TOP-5 global multi-gaming eSports organizations by earnings for 2018

Information agency Credinform represents a ranking of global multi-gaming eSports organizations in term of earnings for 2018.

The first part of research was dedicated to TOP-5 multi-gamins organizations of the CIS. The Credinform experts analyzed the size and audience of eSports market, primary source of revenue, and presented the most popular computer games.

The second part includes analysis of the prize pool won by top teams of the word at the international championships, and their positions in global ratings. TOP-5 of eSports organizations was compiled with Orbis database by Bureau van Dijk.

The revenues of global eSports organizations are significantly different from those of the CIS. The main reason for the low income in the CIS is the lack of large sponsorship contracts. Investors examine carefully this segment, as eSports has recently become a commercially viable and effective business project. In Russia, investors prefer more traditional methods to accumulate capital - oil, gas, precious metals, stones or securities. However, this trend is gradually starting to change. With the development of technology, the growth of the audience and popularization of eSports, there is a smooth inflow of private investments. Today, Russian mobile operators invest their own funds in the development of computer sports, and become general partners. Nevertheless, global foreign organizations are pioneers in the eSports market, and they own most of this segment, hence the significant difference in income.

Today, the news that Nike, Adidas, Kappa or Microsoft have become the main partners of various global multi-gaming organizations is less surprising than 5 years ago.

| Rank | Team | 2018 revenue, million RUB | Prize pool of all time, million RUB | Position in CS: GO global ranking |

Position in Dota 2 global ranking  |

| 1 | Team Liquid (Netherlands) |

1 531,2 | 2 170,9 | 4 | 9 |

| 2 | Fnatic (London) |

1 020,8 | 920,5 | 3 | 8 |

| 3 | Evil Geniuses (USA) |

544,0 | 1 485,5 | 1 | 3 |

| 4 | Astralis (Denmark) |

352,6 | 477,1 | 2 | No Dota 2 team |

| 5 | Ninjas in Pyjamas (Sweden) |

163,8 | 263,8 | 12 | 21 |

| Outside the ranking | |||||

Cloud9 (USA) |

1 850,2 | 590,7 | 37 | Did not participate in the tournament for the last 3 months | |

Source: Orbis database by Bureau van Dijk; data from the Internet sources Forbes, HLTV, esportsearnings, and CQ. Revenue and prize pool converted to rubles at the dollar exchange rate on November 19, 2019.

The first place of the ranking is taken by Team Liquid (1531,2 million RUB). Team Liquid is an internationally renowned professional multi-gaming organization founded in 2000 in the Netherlands. It is one of the most successful eSports organizations in the world. The team unites over 60 cybersportsmen who have become champions in 14 types of computer games. The amount of prize pool won exceeds 2,17 million RUB, that makes the team the global leader. At various tournaments, the organization is a representative of the North American region, since the Americans play in the most teams. It has a sponsorship agreement with the American company Marvel Studios. In November 2019, Team Liquid became the second in the nomination “The Best eSports Organization of the Year” according to the Esports Awards 2019.

The organization’s Counter-Strike team is the 4th in the world. Until recently, the team was on top, but failed at the World Championships in Berlin, and were overtook in the rating. As for CS: GO, the team have never been the world champions. Having won a great number of international tournaments, Team Liquid have never managed to be on the winning side at the most important CS tournament, and left tournaments in the early stages.

Things go much better with Dota 2. The team won The International 2017 with a prize pool of 1,5 billion RUB, and were the second in 2019. For the three-year experience of The International, Team Liquid earned 1,2 billion RUB. However, Dota 2 team considered their results as unsatisfactory and decided to leave the organization. Therefore, Team Liquid was only the 9th in the global ranking.

In terms of income, Fnatic ranks the 2nd (1020,8 million RUB). Based in London, the organization is active since 2004. Fnatic is one of the most popular and titled organizations in the world. Their prize pool won exceeds 920 million RUB. As Team Liquid, Fnatic teams consist of gamers from different regions in the championships. The CS: GO team is comprised only of Swedish gamers, and Dota 2 team consists of representatives from Southeast Asia. In early November 2019, the organization announced a partnership with the Japanese brand Hello Kitty . Thanks to the collaboration, the Fnatic brand will become popular and in demand in Japan, and will bring organization millions of profits.

Fnatic's Counter-Strike team has won all possible prizes. It became a 3-time winner of the World Cup and other serious tournaments. For a long time the team was unequaled, but with the growth of the eSports market, the competition became tougher, and the team climbed down. Until recently, CS team experienced serious gaming problems and closed the world ranking, but substitutions helped to get the 3rd position back.

The organization has never won The International Dota 2. Semifinal in 2016 was the best result in the tournament.

The American organization Evil Geniuses (EG) is the 3rd in the ranking (544 million RUB). It became popular due to its Dota 2 team. In 2015, the team won The International 2015. EG is the only American team who consistently takes high positions in international tournaments. The prize pool won exceeds 1,4 billion RUB. It was Evil Geniuses the former Virtus.Pro player Roman “Ramzes” Kushnarev moved to.

EG did not have CS: GO team. In September 2019, the organization announced the acquire of the team from another organization for 192 million RUB. The team successfully plays under the new tag. It won several serious tournaments and led the world rating.

In 2018, Danish organization Astralis earned 352,6 million RUB. The organization is the most successful in CS: GO. It was created in 2016, and the level of its prize pool for 3 years reached 477,1 million RUB. Counter-Strike team is unique four-time winner of the World Cup. Since 2016, the team won over a half of the tournaments. It is interesting that the gamers of Astralis team are much more popular than the national football team players. The organization successfully creates its clothing line in collaboration with the global brand Jack & Jones.

Ninjas in Pyjamas closes the ranking (163,8 million RUB). The most successful organization in the world was established in 1999 in Sweden. In 2007, the project was closed, but in 2012 it recommenced the activities. The organization became famous thanks to its Counter-Strike team. Gamers won the World Cup, and were unequaled for 2 years. The team got 87 winning streak without defeats. Over its history, the organization received 263,8 million RUB of prize pool.

Another US eSports organization Cloud9 is outside the ranking. Its income level in 2018 exceeded 1,8 billion RUB. The organization successfully applies business ideas to its tag. It creates own clothing line with Puma, and is one of the most popular organizations in the North American region.

The ranking results showed that eSports in the world is developing. Large companies are gradually exploiting the computer sports market, showing that it is not only entertaining, but also commercially profitable. Joint production of clothes, advertising on the Internet, recognition and media, all this helps not only to recapture investments, but also to receive multimillion-dollar profits. This trend cannot go unnoticed, so in the near future large companies will come to the Russian eSports segment.

Activity trends of wine making companies

Information agency Credinform has prepared a review of activity trends of the largest Russian wine producers.

The largest companies (ТОP-100) engaged in grape growing and wine production in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2013 - 2018). The analysis was based on data of the Information and Analytical system Globas.

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest winery in terms of net assets is NAO ABRAU-DYURSO, INN 2315092440, Krasnodar region. In 2018 net assets of the company amounted to more than 4,5 billion RUB. The smallest size of net assets in TOP-100 had LLC LAZURNAYA YAGODA, INN 2309107440, Krasnodar region. The lack of property of the company in 2018 was expressed in negative terms -1,7 billion RUB.

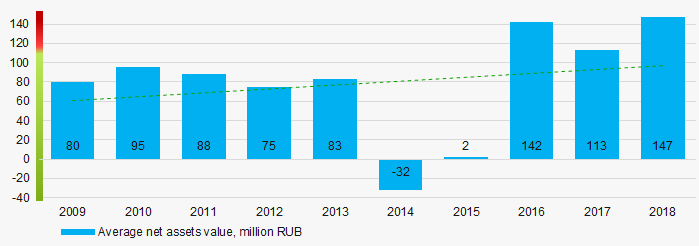

For the last ten years, the average values of net assets showed the growing tendency (Picture 1).

Picture 1. Change in average net assets value in 2009 – 2018

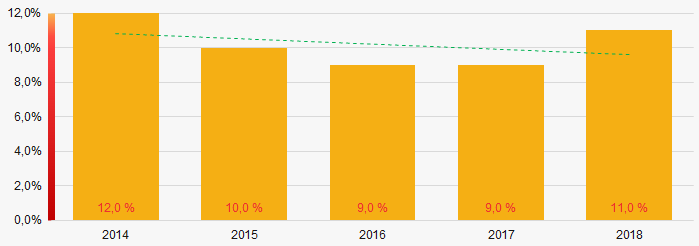

Picture 1. Change in average net assets value in 2009 – 2018For the last five years, the share of ТОP-100 enterprises with lack of property showed the decreasing tendency (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-100

Picture 2. The share of enterprises with negative net assets value in ТОP-100Sales revenue

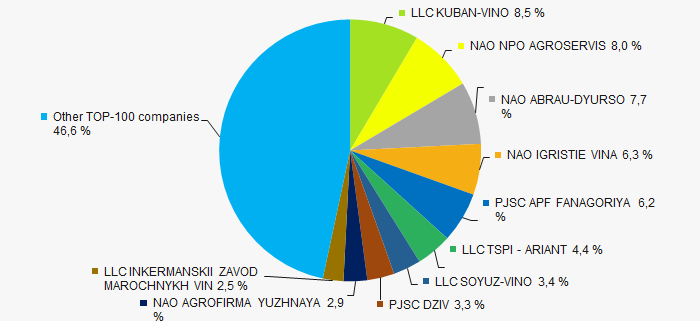

In 2018, the total revenue of 10 largest companies amounted to 53% from ТОP-100 total revenue (Picture 3). This fact testifies the high level of monopolization.

Picture 3. Shares of TOP-10 in TOP-100 total revenue for 2018

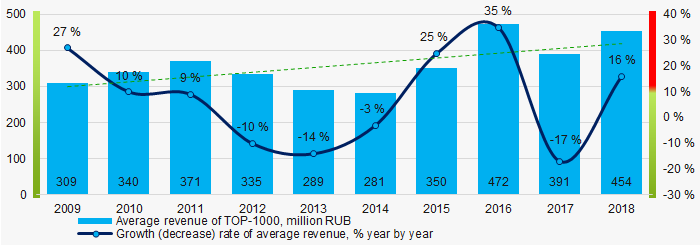

Picture 3. Shares of TOP-10 in TOP-100 total revenue for 2018In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue in 2009 – 2018

Picture 4. Change in average revenue in 2009 – 2018Profit and loss

The largest company in terms of net profit is also NAO ABRAU-DYURSO, INN 2315092440, Krasnodar region. In 2018 the company’s profit amounted to 1,2 billion RUB.

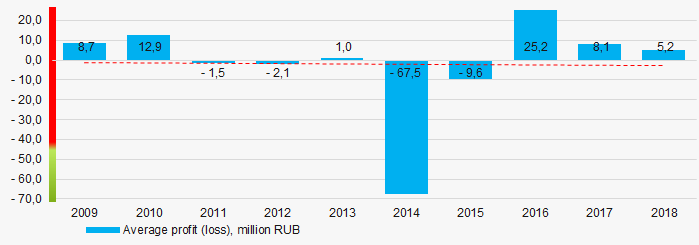

For the last ten years, the average profit values were negative within four years. In general, the decreasing tendency is observed (Picture 5).

Picture 5. Change in average profit (loss) in 2009 – 2018

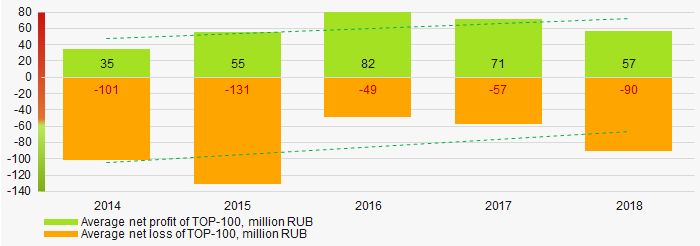

Picture 5. Change in average profit (loss) in 2009 – 2018Over a five-year period, the average net profit values of ТОP-100 show the growing tendency, along with this the average net loss is decreasing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-100 companies in 2014 – 2018

Picture 6. Change in average net profit/loss of ТОP-100 companies in 2014 – 2018Main financial ratios

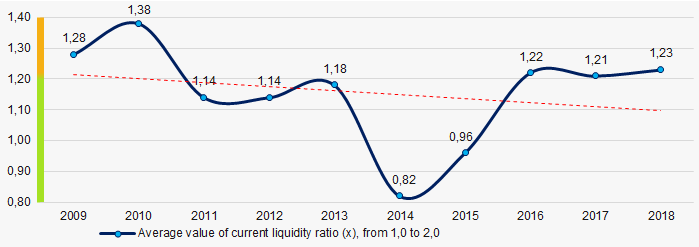

For the last ten years, the average values of the current liquidity ratio were within the recommended values - from 1,0 to 2,0, with decreasing tendency (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio in 2009 – 2018

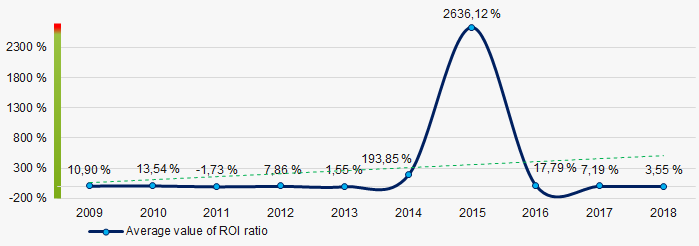

Picture 7. Change in average values of current liquidity ratio in 2009 – 2018For the last ten years, the growing tendency of ROI ratio is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2009 – 2018

