Small business will become the foundation of the Russian economy

Small business will account for over 30% of the turnover of all Russian companies in a few years. This forecast was followed by an analysis of the financial accounts of all Russian companies for 2016.

Since the beginning of market reforms in Russia, the economists speaks about the important role of small business in the balanced development of the domestic economy and exemplify the countries of the West where the contribution of small companies in the GDP generation reaches 50% or more. After all, in Europe the tradition of small business has been continuously existed for more than one hundred years, whereas the history of domestic private enterprises is much more complicated.

Today in Russia, measures are being taken at the legislative level to support entrepreneurial activity and expand private initiative: exemption from inspections, tax holidays for newly established companies, simplified reporting forms, access to participation in state procurement. However, there are problems connected primarily with a high level of fiscal burden and excessive administrative regulation, which hinders the development of small business and affects the structure of the Russian business.

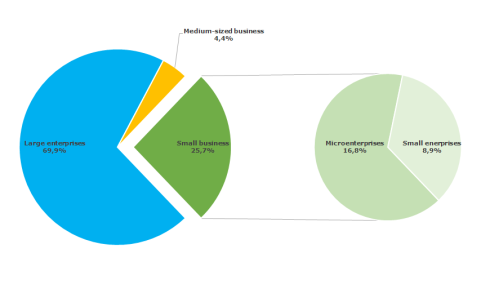

The structure of the Russian economy is well illustrated by the financial accounts for the full circle of companies for the last reporting year 2016, which is available in the Information and Analytical system Globas since September. Large business enterprises still play the leading role and accumulate almost 70% of the total revenue from sales of goods, products, services. The share of medium-sized companies accounts for 4,4% of annual turnover. The share of small business is 25,7% of revenues, 16,8% of which accounts for microenterprises and 8.9% for small organizations (see Picture 1).

Criteria for being qualified as micro, small and medium-sized business are determined by decisions of the Government of Russia. Nowadays, an organization with annual income of up to 120 mln RUB and the number of employees not exceeding 15 people is declared as a micro-, up to 800 mln RUB and 100 employees as small, up to 2 billion rubles and 250 employees as medium-sized enterprise. Other structures belong to large business.

Picture 1. Distribution of the Russian companies by categories according to financial accounts for 2016,% of total revenue

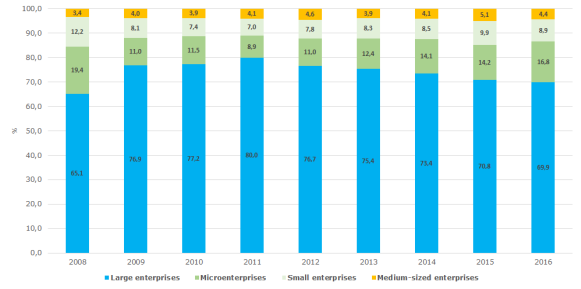

Picture 1. Distribution of the Russian companies by categories according to financial accounts for 2016,% of total revenuePicture 2 shows the dynamics of change in the share of various categories in generation of total revenues from sales of goods, products, services from 2008, when the contribution of small business reached 35%. After the crisis of 2009, large corporations had increased their share until 2011. Since 2012, the share of large business has been gradually declining due to the resumed growth of micro and small enterprises. If the current trends continue, small businesses can give over 30% of turnover of all Russian companies in a few years.

Picture 2. Dynamics of the contribution (share) of enterprises of various categories in generation of revenues from sales of goods, products, services,% of total revenue

Picture 2. Dynamics of the contribution (share) of enterprises of various categories in generation of revenues from sales of goods, products, services,% of total revenueThe development of small forms of entrepreneurship meets the needs of all spheres of the Russian economy and trends of world economic processes. Being a purely market structure, small business is able to provide freedom of entrepreneurial choice and stimulate the effective organization of production. Small business is one of the most flexible sectors of the economy, in which innovative approach and relatively high growth rates are combined with relatively low expenditures for establishment of an enterprise.

