Trends of food retailers

Information agency Credinform has prepared a review of trends of the largest Russian food retailers.

The largest companies of “Perekrestok, “Pyaterochka”, “Karusel”, “Lenta” and “Magnit” chains (TOP-50) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2014-2019). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is LLC CORPORATE CENTER X5, INN 7728632689, Moscow. In 2019, net assets value of the company almost amounted to 463 billion RUB.

The lowest net assets value among TOP-50 belonged to LLC EXPRESS RETAIL, INN 7707648286, Moscow. In 2019, insufficiency of property of the organization was indicated in negative value of -2,4 billion RUB.

Covering the six-year period, the average net assets values have a trend to increase with a decreasing growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2014 – 2019

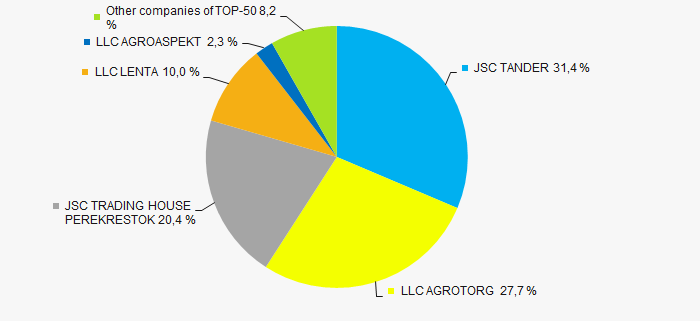

Picture 1. Change in industry average net assets value in 2014 – 2019Over the past six years, the share of companies with insufficient property had a negative trend to increase (Picture 2).

Picture 2. Shares of TOP-50 companies with negative net assets value in 2014-2019

Picture 2. Shares of TOP-50 companies with negative net assets value in 2014-2019Sales revenue

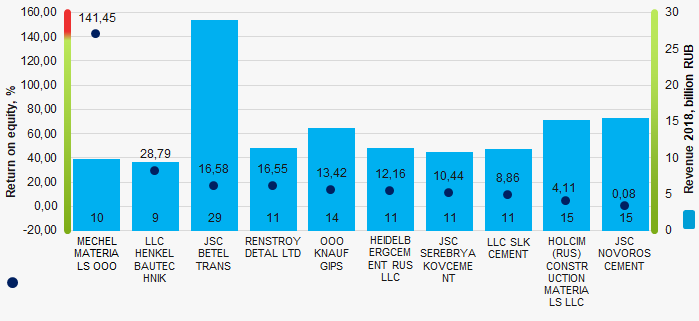

In 2019, the revenue volume of 3 largest companies of the industry was 80% of total TOP-50 revenue (Picture 3). This is indicative of relatively high level of aggregation of capital in the food retail market.

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-50

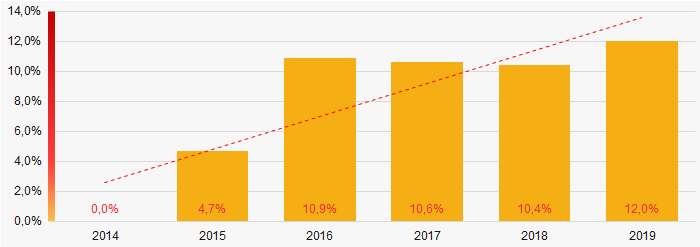

Picture 3. The share of TOP-10 companies in total 2019 revenue of TOP-50 In general, there is a trend to increase in revenue with decreasing growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2014 – 2019

Picture 4. Change in industry average net profit in 2014 – 2019Profit and loss

The largest organization in term of net profit is JSC MAGNIT, INN 2309085638, Krasnodar territory. The company’s profit for 2019 almost reached 41 billion RUB.

