Mechanic engineering companies in Nizhniy Novgorod

Information agency Credinform represents a ranking of the largest mechanic engineering companies in Nizhniy Novgorod. Companies engaged in manufacture of machinery, equipment and vehicles with the largest volume of annual revenue (TOP 10 and TOP 100) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). They were ranked by the solvency ratio (Table 1). The selection and analysis were based on the data of the Information and Analytical system Globas.

Solvency ratio (х) is a ratio of equity to total assets. The ratio shows the dependence of the company on external loans. Recommended value: > 0.5.

The ratio reflects the rate of turnover of equity capital. A high value of the ratio indicates the efficient use of own funds, and a low value - about the inaction of a part of own funds.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, activity | Revenue, million RUB | Net profit (loss), million RUB | Solvency ratio (x), >0,5 | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC LIR INN 5256029449 manufacture of other components and accessories for motor vehicles |

9 806 9 806 |

8 055 8 055 |

713 713 |

907 907 |

0,78 0,78 |

0,80 0,80 |

177 High |

| JSC JSC HYDROMASH INN 5262008630 manufacture of parts and components for aircraft and spacecraft |

5 088 5 088 |

4 550 4 550 |

295 295 |

123 123 |

0,77 0,77 |

0,74 0,74 |

218 Strong |

| JSC MAGNA AUTOMOTIVE RUS INN 5256076921 manufacture of other components and accessories for motor vehicles |

14 603 14 603 |

15 193 15 193 |

1 966 1 966 |

2 594 2 594 |

0,64 0,64 |

0,59 0,59 |

141 Superior |

| JSC KRASNOE SORMOVO PLANT INN 5263006629 construction of ships, vessels and floating structures |

11 764 11 764 |

11 709 11 709 |

709 709 |

1 020 1 020 |

0,38 0,38 |

0,50 0,50 |

181 High |

| LLC PRODUCTION AND COMMERCIAL COMPANY LUIDOR INN 5257065753 manufacture of buses and trolleybuses |

4 431 4 431 |

3 538 3 538 |

204 204 |

48 48 |

0,55 0,55 |

0,46 0,46 |

236 Strong |

| JSC GAZ INN 5200000046 manufacture of other components and accessories for motor vehicles |

28 551 28 551 |

25 995 25 995 |

256 256 |

213 213 |

0,33 0,33 |

0,41 0,41 |

220 Strong |

| LLC NIZHEGORODSKIE MOTORY INN 5256067300 manufacture of other components and accessories for motor vehicles |

4 617 4 617 |

4 472 4 472 |

-60 -60 |

-206 -206 |

0,44 0,44 |

0,37 0,37 |

289 Medium |

| LLC ST NIZHEGORODETS INN 5259062324 manufacture of motor vehicles |

3 216 3 216 |

4 687 4 687 |

37 37 |

90 90 |

0,13 0,13 |

0,12 0,12 |

239 Strong |

| LLC AUTOMOBILE PLANT GAZ INN 5250018433 manufacture of motor vehicles |

102 128 102 128 |

90 447 90 447 |

5 950 5 950 |

-3 329 -3 329 |

0,14 0,14 |

0,09 0,09 |

259 Medium |

| JSC PRODUCTION COMPANY AVTOKOMPONENT NIZHNIY NOVGOROD INN 5256087440 manufacture of electrical and electronic equipment for motor vehicles |

3 275 3 275 |

3 566 3 566 |

13 13 |

-31 -31 |

0,04 0,04 |

0,03 0,03 |

309 Adequate |

| Average value for TOP 10 |  18 748 18 748 |

17 221 17 221 |

1 008 1 008 |

143 143 |

0,42 0,42 |

0,41 0,41 |

|

| Average value for TOP 100 |  2 213 2 213 |

2 081 2 081 |

124 124 |

36 36 |

0,26 0,26 |

0,29 0,29 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The average values of the solvency ratio of TOP 10 and TOP 100 are above the industry average and below the recommended ones.

Only three companies of TOP 10 increased their figures in 2020 compared to 2019. In 2019, the growth was recorded for seven companies.

