How to check the counterparty before signing the contract

The lack of taxpayer «due diligence» in case of contractor choice may cause presentation of claims of supervisory authorities in obtaining unreasonable tax advantage and charges in making deals with a flight-by-night company and, as a consequence, additional tax accrual and attraction to tax responsibility.

Among signs of a fly-by-night company are: registration at "mass" address, "mass" shareholder or director, lack of information about the company in open information sources, communication with the help of representatives and the denial of potential partner in establishment of contacts with management of the company. The existence of main signs are not always specifies on the fly-by-night company. For example, the legal form LLC or minimal authorized capital, the absence at the registered address can speak about high rent prices. But if there is sum of such signs – this is the reason to think about reliability of possible contractor.

The criteria, which tax authorities use while scheduling field tax audit, are described in the order of Federal Tax Service from 30.05.2007 № ММ-3-06/333@ "About the statement of planning system concept of field tax audit".

«The concept provides for the taxpayer self-assessment of risks according to the results of the financial and economic activities by the following criteria. Publicly available criteria of independent risks assessment for taxpayers, which are usually used by tax authorities in objects selection for carrying out field tax audit, can be:

1. Tax burden of the taxpayer is lower than average by operating subjects in the specific branch (type of economic activity).

2. Reflection in balance or tax reports of losses throughout several tax periods.

3. Reflection in tax reports of the considerable amounts of tax deductions for a certain period.

4. Advancing growth rate of expenses above growth rate of the income from sales of goods (works, services).

5. Payment of an average monthly salary per one worker is lower than average by the form of economic activity in Russian Federation.

6. Repeated approximation to limit value of indexes, which are set by the Tax Code of Russian Federation. Such indexes provide the right for taxpayers to apply special tax modes.

7. Reflection by sole proprietor of expenditure amounts, which are most approached to the amount of its income gained for calendar year.

8. Creation of financial and economic activities on the basis of the entering into the contracts with contractors-dealers or intermediaries without reasonable economic or other causes (business aim).

9. Non-presentation by taxpayer of explanations on the tax authority notification message about detection of mismatch of indexes of activities, and (or) non-presentation to the tax authority of the required documents, and (or) existence of information on their destruction, damage, etc.

10. Repeated removal from the account and setting on the account in tax authorities of the taxpayer in connection with location change ("migration" between tax authorities).

11. The considerable variation of profitability level according to accounting reports from profitability level for this field of activity by statistical data.

12. Operation of financial and economic activities with high tax risk.

In case of assessment of the above indexes the tax authority surely analyzes the possibility of extraction or existence of unreasonable tax advantage, including circumstances, which are mentioned in Plenum resolution of the Supreme Arbitration Court of the Russian Federation from 12.10.2006 N 53.

Systematic carrying out of independent risks assessment by results of the financial and economic activities will allow the taxpayer to evaluate timely tax risks and clarify his tax liabilities».

As practice shows, check and data collection, which confirm manifestation of "due diligence", require efforts of stakeholder, as companies are not always provide such information to potential partners. Information and analytical on-line system Globas-i can help in receiving necessary information about contractor: registration data, licenses, litigation, management team. Moreover, the Reliability index is to appear in the system, with the help of such index the user can easily recognize a fly-by-night company.

Ranking the largest timber sawing and planing industry companies of St. Petersburg and the Leningrad region

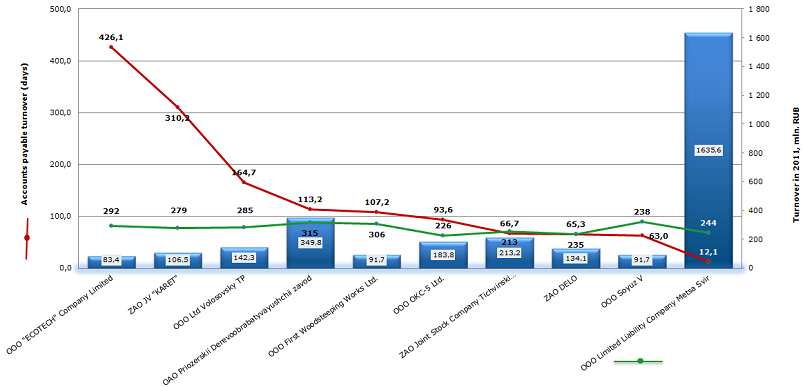

Credinform Information Agency has come with the ranking release of timber sawing and planing industry companies of St. Petersburg and the Leningrad region. Ten companies with the largest sales revenues (as stated Statistics Register 2011) were selected and then ranked upon their accounts payable turnover.

