Cash outflow in Russia: problem, benefit or necessity

Analysis of cash flows shows that practically there are normal and illegal cash outflow. Cash flows fall in the category of normal cash flow and are necessary, because they help export-import operations and financial activity of transnational corporations (TNC). Moreover, cash outflow is a benefit while incomes of the Russian TNC`s external assets and export operations are the source of cash inflow in Russia.

Illegal cash outflow (look «Reference information», table 1) is understood to be: use of illegal business schemes for capital outflow; cases of overcoming customs barriers; instruments of thin capitalization; facts of non-repayment of export income or non-payment of import contract and others.

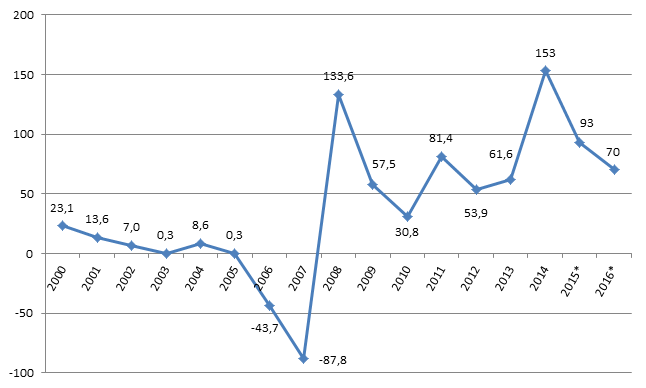

According to the Central Bank of the RF (CB RF), cash outflow in Russia in 2014 was 153 billion USD (picture 1). During 15 years (2000-2014) cash outflow was predominant in Russia. Up to the year 2005 inclusive it was minor/ insignificant, especially on the back of the period of 2008-2014 and outbursts of financial crisis in 2008 and 2014. Cash inflow was in 2006-2007, when Russia seemed to be relatively stable amid the global financial crisis and probably became a place of financial capital maintenance.

Picture 1. Cash outflow (inflow«-»/outflow«+») by private sector in 2000-2014 and 2015-2016 (* - estimate), billion USD

Reasons behind such significant volume of cash outflow are following: Necessity of payment of external debt in 2014 in an amount of 180 billion USD that made this reason the key element of cash outflow;

- Decrease in possibilities for debt refinancing, lack of access to the foreign markets financing because of economic sanctions imposed on Russia;

- Rouble devaluation, especially on December 2014, increased demand for hard currency, USD in particular, that became an impulse for cash outflow;

- Disinvestment in Russian markets on the back of unstable economic climate;

- Out of total sum of cash outflow in 2014 (the fourth quarter) about 20 billion USD accounted for REPO bargains with banks, however the money should be paid back.

The Ministry of Economic Development and Trade forecasts cash outflow in an amount of 93 billion USD at the end of 2015, and 70 billion USD - at the end of 2016. Predicted values are diminished, because external debt payments are planned to be measurably reduced, e.g. at the end of 2015 – 120 billion USD. Moreover, fall in oil prices in the world market may help. In this case a smaller source level will be required for such purpose. Also business may use tax amnesty that remains in force up to December 31, 2015.

Significant cash outflow is a big problem for the state, especially in respect to illegal cash outflow, because funds at the state`s disposal are decreased. Such situation leads to the investment reduction; slowdown in economic development; reduction of cash deposit in human capital assets by means of development of educational system, medicine, culture; prevention from social programs accomplishment and, finally, worsening of food supply security and country`s defense potential.

Reference information.

According to Russian analysts, who used balance of payment the CB RF data, for the period 2008-2013 cash outflow in Russia was 416.9 billion USD more than cash inflow. Almost 60% of this sum (about 249 billion USD) were accounted for illegal outflow (table 1).