Unreliable data in the Unified State Register of Legal Entities: how to escape negative consequences

According to the data of the Information and Analytical system Globas as of October 2017, almost 410,000 companies have an entry concerning unreliability of data in the Unified State Register of Legal Entities (EGRUL).

An entry on data unreliability is to compromise any company’s operation. Such company will lose its counterparties. Banks will try to get protected from risks and freeze all its accounts, and this will close the door on the company’s activity. There will be no access to state procurement and tenders. An unreliability entry might cause loss of the company’s market reputation, cancellation of contracts, bringing administrative action against the company’s CEO or shareholder, or restriction of their rights.

Tax authorities are entitled to check the reliability of data both already contained and the one to be included in the EGRUL under the Federal Law #67-FZ from March 30, 2015. And since September 1, 2017, the Federal Law #488-FZ from December 28, 2016 establishes the order of forced striking off the EGRUL: a 6-month long entry on unreliability is enough for that.

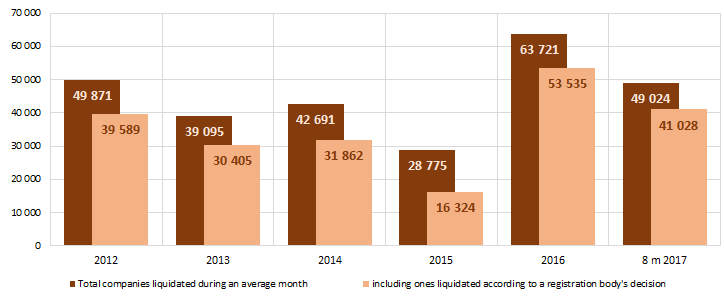

The Federal Tax Service keeps fighting fly-by-night companies (see statistics in Pictures 1 and 2) by liquidation of doubtful companies. However, even responsible companies may get an unreliability entry. The Federal Tax Service may question the operational address if mail is undeliverable and returns to the Federal Tax Service; if the address seems to be a mass registration address; if a company failed to update information about change of CEO or it did not make sure to inform tax authorities in time.

A timely checking of one’s counterparties’ responsibility in the Information and Analytical system Globas can help to avoid negative consequences of entries on unreliability of data in the EGRUL.

It is possible to escape the consequences of an unreliability entry by introduction of reliable data to the EGRUL instead of unreliable data, appealing through legal proceedings against such entry, over 3 years past the entry. Having received a notification from the Federal Tax Service, a company has one month for data correction.

A timely checking of one’s counterparties’ responsibility in the Information and Analytical system Globas can help to avoid negative consequences of entries on unreliability of data in the EGRUL.

Picture 1. Rate of change in the number of dissolved legal entities according to the EGRUL (during an average month)

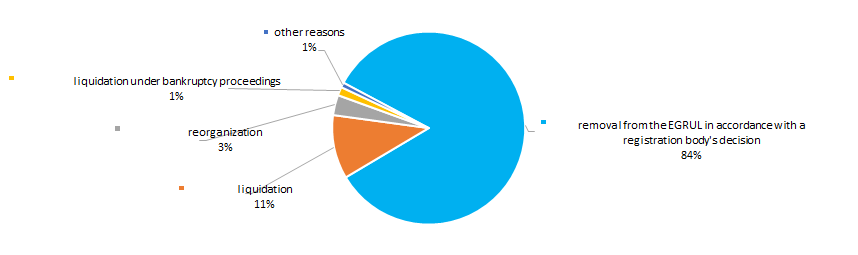

Picture 1. Rate of change in the number of dissolved legal entities according to the EGRUL (during an average month) For eight months of 2017 most companies ceased operations due to removal from the EGRUL in accordance with a registration body’s decision (Picture 2).

Picture 2. Reasons of termination of operations of legal entities for 8 months of 2017, according to the EGRUL (share %)

Picture 2. Reasons of termination of operations of legal entities for 8 months of 2017, according to the EGRUL (share %)