New Regulation on the Russian State Internet network segment

The new Regulation on the Russian state information and telecommunications network Internet segment was approved by the Order №443 of the Federal Guard Service of the Russian Federation (FGS) as of September 7th, 2016 instead of the Regulation being valid since 2009. The new regulation was developed in accordance with the Edict of the President of the RF as of May 22nd, 2015.

Provision is made for creation of the individual state segment of Internet network called RSNet on the basis of the operating information and telecommunications networks of the FGS. In future information systems and information and telecommunications networks of the federal state governmental authorities as well as their subordinate organizations will be connected to RSNet network. The connection will be carried out by the Special communications and information service of FGS in cooperation with:

- private communications providers, rendering services on granting Internet access;

- state authorities and organizations, connected to the Internet and publishing information there;

- organizations, working on the basis of public and private partnership, dealing with development of network services and data security protection.

In order to connect to RSNet network, state authorities and communications providers concluded an agreement having technic specifications for connecting, including description of processing area, communications channels, data transmission speed and information security requirements.

For users of state governmental authorities web-sites there won’t be any external changes. However, according to developers, information security in databases of state authorities will be improved what looks particularly true considering the increasing traffic of data transmission in Internet network.

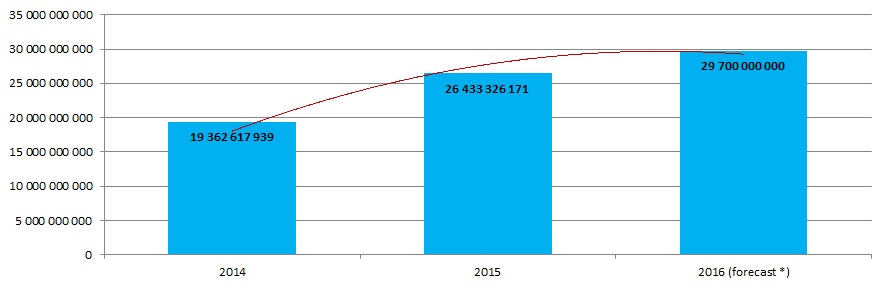

Thus according to data of the Ministry of Telecom and Mass Communications of the Russian Federation, information volume transferred from/to subscribers through Internet access (including mobile network) in 2015 increased by 36,5% comparing with 2014 and for 6 months of 2016 the traffic increase amounted to 23,3% to corresponding period of 2015 (Figure 1). Meanwhile, according to Information and Analytical system Globas-i, currently there are 1 077 vibrant organizations, having among registered types “Activities on providing data transmission and access to information and communication network Internet”.

(*) forecast on 2016 is calculated according to average value of indicators and growth rates of 2014-2015 and for 6 months of 2015-2016

It is expected to put into operation 35 network nodes of RSNet and 5 protected regional centers of data processing by the end of 2016 by the State program “Information society” for 2011-2020, approved by the Government of the RF within change-over to program principles of budget formation.

The state system of legal information “Official Internet Portal of Legal Information” is already operating in RSNet network.

Engines of the Russian economy

In any state with high GDP there are companies well-known abroad. Their activity spreads beyond the national borders, and sometimes the brand cost exceeds fixed assets value. These corporations rule the roost of the world economy, being the largest investors and employers, and source of innovations at a global scale. They supply goods and services being an integral part of the modern house-keeping. Toyota, Samsung, Siemens, Apple, Michelin, Exxon Mobil – rather everybody know profile and country of these holdings’ origin.

Russia is no exception: the Russian companies are on the international markets and their brands are well-known. Mainly it is about companies of the fuel and energy complex (FEC). One school of thought holds that opportunities for formation of high level added value are limited due to the raw materials base of the country’s economy. However the Russian economy has natural competitive advantages, because industry and agriculture are rarely existed without HC-hydrocarbon, as well as city-living will be quite difficult without them. Despite of active search of new sources of energy by foreign researchers and investment in alternative energetics, Gazprom and other companies leading in FEC still play the key role at this market.

The largest companies of Russia in term of annual turnover

According to the analyses of the largest companies of Russia in term of turnover (Top-100), excluding FEC enterprises accumulating 58,4% of total annual turnover for 2015, quite high share falls for companies engaged in trade (14,1%), metallurgy (6,2%), transport (5,6%), electric power (4,1%), chemistry and petro-chemistry (3,6%), communications (3,6%), etc.

