Trends in hotel industry

Information agency Credinform has observed trends in the activity of the enterprises of hotel industry of the 10 largest Russian cities.

Enterprises of hotel industry with the largest volume of annual revenue (TOP-1000) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2014-2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets is an indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets amount is LLC INTUR-HOTEL, INN 7702729622, Moscow. The company is in process of reorganization in the form of acquisition since 29.05.2019 and belongs to the AZIMUT group. In 2018 net assets of the enterprise amounted to 9 billion RUB.

LLC SKI RESORT DEVELOPMENT COMPANY ROSA KHUTOR , INN 7702347870, Moscow, had the smallest amount of net assets in the TOP-1000 group. Insufficiency of property of the company in 2018 was expressed in negative value -47,2 million RUB.

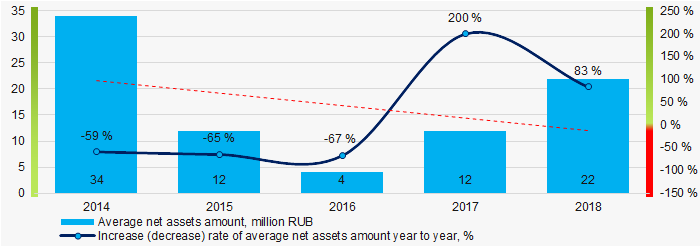

For a five-year period average amount of net assets of TOP-1000 companies has increasing tendency (Picture 1).

Picture 1. Change in average indicators of the net asset amount of TOP-1000 companies in 2014 – 2018

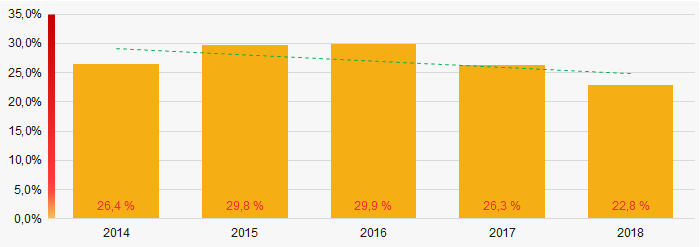

Picture 1. Change in average indicators of the net asset amount of TOP-1000 companies in 2014 – 2018Share of companies with insufficiency of property in the TOP-1000 was on high level with decreasing tendency for the last five years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companiesSales revenue

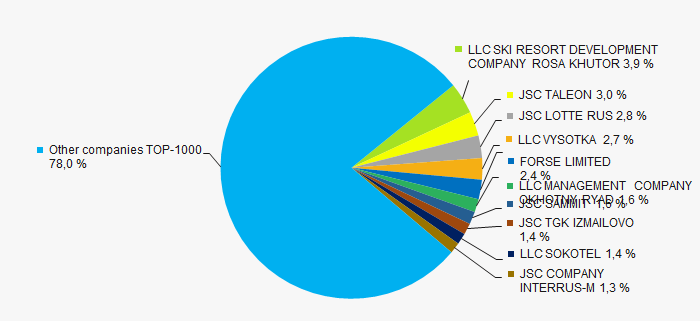

The revenue volume of 10 leaders of the industry made 22% of the total revenue of TOP-1000 companies in 2018 (Picture 3). It demonstrates high level of competition in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2018

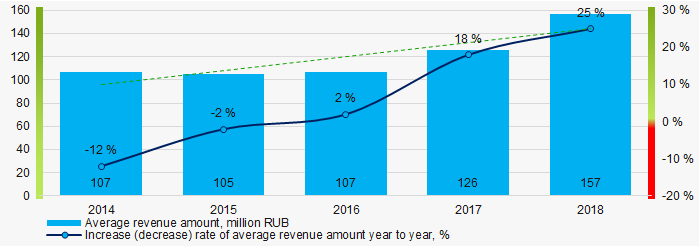

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2018In general, an increasing tendency in revenue volume is observed (Picture 4).

