Return on assets of collectors

Information agency Credinform has prepared a ranking of the Russian payment collection and credit information agencies. The largest enterprises (TOP-10 and TOP-100) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the available periods (2018-2020). Then the companies were ranged by return on assets ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Return on assets (%) is calculated as the relation of the sum of net profit and interest payable to the total assets value of a company and shows how many monetary units of net profit are earned by every unit of total assets.

The ratio characterizes the effectiveness of using by the company of its resources. The higher is the ratio value, the more effective is business, that is the higher the return per every monetary unit invested in assets.

However, it is necessary to take into account that under the influence of inflation, the book value of fixed assets will increasingly be underestimated in time, that will lead to an overestimation of the return on assets. Thus, it is necessary to take into account not only the structure, but also the age of the assets.

It should be also taken into account the dynamics of this indicator. Its consistent decline indicates a drop in asset utilization.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. In 2020, the practical value of return on assets ratio for the payment collection and credit information agencies is from 0,1 to 18,99 %%.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on assets, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC ACTIVEBUSINESSCONSULT INN 7736659589 Moscow |

1 249,6 1 249,6 |

1 412,5 1 412,5 |

320,3 320,3 |

388,6 388,6 |

41,39 41,39 |

42,79 42,79 |

152 Superior |

| LLC CREDITEXPRESS FINANCE INN 7707790885 Moscow |

425,2 425,2 |

439,5 439,5 |

40,6 40,6 |

69,0 69,0 |

25,25 25,25 |

30,49 30,49 |

206 Strong |

| JSC FIRST COLLECTION BUREAU INN 2723115222 Moscow |

6 768,4 6 768,4 |

6 558,1 6 558,1 |

996,7 996,7 |

2 428,9 2 428,9 |

14,32 14,32 |

29,69 29,69 |

131 Superior |

| LLC ID COLLECT INN 7730233723 Moscow |

185,4 185,4 |

693,8 693,8 |

42,5 42,5 |

260,1 260,1 |

27,29 27,29 |

20,18 20,18 |

262 Medium |

| LLC REGIONAL COLLECTION SERVICE INN 7707782563 Moscow |

515,2 515,2 |

886,4 886,4 |

120,3 120,3 |

169,4 169,4 |

17,03 17,03 |

10,53 10,53 |

232 Strong |

| LLC LEGAL CENTRE PARITET INN 7718931947 Moscow |

571,4 571,4 |

669,5 669,5 |

96,8 96,8 |

98,1 98,1 |

7,54 7,54 |

9,40 9,40 |

237 Strong |

| LLC NATSIONALNAYA FABRIKA IPOTEKI INN 7706450420 Moscow |

9 073,8 9 073,8 |

8 846,2 8 846,2 |

112,8 112,8 |

413,9 413,9 |

2,42 2,42 |

6,22 6,22 |

233 Strong |

| LLC SERIOUS TRADE INN 2801146767 Novosibirsk region |

362,6 362,6 |

643,2 643,2 |

-20,2 -20,2 |

29,2 29,2 |

-4,15 -4,15 |

5,00 5,00 |

266 Medium |

| NATIONAL RECOVERY SERVICE LLC INN 7727551797 Moscow |

1 140,1 1 140,1 |

549,9 549,9 |

55,9 55,9 |

39,5 39,5 |

6,90 6,90 |

4,91 4,91 |

248 Strong |

| LLC CAFT INN 7813286084 St. Petersburg |

1 601,8 1 601,8 |

3 613,4 3 613,4 |

7,5 7,5 |

58,6 58,6 |

0,11 0,11 |

1,12 1,12 |

234 Strong |

| Average value for TOP-10 companies |  2 189,3 2 189,3 |

2 431,3 2 431,3 |

177,3 177,3 |

395,5 395,5 |

13,81 13,81 |

16,03 16,03 |

|

| Average value for TOP-100 companies |  268,7 268,7 |

304,1 304,1 |

34,2 34,2 |

56,5 56,5 |

20,39 20,39 |

14,57 14,57 |

|

| Average industry value |  83,4 83,4 |

67,0 67,0 |

21,2 21,2 |

25,4 25,4 |

10,32 10,32 |

13,82 13,82 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

In 2020, the average value of return on assets, TOP-10 and TOP-100 companies is in the range of practical value. In 2020, three companies reduced the results, while in 2019, the decline was observed in five companies. At the same time, seven companies showed the increase in revenue and nine companies demonstrated the increase in net profit.

