“Transparent business” project of the Federal Tax Service

Since August 1, 2018 the Federal Tax Service (hereinafter “the FTS”) has launched “Transparent business” project involving disclosure of companies’ data not of tax secrecy.

The regime of tax secrecy on information about companies, available for the FTS, was withdrawn on the basis of Cl. 1.1 Art. 102 of the Tax Code of the Russian Federation (as amended by the Federal Law No. 243-FL of July 3, 2016). In this regard, the authority has an obligation to approve the terms and period of data placement, and then start publishing.

The approval of the terms and period for publishing was based on the FTS Order No. MMV-7-14 / 729 @ of December 23, 2016 (as amended on May 30, 2018). The stages of publication of information not of tax secrecy on the website of the Federal Tax Service are presented in Table 1.

| Date | Data |

| August 1, 2018 | - special tax regimes;- participation in the consolidated group of taxpayers;- average number of employees. |

| October 01, 2018 | - paid taxes (fees, dues);- amounts of income and expenses according to the financial accounts. |

| December 01, 2018 | - data on taxes, penalties and fines arrears;- offenses and measures of responsibility for them (decisions on bringing to responsibility, which entered into force during the period from June 2, 2016 to December 31, 2017, but only if the company did not pay the fine before October 1, 2018). |

| December 01, 2019 | - data on insurance contributions arrears. |

Open data on most business associations and societies were placed according to the schedule. In 2020, information on other organizations, including strategic enterprises and joint-stock companies, organizations of the defense industry complex, and the largest taxpayers will be published.

Up-to-date information, previously considered as of tax secrecy, is already available for Globas users. In the section “Key financial and economic indicators” of the report, information on application of special tax regimes (on 2 million companies), the average number of employees (on 2,5 million companies) and information on participation in the consolidated group of taxpayers (on 88 companies) is presented as of December 31, 2017.

The innovation will allow more detailed verification of counterparties and assess risks, exercising due diligence and carefulness before concluding contracts.

Free registration of legal entities in electronic format

Registration of legal entities in electronic format will be free

The draft federal law on amendments to paragraph 3 of article 333.35 of the Tax Code of the Russian Federation, that describes the significant legal actions under which the government fees are not charged, was adopted by the State Duma of the Russian Federation and agreed with the Federation Council of the Russian Federation.

In case the amendments will come into force, since 2019 the payment of government fee will be not required in following cases: submitting documents in electronic format to registration authorities for registration of legal entities (individual entrepreneurs) and amending to corporate establishment documents; liquidation of legal entities or termination of individual entrepreneurs activity.

At the present time, the government fees for above registration actions are from 160 to 4 thousand rubles.

The payment of government fee is still required while submitting documents in paper format.

According to the authors of the bill, the amendments will help to increase the number of documents in electronic format, which in turn will reduce the costs of citizens and authorized state bodies for their acceptance and paperwork.

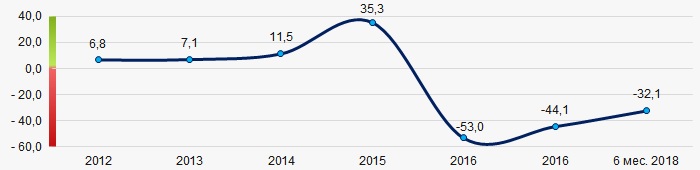

According to the Federal State Statistics Service, from 2016 to the first half of 2018 a growth rate of entities of all legal forms across the country is negative (Picture 1).

The ratio is calculated as the difference between the establishment and official liquidation ratios.

This fact testifies that within the specified period the number of entities is decreasing.

Picture 1. Growth rate of entities (units)

Picture 1. Growth rate of entities (units)