Picture 4. Change in the average revenue of manufacturers of pharmaceuticals and medical products in 2014 – 2018

Picture 4. Change in the average revenue of manufacturers of pharmaceuticals and medical products in 2014 – 2018Profit and losses

The largest company in terms of net profit amount is LLC VYSOTKA, INN 7730121138 (hotel «Ukraina»). Net profit of the company amounted to more than 957 million RUB for 2018.

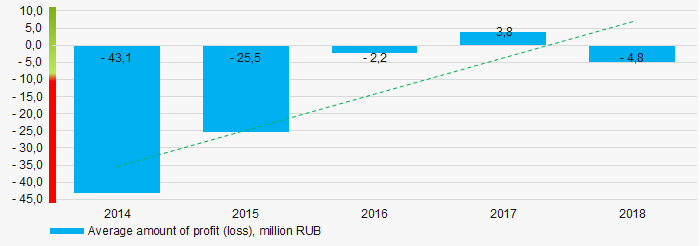

For the last five years average indicators of net profit for TOP-1000 group have an increasing tendency (Picture 5).

Picture 5. Change in the average indicators of net profit of TOP-1000 companies in 2014 – 2018

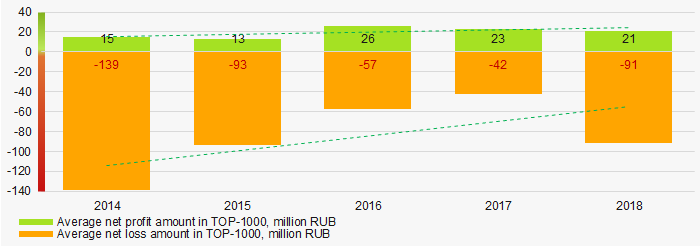

Picture 5. Change in the average indicators of net profit of TOP-1000 companies in 2014 – 2018Over a five-year period, the average values of net profit indicators of TOP-1000 companies tend to increase. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2014 – 2018

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2014 – 2018Key financial ratios

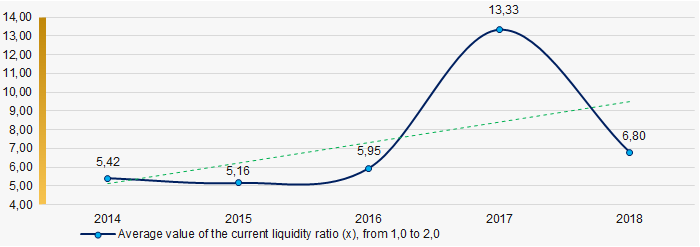

Over the five-year period the average indicators of the current liquidity ratio of TOP-1000 in general were within the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2014 – 2018

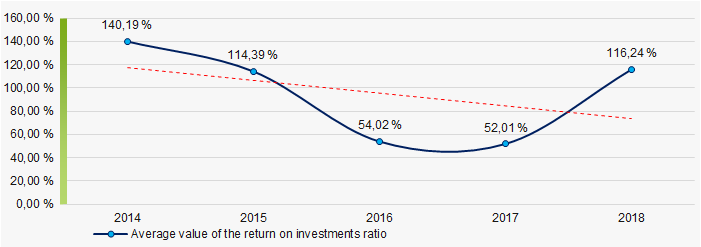

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2014 – 2018High level of the average values of the indicators of the return on investment ratio with decreasing tendency have been observed for five years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2014 – 2018

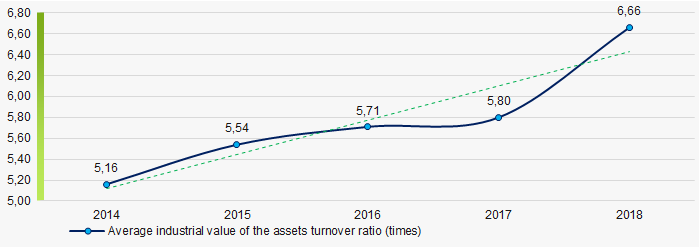

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2014 – 2018Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to increase for a five-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2014 – 2018

