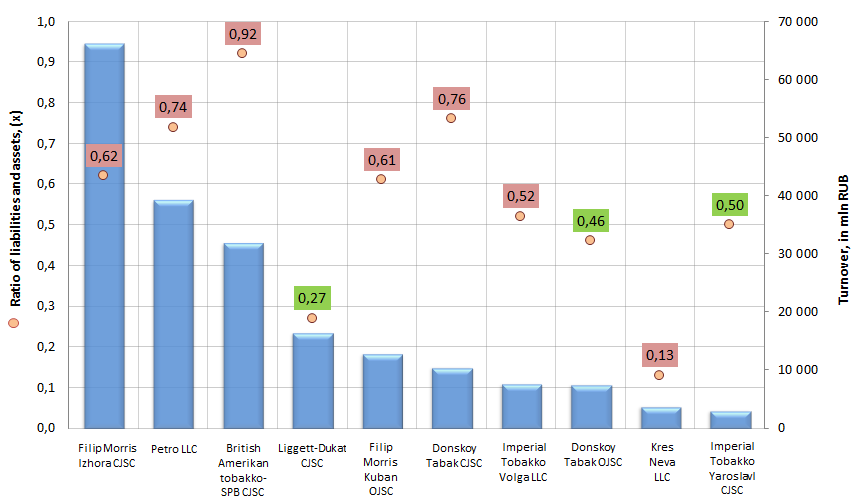

Ratio of liabilities and assets of tobacco manufacturers

Information agency Credinform prepared a ranking of companies of tobacco industry.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by increase in the value of consolidated revenues per annum. The ratio of liabilities and assets was calculated for each company.

The ratio of liabilities and assets (х) is the relation of long-term and short-term borrowings to total assets. It shows what share of assets of an enterprise is funded through borrowings.

Recommended value: from 0,2 to 0,5.

If the ratio value is above 0,5, then it testifies that an organization is strongly dependent on borrowings. The risk of liquidity crisis and debt load occurs.

And if the ratio is below 0,2, then it can be drawn the conclusion about company’s development policy due to own sources, that makes sense not always and let maintain a certain market share.

It should be understood, that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry, consequently, these values are exclusively of informational character.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all available combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Changeby 2012, % | Ratio of liabilities and assets, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Filip Morris Izhora CJSC INN: 4720007247 |

Leningrad region | 66 229 | 11,7 | 0,62 | 174 the highest |

| 2 | Petro LLC INN: 7834005168 |

Saint-Petersburg | 39 306 | -3,1 | 0,74 | 230 high |

| 3 | British Amerikan tobakko-SPB CJSC INN: 7809008119 |

Saint-Petersburg | 31 948 | 0,0 | 0,92 | 195 the highest |

| 4 | Liggett-DukatCJSC INN: 7710064121 |

Moscow | 16 449 | -11,1 | 0,27 | 223 high |

| 5 | Filip Morris Kuban OJSC INN: 2311010485 |

Krasnodar territory | 12 851 | 29,7 | 0,61 | 206 high |

| 6 | DonskoyTabakCJSC INN: 6162063051 |

Rostov region | 10 542 | 242,4 | 0,76 | 239 high |

| 7 | Imperial Tobakko Volga LLC INN: 3443033593 |

Volgogradregion | 7 690 | -4,0 | 0,52 | 241 high |

| 8 | DonskoyTabakOJSC INN: 6163012571 |

Rostov region | 7 528 | -15,7 | 0,46 | 218 high |

| 9 | Kres Neva LLC INN: 4720011412 |

Leningrad region | 3 815 | -1,8 | 0,13 | 192 the highest |

| 10 | Imperial Tobakko Yaroslavl CJSC INN: 7601000015 |

Yaroslavlregion | 3 059 | -5,6 | 0,50 | 234 high |

Picture 1. Ratio of liabilities and assets, turnover of the largest tobacco companies of Russia (TOP-10)

The turnover of the largest tobacco manufacturers (TOP-10) made 199,4 bln RUB according to the last published annual financial statement, what gives 95,2% from the revenues of all enterprises of the market. Now therefore, there is a sufficiently strong monopolization of the industry.

In spite of a number of anti-tobacco measures taken at the legislative level consolidated revenues of all Russian tobacco companies increased by 8,3% up tо 209,4 bln RUB following the results of the previous year.

Only three participants of TOP-10 list showed the analyzed ratio being within recommended value: Liggett-Dukat CJSC (0,27), Donskoy tabak OJSC (0,46) and Imperial Tobakko Yaroslavl CJSC (0,5).

These organizations strike rationally a balance between loan and own funds. The occurrence of the risk of liquidity crisis by such relation is below average.

Kres Neva LLC conducts moderate policy and develops mostly due to own resources.

The rest participants of the ranking attract extensively borrowed capital, what increases the risk of loss of their financial stability amid the crisis, but at the same time it let them grow rapidly and maintain their market share.

According to the independent estimation of the Information agency Credinform the organizations of the TOP-10 list got a high and the highest solvency index, what can signal to potential investors, that the largest market players can pay off their debts in time and fully, while risk of default is minimal.

The Ministry of Economic Development has defined the most efficient regions

The Ministry of Economic Development has defined ten the most efficient subjects of RF as of the end of the previous year. The Republic of Tatarstan has taken the lead among Russian regions.

At assessing the efficiency of the regions, the Ministry derived its support from 12 indices, which can be divided into 3 sections: economy development, social sector development, public opinion polls and 2 individual approaches. The leaders of the rating will be remunerated with cash grants. The Republic of Tatarstan, Tyumen region, the Khanty-Mansijsk Autonomous District – Yugra, Voronezh region, Chechnya, Astrakhan region, Sakhalin region, the Yamalo-Nenets Autonomous District, Kursk and Tambov regions are among the winners.

The Republic of Tatarstan is the undisputed leader with its 66.8 points out of 83. Thus, the republic has not only kept the position of leadership, but also improved its figures. The second best is Tyumen region, high results of which in investments attraction, development of small businesses and education were praised. Moreover, it should be noted that following the previous year Tyumen region has managed to achieve a reduction of expenditures on general state issues by 3-5%, which is also an index of efficiency of the region.

The Khanty-Mansijsk Autonomous District – Yugra is among the leaders in small business and housing construction development. The region is also one of the leaders in terms of real income of the population and is characterized by a relatively low level of unemployment.

Voronezh region was honorary mentioned for the dynamic of private investments attraction and has a 4th place in the monitoring of efficiency of activities carried out by the regional authorities.

Chechen Republic closes the top five, holding the leading positions with 6 indices, including on volumes of commissioned housing.

It is not only honorably, but also profitably to be a leader of this rating. The federal budget for 2014 includes intergovernmental transfers to remunerate the distinguished regions; the total is just over 3.48 billion rubles. The amounts of grants will be determined in proportion to the "merits" of each subject of the Russian Federation. So it was previously reported that Tatarstan, the leader of the rating, can expect 216 million rubles, Tyumen region 201 million rubles, and its constituent Yugra another 191 million rubles. Voronezh region will receive 184 million rubles for fourth place, and Chechnya 182 million rubles.