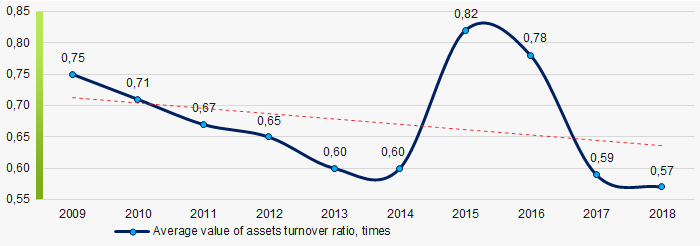

Picture 8. Change in average values of ROI ratio in 2009 – 2018Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last ten years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2009 – 2018

Picture 9. Change in average values of assets turnover ratio in 2009 – 2018 Small businesses

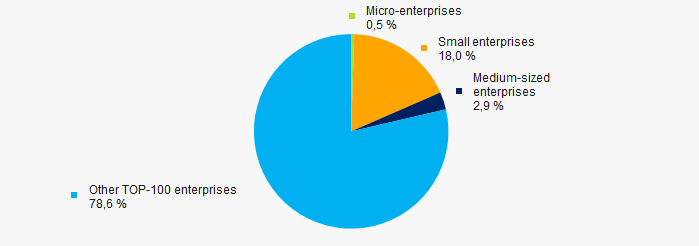

58% of ТОP-100 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-100 total revenue amounted to 21,4%, which is slightly lower than national average value (figure 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-100

Picture 10. Shares of small and medium-sized enterprises in ТОP-100Main regions of activity

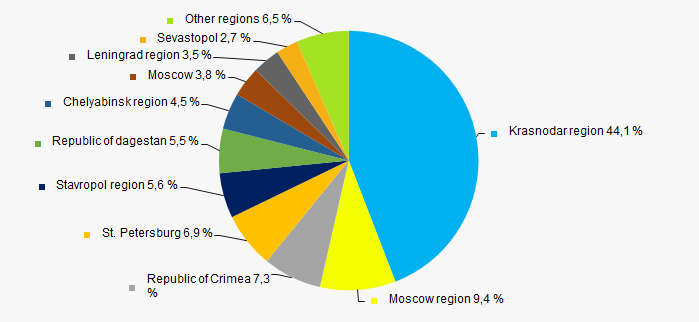

ТОP-100 companies are registered in 18 regions and unequally located across the country, taking into account the geographical location and climatic characteristics of the raw material base. More than 44% of the largest enterprises in terms of revenue are located in Krasnodar region (Picture 11).

Picture 11. Distribution of TOP-100 revenue by regions of Russia

Picture 11. Distribution of TOP-100 revenue by regions of RussiaFinancial position score

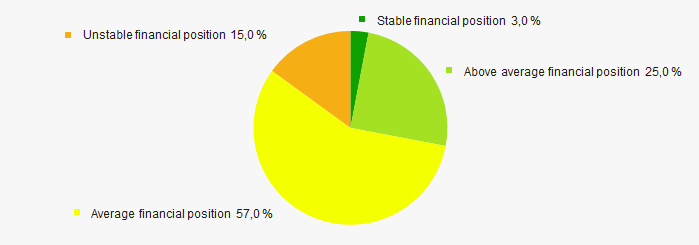

An assessment of the financial position of TOP-100 companies shows that the largest part have the average financial position (Picture 12).

Picture 12. Distribution of TOP-100 companies by financial position score

Picture 12. Distribution of TOP-100 companies by financial position scoreSolvency index Globas

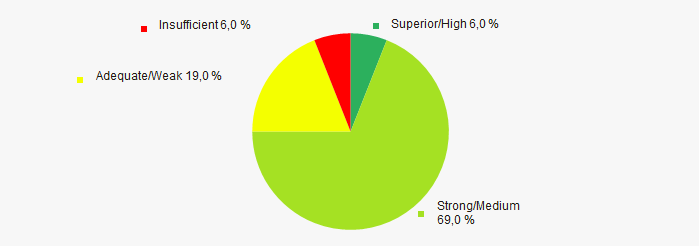

Most of TOP-100 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-100 companies by Solvency index Globas

Picture 13. Distribution of TOP-100 companies by Solvency index GlobasConclusion

A complex assessment of the largest Russian wine producers, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

| The level of competition / monopolization |  -10 -10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  -10 -10 |

| Increase / decrease in average net profit of ТОP-100 companies |  10 10 |

| Increase / decrease in average net loss of ТОP-100 companies |  10 10 |

| Increase / decrease in average values of current liquidity ratio |  -5 -5 |

| Increase / decrease in average values of ROI ratio |  10 10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  -5 -5 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  2,1 2,1 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).