These figures are self-explanatory: currently the national economy is quite diversified (see picture 1).

Picture 1. Distribution of total revenue of Top-100 companies of Russia by sectors, % according to the results of 2015

Picture 1. Distribution of total revenue of Top-100 companies of Russia by sectors, % according to the results of 2015The table of leaders according to the results of 2015 and compared to 2014 has not been significantly changed: seven of ten from Top-10 companies are included in FEC, wherein Gazprom leaved its long-time competitor, Rosneft Oil Company, behind and took the lead. Turnover of gas corporation amounted to 4 334,3 bln RUB that is equivalent to USD 70,7 bln at the mid-year ruble-dollar rate. For example Wal-Mart, American retail corporation, leading in the world by annual revenue, has an annual turnover of USD 482,1 bln.

Retailers Tander (Magnit chain) and Trading House Perekrestok have demonstrated the largest increase in revenue (see table 1).

| № | Company | Annual turnover for 2015,Bln RUB. | Increase (decrease) in turnover to 2014, % | Sector |

| 1 | PJSC Gazprom | 4 334,3 | 8,6 | FEC |

| 2 | PJSC Oil Company Rosneft | 3 831,1 | -10,9 | FEC |

| 3 | PJSC Russian Railways | 1 510,8 | 7,8 | Transport |

| 4 | PJSC GAZPROM NEFT | 1 273,0 | 1,9 | FEC |

| 5 | JSC TANDER (Magnit) | 1 032,0 | 24,3 | Trade |

| 6 | PJSC SURGUTNEFTEGAZ | 978,2 | 13,4 | FEC |

| 7 | LLC GAZPROM MEZHREGIONGAZ | 853,5 | -4,8 | FEC |

| 8 | PJSC TRANSNEFT | 756,9 | 5,5 | FEC |

| 9 | JSC TRADING HOUSE PEREKRESTOK | 726,4 | 24,6 | Trade |

| 10 | LLC LUKOIL-West Siberia | 695,8 | 11,0 | FEC |

The largest companies of Russia by net profit

Net profit is another indicator speaking about engines of the Russian economy.

FEC is also leading by this indicator: 71% of total net profit of Top-100 companies is accumulated in this sector (see picture 2). The second place is taken by the ferrous and nonferrous metallurgy (8,9%) and then follows the chemistry and petro-chemistry (4,8%).

Besides traditional industries, Top-100 contains IT-company Yandex, providing services in Russia, CIS, Turkey and France.

Picture 2. Distribution of total net profit of Top-100 companies of Russia by sectors, % according to the results of 2015.

Picture 2. Distribution of total net profit of Top-100 companies of Russia by sectors, % according to the results of 2015.Mining and Metallurgical Company "Norilsk Nickel", world's No. 1 in nickel production, grew 2015 net profit by 329% (almost in 4 times).

Following the results of 2015, the largest net profit was recorded for Surgutneftegaz (751,4 bln RUB), that exceeds Gazprom’s results (403,5 bln RUB) almost in two times (see table 2).

| № | Company | Net profit in 2015, bln RUB | Increase (decrease) in net profit to 2014 г., % | Sector |

| 1 | PJSC SURGUTNEFTEGAZ | 751,4 | -15,7 | FEC |

| 2 | PJSC GAZPROM | 403,5 | 113,5 | FEC |

| 3 | PJSC Oil Company Lukoil | 302,3 | -18,7 | FEC |

| 4 | PJSC Oil Company Rosneft | 239,4 | -52,2 | FEC |

| 5 | JSC ROSNEFTEGAZ | 149,4 | -18,8 | FEC |

| 6 | PJSC MMC NORILSK NICKEL | 146,2 | 329,3 | Mettalurgy |

| 7 | PJSC ORENBURGNEZT | 98,7 | -3,2 | FEC |

| 8 | LLC LUKOIL-West Siberia | 97,0 | 15,6 | FEC |

| 9 | JSC TATNEFT named after V.D. Shashin | 85,0 | 3,6 | FEC |

| 10 | PJSC NOVATEK | 84,1 | 101,4 | FEC |

Except key figures of activity, the most expensive companies of Russia by total assets worth and current market capitalization should be mentioned.

