Domestic demand will promote the economy growth

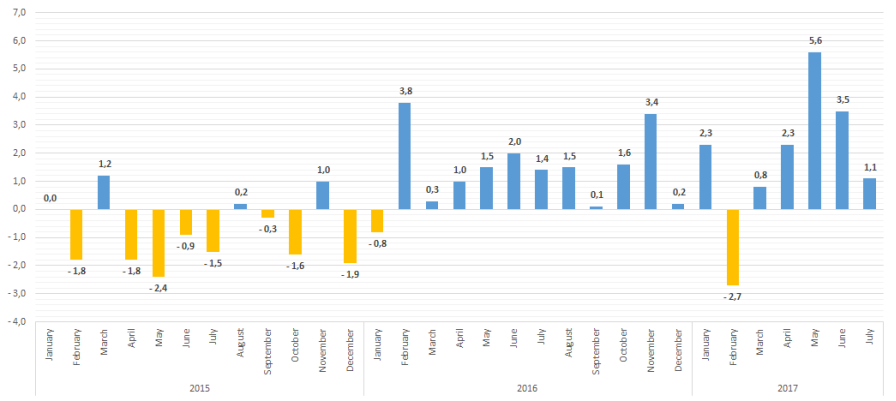

Having showed the promising results in spring when industrial production index reached a maximum value of 5.6% since February 2012, in June-July the manufacturing industry in Russia demonstrated decrease. If in June the index of 3,5% was recorded, in July it was reduced to 1,1% (see Picture 1).

Increase of index can be explained with unusually cold weather in most of the European territory of the country that led to extension of the heating season and increase in demand on energy consumption. The fact of 1 working day more in May of 2017 against the previous year also played a role in positive cumulative effect. In June, the effect of the seasonal and calendar factors has stopped and it became obvious that the economy would not maintain high growth rates. The decline occurred in all sectors, however, it should be noted that among the sectors that have maintained a positive growth dynamics, there are not only raw materials, but also production of consumer goods.

Currently the industry could be supported not so much with export as with domestic demand. Under otherwise equal conditions the growing domestic consumption stimulates the increasing of goods output.

Strengthening of the ruble in the first half of 2017 led to import growth on 27% in US dollar terms. That was resulted in revival of retail business and manufacturing activity being a part of transnational brands – auto industry, electronics, etc.

However after a new wave of domestic currency weakening in August, the number of sectors has heavy expenses again: in Russia there are no analogues of needed equipment and materials or they just don’t meet current standards of quality and efficiency. Import substitution program launched by the Government is not able to reduce the lag in technology at short notice.

Conservative policy of the Central Bank aiming at struggle against price boost gives discrepant results – informing about successful achievement of the minimal inflation level ever, the Bank too carefully manages the reduction of rates thereby limiting the access to low-interest credit for business and citizens. Artificial limitation of money stock is resulted in nothing but economic stagnation.

Real income of population being decreased for three consecutive years takes a toll on domestic consumption: in 2014 they reduced on 0,7%; in 2015 – on 3,2%; in 2016 – on 5,9%; in January-July 2017 – on 1,4% (Income net of all obligatory payments and taxes adjusted for inflation).

Only export-oriented mineral companies, food industry enterprises, as well as companies rapidly crossed over to other suppliers, including from the RF, had the benefit.

Picture 1. Dynamics of industrial production in Russia, % to the relevant month of the previous year

Picture 1. Dynamics of industrial production in Russia, % to the relevant month of the previous yearTable 1 contains information about industrial production by key industries in July 2017 (to July 2016) and January-July 2017 (to the same period of 2016).

Following the results of July 2017, the processing sector demonstrates increase in furniture production – on 11,2%, pharmaceuticals – on 10,1%, food products – on 8,4%, finished goods – on 8,1%, textile – on 7,7%. At the same time, output of other vehicles (buses, trains, etc.) decreased on 33,3%, cigarettes and tobacco – on 16,5%, printing products – on 9%.

Comparing the dynamics of industrial production index for January-July 2017, the auto industry appeared to be a leader with increase on 11,7% despite of decrease in shipments from factories on 0,5% (against July 2016). Car market will likely resume its growth bypassing monthly recession. Automobile construction is one of the key indicators of the development of consumer confidence and economic recovery because only under stability the population begins to purchase goods of deferred demand.

