Top industries by turnover dynamics of companies in 2019-2020

The Federal State Statistics Service (hereinafter “Rosstat”) has published information concerning 2020 turnover of companies in Russia. The COVID-19 crisis and limitations had various impact on companies in dependence to the industry. Transport enterprises, servicing and mining companies suffered the most. Pharmaceutical holdings, IT companies and delivery services had benefits.

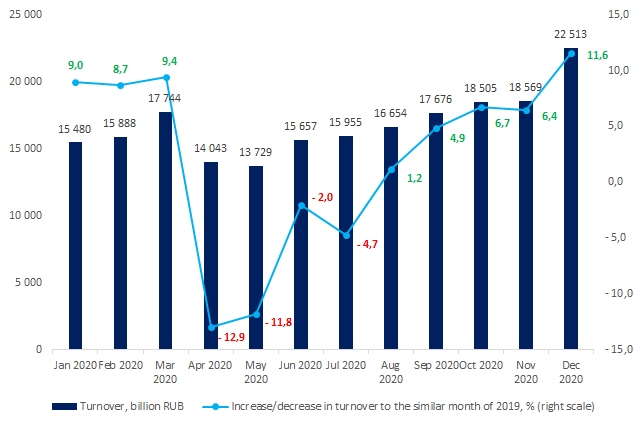

In general, the period from April 2020 to July 2020 was the hardest for the economy. Turnover of companies have decreased for 4 months to the same period of 2019. In April and May there was recorded a 12,9% and 11,8% reduction respectively (see Picture 1).

The period of recovery started in August was at its peak in December when there was a 11,6% increase in turnover compared to December 2019. At the year end, surpassing 202 trillion RUB, the comprehensive turnover of companies exceeded the figures of 2019 by 2,4%.

Picture 1. Turnover dynamics of companies in Russia in 2020

Picture 1. Turnover dynamics of companies in Russia in 2020Speaking about industry-based figures, the turnover of companies engaged in railroad passenger transportation reduced by 58,2% in 2020, airline companies – by 41,8%, hotels – by 33%, crude oil and gas producers – by 24,2% (see Table 1).

At the same time, pharmaceutical companies increased their turnover from 633 billion RUB to 946 billion RUB (1,5%), IT companies - by 33,4% and post and delivery services – by 28,9%.

These figures prove the peculiarity of the current economic situation both inside the country and on foreign markets.

| Activity | OKVED2 code | 2019 turnover, billion RUB | 2020 turnover, billion RUB | Increase/decrease in turnover, % | Share in total turnover, % |

| Total | - | 197 733 | 202 413 | 2,4 | 100,0 |

| Production of medicines and materials | 21 | 633 | 946 | 49,3 | 0,5 |

| IT | 63 | 414 | 552 | 33,4 | 0,3 |

| Post and delivery services | 53 | 230 | 296 | 28,9 | 0,1 |

| Manufacture of tobacco products | 12 | 239 | 294 | 22,9 | 0,1 |

| Mining of metal ores | 07 | 1 550 | 1 882 | 21,4 | 0,9 |

| Metallurgical production | 24 | 6 676 | 7 796 | 16,8 | 3,9 |

| Plant growing and cattle breeding | 01 | 2 793 | 3 257 | 16,6 | 1,6 |

| Manufacture of rubber and plastic products | 22 | 1 119 | 1 295 | 15,7 | 0,6 |

| Production, transmission and distribution of steam and hot water | 35.3 | 1 275 | 1 467 | 15,0 | 0,7 |

| Water supply; sewerage, organization of waste collection and disposal | E | 1 166 | 1 336 | 14,5 | 0,7 |

| Construction | F | 7 056 | 8 068 | 14,3 | 4,0 |

| Manufacture of textiles | 13 | 253 | 284 | 12,1 | 0,1 |

| Manufacture of wearing apparel | 14 | 250 | 280 | 11,8 | 0,1 |

| Food production | 10 | 5 648 | 6 274 | 11,1 | 3,1 |

| Wholesale | 46 | 52 058 | 57 342 | 10,2 | 28,3 |

| Wood processing and manufacture of wood and cork products, excluding furniture | 16 | 647 | 711 | 9,8 | 0,4 |

