The requirements for SMEs are changed

The Federal Law №313-FZ of 03.08.2018 introduces amendments to the Federal Law «On development of small and medium-sized enterprises in the Russian Federation».

The amendments removed restrictions on a limit share (49%) of foreign legal entities in the authorized capital of small and medium-sized enterprises (SMEs).

This refers to the foreign legal entities related to small and medium-sized enterprises, which are not registered in offshore zones. In addition the procedure for identification of foreign legal entities as the SMEs is defined. Audit companies make a conclusion based on legally confirmed criteria: average employees number and turnover.

Meanwhile, it is introduced, that in order to maintain the Unified register of SMEs, once a year the audit companies should submit the list of limited liability companies to the Federal Tax Service of Russia. The list should contain the companies with foreign legal entities as shareholders as of January 1 of the current calendar year. The list will be formed by audit companies based on the analysis of statements provided to the tax authorities in countries where they were established.

The Law also clarifies the procedure, regulating the annual inclusion of information on joint stock companies in the Unified register of SMEs on the basis of data received by the Federal Tax Service of Russia from share registrars.

Besides, business partnerships can now be classified as SMEs.

The Law also empowers NAO Federal Corporation for Development of Small and Medium Enterprises to provide services for the development of SMEs, including the information, marketing, financial and legal support of SMEs and individuals intending to start commercial activities.

The Federal law has already entered into force with the exception of certain provisions, which will come into operation from 01.12.2018.

At the same time, the Federal Law №322-FZ of 03.08.2018 amending the Federal Law «On insurance of deposits of individuals in banks of the Russian Federation» and other legislative acts of the Russian Federation was adopted. According to the amendments, from 01.01.2019 the deposit guarantee scheme will include the small businesses contained in the Unified register of SMEs.

The funds of small enterprises do not pass the insurance procedure in case they are placed in deposits certified by deposit certificates or placed in subordinated deposits. Herewith, banks are obliged to keep records of liabilities to depositors in such a way as to provide the ability to determine funds on the same balance accounts being or not being subject to insurance.

Banks are also obliged to update information on depositors - small enterprises.

The right to compensation for deposits for small enterprises arises under the condition of registration in the Unified registry of SMEs as of the occurrence of the insured event.

As of 10.08.2018, 5922420 entities employing 16053300 workers are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Detailed information about activities of the registered companies is available by subscription to the systemGlobas

Activity trends of Nizhniy Novgorod companies

Information agency Credinform has observed trends in the activity of the largest real economy companies of Nizhniy Novgorod region. Enterprises with the largest volume of annual revenue (TOP-10 and TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2012-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets -indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № in TOP-1000 | Name, INN, main type of activity | Net assets value, bln RUB | Solvency index Globas | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 | AO TRANSNEFT-VERKHNYAYA VOLGA INN 5260900725 Oil transportation by pipeline |

100.06 100.06 |

107.53 107.53 |

113.74 113.74 |

123.66 123.66 |

132.03 132.03 |

180 High |

| 2 | JSC VYKSA STEEL WORKS INN 5247004695 Manufacture of steel pipes, hollow profiles and fittings |

68.23 68.23 |

54.82 54.82 |

54.51 54.51 |

74.50 74.50 |

95.19 95.19 |

174 Superior |

| 3 | LLC LUKOIL-NIZHEGORODNEFTEORGSINTEZ INN 5250043567 Manufacture of oil products |

89.31 89.31 |

110.26 110.26 |

96.66 96.66 |

66.95 66.95 |

70.76 70.76 |

195 High |

| 4 | JSC IDGC of Centre and Volga Region INN 5260200603 Power transmission and technological connection to distribution systems |

48.95 48.95 |

49.79 49.79 |

50.33 50.33 |

52.48 52.48 |

62.15 62.15 |

162 Superior |

| 5 | LLC RUSVINYL INN 5262218620 Manufacture of basic chemicals, fertilizers and nitrogen compounds, plastics and synthetic rubber in primary forms |

33.11 33.11 |

32.36 32.36 |

23.99 23.99 |

27.71 27.71 |

25.30 25.30 |

272 Medium |

| 996 | LLC A.S.& PALITRA INN 5012049730 Manufacture of wallpapers |

-0.14 -0.14 |

-1.06 -1.06 |

-1.43 -1.43 |

-0.86 -0.86 |

-1.19 -1.19 |

337 Adequate |

| 997 | HYGIENE TECHNOLOGIES LTD INN 5261058974 Manufacture of paper products of utility and sanitary-hygienic purpose |

