The unified tax for the small business: fact or fiction?

On the recent press conference Mikhail Orlov, the chairman of the board of the State Duma Committee on Budget and Taxes, has stated that within the simplification of the small business tax administration policy, the State Duma drafts a bill that is going to introduce the one stop-shop principle for fiscal charges.

The core of the initiative comes down to the fact that all the liabilities of the taxpayer to the state will be united into one payment, which entrepreneur will pay once a year or at other intervals.

Besides, one more important aspect of the reform is being studied. The board of Treasury, not the company itself, is going to distribute the unified payment into different level budgets and into non-budgetary funds. At the moment it is making incursions upon company’s labor hours.

The governmental authorities more often began to speak about the support of the small business, after it became clear than the country’s economy has sunk into stagnation under well external business climate on export goods. Its share in the Russia’s GDP is still low enough, especially in comparison with developed countries. The increase of required insurance payments resulted in the fact that more than 500 thousand small firms were closed down in a short time. Such controversial steps led to boomerang effect – the total tax base has decreased. The offered bill should to some extent compensate the loss.

The unified tax principle is instinctively clear and can be easily implemented in practice both for the payer and for fiscal authorities. The question “what kind of total load will it be for the entrepreneur?” remains undetermined. In fact, it is hard to understand the real effective rate of all the payments, when there are a lot of taxes and the payments are delivered at different times. On the other hand, the high interest amount of the general tax may exert negative psychological effect on the people, starting their business for the first time.

Current assets to equity ratio of organizations, carrying out veterinary activity

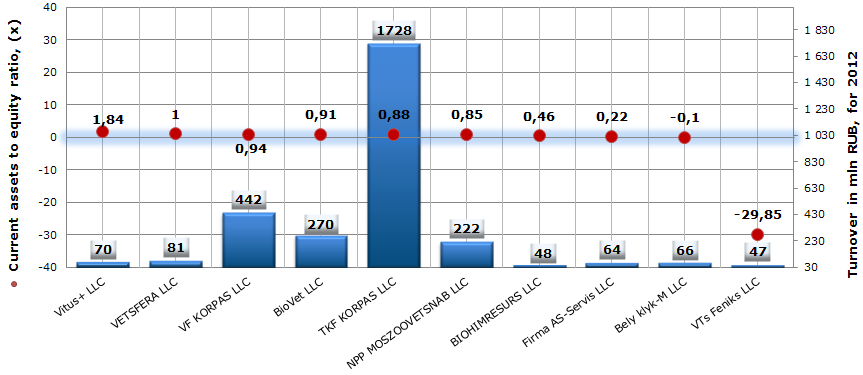

Information agency Credinform prepared a ranking «Current assets to equity ratio of organizations, carrying out veterinary activity in Russia». The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in current assets to equity ratio.

Current assets to equity ratio is calculated as the relation of current assets of a company to total value of equity and shows the ability of the enterprise to maintain the current capital level and to finance current assets in case of need with own sources. The recommended value is from 0,2 to 0,5. The closer is the indicator value to the upper limit of recommended values, the more opportunities has the enterprise for a financial maneuver.

| № | Legal form of organization Name INN | Region | Turnover for 2012, in mln RUB | Current assets to equity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Vitus+ LLC INN 7713094639 |

Moscow | 70 | 1,84 | 280 (high) |

| 2 | VETSFERA LLC INN 7722285397 |

Moscow | 81 | 1 | 315 (satisfactory) |

| 3 | VETERINARNAYA FIRMA KORPAS LLC INN 7715500910 |

Moscow region | 442 | 0,94 | 288 (high) |

| 4 | BioVet LLC INN 7724707870 |

Moscow | 270 | 0,91 | 250 (high) |

| 5 | TKF KORPAS LLC INN 7717620226 |

Moscow | 1728 | 0,88 | 213 (high) |

| 6 | Nauchno-proizvodstvennoe predpriyatie MOSZOOVETSNAB LLC INN 7725047224 |

Moscow | 222 | 0,85 | 239 (high) |

| 7 | BIOHIMRESURS LLC INN 3328479069 |

Vladimir region | 48 | 0,46 | 225 (high) |

| 8 | Firma AS-Servis LLC INN 5032052018 |

Moscow region | 64 | 0,22 | 208 (high) |

| 9 | Bely klyk-M LLC INN 7733080345 |

Moscow | 66 | -0,1 | 279 (high) |

| 10 | Veterinarny tsentr Feniks LLC INN 5007043958 |

Moscow region | 47 | -29,85 | 285 (high) |

Cumulative turnover of the TOP-10 largest Russian companies, carrying out veterinary activity, reached 3039 mln RUB.

The company Vitus+ LLC is at the top of the ranking with the value of current assets to equity ratio 1,84, that is higher than the recommended value, what isn’t also an positive result and can testify that the enterprise has uncovered loss in the accounting period. The company got a high solvency index GLOBAS-i®, that characterizes it as financially stable.

Current assets to equity ratio of organizations, carrying out veterinary activity in Russia, TOP-10

The second place of the ranking belongs to VETSFERA LLC with the current assets to equity ratio equal 1, that points to an imbalance in the company's capital structure. By that the enterprise got a satisfactory solvency index, because, except the loss for the last accounting period, there are data on non-fulfillment of its obligations in time by the enterprise.

Among TOP-10 companies only two - BIOHIMRESURS LLC and Firma AS-Servis LLC – have the indicator value be of interest to us, which corresponds with the recommended values from 0,2 to 0,5. By that the enterprise BIOHIMRESURS LLC has higher financial maneuverability. However, both companies got a high solvency index GLOBAS-i®.

Only two of TOP-10 companies have the negative value of the current assets to equity ratio: Bely klyk-M LLC and Veterenarny tsentr Feniks LLC. Such results can testify to an imbalance in the company's equity structure. At the same time both companies got a high solvency index GLOBAS-i®.

In summary, it should be noted, that for the objective assessment of a company it is necessary to consider the combination of both financial and non-financial indicators. An assessment basing on only one indicator doesn’t provide a complete picture.