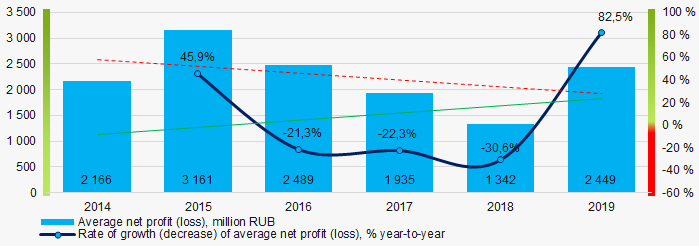

Covering the six-year period, there is a trend to decrease in average net profit with the increasing growth rate (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2014 – 2019

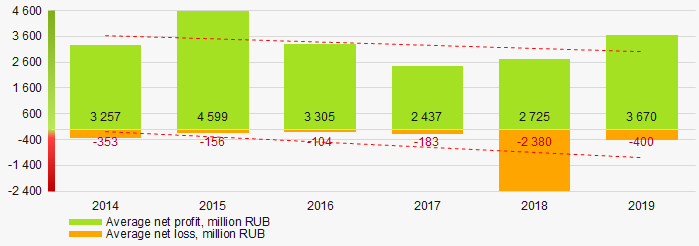

Picture 5. Change in industry average net profit (loss) values in 2014 – 2019For the six-year period, the average net profit values of TOP-50 have the decreasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-50 in 2014 – 2019

Picture 6. Change in average net profit and net loss of ТОP-50 in 2014 – 2019Key financial ratios

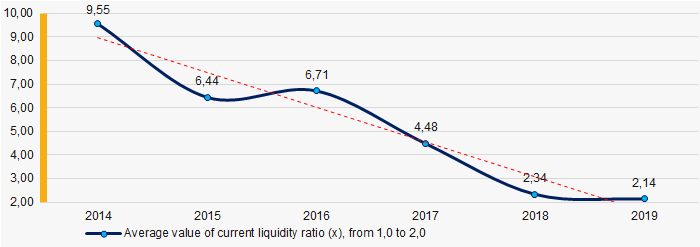

Covering the six-year period, the average values of the current liquidity ratio were above the recommended one - from 1,0 to 2,0 with a trend to decrease (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2019

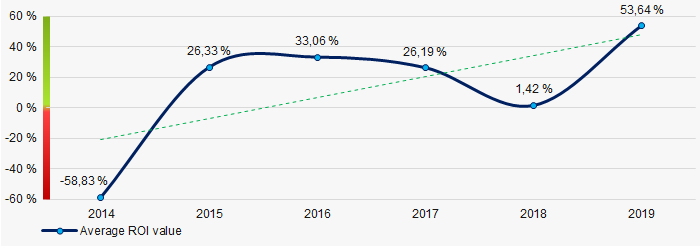

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2019 Covering the six-year period, the average values of ROI ratio have a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2014 – 2019

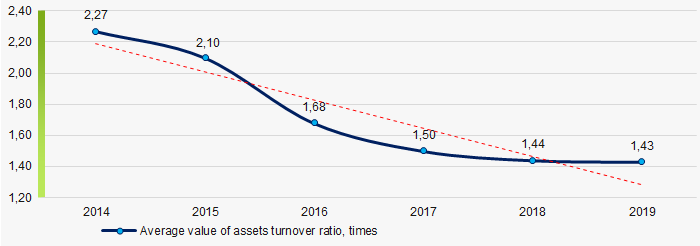

Picture 8. Change in industry average values of ROI ratio in 2014 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the six-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019

Picture 9. Change in average values of assets turnover ratio in 2014 – 2019Small business

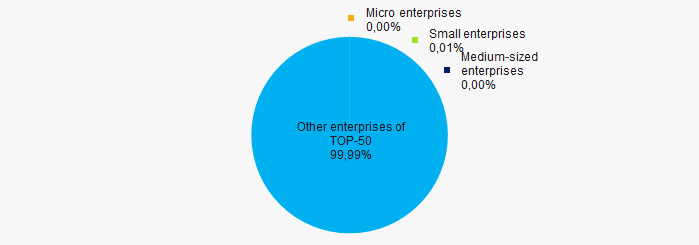

Only one company of the TOP-50 is registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Its share in total revenue of TOP-50 is 0,01% that is significantly lower than the national average in 2018-2019 (Picture 10).