| INDUSTRY BY OKVED2 (the Russian Standard Industrial Classification of Economic Activities) | INCREASE (DECREASE), July 2017 to July 2016, % | INCREASE (DECREASE), January-July 2017 to January-July 2016, % |

| INDUSTRIAL PRODUCTION IN GENERAL | 1,1 | 1,8 |

| MINING | 4,0 | 3,2 |

| Other minerals mining | 15,1 | 8,3 |

| Provision of services related to mining | 18,4 | 8,2 |

| Mining of coal | 7,1 | 4,1 |

| Mining of metal ores | 0,3 | 3,8 |

| Mining of crude oil and natural gas | 1,3 | 2,2 |

| MANUFACTURING | -0,8 | 0,9 |

| Manufacture of motor vehicles, trailers and semi-trailers | -0,5 | 11,7 |

| Manufacture of pharmaceutical products and medical devices | 10,1 | 11,1 |

| Manufacture of furniture | 11,2 | 8,5 |

| Manufacture of paper and paper products | 5,0 | 6,9 |

| Manufacture of textile products | 7,7 | 6,5 |

| Manufacture of chemicals and chemical products | 0,9 | 6,5 |

| Manufacture of electrical equipment | 1,5 | 6,0 |

| Manufacture of leather and leather products | -1,2 | 5,2 |

| Manufacture of clothes | -3,1 | 5,0 |

| Manufacture of food products | 8,4 | 4,4 |

| Manufacture of rubber and plastic products | -1,1 | 4,2 |

| Manufacture of wood and products of wood and cork | 1,5 | 2,5 |

| Manufacture of other non-metallic mineral products | 2,0 | 2,3 |

| Manufacture of machinery and equipment | 0,4 | 1,8 |

| Manufacture of coke and petroleum products | 3,5 | 0,9 |

| Manufacture of other finished goods | 8,1 | -1,0 |

| Repair and maintenance of machinery and equipment | -1,5 | -1,8 |

| Manufacture of beverages | -8,3 | -2,2 |

| Manufacture of computers, electronic and optical products | -6,6 | -2,4 |

| Manufacture of other motor-vehicles and equipment | -33,3 | -3,3 |

| Manufacture of fabricated metal products | 1,5 | -3,4 |

| Metal industry | -4,5 | -5,1 |

| Printing and copying recorded media | -9,0 | -7,5 |

| Manufacture of tobacco products | -16,5 | -21,4 |

| DISTRIBUTION OF ELECTRICITY, GAS, STEAM | 0,1 | 2,1 |

| WATER SUPPLY, WATER DISPOSAL, WASTE DISPOSAL | -4,0 | -2,2 |

Release of recent statistics on production in August and September will indicate whether the Russian production sector has gone into stagnation.

Continuing external sanctions pressure, transaction with OPEC binding Russia to reduce the exploitation rate for stabilization of the world market, increased volatility of the ruble also introduced additional risks into long-term business planning.

Despite the difficulties, the GDP growth in April-June 2017 in the annual comparison turned out to be the maximum for the last 19 quarters (from III quarter of 2012). Preliminary assessment of the GDP dynamics for II quarter was 2,5%. With the exception of seasonality, it can be stated that the Russian economy is growing for the fifth consecutive quarter, having passed the bottom of compression in early 2016.

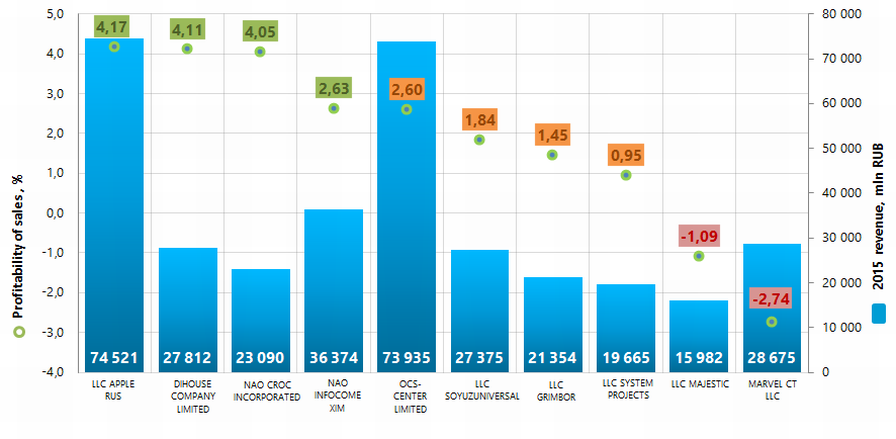

Profitability of sales of the largest Russian wholesalers of information and communication equipment

Information Agency Credinform has prepared the ranking of the largest Russian wholesalers of information and communication equipment. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2014). Then the companies were ranged by 2015 profitability of sales ratio (Table 1). The analysis was based on data of the Information and Analytical system Globas.

Profitability of sales (%) is the share of operating profit in the sales volume of the company. The ratio characterizes the efficiency of the industrial and commercial activity and shows the company’s funds, which remained after covering the cost of production, interest and tax payments.

The rage of ratio’s values within companies of the same industry is defined by the differences in competitive strategies and product lines. Therefore, it should be taken into account, that at equal values of revenue, operational expenses and profit before tax, the profitability of sales ratio of two companies can be different due to the influence of interest payments on net profit.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. The practical value of profitability of sales ratio for the wholesalers of information and communication equipment starts from 2,63%.