-0.12 -0.12 |

-0.75 -0.75 |

-1.35 -1.35 |

-0.87 -0.87 |

-1.14 -1.14 |

277 Medium |

| 998 | LLC GAZ GROUP INN 7730522644 Market situation survey and public opinion research |

-0.10 -0.10 |

-0.32 -0.32 |

-0.59 -0.59 |

-0.98 -0.98 |

-1.09 -1.09 |

285 Medium |

| 999 | LLC KSTOVO INDUSTRIAL PARK 1 INN 5260200272 Site preparation |

-1.00 -1.00 |

-2.03 -2.03 |

-2.53 -2.53 |

-2.11 -2.11 |

-1.90 -1.90 |

283 Medium |

| 1000 | JSC NIZHEGORODSKY MACHINE BUILDING PLANT INN 5259008768 Manufacture of weapons and ammunition |

-1.33 -1.33 |

-1.27 -1.27 |

-2.59 -2.59 |

-2.28 -2.28 |

-2.26 -2.26 |

232 Strong |

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period.

— decline of the indicator to the previous period.

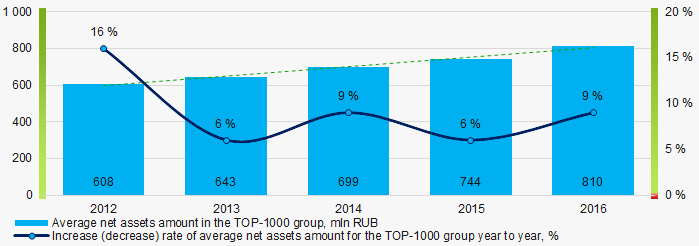

For a five-year period average amount of net assets of TOP-1000 companies have increasing tendency (Picture 1).

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2012 – 2016

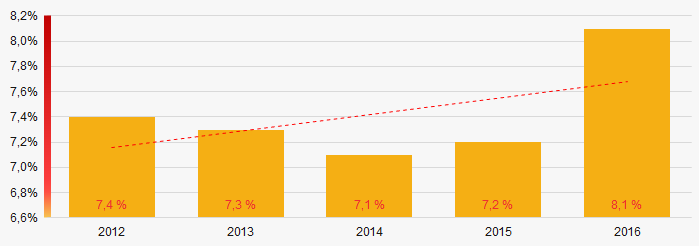

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2012 – 2016 Besides, share of companies with insufficiency of property in the TOP-1000 has grown for the last five years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companiesSales revenue

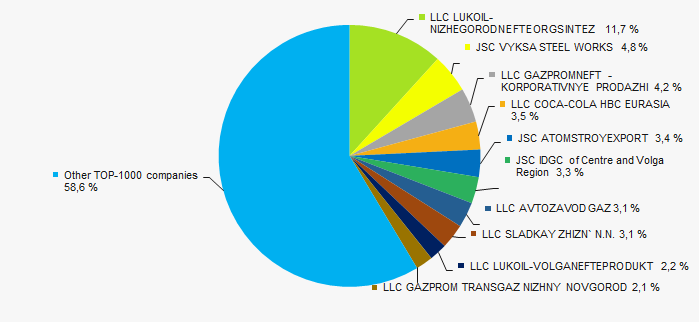

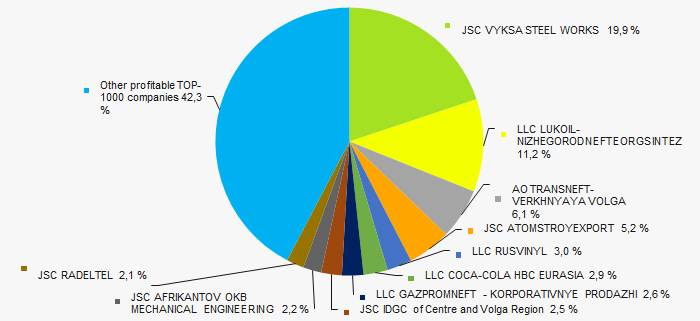

The revenue of 10 leaders of the industry made 41% of the total revenue of TOP-1000 companies in 2016(Picture 3). It demonstrates concentration of large companies in Nizhniy Novgorod region

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016

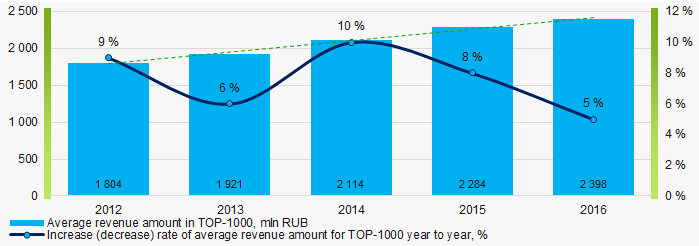

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016In general, an increasing tendency in volume revenue is observed (Picture 4).

Picture 4. Change in the average revenue of TOP-1000 companies in 2012 – 2016

Picture 4. Change in the average revenue of TOP-1000 companies in 2012 – 2016Profit and losses

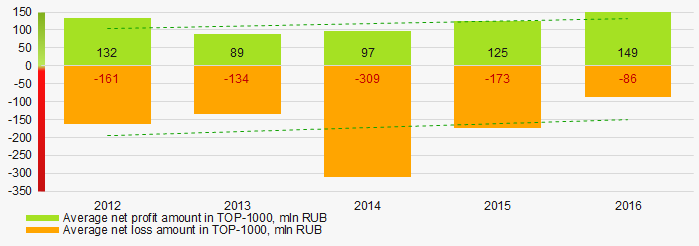

The profit volume of 10 leading enterprises in 2016 made 58% of the total profit of TOP-1000 companies (Picture 5).

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016Over a five-year period, the average values of net profit indicators of TOP-1000 companies tend to increase. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of profit and loss of TOP-1000 companies in 2012 – 2016

Picture 6. Change in the average indicators of profit and loss of TOP-1000 companies in 2012 – 2016Key financial ratios

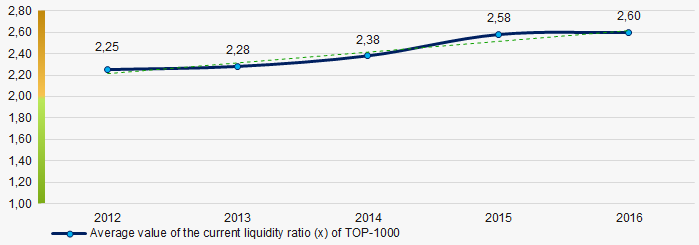

Over the five-year period the average indicators of the current liquidity ratio of TOP-1000 were above the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2012 – 2016

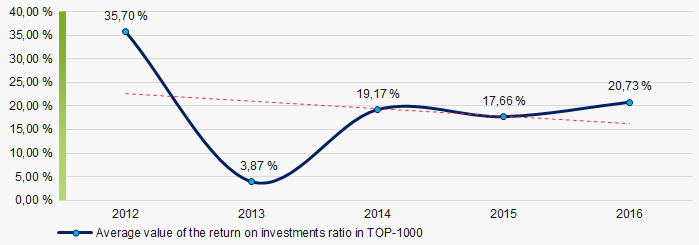

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2012 – 2016Decreasing tendency in the indicators of the return on investment ratio has been observed for five years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2012 – 2016

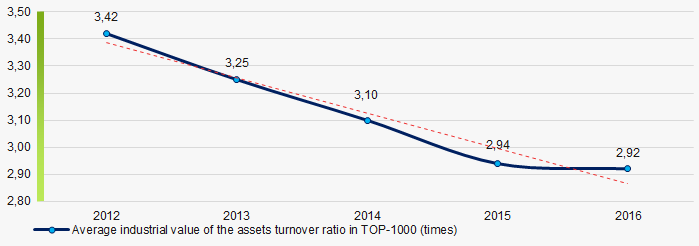

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2012 – 2016Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a five-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2012 – 2016

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2012 – 2016Production structure

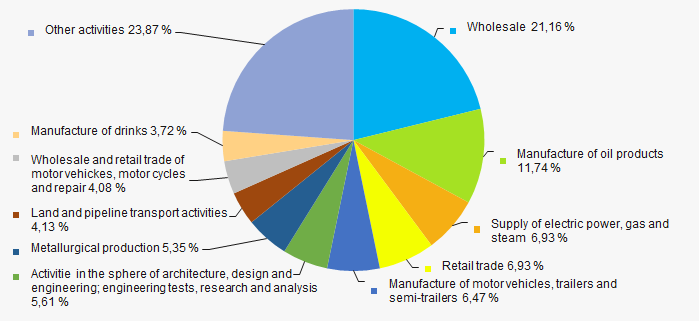

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in wholesale and manufacture of oil products (Picture 10).