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-50

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-50Main regions of activity

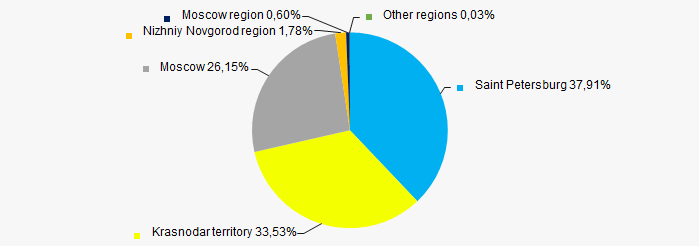

Companies of TOP-50 are registered in 8 regions of Russia, and unequally located across the country. Almost 98% of companies largest by revenue are located in Moscow, Saint Petersburg and Krasnodar territory (Picture 11).

Picture 11. Distribution of TOP-50 revenue by regions of Russia

Picture 11. Distribution of TOP-50 revenue by regions of RussiaFinancial position score

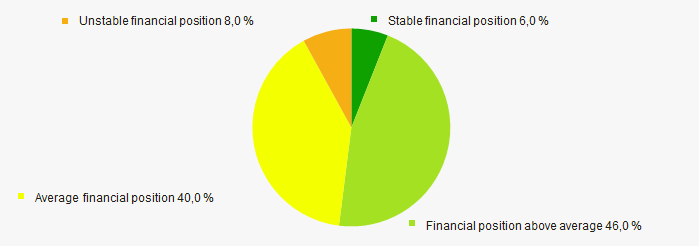

Assessment of the financial position of TOP-50 companies shows that the majority of them have financial position above average (Picture 12).

Picture 12. Distribution of TOP-50 companies by financial position score

Picture 12. Distribution of TOP-50 companies by financial position scoreSolvency index Globas

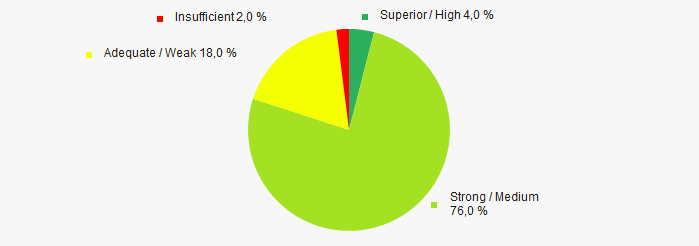

Most of TOP-50 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

Picture 13. Distribution of TOP-50 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest Russian food retailers, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of negative trends in the industry in 2014 - 2019 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  -10 -10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  -10 -10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Rate of growth (decrease) in the average profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  -10 -10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  -2,6 -2,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)

Changes in legislation in 2021

Termination of the moratorium on initiation of bankruptcy proceedings, electronic financial statements, continuation of the “regulatory guillotine”, cancellation of the unified tax on imputed income, tax benefits.

What important legislative changes are awaiting business in 2021?

I. ACTIVITY OF COMPANIES

- January 7, 2021 is the date of the end of the moratorium on the initiation of bankruptcy proceedings for the business affected by the coronavirus.

Source: the Government Decree from October 1, 2020 No.1587 - From January 1, 2021, the scheduled inspections of small businesses have been suspended. Other business entities can be inspected remotely throughout the year, using audio and video communication. From July 31, 2021, instead of scheduled field inspections of companies and sole entrepreneurs, a new simplified form of control can be applied - an inspection visit, the period of which cannot exceed 1 working day. The period of standard documentary and field checks will not exceed 10 working days.

Source: the Government Decree from November 30, 2020 No. 1969 - From July 1, 2021, a new law on state and municipal control will come into force.