The TOP-10 revenue increased on average by 11%, the TOP-100 revenue - by 13%, and the industry average ratio showed the decrease by 20%.

The TOP-10 profit increased by more than twice, the TOP-100 profit increased by 65%, and the average growth whithin the industry amounted to 20%.

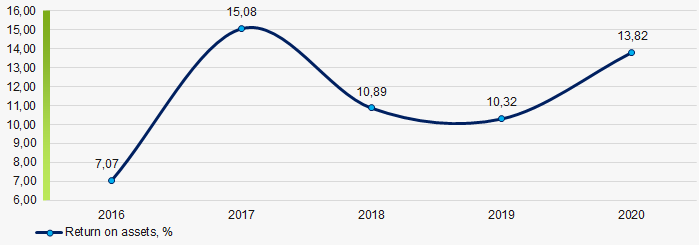

Within the last five years, the average industry indicators of return on assets ratio twice decreased and grew from year to year. The ratio showed the best result in 2017 and the worst in 2016 (Picture 1).

Рисунок 1. Change in average industry values of return on assets of the payment collection and credit information agencies in 2016 – 2020

Рисунок 1. Change in average industry values of return on assets of the payment collection and credit information agencies in 2016 – 2020Trends in hotel industry

Information agency Credinform presents a review of the activity trends of the small enterprises of the hotel industry.

The largest hotel industry enterprises (TOP-1000), registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation, in terms of annual revenue were selected for the analysis according to the data from the Statistical Register and the Federal Tax Service for the latest available accounting periods (2016 – 2020). The selection of companies and the analysis were based on the data from the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest TOP-1000 company in terms of net assets is AO MBIK, INN 7840004758, Saint Petersburg. In 2020, net assets value amounted to almost 3,4 billion RUB.

The lowest net assets value among TOP-1000 was recorded for OOO VEGA, INN 7826138206, Saint Petersburg. In 2020, insufficiency of property was indicated in negative value of -2,2 billion RUB.

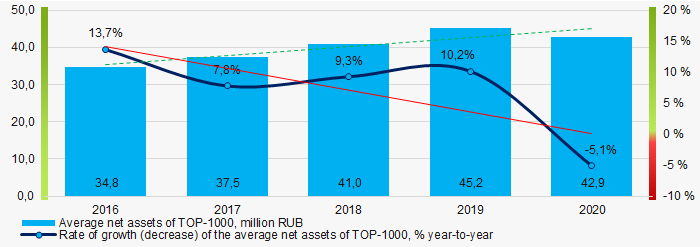

During five-year period, the average net assets values of TOP-1000 have a trend to increase with the decreasing growth rates (Picture 1).

Picture 1. Change in average net assets value in TOP-1000 in 2016 - 2020

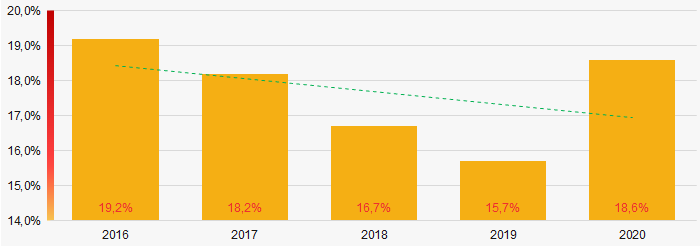

Picture 1. Change in average net assets value in TOP-1000 in 2016 - 2020The shares of TOP-1000 enterprises with insufficient property had positive trend to decrease during last 5 years (Picture 2).

Picture 2. Shares of TOP-1000 companies with negative net assets values in 2016 - 2019

Picture 2. Shares of TOP-1000 companies with negative net assets values in 2016 - 2019Sales revenue

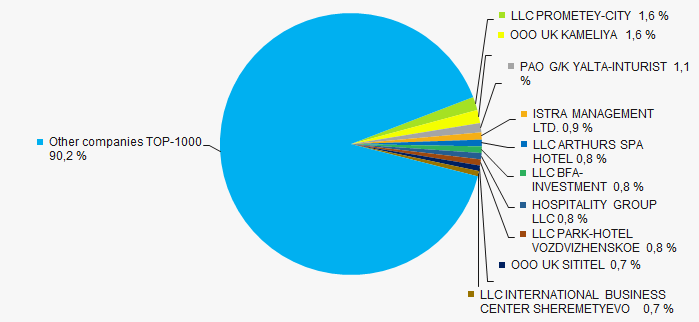

The revenue volume of the ten leading companies amounted to almost 10% of the total revenue of TOP-1000 companies in 2020 (Picture 3). It gives evidence to high level of the competition in the hotel industry.

Picture 3. Shares of TOP-10 companies in the total revenue of TOP-1000 in 2020

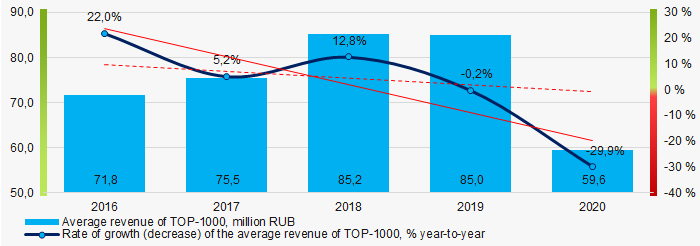

Picture 3. Shares of TOP-10 companies in the total revenue of TOP-1000 in 2020 In general, there is a trend to decrease in revenue with declining of growth rates to negative values in 2019-2020 (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2016 – 2020

Picture 4. Change in average revenue of TOP-1000 in 2016 – 2020Profit and lossstrong>

The largest TOP-1000 company in term of net profit is AO GOSTINITSA TURIST, INN 7717600910, Moscow, in process of being wound up since 23.09.2020. The company’s profit amounted to 706 billion RUB.

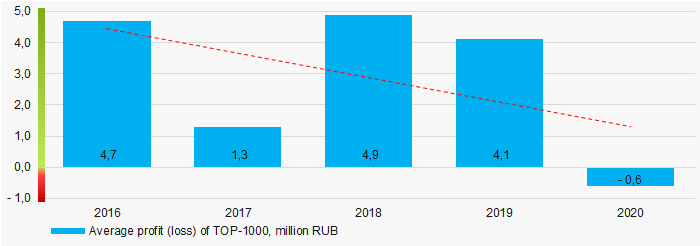

During five-year period, the average profit figures of TOP-1000 have a trend to decrease (Picture 5).

Picture 5. Change in average profit (loss) of TOP-1000 companies in 2016 - 2020

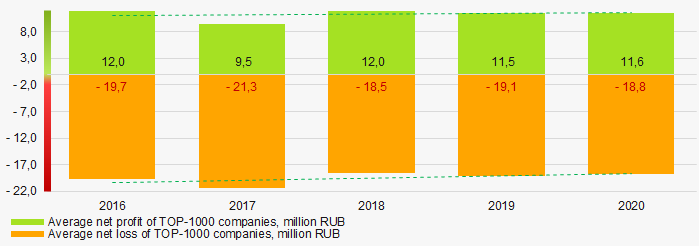

Picture 5. Change in average profit (loss) of TOP-1000 companies in 2016 - 2020In the last five years, the average net profit figures of TOP-1000 companies have a trend to increase with the decreasing average net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 companies in 2016 – 2020

Picture 6. Change in average net profit and net loss of ТОP-1000 companies in 2016 – 2020Key financial ratios

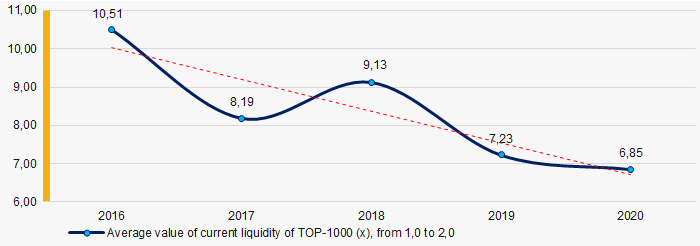

During five-year period, the average values of the current liquidity ratio of TOP-1000 companies were above the recommended one – from 1,0 to 2,0, with a trend to decrease. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 in 2016 – 2020

