Activity trends of the largest real economy companies of Krasnoyarsk territory

Information agency Credinform has observed trends in the activity of the largest real economy companies of Krasnoyarsk territory.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets - indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № | Name, INN, main type of activity |

Net assets value, bln RUB | Solvency index Globas | |||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | ||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |||||

| 1 | JSC Federal Hydro-Generating Company - RusHydro INN 2460066195 Generation of electric power by hydroelectric stations |

624,42 | 718,54 | 742,54 | 769,41 | 825,75 | 153 Superior | |||||

| 2 | JSC Mining and Metallurgical Company NORILSK NICKEL INN 8401005730 Manufacture of other nonferrous metals |

400,26 | 266,98 | 208,84 | 224,89 | 248,97 | 172 Superior | |||||

| 3 | JSC VANKORNEFT INN 2437261631 Crude oil mining |

331,49 | 278,23 | 23,04 | 238,20 | 236,73 | 210 Strong | |||||

| 4 | JSC Krasnoyarsk hydroelectric station INN 2446000322 Generation of electric power by hydroelectric stations |

29,86 | 36,10 | 46,15 | 51,39 | 55,11 | 224 Strong | |||||

| 5 | JSC SUZUN INN 8401005829 Crude oil mining |

-0,69 | -1,45 | -2,03 | 8,99 | 41,58 | 217 Strong | |||||

| 996 | FSUE Main Military Works Department №9 INN 2452026745 Construction of residential and nonresidential buildings |

0,15 | -0,01 | -1,24 | -2,03 | -2,10 | 309 Adequate | |||||

| 997 | JSC KRASLESINVEST INN 2460205089 Wood sawing and planing |

-4,18 | -6,43 | -7,31 | -8,03 | -9,91 | 279 Strong | |||||

| 998 | SLAVNEFT-KRASNOJARSKNEFTEGAZ LTD INN 2464036561 Geological survey, geophysical and geochemical works in the sphere of mineral resources research and mineral reserves replacement |

-0,19 | -7,67 | -15,20 | -16,93 | -23,22 | 308 Adequate | |||||

| 999 | JSC BOGUCHANSK ALUMINIUM SMELTER INN 2465102746 Aluminium production |

-1,25 | -20,78 | -36,34 | -24,26 | -24,26 | 259 Strong | |||||

| 1000 | JSC EAST-SIBERIAN OIL AND GAS COMPANY INN 7710007910 Crude oil mining |

-9,53 | -12,46 | -16,67 | -24,05 | -29,21 | 311 Adequate | |||||

— growth of the indicator to the previous period, — decline of the indicator to the previous period.

For a five-year period average amount of net assets of TOP—1000 companies has increasing tendency (Picture 1).

Picture 1. Change in TOP—1000 average indicators of the net asset amount in 2013 — 2017

Picture 1. Change in TOP—1000 average indicators of the net asset amount in 2013 — 2017Share of companies with insufficiency of property in the TOP—1000 has grown for the last five years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP—1000 companies

Picture 2. Shares of companies with negative values of net assets in TOP—1000 companiesSales revenue

The revenue volume of 10 leaders of the industry made 53% of the total revenue of TOP—1000 companies in 2017 (Picture 3). It demonstrates high concentration of capital in Krasnoyarsk territory.

Picture 3. Shares of participation of TOP—10 companies in the total revenue of TOP—1000 companies for 2017

Picture 3. Shares of participation of TOP—10 companies in the total revenue of TOP—1000 companies for 2017In general, an increasing tendency in revenue volume is observed (Picture 4).

Picture 4. Change in the average revenue of TOP—1000 companies in 2013 — 2017

Picture 4. Change in the average revenue of TOP—1000 companies in 2013 — 2017Profit and losses

The profit volume of 10 leading enterprises in 2017 made 88% of the total profit of TOP-1000 companies (Picture 5).