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2014 – 2018Small business

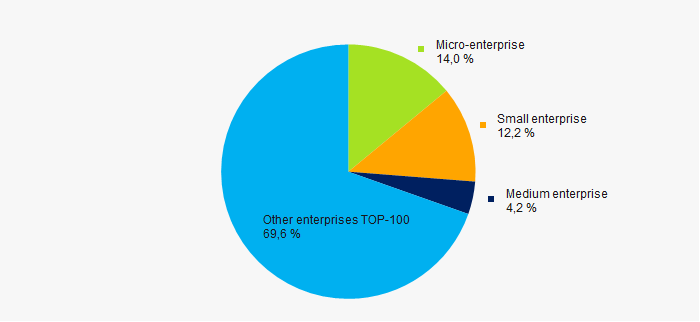

81% of the TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF. Besides, share of revenue in the total volume is 30%, that is significantly higher than the average indicator countrywide (Picture 10).

Picture 10. Shares of small and medium enterprises in TOP-1000 companies, %

Picture 10. Shares of small and medium enterprises in TOP-1000 companies, %Main regions of activity

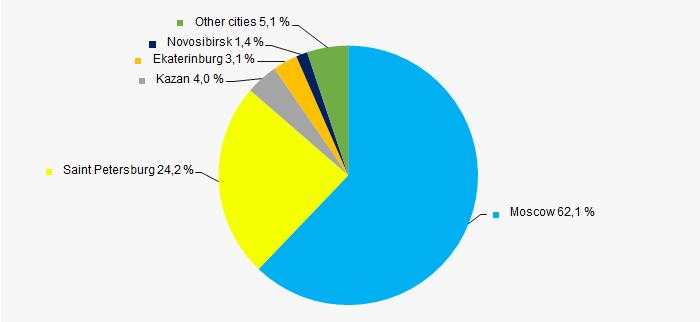

TOP-1000 enterprises that registered in 10 largest cities are unequally distributed along the territory of Russia. More than 86% are located in Moscow and Saint Petersburg (Picture 11).

Picture 11. Distribution of revenue TOP-1000 companies by 10 largest cities of Russia

Picture 11. Distribution of revenue TOP-1000 companies by 10 largest cities of RussiaFinancial position score

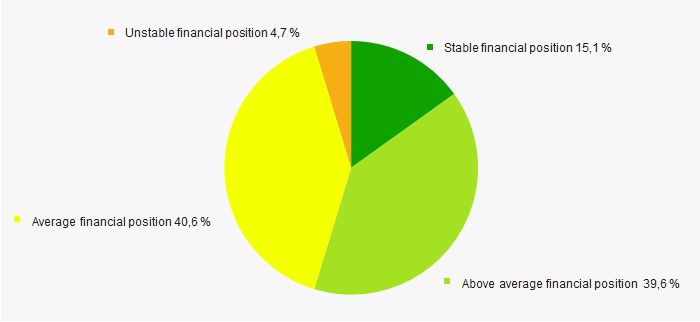

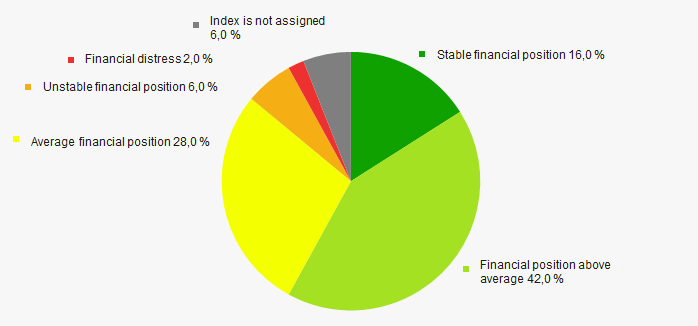

An assessment of the financial position of TOP-1000 companies shows that the largest number is in an average financial position. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