It worth mentioning that illegal cash outflow significantly decreased because of the measures taken by the government, compared to 2001.

| 2001 | 2007 | 2009 | 2012 | 2013 | |

|---|---|---|---|---|---|

| Illegal cash outflow – total, billion USD | 15 416 | 44 230 | 30 953 | 49 187 | 37 998 |

| Illegal cash outflow, % of net cash outflow | 76,2 | 16,2 | 56,9 | 28,1 | 21,9 |

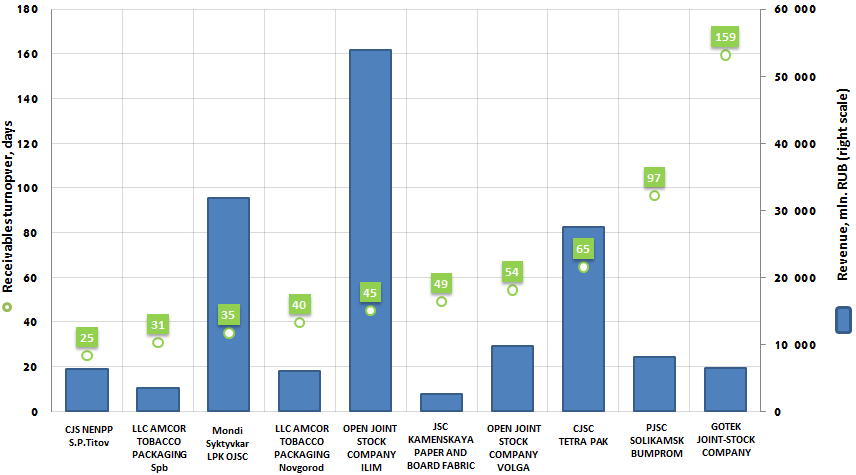

Receivables turnover of paper and cardboard manufacturers

Information agency Credinform prepared a ranking of companies in the RF engaged in paper and cardboard manufacturing.

Companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). The enterprises were ranked by increase in receivables turnover.

Receivables turnover is short- and long-term receivables for the period to sales revenue. It shows the average number of days required for debt recovery. The less is the number, the faster receivables turns to the monetary funds; therefore liquidity of working capital increases.

The ratio shows the efficiency of resources usage by taking the time factor into account.

For the most comprehensive and fair view on the company’s financial condition it is necessary to pay attention not only to the average values in the industry, but also to the whole presented set of financial indicators and ratios.

| № | Name | Region | Revenue, mln. RUB, 2013 | Receivables turnover, days | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | CJS National Enterprise Naberezhnochelninsky paperboard plant S.P.Titov INN 1650017638 |

the Republic of Tatarstan | 6 256 | 25 | 181 the highest |

| 2 | LIMITED LIABILITY COMPANY AMCOR TOBACCO PACKAGING SAINT PETERSBURG INN 7842315276 |

Saint-Petersburg | 3 524 | 31 | 195 the highest |

| 3 | Mondi Syktyvkar LPK OJSC INN 1121003135 |

the Republic of Komi | 31 818 | 35 | 241 high |

| 4 | LIMITED LIABILITY COMPANY AMCOR TOBACCO PACKAGING NOVGOROD INN 5321070760 |

the Novgorod region | 6 004 | 40 | 206 high |

| 5 | OPEN JOINT-STOCK COMPANY ILIM GROUP INN 7840346335 |

Saint-Petersburg | 53 940 | 45 | 294 high |

| 6 | JOINT STOCK COMPANY KAMENSKAYA PAPER AND BOARD FABRIC INN 6929000141 |

the Tver region | 2 623 | 49 | 247 high |

| 7 | OPEN JOINT STOCK COMPANY VOLGA INN 5244009279 |

the Nizhniy Novgorod region | 9 736 | 54 | 281 high |

| 8 | CLOSED JOINT STOCK COMPANY TETRA PAK INN 7706017070 |

Moscow | 27 513 | 65 | 213 high |

| 9 | PUBLIC JOINT STOCK COMPANY SOLIKAMSKBUMPROM INN 5919470121 |

the Perm Territory | 8 146 | 97 | 237 high |

| 10 | GOTEK JOINT-STOCK COMPANY INN 4633000037 |

the Kursk region | 6 416 | 159 | 289 high |

Picture 1. Receivables turnover and revenue of the largest paper and cardboard manufacturers (top-10)