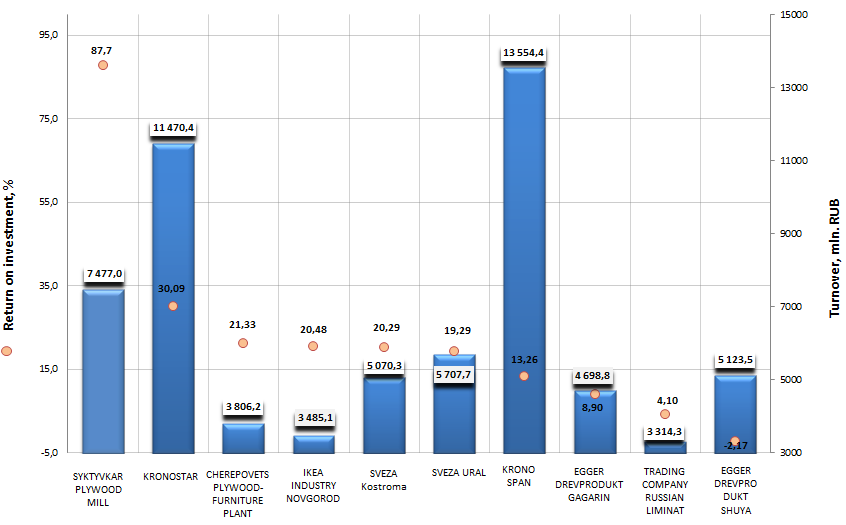

Return on investment of woodworking companies

Information Agency Credinform has prepared the ranking of enterprises engaged in manufacture of veneer, plywood, wood boards and panels by return on investment ratio. The largest enterprises engaged in this activity in terms of turnover were selected according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first ten companies by turnover were ranged by decrease in return on investment ratio.

Return on investment is an indicator of return on involved in commercial activity equity and long-term borrowed funds. It is calculated as a ratio of net profit to the sum of equity and long-term liabilities.

As it is known, there are no general standards for profitability ratios, as their meanings are significantly different depending on industry. That is why each company should be analyzed in comparison with the industry indicators.

| № | Name, INN | Region | Turnover 2013, mln. RUB | Return on investment, % | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | SYKTYVKAR PLYWOOD MILL LIMITED INN 1121009024 |

Komi Republic | 7477 | 87,7 | 176 (the highest) |

| 2 | LLC KRONOSTAR INN 4407006010 |

Kostroma Region | 11 470 | 30,09 | 235 (high) |

| 3 | LIMITED JOINT-STOCK COMPANY CHEREPOVETS PLYWOOD-FURNITURE PLANT INN 3528006408 |

Vologda Region | 3806 | 21,33 | 157 (the highest) |

| 4 | LLC IKEA INDUSTRY NOVGOROD INN 5310011273 |

Novgorod Region | 3485 | 20,48 | 201 (high) |

| 5 | NAOSVEZA Kostroma INN 4401006864 |

Kostroma Region | 5070 | 20,29 | 174 (the highest) |

| 6 | LLC SVEZA URAL INN 5942005010 |

Perm Region | 5708 | 19,29 | 190 (the highest) |

| 7 | KRONOSPAN LLC INN 5011021227 |

Moscow Region | 13 554 | 13,26 | 205 (high) |

| 8 | EGGER DREVPRODUKT GAGARIN LLC INN 6723019741 |

Smolensk Region | 4699 | 8,9 | 220 (high) |

| 9 | TRADING COMPANY RUSSIAN LIMINAT LIMITED INN 5042101105 |

Moscow Region | 3314 | 4,1 | 216 (high) |

| 10 | LLC EGGER DREVPRODUKT SHUYA INN 7704267807 |

Ivanovo Region | 5124 | -2,17 | 268 (high) |

The first three places of the ranking take the following companies: SYKTYVKAR PLYWOOD MILL LIMITED (with ratio value 87,7%), LLC KRONOSTAR (30,09%), IMITED JOINT-STOCK COMPANY CHEREPOVETS PLYWOOD-FURNITURE PLANT (21,33%). All companies showed high level of return on investment ratio, that indicates about the effective use of borrowed funds. The companies have the high and the highest solvency index GLOBAS-i®, that shows its stable financial condition.

Return on investment of the largest Russian woodworking companies, Top-10

LLC EGGER DREVPRODUKT SHUYA is the only company with negative ratio value, because of the loss in the last financial period. However according to total financial and non-financial indicators, the high solvency index Globas-i® was assigned to the company.

In conclusion it should be noted that the ratio is important not only because it shows the return on investment, but also it is possible to estimate the practicability of fund raising under a certain percent on its basis. The company should take out a loan, percent on which is lower than return on investment capital.

Whether the ruble started to recover the lost positions

In April, despite the correction at the beginning of this week, the ruble became significantly stronger against the US dollar. Less than a month, the monthly average ruble exchange rate rose by 17.5% in relation to an average monthly rate of January, 2015. Such prompt rise in our currency put it on the first place in the world by profitability for investors. It seems that it is worth being positive to this news, but not everything is so simple. The country’s currency, with such large economics like Russia, should not show that kind of strong and greatly speculative volatility, which is observed since the second half of last year – the period of accelerated depreciation, and till today - equally rapid recovery.

On the one hand, the strengthening of the ruble is advantageous for customers, as the country largely depends on import of products because of the absence of similar products in our country or non-meeting the necessary requirements and properties. Falling costs of imports will lead to some decrease in rates of inflation, which has already reached 16.3% in annual expression. High inflation devalues salaries and directly influences on living standards. On the other hand, cheap ruble gives new incentives for the development of import substitution and industry in general; besides, the dropping-out income of the budget is compensated by export of energy resources considerably fallen in price.

One of the most important factors, which influence on strengthening of the ruble against dollar, is the rise in oil prices and also the absence of large-scale military operations in the east of Ukraine. These factors decrease the geopolitical pressure on Russia with the corresponding confrontational rhetoric from Western leaders.

It’s time for large Russian companies to pay budget taxes. Those companies, that receive income in foreign currency, have to exchange it for rubles. As a result, it increases the demand for rubles and the cost of Russian national currency. The absence of significant foreign debt payments of Russian companies in April gives the support to ruble.

The additional factor (but not the defining) became the fact that Russians recently began to get rid of foreign cash, which was bought at the excessive demand for it.

Besides the structural problems in economy, the number of external factors will influence the ruble. Escalating conflict in Yemen, in which Saudi Arabia is involved, and lifting of sanctions against Iran, have made the oil price forecasts more uncertain. The possibility of renewal of hostilities in Donbass will continue to be used for economic impact on Moscow.