Picture 5. Share of participation of TOP—10 companies in the total volume of profit of TOP—1000 companies for 2017

Picture 5. Share of participation of TOP—10 companies in the total volume of profit of TOP—1000 companies for 2017Over a five-year period, the average values of net profit indicators of TOP-1000 companies tend to increase. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of profit and loss of TOP—1000 companies in 2013 — 2017

Picture 6. Change in the average indicators of profit and loss of TOP—1000 companies in 2013 — 2017Key financial ratios

Over the five-year period the average indicators of the current liquidity ratio of TOP—1000 were above the range of recommended values — from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of TOP—1000 companies in 2013 — 2017

Picture 7. Change in the average values of the current liquidity ratio of TOP—1000 companies in 2013 — 2017Sufficiently high level of average values of the indicators of the return on investment ratio with decreasing tendency has been observed for five years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP—1000 companies in 2013 — 2017

Picture 8. Change in the average values of the return on investment ratio of TOP—1000 companies in 2013 — 2017Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a five-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of TOP—1000 companies in 2013 — 2017

Picture 9. Change in the average values of the assets turnover ratio of TOP—1000 companies in 2013 — 2017Production structure

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in precious and non-ferrous metals production and iron and steel companies (Picture 10).

Picture 10. Distribution of companies by types of output in the total revenue of TOP—1000, %

Picture 10. Distribution of companies by types of output in the total revenue of TOP—1000, %66% of TOP—1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF. Besides, share of the companies in the total revenue of TOP—1000 amounts to 12% (Picture 11).

Picture 11. Shares of small and medium enterprises in TOP—1000 companies

Picture 11. Shares of small and medium enterprises in TOP—1000 companiesMain regions of activities

TOP—1000 companies are unequally distributed on Krasnoyarsk territory and registered in 44 districts. The largest companies in terms of revenue volume are concentrated in the center of Krasnoyarsk territory — Krasnoyarsk city (Picture 12).

Picture 12. Distribution of TOP—1000 companies by districts of Krasnoyarsk territory

Picture 12. Distribution of TOP—1000 companies by districts of Krasnoyarsk territoryFinancial position score

An assessment of the financial position of TOP—1000 companies shows that the largest number is in an above the average financial position. (Picture 13).

Picture 13. Distribution of TOP—1000 companies by financial position score

Picture 13. Distribution of TOP—1000 companies by financial position scoreSolvency index Globas

Most of TOP—1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 14).

Picture 14. Distribution of TOP—1000 companies by solvency index Globas

Picture 14. Distribution of TOP—1000 companies by solvency index Globas Conclusion

Comprehensive assessment of the activity of largest companies of real sector of economy of Krasnoyarsk territory, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends, such as increase in net assets amount, revenue and net profit volume, decrease in average amount of net losses, increase of the current liquidity ratio. However, among negative factors are increase of share of companies with negative values of net assets, decreasing indicators of return on investment and return on assets ratios, insufficient share of small and medium enterprises in the total production volume, high concentration of production in center of the territory.

According to the data from the Federal State Statistics Service, increasing tendency of the Industrial production index is observed in Krasnoyarsk territory in 2017 — 2018. For 8 months of 2018 industrial production index has 0,9% decreased at average, and in general, for the period from September of 2017 to August of 2018 industrial production has 1,6% decreased at average (Picture 15).

Picture 15. Industrial production index in Krasnoyarsk territory in 2017 — 2018, month to month (%)

Picture 15. Industrial production index in Krasnoyarsk territory in 2017 — 2018, month to month (%)According to the same data, share of Krasnoyarsk territory in revenue volume from sale of goods, products, works, services in general for the country was 2,05% for 6 months of 2018.