| Forestry and logging | 02 | 232 | 254 | 9,3 | 0,1 |

| Manufacture of other finished goods | 32 | 244 | 266 | 9,2 | 0,1 |

| Telecommunication activities | 61 | 1 999 | 2 148 | 7,5 | 1,1 |

| Computer software development | 62 | 1 221 | 1 312 | 7,4 | 0,6 |

| Fishing and fish farming | 03 | 354 | 380 | 7,3 | 0,2 |

| Manufacture of other non-metal mineral products | 23 | 1 645 | 1 765 | 7,3 | 0,9 |

| Manufacture of electrical equipment | 27 | 1 082 | 1 160 | 7,3 | 0,6 |

| Activities in the field of health and social services | Q | 2 955 | 3 146 | 6,4 | 1,6 |

| Water transport activities | 50 | 257 | 273 | 5,9 | 0,1 |

| Retail trade | 47 | 17 987 | 18 949 | 5,4 | 9,4 |

| Real estate operations | L | 2 829 | 2 974 | 5,1 | 1,5 |

| Activities in the field of culture, sports, leisure and entertainment | R | 303 | 318 | 4,8 | 0,2 |

| Production of chemicals and products | 20 | 3 040 | 3 173 | 4,4 | 1,6 |

| Manufacture of machinery and equipment | 28 | 1 390 | 1 446 | 4,1 | 0,7 |

| Manufacture of paper and paper products | 17 | 1 054 | 1 091 | 3,5 | 0,5 |

| Trade in motor vehicles and motorcycles | 45 | 6 956 | 7 157 | 2,9 | 3,5 |

| Manufacture of computers, electronic and optical items | 26 | 1 407 | 1 444 | 2,6 | 0,7 |

| Freight rail transport | 49.2 | 2 145 | 2 199 | 2,6 | 1,1 |

| Manufacturing of finished metal products | 25 | 2 680 | 2 746 | 2,5 | 1,4 |

| Furniture manufacture | 31 | 267 | 272 | 2,0 | 0,1 |

| Manufacture of other vehicles and equipment | 30 | 1 957 | 1 982 | 1,3 | 1,0 |

| Electricity production, transmission and distribution | 35.1 | 7 194 | 7 249 | 0,8 | 3,6 |

| Warehousing and auxiliary transport activities | 52 | 4 011 | 4 028 | 0,4 | 2,0 |

| Administrative activities | N | 1 613 | 1 617 | 0,2 | 0,8 |

| Professional, scientific and technical activities | M | 5 513 | 5 521 | 0,2 | 2,7 |

| Other industries | - | 3 965 | 3 919 | -1,1 | 1,9 |

| Publishing activities | 58 | 124 | 120 | -2,9 | 0,1 |

| Manufacture of leather and leather products | 15 | 80 | 77 | -4,0 | 0,0 |

| Pipeline transport activities | 49.5 | 2 858 | 2 715 | -5,0 | 1,3 |

| Beverages production | 11 | 933 | 883 | -5,3 | 0,4 |

| Manufacture of motor vehicles, trailers and semi-trailers | 29 | 2 888 | 2 735 | -5,3 | 1,4 |

| Production and distribution of gaseous fuels | 35.2 | 1 447 | 1 359 | -6,1 | 0,7 |

| Freight transport activities | 49.4 | 1 309 | 1 219 | -6,9 | 0,6 |

| Printing activities and copying of information carriers | 18 | 305 | 282 | -7,8 | 0,1 |

| Education | P | 608 | 560 | -7,9 | 0,3 |

| Extraction of other minerals | 08 | 587 | 540 | -7,9 | 0,3 |

| Coal mining | 05 | 1 415 | 1 200 | -15,1 | 0,6 |

| Restaurant services | 56 | 1 073 | 907 | -15,4 | 0,4 |

| Activities of other land passenger transport | 49.3 | 484 | 403 | -16,6 | 0,2 |

| Production of coke and petroleum products | 19 | 12 764 | 9 928 | -22,2 | 4,9 |

| Extraction of crude oil and natural gas | 06 | 12 378 | 9 377 | -24,2 | 4,6 |

| Hotel services | 55 | 278 | 186 | -33,0 | 0,1 |

| Air transport activities | 51 | 1 570 | 914 | -41,8 | 0,5 |

| Intercity and international railway passenger transportation | 49.1 | 325 | 136 | -58,2 | 0,1 |

Source: Rosstat, analysis by Credinform

Methodology:

Turnover includes the cost of own-produced shipped goods, own-performed works and services, as well as proceeds from the sale of goods purchased (excluding value added tax, excise taxes and other similar payments).

