The Ministry of Finance of the RF plans to forbid savings certificates to a bearer

This initiative, as expected, will be submitted to the Parliament of the RF in a short time.

Many clients of banks were already able to appreciate the main advantage of such securities – they make it possible to convert funds to one document, which can be transferred to any persons, inherited by any persons, as well as allows to gain fixed income at the rate specified by a bank. The main advantage – it is easy to transport and handle, especially if a converted sum is large. In cases when you need to make a monetary transaction at an early date, for example, in the estate market (without waiting for a transfer or additional bank commissions) - this financial instrument will prove its value.

Today the savings certificates (paper security, which verifies that a sum is placed on deposit in a bank) can be registered, i.e. according to this certificate, only (s)he, who has it executed, can get funds, and to a bearer – with an opportunity to transfer paper to other persons.

The main disadvantage of the savings certificate to a bearer – it is not secured by the deposit insurance system (DIS), and if it will be lost or stolen, it won’t be possible to recover funds on it, because there is no evidence-based mechanism, proving that exactly you were the owner of this certificate. Moreover, if a bank provided the certificate will be revoked a license – to refund money mentioned in it will be also impossible.

The Ministry of Finance offers to keep in circulation only registered savings certificates, which are given in documentary form and obligatory deposited. Only a natural person can be the owner of such paper. All registered certificates are included in the DIS.

Such bill is not groundless. In spite of that registered certificates are less attractive for clients, because they have reduced rates, the risk level with the circulation of certificates to a bearer is very high.

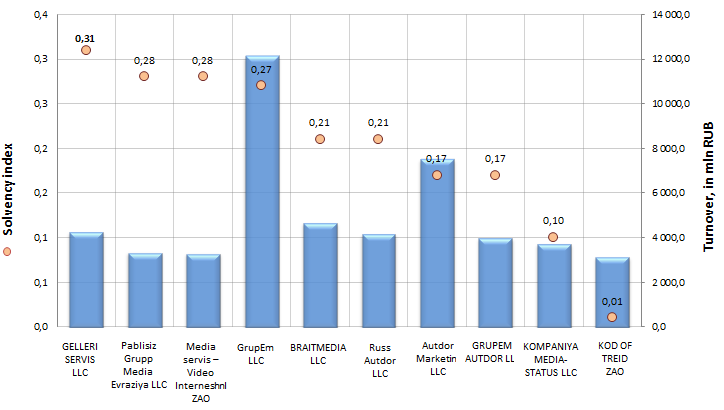

Solvency ratio of enterprises involved in advertising business

Information agency Credinform prepared a ranking of companies engaged in advertising business.

The enterprises with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These firms were ranked by decrease in the value of solvency ratio. It shows company’s dependence on external borrowings.

Recommended value: > 0,5.

The indicator is interesting first of all for investors, engaged in long-term investing, i.e. the ratio characterizes firm's ability to satisfy its long-term obligations.

It’s to be understood that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators in the branch, but also to all presented combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2012 | Solvency index, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | GELLERI SERVIS LLC INN: 7714564333 |

Moscow | 4 270,1 | 0,31 | 246 high |

| 2 | Pablisiz Grupp Media Evraziya LLC INN: 7743068844 |

Moscow | 3 356,8 | 0,28 | 187 the highest |

| 3 | Media servis – Video Interneshnl ZAO INN: 7723141052 |

Moscow | 3 308,6 | 0,28 | 190 the highest |

| 4 | GrupEm LLC INN: 7731529770 |

Moscow | 12 144,5 | 0,27 | 250 high |

| 5 | BRAITMEDIA LLC INN: 7707600213 |

Moscow | 4 692,0 | 0,21 | 254 high |

| 6 | Russ Autdor LLC INN: 7731196087 |

Moscow region | 4 178,8 | 0,21 | 228 high |

| 7 | Autdor Marketing LLC INN: 7709272021 |

Moscow | 7 533,1 | 0,17 | 296 high |

| 8 | GRUPEMAUTDORLLC INN: 7731568779 |

Moscow | 3 988,9 | 0,17 | 230 high |

| 9 | KOMPANIYA MEDIA-STATUS LLC INN: 7718840440 |

Moscow | 3 734,9 | 0,10 | 230 high |

| 10 | KOD OF TREID ZAO INN:7710601954 |

Moscow | 3 137,6 | 0,01 | 313 satisfactory |

Picture 1. Solvency ratio, turnover of the largest enterprises engaged in advertising business (TOP -10)

The turnover of the largest enterprises involved in advertising business (TOP-10) made 50,345 bln RUB. The leaders accumulate up to 20% of sales revenue of all companies of the branch. The average solvency ratio of TOP-10 list is 0,2, what is less than recommended values. This points to that the mentioned service sector is dependent enough on attracted funds, what is explained to a large extent by specific character of its work – advertising and PR orders, contract cost are not always constant values.

On the other hand, according to the independent estimation of the Information agency Credinform, the organizations of the TOP-10 list got a high and the highest solvency index (except KOD OF TREID ZAO), what can signal to a potential investor, that the enterprises can pay off their debts in time and fully, while risk of default is minimal or low.

See also: Solvency ratio of dental clinics