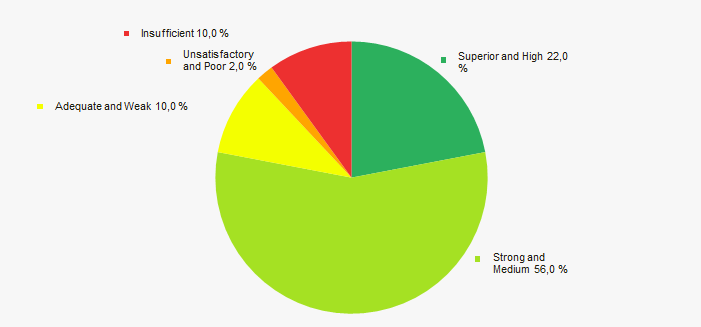

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Comprehensive assessment of the activity of the enterprises of hotel industry of the 10 largest Russian cities, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends (Table 1)

| Trends and assessment factors | Share of factor, % |

| Rate of increase (decrease) of average amount of net assets |  -10 -10 |

| Increase / decrease of share of companies with negative values of net assets |  5 5 |

| Level of competition/monopolization |  10 10 |

| Increase (decrease) rate of average revenue amount |  10 10 |

| Increase (decrease) rate of average net profit (loss) amount |  10 10 |

| Increase / decrease of average net profit amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average net loss amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average industrial values of the current liquidity ratio |  5 5 |

| Increase / decrease of average industrial values of the return on investments ratio |  -5 -5 |

| Increase / decrease of average industrial values of the assets turnover ratio, times |  10 10 |

| Share of small and medium enterprises in the industry in terms of revenue volume more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (major share) |  5 5 |

| Solvency index Globas (major share) |  10 10 |

| Average value of factors |  5,0 5,0 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Trends in the manufacture of accumulators

Information agency Credinform represents an overview of activity trends of the largest Russian manufacturers of accumulators.

Manufacturing companies with the largest volume of annual revenue (TOP-10 and TOP-50) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2016 - 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is TYUMEN BATTERY FACTORY NJSC, INN 7204001630. In 2018, its net assets amounted to more than 3,3 billion rubles.

The smallest amount of net assets in the TOP-50 list was hold by Zavod AIT PJSC, INN 6451104116 (process of being wound up, 12.04.2018). The insufficiency of property of this company in 2018 was expressed as a negative value of -881 million rubles.

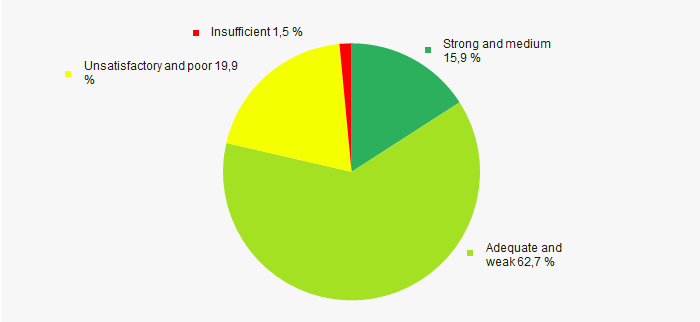

The average values of net assets tend to decrease over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net asset value of the manufacturers of accumulators in 2009 – 2018

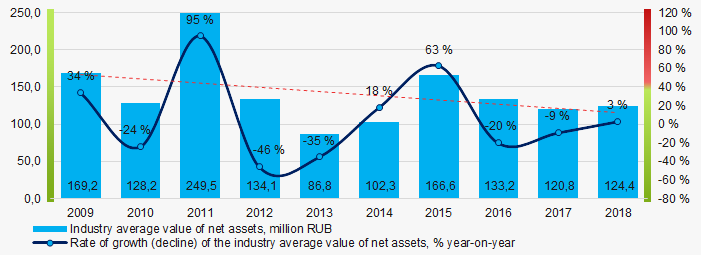

Picture 1. Change in the industry average indicators of the net asset value of the manufacturers of accumulators in 2009 – 2018The shares of TOP-1000 enterprises with insufficiency of assets have a tendency to increase in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-50 in 2014 – 2018

