Russia is first in Europe by the industrial production volume

Development of countries in the post-industrial period leads to paradoxical results: countries with up-to-date export-oriented manufacturing will benefit in the long view. Russia is among them.

Nominal GDP volume – the market price of all produced goods and rendered services over a year – is one of the key figures in international comparison of economic development of countries and territories.

Nowadays, services sector is prevalent in modern economies. The majority of countries have embraced the post-industrial period. However, we still in need of houses, electric power and manufactured goods.

GDP calculated using the purchasing power parity (PPP) reflects more objectively the achievements of various countries. Data on contribution of manufacturing to GDP makes it possible to compare countries, assess their significance and share in global industrial production.

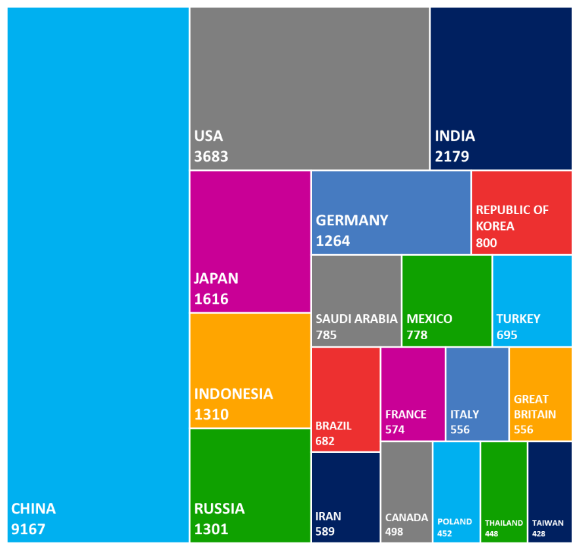

Speaking about the figures, China reasonably has status of “the world’s factory”. Following the results of 2017, over 24% of total industrial production at the amount of 9 167 billion USD at PPP fell for its share. Production makes 39,5% of GDP in China (see Table 1).

Considered as the industrial leader over the last century, now the USA yields the palm: the country produces goods at the amount of 3 683 billion USD or 9,7% of global production, that is 2,5 times less than in China. The United States is trapped with globalization: at the time, American companies have transferred operations to China. This was resulted in huge negative trade balance, which forms particularly due to the trade with China. The country has to import on a massive scale. In this regard, it could well be understood in attempts to remedy the situation by introducing protective duties to reduce dependence on imports.

Being ahead of Germany, Russia is the first in Europe and sixth in the world by industrial production. Our country has developed fuel and energy complex, as well as advanced developments and orders in nuclear power, military-industrial complex, metallurgy, and chemical industry. By the trade surplus volume (when export exceeds import) in absolute monetary terms, Russia ranks third after China and Germany.

| Position | Country | Industrial output volume at PPP, billion USD | Share of manufacturing in GDP, % | Share in global industrial output volume, % | GDP at PPP, billion USD |

| 1 | China | 9 167 | 39,5 | 24,2 | 23 208 |

| 2 | USA | 3 683 | 18,9 | 9,7 | 19 485 |

| 3 | India | 2 179 | 23,0 | 5,8 | 9 474 |

| 4 | Japan | 1 616 | 29,7 | 4,3 | 5 443 |

| 5 | Indonesia | 1 310 | 40,3 | 3,5 | 3 250 |

| 6 | Russia | 1 301 | 32,4 | 3,4 | 4 016 |

| 7 | Germany | 1 264 | 30,1 | 3,3 | 4 199 |

| 8 | Republic of Korea | 800 | 39,3 | 2,1 | 2 035 |

| 9 | Saudi Arabia | 785 | 44,2 | 2,1 | 1 775 |

| 10 | Mexico | 778 | 31,6 | 2,1 | 2 463 |

| - | Top-10 | 22 883 | 30,4 | 60,5 | 75 348 |

| - | Other countries | 14 928 | 28,4 | 39,5 | 52 525 |

| - | Total | 37 811 | 29,6 | 100 | 127 873 |

Source: IMF, World Economic Outlook Database, Credinform calculations

Picture 2 shows distribution of countries by contributions to industrial production. For example, the Great Britain is by 2,3 times behind of Russia – 1 301 billion USD versus 556 billion USD respectively. Once the largest global empire will lose economic and political significance after Brexit.

Picture 1. Top-20 of countries in terms of industrial production volume for 2017, billion USD

Picture 1. Top-20 of countries in terms of industrial production volume for 2017, billion USDSumming up

- China strengthens its status of “the world’s factory”. However, the increasing salaries and ageing of the population could lead to reverse process – corporations will transfer operations to the countries with low-paid work force (India, for instance).

- Due to availability of natural resources and highly developed sectors of heavy industry and fuel and energy complex, the Russia’s contribution to the global division of labor is significant and stable in the long view.

- Occident is losing momentum as the leading industrial countries.