In 2020, seven companies included in TOP 10 reduced revenue and six companies reduced net profit. The average revenue fell 8% and 6% for TOP 10 and TOP 100 respectively. The average profit of TOP 10 and TOP 100 fell 7 times and almost 3 times respectively.

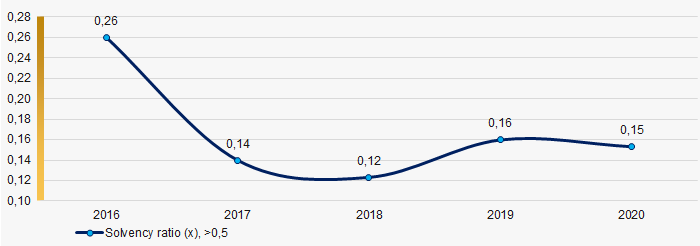

Over the past five years, the growths of the industry average values of the solvency ratio was recorded only for one period. The highest value was recorded in 2016 and the lowest one was in 2018 (Picture 1).

Picture 1. Change in the industry average values of the solvency ratio of the mechanic engineering companies in Nizhniy Novgorod in 2016 - 2020

Picture 1. Change in the industry average values of the solvency ratio of the mechanic engineering companies in Nizhniy Novgorod in 2016 - 2020Trends in business management

Information agency Credinform has prepared a review of trends in activity of the companies engaged in head office management. The largest companies (TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2011 – 2020). The company selection and analysis were based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is JSC ROSNEFTEGAZ, INN 7705630445, Moscow, holding companies management activities. In 2020 net assets of the company amounted to more than 3,3 trillion RUB.

The smallest size of net assets in TOP-1000 had LLC CORPORATE MANAGEMENT COMPANY, INN 2130001337, Chuvash Republic, financial industrial group management activities. The lack of property of the company in 2020 was expressed in negative terms -110 billion RUB.

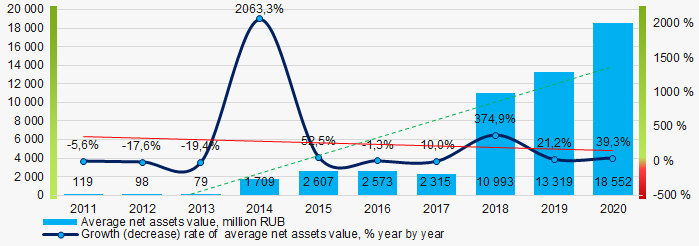

For the last ten years, the average industry values of net assets showed the upward tendency with negative dynamics of growth rates (Picture 1).

Picture 1. Change in average net assets value in 2011 – 2020

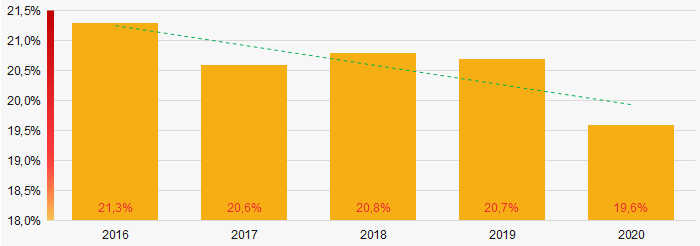

Picture 1. Change in average net assets value in 2011 – 2020For the last five years, the share of ТОP-1000 enterprises with lack of property was relatively high with the positive decreasing trend (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000 in 2016-2020

Picture 2. The share of enterprises with negative net assets value in ТОP-1000 in 2016-2020Sales revenue

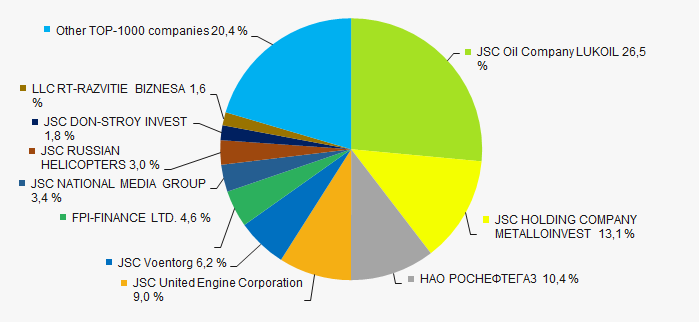

In 2020, the total revenue of 3 largest companies amounted to 50% from ТОP-1000 total revenue (Picture 3). This fact testifies the relatively high level of capital concentration among this type of activities.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2020