Picture 2. Shares of enterprises with negative values of net assets in TOP-50 in 2014 – 2018Sales revenue

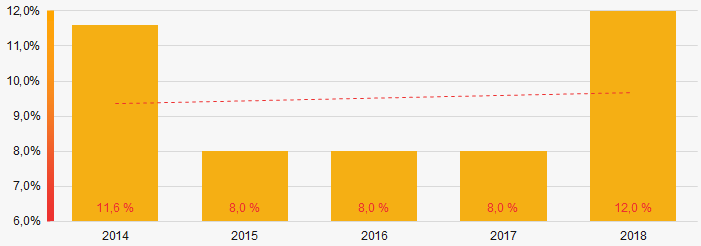

The revenue volume of 10 leading companies of the industry made almost 71% of the total revenue of TOP-50 in 2018 (Picture 3). It points to a relatively high level of monopolization in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-50 enterprises for 2018

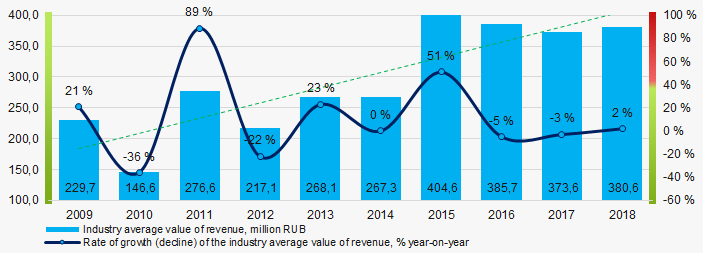

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-50 enterprises for 2018In general, there is an increase in industry average revenue over the ten-year period (Picture 4).

Picture 4. Change in the industry average revenue of the manufacturers of accumulators in 2009 – 2018

Picture 4. Change in the industry average revenue of the manufacturers of accumulators in 2009 – 2018Profit and loss

The largest company of the industry in terms of net profit value is ENERGIYA NJSC, INN 4821000142. The company's profit amounted to almost 450 million rubles in 2018.

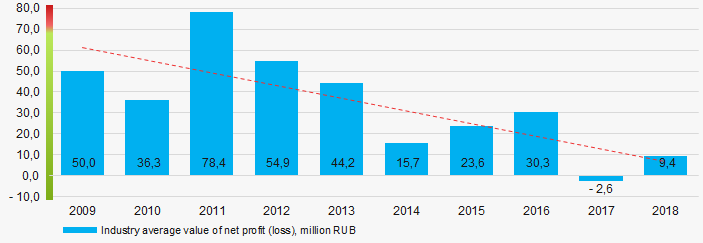

Industry average values of net profit trend to decrease over the past ten years (Picture 5).

Picture 5. Change in the industry average indicators of net profit of the manufacturers of accumulators in 2009 – 2018

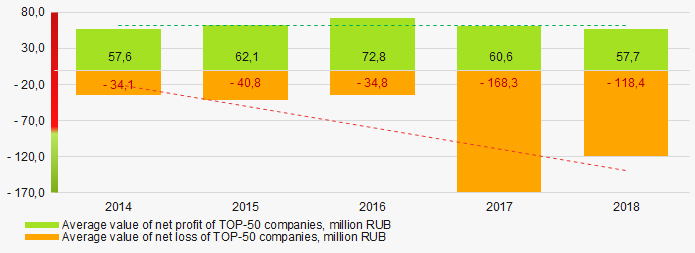

Picture 5. Change in the industry average indicators of net profit of the manufacturers of accumulators in 2009 – 2018Average values of net profit’s indicators of TOP-50 companies are at a stable level over a five-year period, at the same time the average value of net loss increases. (Picture 6).

