 2 | Republic of Belarus | 867 | 30,8 | 63,1 |

| 3 | Turkey | 123 | 4,4 | 21,0 |

| 4 | Japan | 97 | 3,4 | 2,4 |

| 5 | Germany | 81 | 2,9 | 6,6 |

| Total for TOP-5 | 2602 | 92,4 | 201,1 | |

| Total imports | 2817 | 100,0 | 222,7 | |

Source: the Federal Tax Service, calculations by Credinform.

There are only 10% of foreign-manufactured vehicles among the Russian aboveground public transport (excluding public minibus taxis). In 2019, export of domestic-manufactures buses exceeded import. The main strategic partners of Russia are Kazakhstan (export share of 18,1%) and the Republic of Belarus (export share of 15,8%; import share of 30,8%). The share of import from the number of manufactured buses was only 20% in 2019.

The results of the ranking show that domestic-manufactured vehicles prevail in Russia, and passenger transportation is provided mainly by own facilities.

However, the situation is not that good. Age is a serious problem for the Russian service vehicles park. According to the Ministry of Transport of Russia, the average age of buses and trolleybuses is over 15 years. In some regions, passengers are transported by the Soviet-style buses that have been in use for more than 30 years.

A court increasingly becomes a tool for pressure

Every 10th case returns to the applicant without consideration. It means that many companies try to recover the claimed amounts through a court, and withdrawn the case as received the money.

We combined the experience of companies participated in arbitration cases over the past five years. Here are the results of our research.

Main statistics

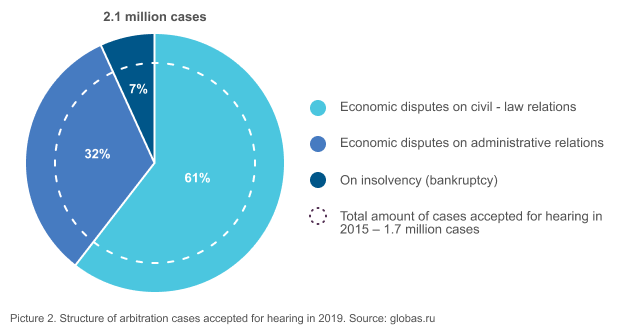

In 2019, the arbitration courts considered a record 2,1 million cases. The number of them is growing annually, and over the past 5 years it has increased 1,3 times. Companies are increasingly turning to arbitration to resolve economic disputes with counterparties, but upholding their interests in court does not always guarantee satisfaction of claims and repayment of losses.

Most often, counterparties sue directly among themselves (61%). Economic disputes with administrative authorities account for just over a third of arbitration cases (32%). The share of bankruptcy cases is 7%.

Only one third of the amount of claims is recoverable

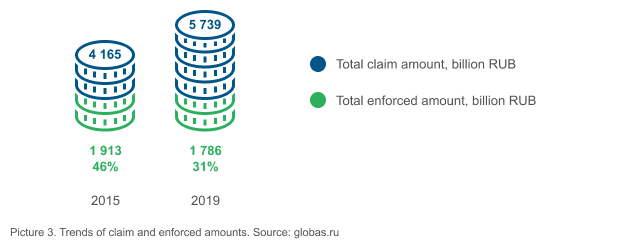

The total amount of claims filed by the court in 2019 amounted to 5,7 trillion RUB. Of these, the court decided to recover only 31% of the initial amount of claims, which amounted to 1,8 trillion RUB. The percentage of satisfied claims is reduced annually: 5 years ago, 46% of the claimed claims were recovered.

Non-fulfillment of the sale and purchase agreement is the most frequent dispute between counterparties in Russia

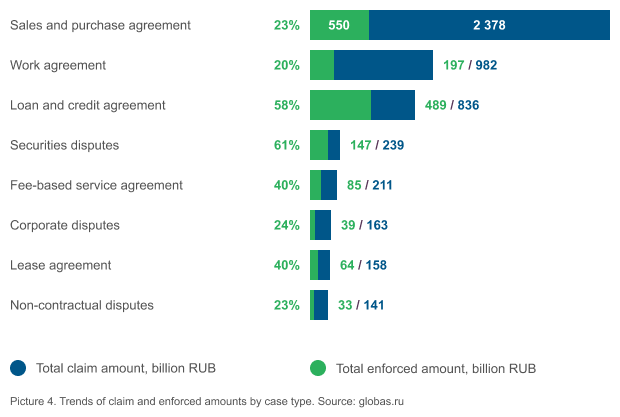

In 2019, the courts examined 514 thousand cases of non-fulfillment of sale and purchase agreements at the amount of 2,378 billion RUB. Of these, the court decided to recover less than a quarter: 550 billion RUB or 23% of the initial claims on debtors.

| The most frequently acts as defendant | The most frequently acts as claimant | |

| ОАО РЖД | PJSC Rostelecom | |

| 12 104 cases in 2019 | 11 118 cases in 2019 |

How to minimize the risks

The resolution of economic disputes in an arbitration court is a traditional and generally accepted way, but it does not always lead to a positive result, since the probability of full judicial compensation for losses is very small. The most effective way to avoid losses and minimize the likelihood of breach of contractual obligations is to carefully check and select reliable counterparties using a professional information system.