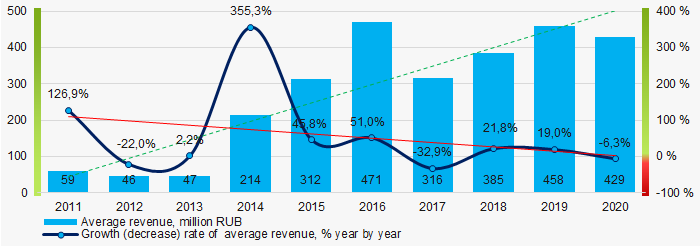

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2020In general, the increasing trend in sales revenue with downward dynamics of growth rates is observed (Picture 4).

Picture 4. Change in average revenue in 2011 – 2020

Picture 4. Change in average revenue in 2011 – 2020Profit and loss

The largest company in terms of net profit is JSC Oil Company LUKOIL, INN 7708004767, Moscow, holding companies management activities. The company’s profit amounted to almost 198 billion RUB.

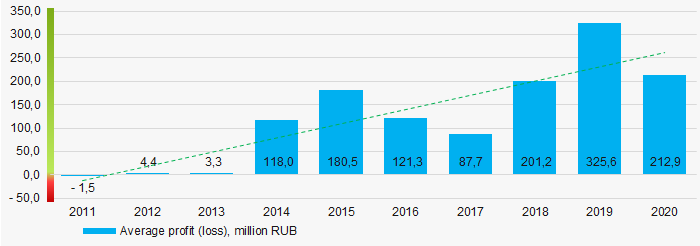

For the last ten years, the average profit values show the increasing tendency (Picture 5).

Picture 5. Change in average profit (loss) in 2011 – 2020

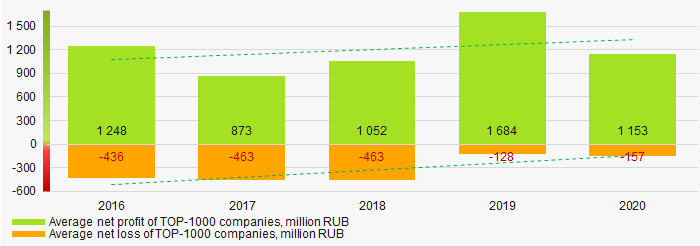

Picture 5. Change in average profit (loss) in 2011 – 2020Over a five-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is decreasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2016 – 2020

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2016 – 2020Main financial ratios

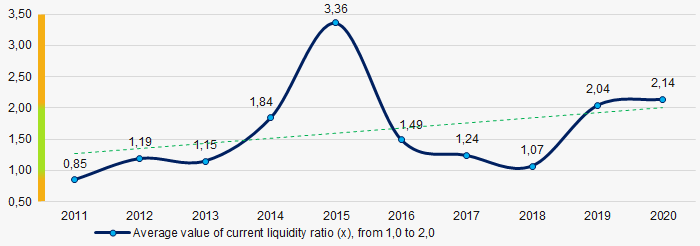

For the last ten years, the average values of the current liquidity ratio were within the recommended values - from 1,0 to 2,0, with growing trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2011 - 2020

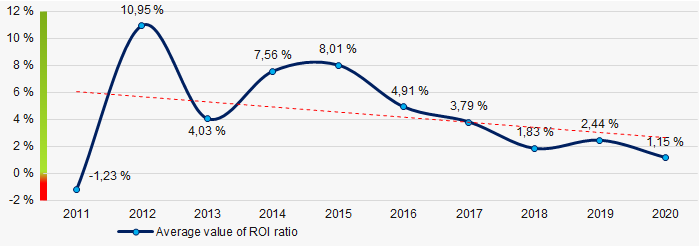

Picture 7. Change in average values of current liquidity ratio in 2011 - 2020Within ten years, the decreasing trend of the average values of ROI ratio is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2011 – 2020