The data of current statistics on "turnover" for the full range of enterprises are formed monthly on the basis of information from the unified form of federal statistical observation No. P-1 "Information on the production and shipment of goods and services" and an additional calculation for the aggregate of enterprises for which there is no monthly data.

The Federal statistical observation form No. P-1 is provided by all legal entities that are commercial organizations, as well as non-commercial organizations of all types of ownership that manufacture goods and services for sale to other legal entities and individuals (except for small businesses, banks, insurance and other financial and credit institutions), the average number of employees of which for the previous year exceeds 15 people, including those working part-time and under civil law contracts.

The additional calculation of data is made for the aggregate of small enterprises and enterprises with the average number of employees for the previous year exceeding 15 people, including those working part-time and under civil law contracts, which are not small businesses.

Audit of financial statements for small businesses

Information agency Credinform has prepared a review of trends in activity of companies that meet the criteria for mandatory audit of financial statements.

The largest companies (ТОP-500) that meet the updated criteria for mandatory audit of financial statements in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014 - 2019). The company selection and analysis were based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is JSC INDUSTRIAL RECONSTRUCTION AND DEVELOPMENT OIL FUND, INN 7702028070, Moscow. In 2019 net assets of the company amounted to 26 billion RUB.

The smallest size of net assets in TOP-500 had LLC STIMUL-T, INN 7017007293, Tomsk region. The lack of property of the company in 2019 was expressed in negative terms -7 billion RUB.

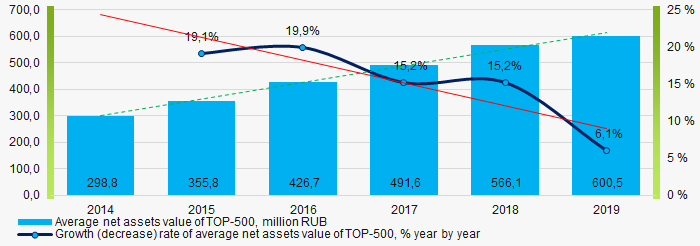

For the last six years, the average industry values of net assets showed the growing tendency with negative dynamics of growth rates (Picture 1).

Picture 1. Change in average net assets value in 2014 – 2019

Picture 1. Change in average net assets value in 2014 – 2019For the last six years, the share of ТОP-500 enterprises with lack of property is decreasing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-500 in 2014-2019

Picture 2. The share of enterprises with negative net assets value in ТОP-500 in 2014-2019Sales revenue

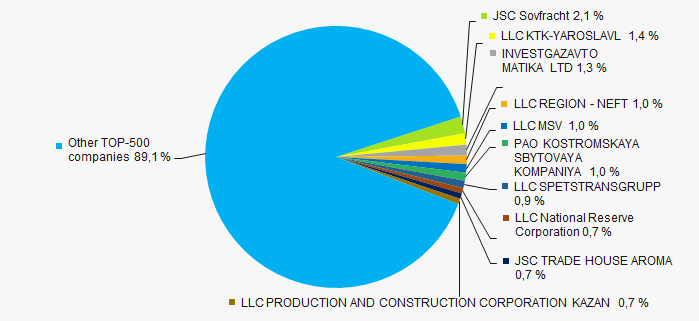

In 2019, the total revenue of 10 largest companies amounted to 11% from ТОP-500 total revenue (Picture 3). This fact testifies the high level of capital concentration within this group of enterprises.