For the most full and fair opinion about the company’s financial position, the whole set of financial indicators and ratios of the company should be taken into account.

| Name, INN, region | Net profit, mln RUB * | Revenue, mln RUB * | Profitability of sales, % | Solvency index Globas | ||||

| 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| LLC APPLE RUS INN 7707767220 Moscow |

1 343,4 | 7,2 | 6 452,2 | 96 057,4 | 74 520,9 | 123 565,1 | 4,17 | 191 The highest |

| DIHOUSE COMPANY LIMITED INN 7709751313 Moscow |

1 301,3 | 509,7 | 634,7 | 38 722,2 | 27 811,7 | 39 236,5 | 4,11 | 215 High |

| NAO CROC INCORPORATED INN 7701004101 Moscow |

502,0 | 383,2 | 353,1 | 22 455,1 | 23 090,1 | 24 095,8 | 4,05 | 212 High |

| NAO INFOCOMEXIM INN 7733562074 Moscow |

123,1 | 1 086,2 | 529,2 | 20 978,1 | 36 374,4 | 29 860,6 | 2,63 | 222 High |

| OCS-CENTER LIMITED INN 7701341820 Moscow |

612,4 | 773,5 | 999,6 | 86 229,6 | 73 934,8 | 92 616,8 | 2,60 | 218 High |

| LLC SOYUZUNIVERSAL INN 7701153505 Moscow |

7,3 | 200,0 | -68,3 | 10 421,0 | 27 374,7 | 25 208,6 | 1,84 | 251 High |

| LLC GRIMBOR INN 7707798531 Moscow |

2,3 | 38,5 | н/д | 20 494,8 | 21 354,1 | н/д | 1,45 | 262 High |

| LLC SYSTEM PROJECTS INN 7838502682 Saint-Petersburg |

1,0 | 105,2 | 31,7 | 776,4 | 19 665,0 | 6 562,6 | 0,95 | 284 High |

| LLC MAJESTIC INN 7701621619 Moscow |

1,6 | 1,7 | 4,5 | 5 386,6 | 15 981,6 | 11 867,4 | -1,09 | 231 High |

| MARVEL CT LLC INN 7811365157 Moscow |

59,0 | 122,1 | 2 407,6 | 9 320,8 | 28 674,9 | 63 877,9 | -2,74 | 207 High |

| Total for TOP-10 group of companies | 3 953,4 | 3 227,5 | 310 842,0 | 348 782,4 | ||||

| Average value within TOP-10 group of companies | 395,3 | 322,7 | 31 084,2 | 34 878,2 | 1,80 | |||

| Industry average value | 1,3 | 2,3 | 210,7 | 83,6 | 2,63 | |||

*2016 data is for reference

The average value of profitability of sales ratio in TOP-10 group of companies is lower than practical value. Four companies have values higher than practical value (green color in column 8 of Table 1 and Picture 1). The negative value of the ratio have two companies (red color in column 8 of Table 1 and Picture 1). In 2015 four companies from TOP-10 list have decrease in revenue and net profit in comparison with previous period (red color in 3 and 6 columns of Table 1).

Picture 1. Profitability of sales and revenue of the largest Russian wholesalers of information and communication equipment (TOP-10)

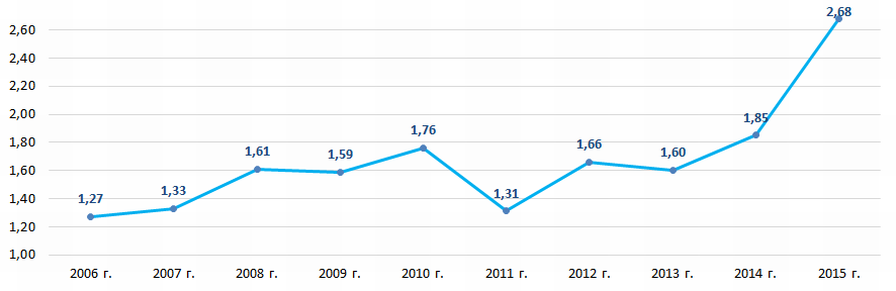

Picture 1. Profitability of sales and revenue of the largest Russian wholesalers of information and communication equipment (TOP-10)In general, the average values of profitability of sales within 2006 – 2015 (Picture 2) have the upward trend. Over the past 10 years, the ratio value decreased only three times in 2009, 2011 and 2013.

Picture 2. The change of profitability of sales average values within 2009-2015 for the wholesalers of information and communication equipment

Picture 2. The change of profitability of sales average values within 2009-2015 for the wholesalers of information and communication equipmentAll companies from TOP-10 list have the highest or high solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully.