Profit of companies of the financial market

Information agency Credinform represents a ranking of the largest Russian companies of the financial market. The largest holding companies, investment funds, pawn shops, micro financial organizations and other companies (TOP-10) in terms of annual revenue were selected for the ranking according to the latest accounting periods in the Statistical Register (2017 – 2019) were selected for the ranking. Then they were range by the net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is a relation of net profit (loss) to sales revenue. It is an indicator of the level of sales revenue.

There is no standard value for this ratio. It is recommended to compare companies of the same industry, or change in the ratio of the specific company. Negative value of the ratio is indicative of the net loss, and the high one means the efficiency of the company.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, billion RUB | Net profit (loss), billion RUB | Net profit ratio, % | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC RN HOLDING INN 7225004092 Moscow, in process of reorganization by spin-off simultaneously with the acquisition since 04.03.2020 |

30,06 30,06 |

326,33 326,33 |

51,73 51,73 |

351,85 351,85 |

300,75 300,75 |

172,10 172,10 |

305 Adequate |

| LLC RN-RAZVEDKA I DOBYCHA INN 2322026840 Moscow, in process of reorganization in the form of acquisition simultaneously with the spinning-off since 03.03.2020 |

8,84 8,84 |

104,37 104,37 |

7,38 7,38 |

104,76 104,76 |

13,88 13,88 |

83,51 83,51 |

215 Strong |

| JSC STATE TRANSPORT LEASING COMPANY INN 7720261827 Yamal-Nenets autonomous district |

39,06 39,06 |

162,62 162,62 |

2,01 2,01 |

2,80 2,80 |

21,88 21,88 |

5,16 5,16 |

247 Strong |

| JSC RUSSIAN ALUMINUM INN 7709329253 Moscow |

279,47 279,47 |

320,23 320,23 |

6,02 6,02 |

1,49 1,49 |

5,07 5,07 |

2,15 2,15 |

273 Medium |

| LLC REGION FINANCIAL SERVICES INN 7706444025 Moscow |

107,48 107,48 |

113,43 113,43 |

1,73 1,73 |

0,96 0,96 |

0,22 0,22 |

1,60 1,60 |

261 Medium |

| JSC TREND INN 7708729065 Moscow |

461,73 461,73 |

255,68 255,68 |

4,18 4,18 |

4,29 4,29 |

0,63 0,63 |

0,90 0,90 |

243 Strong |

| LLC LOGOS INN 7723849543 Moscow |

292,00 292,00 |

163,78 163,78 |

1,42 1,42 |

5,64 5,64 |

0,27 0,27 |

0,49 0,49 |

260 Medium |

| LLC OSTC - ATON INN 7701375466 Moscow |

266,78 266,78 |

276,48 276,48 |

0,22 0,22 |

0,14 0,14 |

0,08 0,08 |

0,08 0,08 |

213 Strong |

| LLC KIT FINANCE TRADE INN 7840471255 Saint Petersburg |

325,90 325,90 |

147,83 147,83 |

-0,16 -0,16 |

-0,21 -0,21 |

0,08 0,08 |

-0,05 -0,05 |

368 Adequate |

| JSC PIPE METALLURGICAL COMPANY INN 7710373095 Moscow |

211,17 211,17 |

229,99 229,99 |

-2,58 -2,58 |

14,35 14,35 |

5,25 5,25 |

-1,22 -1,22 |

257 Medium |

| Average value for TOP-10 |  202,25 202,25 |

210,07 210,07 |

7,19 7,19 |

48,61 48,61 |

34,81 34,81 |

26,47 26,47 |

|

| Industry average value |  0,22 0,22 |

0,22 0,22 |

0,01 0,01 |

0,06 0,06 |

2,81 2,81 |

25,54 25,54 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period

decrease of indicator to the previous period

The average indicator of the net profit ratio is above the standard value. Indicators of five companies are increased in 2019.

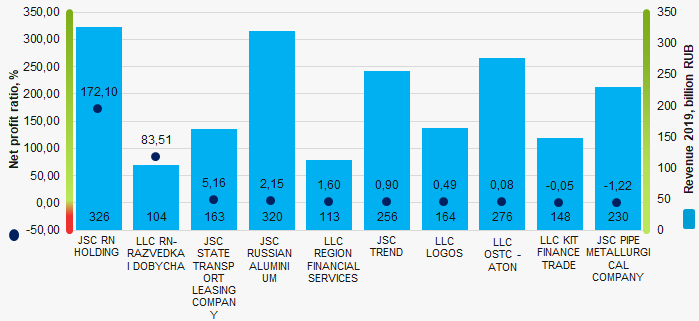

Picture 1. Net profit ratio and revenue of the largest Russian companies of the financial market (TOP-10)

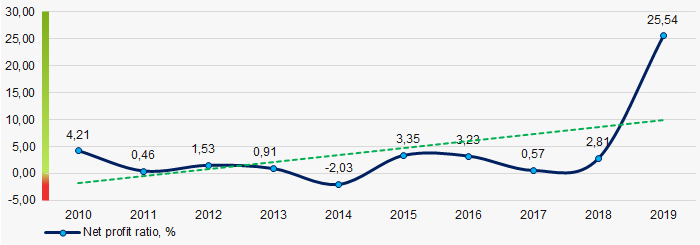

Picture 1. Net profit ratio and revenue of the largest Russian companies of the financial market (TOP-10)Over the past 10 years, the industry average values of the net profit ratio have a trend to increase (Picture 2).

Picture 2. Change in the industry average values of the net profit ratio of the largest Russian companies of the financial market in 2010 - 2019

Picture 2. Change in the industry average values of the net profit ratio of the largest Russian companies of the financial market in 2010 - 2019Changes in legislation

The Federal law of June 23, 2020 No. 187-FL entered into force, establishing the administrative liability of self-regulating organizations (hereinafter “SRO”) in the financial market for violations in monitoring the activities of its members, the procedure and deadlines for submitting information about SROs to regulatory authorities.

In particular, the law establishes that violations of the procedure for monitoring the activities of SRO members and the application of the power measures to them entail a warning or an administrative fine: from 10 thousand RUB to 50 thousand RUB for officials; from 50 thousand RUB to 200 thousand RUB for legal entities.

In addition, officials and legal entities are subjects to a warning or an administrative fine at the amount from 10 thousand RUB to 30 thousand RUB, and from 30 thousand RUB to 50 thousand RUB respectively for failure to present or violation of the order or deadlines for the submission of the following information:

- on changing addresses or locations of SROs, email addresses, contact phone numbers, addresses of official websites on the Internet;

- on changes in the statutes;

- on documents approved or adopted by the SRO governing the work of its specialized bodies.

Administrative fine may be paid in the amount of 50% of the amount if it is paid off no later than 20 days from the date of the decision.

In case of receipt of a copy of the decision on the imposing an administrative fine by registered mail after 20 days, this period may be renewed at the request of the court or the authority that made the decision.

According to the Central Bank of the Russian Federation, there are currently 24 operating self-regulating organizations in the financial market.