Picture 10. Distribution of companies by types of output in the total revenue of TOP-1000, %

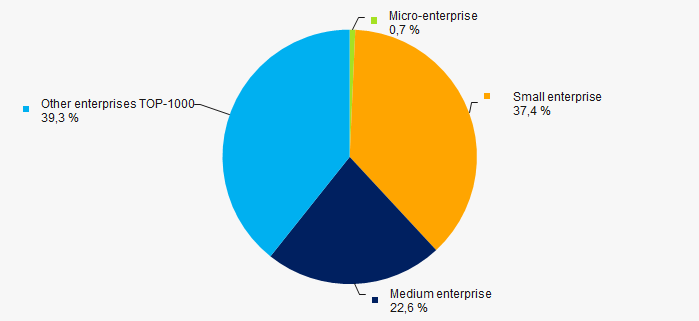

Picture 10. Distribution of companies by types of output in the total revenue of TOP-1000, %61% of TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF (Picture 11).

Picture 11. Shares of small and medium enterprises in TOP-1000 companies, %

Picture 11. Shares of small and medium enterprises in TOP-1000 companies, %Financial position score

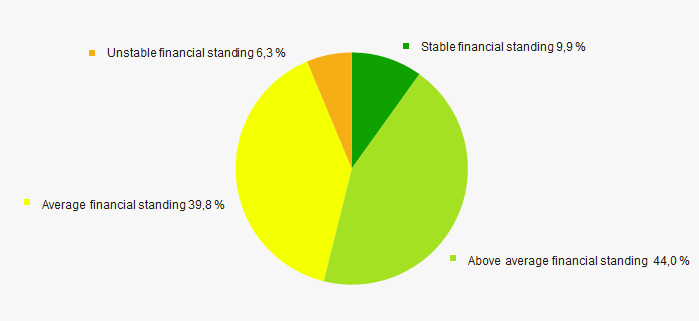

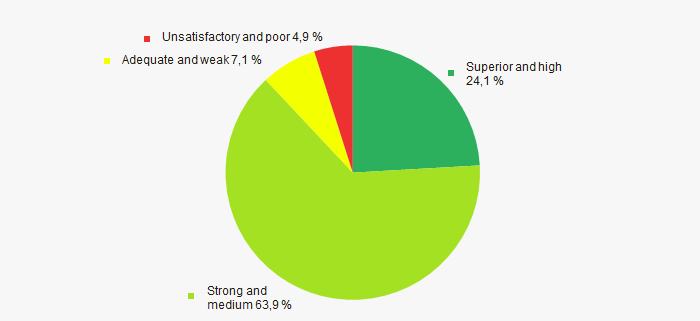

An assessment of the financial position of TOP-1000 companies shows that the largest number is in a stable financial position and above the average. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index Globas Conclusion

Comprehensive assessment of the activity of largest companies of real sector of economy of Nizhniy Novgorod region, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends. However, among negative factors are increase of share of companies with insufficiency of property, decreasing indicators of return on investment and return on assets ratios.

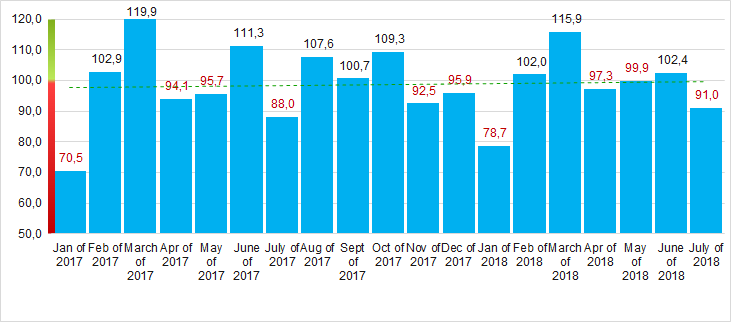

According to the data from the Federal State Statistics Service, tendency for slight increase of the Industrial production index is observed in Nizhniy Novgorod region in 2017 – 2018 (Picture 14). In 2017 industrial production has 1% decreased at average, and for 7 months of 2018 – decrease amounted to 1,8%. In general, for the period of 2017 – 2018 industrial production has 1,3% decreased.

Picture 14. Industrial production index in Nizhniy Novgorod region in 2017 – 2018, month to month (%)

Picture 14. Industrial production index in Nizhniy Novgorod region in 2017 – 2018, month to month (%)