Russian Risk Climate: Bankruptcy Data Sources and Specificity of the Information Reporting

When dealing with bankruptcy cases in Russia one has to observe the following: Creditors, an authorized body such as the Federal Tax Service or a company-debtor are authorized to file bankruptcies in arbitration courts. If a company realizes that it will not be able to meet its financial liabilities when due it must file bankruptcy.

At the same time the company involved in a bankruptcy case must complete its own bankruptcy filing upon becoming insolvent or has determined that it will not be able to settle its liabilies

There are 2 sources authorized by the State where the information about the bankruptcies & claims are filed and published:

- The Unified Federal Register of Bankruptcy Information (EFRSB),

- Database of bankruptcy (insolvency) announcements provided by the «Commersant» newspaper.

According to the Federal Law No. 296-FZ as of 30 December 2008 «On Amendments to the Federal Law «On insolvency (bankruptcy)» bankruptcy commissioners are obligated to disclose for the Unified Federal Register of Bankruptcy Information the following data:

- introduction of supervision, financial restructuring, external management, declaring a debtor bankrupt, initiation of the bankruptcy proceedings;

- termination of the bankruptcy proceedings;

- appointment, discharge or dismissal by the bankruptcy commissioner;

- intention to pay outstanding receivables as was claimed by creditors;

- compulsory (judicial) sale procedures and their results;

- cancellation or change of data in judicial files;

- other information prescribed by the law.

The newspaper «Commersant» is the legal gazette for publishing information on bankruptcies according to the Decree of the Government of the Russian Federation No. 1049-r as of 21 July, 2008. The announcements of bankruptcy and legally relevant events should be published in Saturday’s issues of «Commersant». The following data has to be reported:

- full name of a debtor;

- location of the debtor;

- ID codes: Primary State Registration Number (OGRN), Primary State Registration Number of the Sole Entrepreneur (OGRNIP), Tax number (INN);

- Arbitration court accepted the judicial file, the date of accept, the reference to the bankruptcy case title as well as the number of bankruptcy case;

- surname, name and patronymic of the appointed bankruptcy commissioner;

- correspondence address of the arbitration administrator;

- full name and address of the self-regulatory organization (SRO) where the bankruptcy commissioner is a member;

- date of the court session related to the bankruptcy proceeding;

- other information prescribed by the law.

The information published in both sources completes the data disclosed by arbitration courts particularly as concerns announcements relevant to all past, present and future stages of bankruptcy proceedings. The EFRSB and “Commersant” are the only sources where news about compulsory (judicial) sale procedures and their results are reported.

Careful study of arbitration practices of business partners, particularly in regard to eventual bankruptcy proceedings, which have been ordered are obligatory components of the counterparty check. For instance, there is a potential chance to overlook the first claim related to a bankruptcy against the counterparty, this needs to be avoided.

All stages of the bankruptcy procedure of a Russian business partner can be also studied on-line in English in the subscription based business information System Globas-i® of Credinform (Russia).

Performing fresh investigations on Russian companies Credinform, experts always verify bankruptcy announcements in official sources as mentioned above and to provide such data in credit reports.

For more detailed information about bankruptcy dynamics in Russia please see “Bankruptcies and Registrations in Russia – Dynamics 2015”