The largest companies of Russia by assets worth

Gazprom is on the top of the rating of the most expensive companies by total assets worth: in 2015 they were assessed in almost 13 tln RUB. The second place is for Oil Company Rosneft (9,4 tln RUB) and Russian Railways are the third (5,1 tln RUB). The sum of assets of Top-10 companies will exceed 42 tln and be a half of the Russian GDP.

The state controls the majority of companies in the list, and plans of Rosneft privatization for tinkering with the budget seem to be reasonable – the company is a sweet spot in the governmental property. The opponents of the accommodating approach speak about undesirability of these measures. Background of the nearest Eastern European countries where the sale of the most expensive assets in the governmental property took place, lead to disappearance of some real economy segments or their complete degradation.

| № | Company | Assets volume in 2015, bln RUB | Increase (decrease) in assets to 2014, % | Sector |

| 1 | PJSC Gazprom | 12 981,2 | 6,0 | FEC |

| 2 | PJSC Oil Company Rosneft | 9 449,9 | 21,3 | FEC |

| 3 | PJSC Russian Railways | 5 057,1 | 4,3 | Transport |

| 4 | PJSC SURGUTNEFTEGAZ | 3 704,5 | 22,8 | FEC |

| 5 | JSC ROSNEFTGAZ | 2 834,8 | 25,6 | FEC |

| 6 | PJSC Oil Company Lukoil | 2 023,2 | 15,2 | FEC |

| 7 | SUE MOSCOW METRO | 1 601,9 | 10,6 | Transport |

| 8 | JSC ATOMENERGOPROM | 1 473,8 | 3,6 | Electric power |

| 9 | PJSC ROSENERGOATOM CONCERN | 1 470,7 | 8,5 | Electric power |

| 10 | PJSC GAZPROM NEFT | 1 400,5 | 19,5 | FEC |

The largest companies of Russia by market capitalization

Currently, following the results of stock exchange trading, Oil Company Rosneft is first by the market capitalization: in November 2016 its capitalization approached to 3,7 tln RUB.

On November 28 Sberbank, being the third, for several hours was the most expensive company that indicates volatility of trades.

Comparing the assets volume and market capitalization, it is reasonable to conclude that the Russian business is highly underestimated. Assets of Oil Company Rosneft’s exceed the market capitalization in 2,6 times. Enormous potential for assets market growth is obvious, while now it is under the pressure of external fundamental grounds (statements of politics and opinion of financial institutions, volatility in oil market) and doesn’t indicate the real cost of enterprises.

| № | Company | Current market capitalization, bln RUB | Share in total capitalization of all PJSC in Russia, % | Sector |

| 1 | PJSC Oil Company Rosneft | 3 682,3 | 10,9 | FEC |

| 2 | PJSC GAZPROM | 3 539,0 | 10,5 | FEC |

| 3 | PJSC SBERBANK of Russia | 3 350,9 | 9,9 | Banks |

| 4 | PJSC Oil Company Lukoil | 2 700,5 | 8,0 | FEC |

| 5 | PJSC NOVATEK | 2 208,9 | 6,5 | FEC |

| 6 | PJSC MMC NORILSK NICKEL | 1 660,0 | 4,9 | Metallurgy |

| 7 | PJSC SURGUTNEFTEGAZ | 1 042,8 | 3,1 | FEC |

| 8 | PJSC MAGNIT | 991,7 | 2,9 | Trade |

| 9 | PJSC GAZPROM NEFT | 913,9 | 2,7 | FEC |

| 10 | PJSC BANK VTB | 891,0 | 2,6 | Banks |

Though complicated economic conditions, the Russia companies have potential for growth. Currently about 4,6 mln companies operates in the country. Domestic economy is quite diversified. There are industries where the losses after the dissolution of the Soviet Union are observed - first of all, it is about engineering industry and machine tool industry. Conversely, companies of next generation have appeared for the relative short time range: IT, mobile operators, trade chains, even nowadays are approaching to FEC and metallurgy corporations by financial indicators.