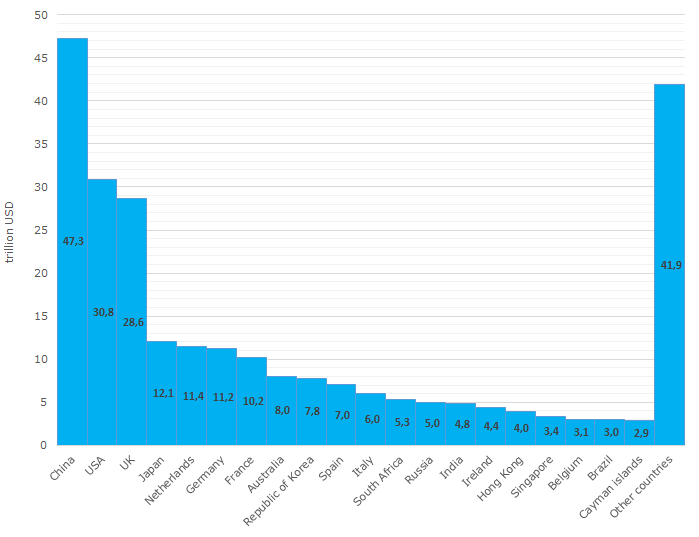

TOP-20 countries accumulate over 80% of global industrial assets

As a rule, GDP (an aggregate performance of all households and companies) is used for analysis of a country’s economy size. Evaluation of economy by assets value of national companies is as much informative. Real economy companies, and not banks, financial corporations and hedge funds, are relevant for this type of analysis. Hence, actual contribution of a country to global industrial production can be estimated.

According to Orbis database (Bureau van Dijk), 2017 resulted in total assets value of industrial companies reaching 258 trillion USD. Assets value speaks of prospective earnings for their owners. The larger the real assets the more significant the role of the country and its residents is.

For reference, nominal global GDP in 2017 amounted to 80,7 trillion USD (World Bank).

China’s total real economy’s assets rank first in the world. Over 18% of industrial assets of over 47 trillion USD are concentrated in China. The USA ranks second, trailing the leader by half: about 12% of global assets are aggregated in the former leading state. The UK rounds out the top three with its 11% of industrial assets (see Table 1).

Russian industrial assets’ estimated value is 5 trillion USD, which puts our country it the 13th place of global ranking.

| Global ranking | Country | Total assets, trillion USD | Share in total global assets, % |

| - | WORLD | 258,3 | 100,0 |

| 1 | China | 47,3 | 18,3 |

| 2 | USA | 30,8 | 11,9 |

| 3 | UK | 28,6 | 11,1 |

| 4 | Japan | 12,1 | 4,7 |

| 5 | Netherlands | 11,4 | 4,4 |

| 6 | Germany | 11,2 | 4,3 |

| 7 | France | 10,2 | 3,9 |

| 8 | Australia | 8,0 | 3,1 |

| 9 | Republic of Korea | 7,8 | 3,0 |

| 10 | Spain | 7,0 | 2,7 |

| 11 | Italy | 6,0 | 2,3 |

| 12 | South Africa | 5,3 | 2,1 |

| 13 | Russia | 5,0 | 1,9 |

| 14 | India | 4,8 | 1,9 |

| 15 | Ireland | 4,4 | 1,7 |

| 16 | Hong Kong | 4,0 | 1,5 |

| 17 | Singapore | 3,4 | 1,3 |

| 18 | Belgium | 3,1 | 1,2 |

| 19 | Brazil | 3,0 | 1,2 |

| 20 | Cayman islands | 2,9 | 1,1 |

| - | Total for Top 20 | 216,4 | 83,8 |

Such countries and territories as Hong Kong, Singapore and the Cayman islands among top 20 indicate these safe harbors’ attractiveness for business registration due to low taxes and ease of registration.

Picture 1. Global industrial assets by countries and territories, trillion USD, 2017

Picture 1. Global industrial assets by countries and territories, trillion USD, 2017Top 20 countries and territories accumulate over 80% of global industrial assets of total value of 216 trillion USD. Other countries have the rest 17% (see Picture 1), that indicates a high grade of concentration of industrial potential and technology at a certain number of participants of global division of labor.