Net profit ratio of the largest Russian coal mining companies

Information agency Credinform represents the ranking of Russian coal mining companies. Coal mining enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 - 2017). Then they were ranked by the revenue volume (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Proceeds from the sale of goods, products, works, services – these are monetary amounts or material values in monetary terms, obtained as a result of business activities after the sale of goods and services.

Net profit ratio is a relation of net profit (loss) of a company to sales revenue.

The revenue and ratio show the scale of an enterprise and the effectiveness of its business activities. As a rule, the larger is company's revenue, the higher is its resistance to the effects of negative factors that could be crushing for small and micro enterprises. Revenue also indicates the production capacity of an organization, especially if you look at this indicator in dynamics. By adding to the analysis of the net profit ratio, it is possible to assess realistically the competitiveness of the company in the market. A high value of the net profit ratio (above the industry average) characterizes a more successful position of the enterprise in relation to its competitors.

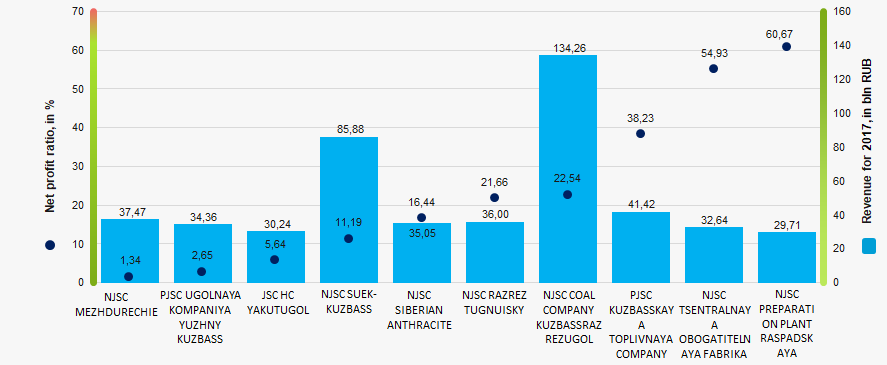

In 2016, about 30% of coal mining companies had the net profit ratio higher than the industry average one, and in 2017 - only 23.8%. This suggests that, in general, the coal industry is not sufficiently effective in terms of the ability of the majority of companies to compete on an equal footing. To a some extent, this is due to a certain concentration: the TOP-10 companies cover 40% of the entire coal mining industry, and the TOP-25 - already more than 65%.

For getting of the most comprehensive and fair picture of the financial standing of enterprises of this sector it is necessary to pay attention to combination of the two considered indicators and take into account the dynamics of their change. The ranking of TOP-10 companies is presented below (Table 1).

| Name, INN, region | Sales revenue, mln RUB | Net profit (loss), mln RUB | Net profit ratio, in % | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| NJSC SUEK-KUZBASS INN 4212024138 Kemerovo region |

105508 105508 |

134255 134255 |

22171 22171 |

30262 30262 |

21 21 |

22,5 22,5 |

204 Strong |

| NJSC COAL COMPANY KUZBASSRAZREZUGOL INN 4205049090 Kemerovo region |

69130 69130 |

85884 85884 |

2690 2690 |

9611 9611 |

3,8 3,8 |

11,1 11,1 |

218 Strong |

| JSC HC YAKUTUGOL INN 1434026980 Republic of Sakha (Yakutia) |

40006 40006 |

41423 41423 |

14051 14051 |

15834 15834 |

35,1 35,1 |

38,2 38,2 |

231 Strong |

| NJSC PREPARATION PLANT RASPADSKAYA INN 4214018690 Kemerovo region |

17527 17527 |

37470 37470 |

843 843 |

503 503 |

4,8 4,8 |

1,3 1,3 |

225 Strong |

| NJSC SIBERIAN ANTHRACITE INN 5406192366 Novosibirsk region |

21485 21485 |

35996 35996 |

2860 2860 |

7795 7795 |

13,3 13,3 |

21,6 21,6 |

205 Strong |

| NJSC RAZREZ TUGNUISKY INN 0314002305 Republic of Buryatia |

32093 32093 |

35049 35049 |

5346 5346 |

5761 5761 |

16,6 16,6 |

16,4 16,4 |

213 Strong |

| NJSC TSENTRALNAYA OBOGATITELNAYA FABRIKA KUZNETSKAYA INN 4218000253 Kemerovo region |