Picture 6. Change in the industry average values of indicators of net profit and net loss of TOP-50 in 2014 – 2018

Picture 6. Change in the industry average values of indicators of net profit and net loss of TOP-50 in 2014 – 2018Key financial ratios

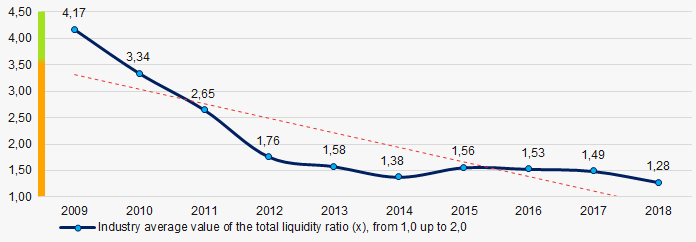

Over the ten-year period the average indicators of the total liquidity ratio of TOP-1000 enterprises were mainly in the range of recommended values - from 1,0 up to 2,0, with a tendency to decrease (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio of the manufacturers of accumulators in 2009 – 2018

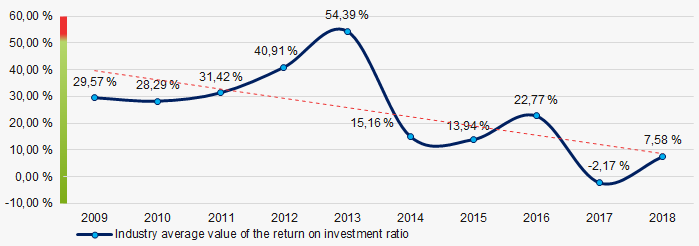

Picture 7. Change in the industry average values of the total liquidity ratio of the manufacturers of accumulators in 2009 – 2018The average industry values of the return on investment ratio have a tendency to decrease over the course of ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the industry average values of the return on investment ratio of the manufacturers of accumulators in 2009 – 2018

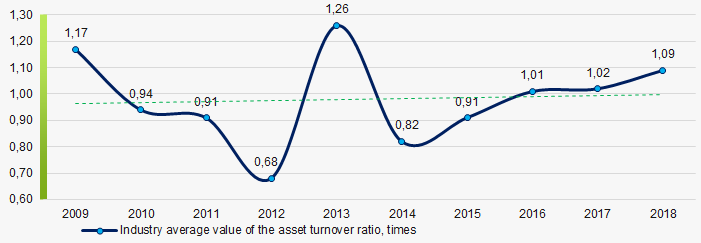

Picture 8. Change in the industry average values of the return on investment ratio of the manufacturers of accumulators in 2009 – 2018Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to increase over the ten-year period (Picture 9).

Picture 9. Change in the industry average values of the asset turnover ratio of the manufacturers of accumulators in 2009 – 2018

Picture 9. Change in the industry average values of the asset turnover ratio of the manufacturers of accumulators in 2009 – 2018Small business

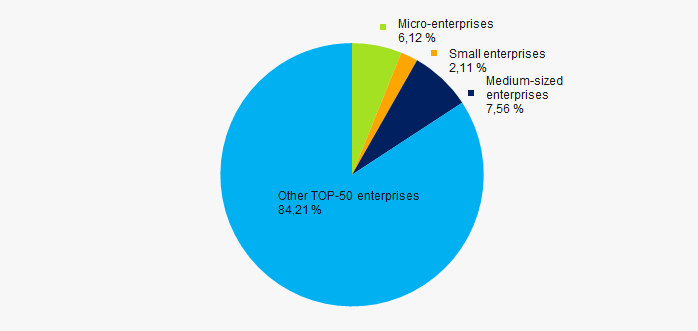

60% of TOP-50 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue amounted to almost 16% in 2018, that is lower than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-50 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-50 companiesMain regions of activity