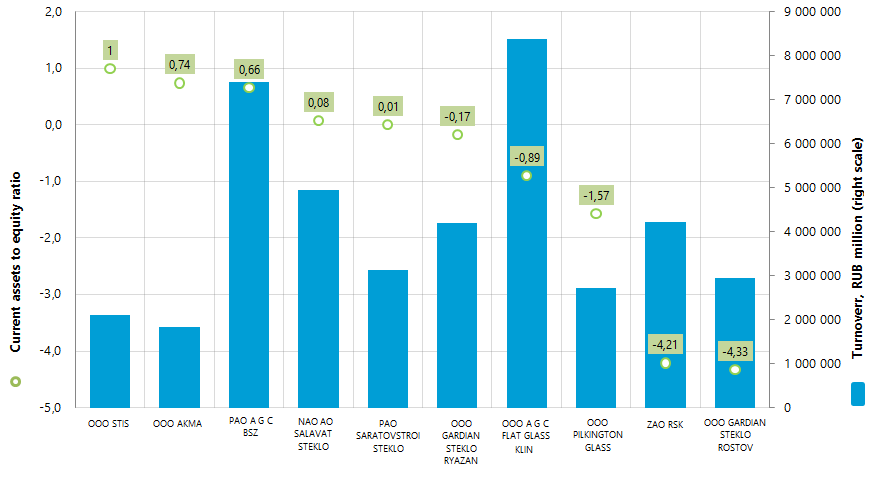

Current assets to equity ratio of plate glass manufacturers

Information agency Credinform has prepared the ranking of plate glass manufacturers on current assets to equity ratio. The largest companies in this industry by revenue from sale for the last available in the Statistical register period (2014) were taken for the investigation. Further the Top-10 enterprises by revenue were ranked in the descending order of current assets to equity ratio value.

Current assets to equity ratio (х) shows the ability of an enterprise to control the rate of own working capital and replenish current assets in case of need at its own sources. This indicator is calculated as a ratio of company’s own current assets to the total sum of own assets. Recommended value: from 0,2 to 0,5.

Decrease of an indicator designates the possible delay in payment of receivables or tightening of trade credit conditions on the part of suppliers or contractors.

| № | Name, tax number | Region | Revenue for 2014 г., RUB million | Current assets to equity ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | ООО STIS Tax number 6451415520 |

Moscow region | 2 113 458 | 1,00 | 228 (high) |

| 2 | ООО AKMA Tax number 7808032006 |

Saint-Petersburg | 1 836 908 | 0,74 | 262 (high) |

| 3 | PAO A G C BSZ Tax number 5246002261 |

Nizhny Novgorod region | 7 407 998 | 0,66 | 186 (prime) |

| 4 | NAO AO SALAVATSTEKLO Tax number 0266004050 |

Republic of Bashkortostan | 4 942 687 | 0,08 | 208 (high) |

| 5 | PAO SARATOVSTROISTEKLO Tax number 6453054397 |

Saratov region | 3 123 517 | 0,01 | 289 (high) |

| 6 | ООО GARDIAN STEKLO RYAZAN Tax number 6234017547 |

Ryazan region | 4 202 786 | -0,17 | 252 (high) |

| 7 | ООО A G C FLAT GLASS KLIN Tax number 5020033028 |

Moscow region | 8 392 857 | -0,89 | 313 (satisfactory) |

| 8 | ООО PILKINGTON GLASS Tax number 5040054932 |

Moscow region | 2 727 782 | -1,57 | 268 (high) |

| 9 | ZAO RSK Tax number 7802445776 |

Saint-Petersburg | 4 210 347 | -4,21 | 217 (high) |

| 10 | ООО GARDIAN STEKLO ROSTOV Tax number 6148559000 |

Rostov region | 2 948 023 | -4,33 | 302 (satisfactory) |

The first spot of the ranking is taken by OOO Stis with the value of current assets to equity ratio that equals to 1,00. It shows that all company’s own working capital is in turnover and gives evidence to the high degree of freedom to manipulate own assets. The company was given the high solvency index Globas-i® by the experts of Information agency Credinform, which characterize it as a financially stable.

Figure. Current assets to equity ratio of the largest plate glass manufacturers in Russia, Top-10

The industry leader by turnover OOO A G C Flat Glass Klin is placed on the seventh spot of the ranking with the current assets to equity ratio value that equals to -0,89 and satisfactory solvency index Globas-i®.

None of the represented companies in the Top-10 fit in the ratio statutory value. The closest to the statutory values are the indicators 0,66 and 0,08 belonging to PAO A G C BSZ and NAO AO Salavatsteklo respectively, having the prime and high solvency index Globas-i®.

Following the results of 2014 the industry-average indicator of current assets to equity ratio amounted to -1,8, which in the whole speaks for irrational use of the working capital. The indicators of ZAO RSK and OOO Gardian Steklo Rostov are lower that the industry-average ones. It means that the companies have the low mobility rate of own assets due to the fact that the major part of them is invested in the slowly realizable assets instead of the currents assets.