24996 24996 |

34358 34358 |

609 609 |

910 910 |

2,4 2,4 |

2,6 2,6 |

184 High |

| PJSC UGOLNAYA KOMPANIYA YUZHNY KUZBASS INN 4214000608 Kemerovo region |

27758 27758 |

32636 32636 |

7814 7814 |

17926 17926 |

28,1 28,1 |

54,9 54,9 |

233 Strong |

| PJSC KUZBASSKAYA TOPLIVNAYA COMPANY INN 4205003440 Kemerovo region |

21823 21823 |

30237 30237 |

600 600 |

1705 1705 |

2,7 2,7 |

5,64 5,64 |

171 Superior |

| NJSC MEZHDURECHIE INN 4214000252 Kemerovo region |

18907 18907 |

29712 29712 |

11149 11149 |

18026 18026 |

58,9 58,9 |

60,6 60,6 |

197 High |

| Total by TOP-10 companies |  379233 379233 |

497020 497020 |

68132 68132 |

108344 108344 |

|||

| Average value by TOP-10 companies |  37923 37923 |

49702 49702 |

6813 6813 |

10833 10833 |

18,7 18,7 |

23,5 23,5 |

|

| Industry average value |  1652 1652 |

2379 2379 |

203 203 |

386 386 |

12,3 12,3 |

16,2 16,2 |

|

— improvement of the indicator to the previous period,

— improvement of the indicator to the previous period,  — decline in the indicator to the previous period.

— decline in the indicator to the previous period.

The average value of the net profit ratio of TOP-10 companies is above the industry average one. In 2017, all TOP-10 companies improved sales revenue, and in terms of the net profit ratio eight companies increased their efficiency. Moreover, all average values of companies’ indicators improved.

Picture 1. Net profit ratio and revenue of the largest Russian coal mining companies (TOP-10)

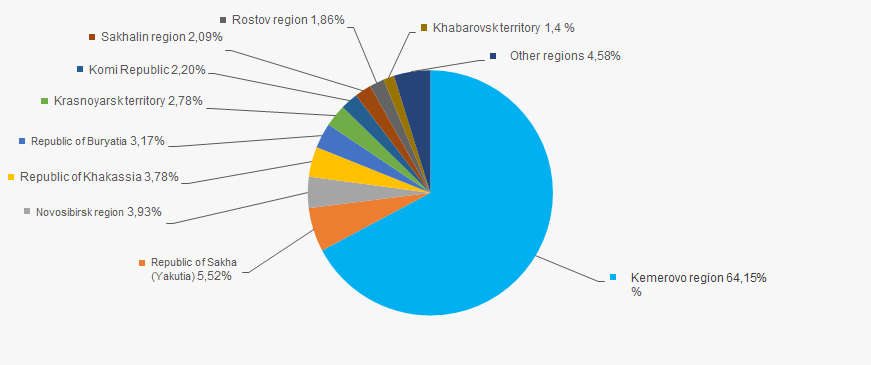

Picture 1. Net profit ratio and revenue of the largest Russian coal mining companies (TOP-10)67,2% of the total revenue of the industry in 2017 was generated by enterprises located in Kemerovo region (Picture 2). At the same time, only 34% of coal mining companies operate in this region. This indicates that namely Kemerovo region is the locomotive of the coal industry. The second place in terms of revenue takes the Republic of Sakha (Yakutia). It accounts for 5,8% of total consolidated revenue and 3,6% of companies.

Picture 2. Distribution of regions by share in total revenue in 2017

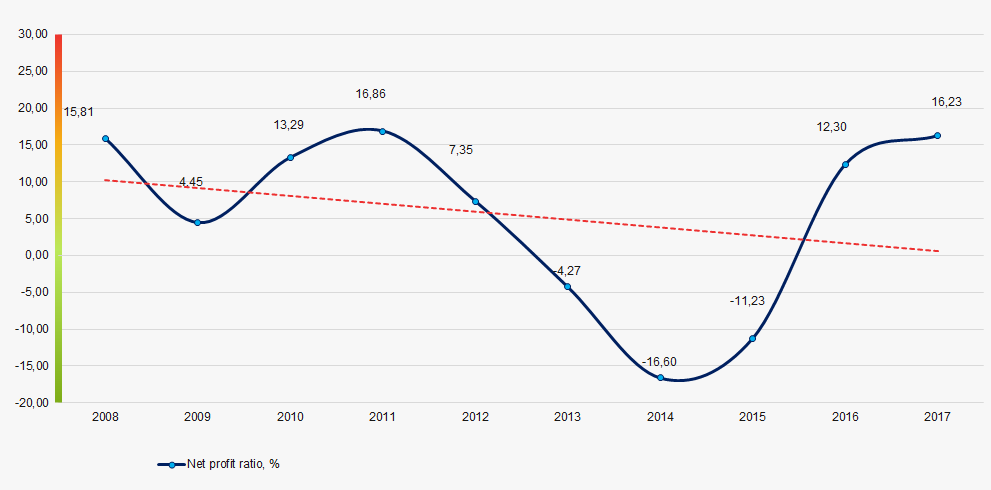

Picture 2. Distribution of regions by share in total revenue in 2017For 10 years, industry average values of the net profit ratio have a certain stability, except for the crisis years (picture 3). In general, the industry was able to cope with the recession of 2013-2015 and reach the pre-crisis level of the net profit ratio.

Picture 3. Change in industry average values of the net profit ratio of Russian coal mining companies in 2008–2017

Picture 3. Change in industry average values of the net profit ratio of Russian coal mining companies in 2008–2017