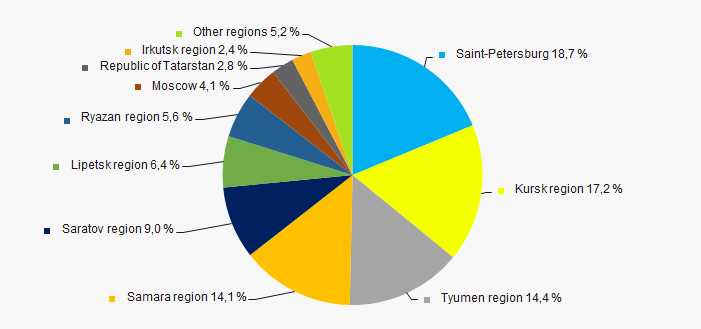

The TOP-50 companies are distributed unequal across Russia and registered in 20 regions. More than 64% of their revenue for 2018 are concentrated in St. Petersburg, Kursk, Tyumen and Samara regions (Picture 11).

Picture 11. Distribution of the revenue of TOP-50 companies by Russian regions in 2018

Picture 11. Distribution of the revenue of TOP-50 companies by Russian regions in 2018Financial position score

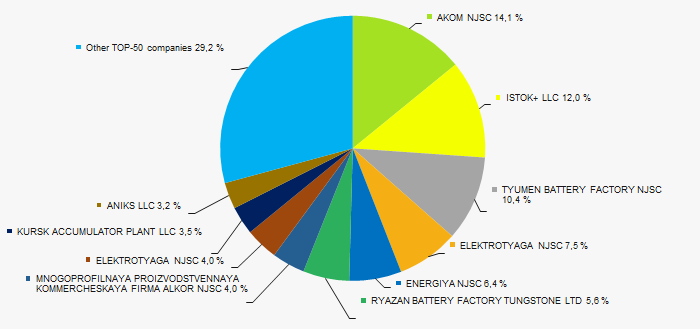

An assessment of the financial position of TOP-50 companies shows that the financial position of most of them is above average (Picture 12).

Picture 12. Distribution of TOP-50 companies by financial position score

Picture 12. Distribution of TOP-50 companies by financial position scoreSolvency index Globas

The vast majority of TOP-50 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

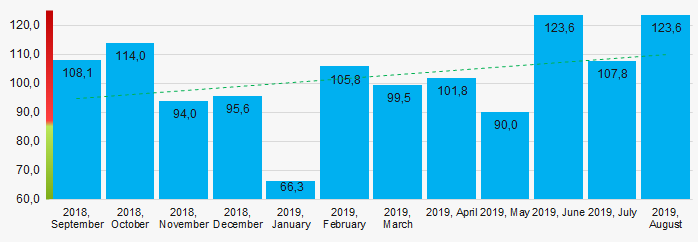

Picture 13. Distribution of TOP-50 companies by solvency index GlobasIndustrial production index

According to the Federal State Statistics Service, there is a tendency towards an increase in indicators of the industrial production index in the field of the industrial production of accumulators during 2018 - 2019 (Picture 14). At the same time, the average index from month to month was 102,5%.

Picture 14. Industrial production index in 2018 – 2019, (%)

Picture 14. Industrial production index in 2018 – 2019, (%)According to the same information, the share of the manufacturers of accumulators in the revenue volume from the sale of goods, products, works, services made 0,0004% countrywide for 2018.

Conclusion

A comprehensive assessment of activity of the largest Russian manufacturers of accumulators, taking into account the main indices, financial indicators and ratios, points to the prevalence of negative trends in the industry (Table 1).

| Trends and evaluation factors | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  -10 -10 |

| Growth / decline in average values of net profit of TOP-50 companies |  5 5 |

| Growth / decline in average values of net loss of TOP-50 companies |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized enterprises in the industry in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  10 10 |

| Average value of factors |  -1,7 -1,7 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).