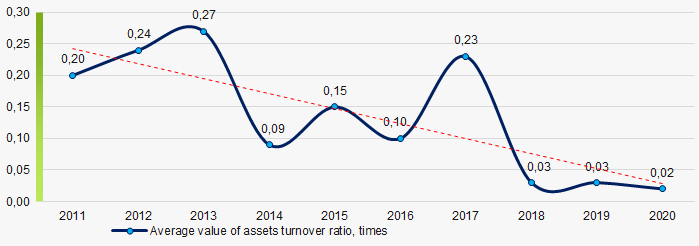

Picture 8. Change in average values of ROI ratio in 2011 – 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last ten years, this business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2011 – 2020

Picture 9. Change in average values of assets turnover ratio in 2011 – 2020Small businesses

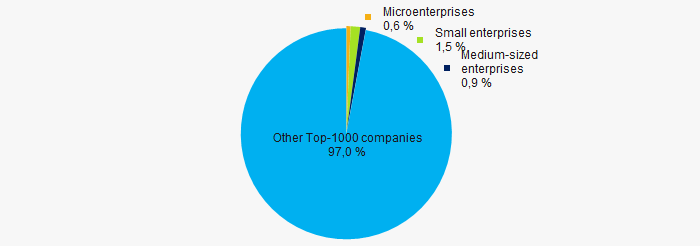

74% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue is only 3%, which is significantly lower than the national average value in 2018 – 2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

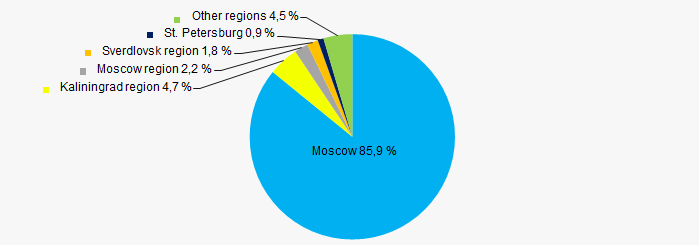

TOP-1000 companies are registered in 68 regions of Russia (this is 80% of territorial subjects of the Russian Federation) and are unequally located across the country. Almost 86% of the largest enterprises in terms of revenue are located Moscow (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the regions of Russia

Picture 11. Distribution of TOP-1000 revenue by the regions of RussiaFinancial position score

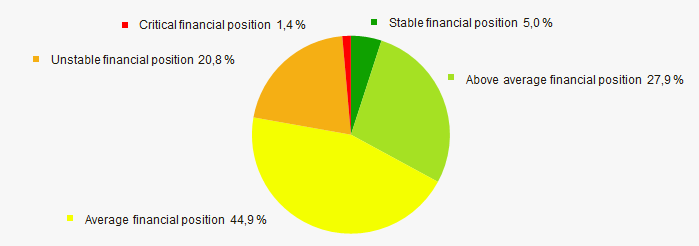

An assessment of the financial position of TOP-1000 companies shows that the largest part has the above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

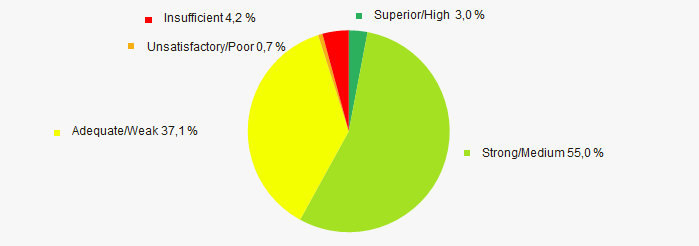

Most of TOP-1000 companies got superior/high and strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasConclusion

A complex assessment of the companies engaged in head office management demonstrates the presence of positive trends within 2011-2020 (Table 1).

| Trends and assessment factors | Relative share, % |

| Dynamics of average net assets value |  10 10 |

| Growth/drawdown rate of average net assets value |  -10 -10 |

| Increase / decrease in the share of enterprises with negative net assets |  5 5 |

| The level of monopolization / competition |  -10 -10 |

| Dynamics of average revenue |  10 10 |

| Growth/drawdown rate of average revenue |  -10 -10 |

| Dynamics of average profit (loss) |  10 10 |

| Growth/drawdown rate of average net profit |  10 10 |

| Growth/drawdown rate of average net loss |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  10 10 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 20% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  0,6 0,6 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor)

unfavorable trend (factor)