Picture 3. Shares of TOP-10 in TOP-500 total revenue for 2019

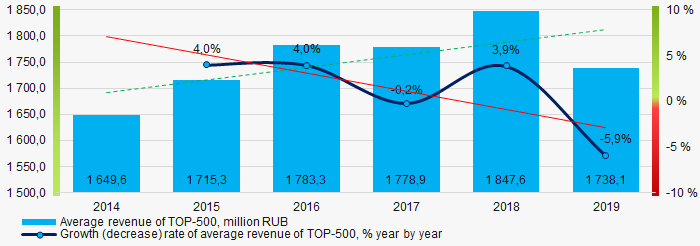

Picture 3. Shares of TOP-10 in TOP-500 total revenue for 2019n general, the growing trend in sales revenue with negative dynamics of growth rates is observed (Picture 4).

Picture 4. Change in average revenue in 2014 – 2019

Picture 4. Change in average revenue in 2014 – 2019 Profit and loss

The largest company in terms of net profit is also JSC INDUSTRIAL RECONSTRUCTION AND DEVELOPMENT OIL FUND, INN 7702028070, Moscow. In 2019 the company’s profit amounted to 4 billion RUB.

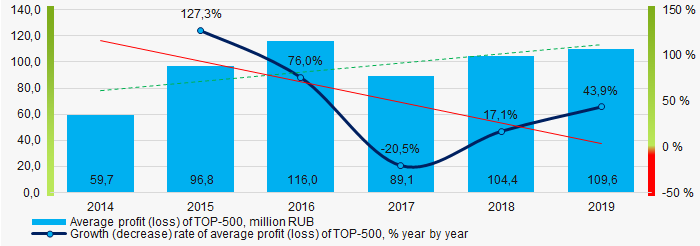

For the last six years, the average profit values show the growing tendency with negative dynamics of growth rates (Picture 5).

Picture 5. Change in average profit (loss) in 2014 – 2019

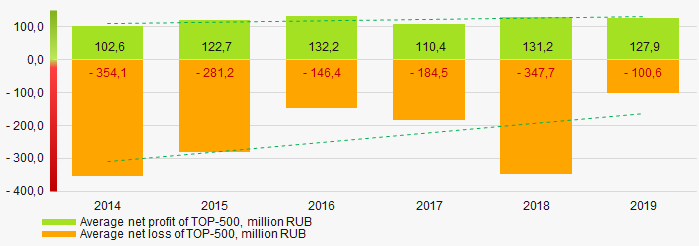

Picture 5. Change in average profit (loss) in 2014 – 2019Over a six-year period, the average net profit values of ТОP-500 show the growing tendency, along with this the average net loss is decreasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-500 companies in 2014 – 2019

Picture 6. Change in average net profit/loss of ТОP-500 companies in 2014 – 2019Main financial ratios

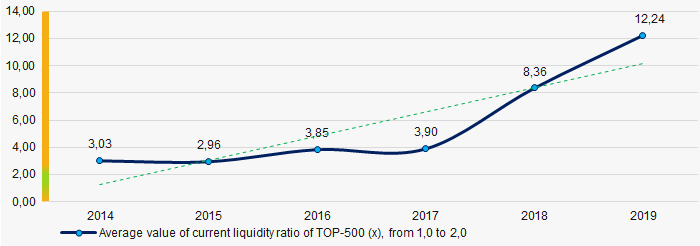

For the last six years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2014 – 2019

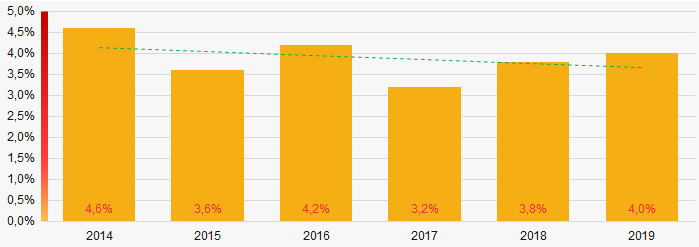

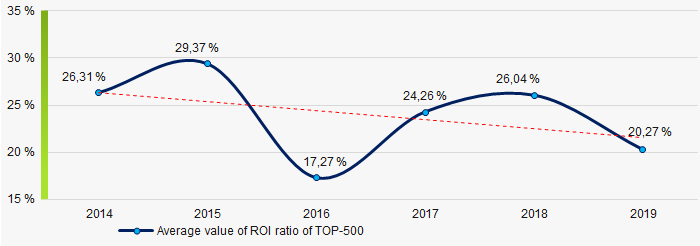

Picture 7. Change in average values of current liquidity ratio in 2014 – 2019Within six years, the downward trend of the average values of ROI ratio is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2014 – 2019