The accounts payable turnover (days) is a relation of the average payables, taken for a certain time period, to the cost of goods sold. It shows the period (number of days) in which company discharges its liabilities.

| № | Company | Region | Turnover in 2011, mln. RUB | The accounts payable turnover(days) | Globas-i® solvency index |

|---|---|---|---|---|---|

| 1 | OOO "ECOTECH" Company Limited INN – Tax number: 4711005451 | The Leningrad Region | 83,4 | 426,1 | 292(high) |

| 2 | ZAO JV "KARET" INN – Tax number: 7817005947 |

St. Petersburg | 106,5 | 310,15 | 279(high) |

| 3 | OOO Ltd Volosovsky TPINN – Tax number: 4717009237 | The Leningrad Region | 142,3 | 164,67 | 285(high) |

| 4 | OAO Priozerskii Derevoobrabatyvayushchii zavod INN – Tax number: 4712000329 | The Leningrad Region | 349,8 | 113,17 | 315(sufficient) |

| 5 | OOO First Woodsteeping Works Ltd.INN – Tax number: 4708013050 | The Leningrad Region | 91,7 | 107,23 | 306(sufficient) |

| 6 | OOO OKC-5 Ltd.INN – Tax number: 7804408402 | St. Petersburg | 183,8 | 93,64 | 226(high) |

| 7 | ZAO Joint Stock Company Tichvinski kompleksni lesproINN – Tax number: 4715001850 | The Leningrad Region | 213,2 | 66,74 | 253(high) |

| 8 | ZAO DELOINN – Tax number: 4712013511 | The Leningrad Region | 134,1 | 65,25 | 235(high) |

| 9 | OOO Soyuz VINN – Tax number: 4704079332 | The Leningrad Region | 91,7 | 62,95 | 320(sufficient) |

| 10 | OOO Limited Liability Company Metsa Svir INN – Tax number: 4711005733 | The Leningrad Region | 1 635,6 | 12,08 | 244(high) |

Diagram. The accounts payable turnover of Top-10 timber sawing and planing industry companies of St. Petersburg and the Leningrad region

In the table, you find industry biggest companies of St. Petersburg and the Leningrad region. Following 2011 results, top-10 total turnover reached 3 032,1 mln. RUB. The average value of payable turnover ratio is 142 days.

You can see from the table that no company, except for OOO "ECOTECH" Company Limited, has exceeded 350 mln. RUB. of its turnover.

Following 2011 results, three companies on Top-10 list – OOO "ECOTECH" Company Limited, ZAO JV "KARET", and OOO Ltd Volosovsky TP – have the longest period of the accounts payable turnover, 426, 310 and 165 days respectively. The slow-paced turnover here is most probably reasoned by industry’s features like dependency on timber delivery, high prices monopoly tariffs etc.; besides, the sales revenues of these companies are relatively small – the so called ‘scale effect’ is less important here compared to the large companies. However, all these firms got the highest score in Credinform independent Globas-i® solvency ranking; this means they are able to discharge their liabilities duly and in time, and risk of becoming a default is rather minor.

Three companies – OAO Priozerskii Derevoobrabatyvayushchii zavod, with the accounts payable turnover 113 days, OOO First Woodsteeping Works Ltd., 107 days and OOO Soyuz V, 63 days – got Globas-i® sufficient ranking, which means there is no guarantee they will pay their liabilities out, duly and in time – besides, they are not strong enough to adapt to changing economic situation. Although the accounts payable turnover of these companies is lower than that of the Top-10 Big Three, there is a clear need for companies’ management to re-think their financial strategy – credit line drawdown terms, product markets, logistics policy, and marketing programmes.

The rest of the companies on Top-10 list got high solvency ranking – noteworthy, the accounts payable turnover of OOO "ECOTECH" Company Limited, 12 days, is much lower than that of the largest manufacturers. There is no big surprise here, however, - company’s revenues include ‘scale effect’ which makes it possible for it to discharge its current liabilities, duly and in time.