Compulsory requirement for business entities to have a corporate seal is canceled

Two months have passed since the Federal law №82-FL “On amending certain legislative acts of the Russian Federation with regard to the abolishment of a compulsory requirement for business entities to have a corporate seal” as of 06.04.2015 has come into force.

Changes are applied to 15 acting legislative documents, the most important of which are:

- Part II of the Civil Code of the RF;

- The Labor Code of the RF;

- The Arbitration Procedure Code of the RF;

- The Code of Civil Procedure of the RF;

- Laws:

- - №208-FL "On joint-stock companies";

- - №14-FL "On limited liability companies";

- - №39-FL "On securities market";

- - №122-FL " On state registration of rights to real estate and dealings with it";

- - №102-FL "On mortgage (pledge of real estate)";

- - №229-FL "On enforcement proceedings";

- - №44-FL "On the contract system for the procurement of goods, works and services for the supply of government and municipal needs ".

The following federal laws were also amended: on state regulation of the production and circulation of ethyl alcohol and alcohol products; privatization of state and municipal property; protection of legal entities' and individual entrepreneurs' rights in the course of state control (supervision) and municipal control; customs regulation.

The development of the law was carried out in the context of the implementation of measures approved by the Order of the Chairman of the Government of the Russian Federation №317-r «Optimization of procedures for the registration of legal entities and individual entrepreneurs» as of March 7, 2013 and pursuant to the Decree of the President of the Russian Federation on May 7, 2012 № 596 «About long-term state economic policy». When preparing the draft law, the legislature based on international experience enables entrepreneurs to choose methods and means of documents protection and apply modern forms such as digital signature, secure forms, holograms etc.

On the one hand, according to analysts, the presence of the seal does not guarantee the authenticity of the document because of the technologies development; on the other hand, cancellation of seals reduces the level of documents security. This may exacerbate the problem of forgery and thus increase competition in the market of electronic signature certificates.

As a result of generalization the amendments can be summarized in the following key positions:

- the amendments applying only to business entities not required to have a seal, but with the right to have;

- the seal is obligatory for all companies registered before the act came into force;

- information on seal should be spelled out in the statute;

- the seal is equated to the individual attributes of the organization on a par with the logo or trademark, and does not have to be round;

- both at the federal level and in the regulations the obligatory sealing persists in certain cases (strict reporting forms, declarations and other tax statements, etc.).

The majority of experts tend to believe that business entities should not rush to give up the practice of sealing before amending the relevant laws and regulations.

However, the amendments facilitate the process of registration of legal entities, make doing business more secure for entrepreneurs and stimulate further implementation of digital signature, legally relevant electronic documents exchange systems and integrated information support of business.

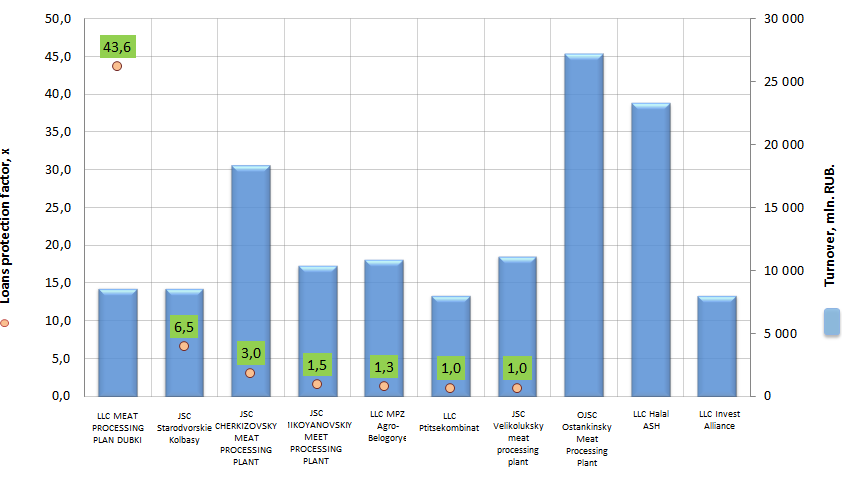

Loans protection factor of the leading Russian meat processing companies

Information Agency Credinform has prepared the ranking of the largest meat processing companies in Russia by decrease in loans protection factor.

The largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period for the year 2013; the companies are engaged in meat and poultry processing, manufacture of finished products (sausages, semi-finished products, meat fillings etc.). Loans protection factor and solvency index GLOBAS-i® of the Information Agency Credinform were calculated for each company.

Loans protection factor (x) – is a ratio of pre-tax earnings and loan interest to the sum of interest payable. It characterizes the security level of creditors from non-payment of interest for the granted loan and shows how many times during the reporting period the company earned means to pay the interest on loans.

The recommended value is >1. If the protection factor is not calculated, then, according to the company’s financials, there is no interest payable to creditors.

For the most full and fair opinion about the company’s financial condition, not only the average revenue values should be taken into account, but also the whole set of financial data.

The negative value of the protection factor indicates about the company’s loss for the last analyzed period.

| № | Name | Region | Revenue, mln. RUB., 2013 г. | Loans protection factor, x | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | LLC MEAT PROCESSING PLAN DUBKI INN 6432013128 |

Saratov region | 8 662,9 | 43,6 | 216 high |

| 2 | JSC Starodvorskie Kolbasy INN 3328426780 |

Vladimir region | 8 634,1 | 6,5 | 229 high |

| 3 | JSC CHERKIZOVSKY MEAT PROCESSING PLANT INN 7718013714 |

Moscow | 18 396,9 | 3,0 | 188 the highest |

| 4 | JSC MIKOYANOVSKIY MEET PROCESSING PLANT INN 7722169626 |

Moscow | 10 437,1 | 1,5 | 205 high |

| 5 | LLC MPZ Agro-Belogorye INN 3123183960 |

Belgorod region | 10 907,0 | 1,3 | 270 high |

| 6 | LLC Ptitsekombinat INN 2631029799 |

Stavropol region | 8 083,2 | 1,0 | 235 high |

| 7 | JSC Velikoluksky meat processing plant INN 6025009824 |

Pskov region | 11 187,7 | 1,0 | 275 high |

| 8 | OJSC Ostankinsky Meat Processing Plant INN 7715034360 |

Moscow | 27 240,2 | - | 197 the highest |

| 9 | LLC Halal ASH INN 5050046264 |

Moscow region | 23 342,2 | - | 293 high |

| 10 | LLC Invest Alliance INN 5074028377 |

Kaluga region | 8 039,0 | - | 193 the highest |

According to the latest financial statements (2013), the revenue of the leading meat processing companies in Russia (Top-10) amounted to 134,9 bln. RUB., that is 13,4% higher that total revenue of the enterprises in 2012 (118,4 bln. RUB.).

Picture 1. Loans protection factor and revenue of the leading meat processing companies in Russian Federation (Топ-10)

According to the financial statements, 3 out of 10 participants from the Top-10 list had no interest payable to creditors; that can be considered from the positive side. These are - OJSC Ostankinsky Meat Processing Plant, LLC Halal ASH and LLC Invest Alliance.

OJSC Ostankinsky Meat Processing Plant – is the leading manufacturer of meat processing and semi-finished products in Russia. The enterprise was founded in 1954.

The company owns 13 trade houses, 7 brand shops in Moscow and one of the most modern pig farms in the country.

7,700 employees, each of which is a professional in its field, work at plant (manufactures 500 tons of products per day). All production facilities are equipped with the latest German and Austrian equipment. The combination of these factors allows to adhere to the international standards in manufacture of products, the quality, naturalness and taste of which are held in esteem among buyers.

Since 2006 the plant is officially recognized as a leader of meat-processing industry.

According to 2011 results, the plant kept the leading positions among manufacturers of sausage and meat production. Sales volume in 2011 amounted to 156 th. tons.

Sales volume in 2014 exceeded 180 th. tons.

LLC Halal ASH – is a professional refiner and manufacturer of meat, sausage and semi-finished products under «Halal» trade mark. In order to meet the needs of the Muslim population of the capital and the region, in 1997 under the spiritual patronage of the Muslim community in Moscow and the Moscow region, the sausages shop «Halal Ash» was opened. It allowed significantly expand the range of meat products. Today the company’s products are represented in all stores.

LLC Invest Alliance manufactures meat semi-finished products and other processed meat products; the company's production facility is located in Ermolino city (Kaluga region).

The debt load level of other companies from the Top-10 list does not exceed the permissible parameters; the loans protection factor is above 1; in other words, in case of simultaneous demand by creditors of all invested funds, the companies will be able to pay them at the expense of available profit (before tax). Usually, such situations do not happen in the market, so the financial condition of the industry’s largest companies is stable at the moment.

It is proved by the independent assessment of the Information Agency Credinform – all participants of Top-10 list have the highest and high solvency index, this fact shows the ability of market participants to meet their obligations in time and fully; the risk of unfulfillment is low.