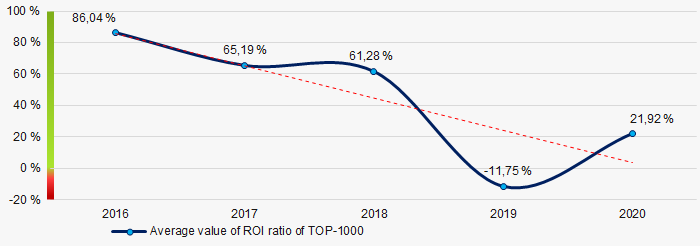

Picture 7. Change in average values of current liquidity ratio of TOP-1000 in 2016 – 2020During five years, there was a trend to decrease in the average ROI values of TOP-1000 companies (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio of TOP-1000 in 2016 – 2020

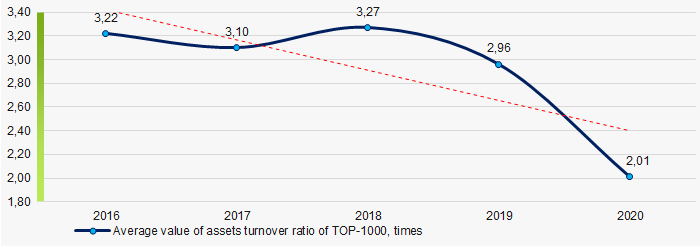

Picture 8. Change in average values of ROI ratio of TOP-1000 in 2016 – 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

During the five-year period, there was a trend to decrease of this ratio (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2016 – 2020

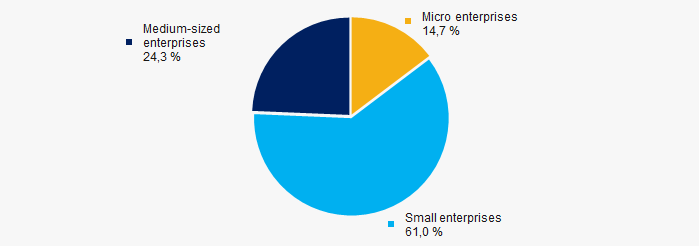

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2016 – 2020Small enterprises

Small enterprises have the major share in total revenue of TOP-1000 in 2020. (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of small and medium-sized enterprises in TOP-1000Main regions of activity

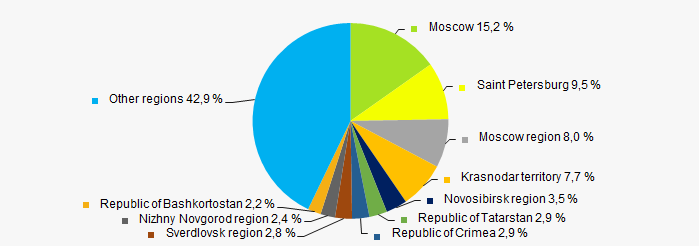

Companies of TOP-1000 are registered in 81 regions of Russia, and unequally located across the country. Almost 33% of the TOP-1000 companies’ total revenue consolidate in Moscow, Saint Petersburg and Moscow region (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the regions of Russia

Picture 11. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

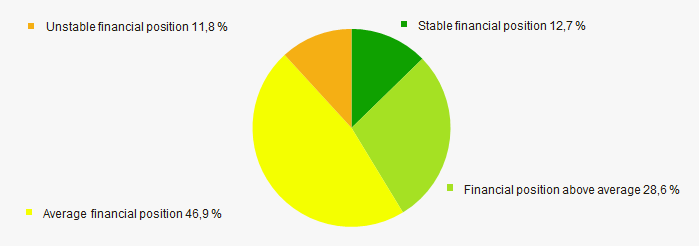

According to the assessment, the financial position of most of TOP-1000 companies is average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

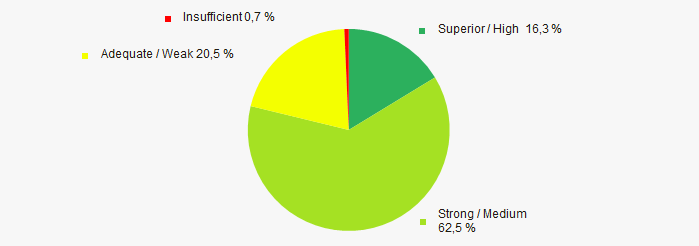

Most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the small enterprises of the hotel industry, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of negative trends in their activity in 2016- 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of capital concentration |  10 10 |

| Dynamics of the average revenue |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Growth / decline in average values of net profit |  10 10 |

| Growth / decline in average values of net loss |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  -0,3 -0,3 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)