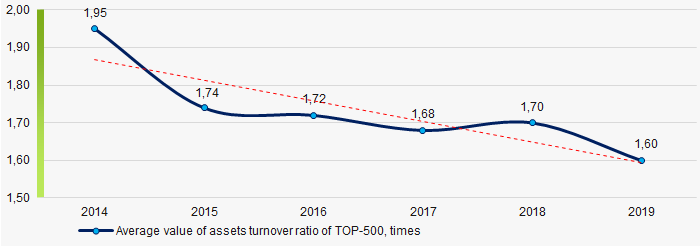

Picture 8. Change in average values of ROI ratio in 2014 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last six years, this business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019Main regions of activity

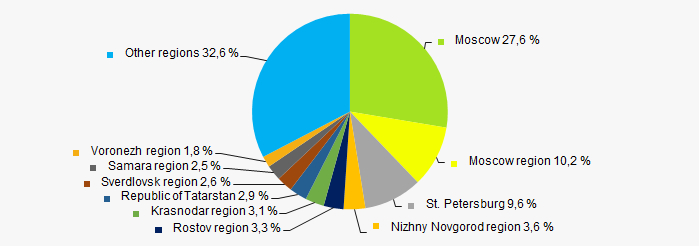

ТОP-500 companies are unequally located across the country and registered in 66 regions of Russia. More than 47% of the largest enterprises in terms of revenue are located in Moscow, Moscow region and Saint Petersburg Picture 10).

Picture 10. Distribution of TOP-500 revenue by the regions of Russia

Picture 10. Distribution of TOP-500 revenue by the regions of RussiaFinancial position score

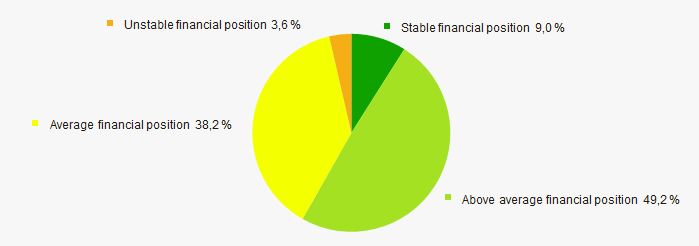

An assessment of the financial position of TOP-500 companies shows that almost the half has above average financial position (Picture 11).

Picture 11. Distribution of TOP-500 companies by financial position score

Picture 11. Distribution of TOP-500 companies by financial position scoreSolvency index Globas

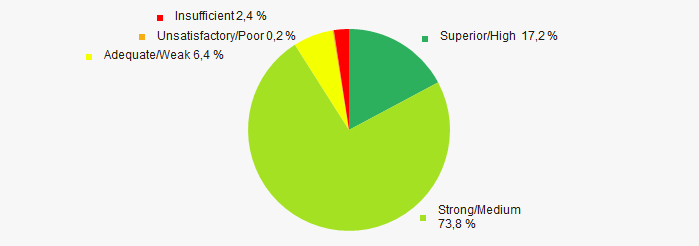

Most of TOP-500 companies got superior/high and strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 12).

Picture 12. Distribution of TOP-500 companies by Solvency index Globas

Picture 12. Distribution of TOP-500 companies by Solvency index GlobasConclusion

A complex assessment of small businesses that meet the criteria for mandatory audit of financial statements, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends within 2014-2019 (Table 1).

| Trends and assessment factors | Relative share, % |

| Dynamics of average net assets value |  10 10 |

| Growth/drawdown rate of average net assets value |  -10 -10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| The level of capital concentration |  10 10 |

| Dynamics of average net profit |  10 10 |

| Growth/drawdown rate of average revenue |  -10 -10 |

| Dynamics of average profit (loss) |  10 10 |

| Growth/drawdown rate of average profit (loss) |  -10 -10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  2,2 2,2 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor)

unfavorable trend (factor)