Source: the Federal Law from July 31, 2020 No. 248-FL - From July 2021, a ban is introduced on any control (supervisory) activity without advanced inclusion of information about it in the Unified Register of Control (Supervisory) Activities.

Source: Information by the Prosecutor General's Office from September 23, 2020 - Sole entrepreneurs using the simplified tax system and patent tax system will be able to apply tax holidays until 2024 under a number of conditions: a law on tax holidays has been adopted in the region; a sole entrepreneur is registered after the adoption of this law and operates in a preferential industry.

Source: the Federal Law from July 31, 2020 No. 266-FL - The right to use the patent tax system was granted to photographers, teachers, cooks and farmers.

Source: the Federal Law from February 6, 2020 No. 8-FL - According to the Order of the Ministry of Industry and Trade, from January 1, 2021, new forms of declaration and certificate of conformity will come into force. The Order is valid until January 1, 2027. Then another update should be expected.

Source: Orders of the Ministry of Industry and Trade from October 28, 2020 No. 3725 and No. 3726 - Until July 1, 2021, sole entrepreneurs having no stuff and providing services and sell goods of their own production are allowed to continue working without cash register equipment.

Source: the Federal law from June 6, 2019 No. 129-FL - As part of the implementation of the “regulatory guillotine” mechanism, some regulatory legal acts containing mandatory requirements for companies are no longer in force. For example, in ecology, energy, industrial safety, labor relations, labor protection.

Source: the Federal Law from July 31, 2020 No. 247-FL - The transition to a “registry model” in licensing certain types of activities begins. The model assumes the refusal to provide licenses in paper form in favor of making an entry on the grant of a license in the license register.

Source: the Federal Law from December 27, 2019 No. 478-FL

II. FINANCIAL ACCOUNTING

- Starting from the financial accounting for 2020, all organizations, including small businesses, are obliged to submit the reports in electronic form. Website of the Federal Tax Service provides an opportunity to fill out them in a personal account.

Source: the Federal Law from November 28, 2018 No. 444-FL - Starting from the reporting for 2020, information on the average number of employees should be submitted once a year as a part of a new calculation of insurance premiums. Reports on the average number of employees are canceled. In Globas, the information about the average number of employees is saved.

Source: the Federal Law from January 28, 2020 No. 5-FL - Starting from the financial accounting for 2021, the new Federal Accounting Standard 5/2019 "Inventories" will be applied, which is mandatory for all companies, except for budgetary organizations and micro-organizations with the right of simplified accounting. The standard has changed a lot in the accounting of materials, goods, finished products.

Source: the Order of the Ministry of Finance from November 15, 2019 No. 180n

III. TAX AND BANKING CONTROL

- From January 10, 2021, all cash transactions in the amount of 600,000 RUB or more, postal orders in the amount of 100,000 RUB or more, lease payments from 600,000 RUB and all settlements related to real estate transactions from 3 million RUB are subject to control. The limit for controlling operations related to the execution of the state defense order was also reduced from 50 million RUB to 10 million RUB. Previously, only transactions that were not due to the economic activities of the company or sole entrepreneur were subject to control. If suspicious transactions are identified, banks will report to the Federal Service for Financial Monitoring not only about the transactions, but also about other client actions that are associated with these transactions.

Source: the Federal Law from July 13, 2020 No. 208-FL - The Ministry of Finance has prepared revolutionary amendments to the Tax Code of the Russian Federation, which will expand the tax authorities' access to banking secrecy: they will be able to receive data on transactions on the accounts of banks and their clients not only upon request, as now, but within the framework of regular information exchange with the Central Bank. The Bank of Russia, in turn, will be able to receive information constituting tax secrets from the Federal Tax Service. If the amendments are adopted, already in 2021, the "exchange of secrets" will greatly facilitate the collection of information on all cash flows in the country and de facto will make it possible to control expenses and income of companies and individuals.

Source: Draft of the Federal Law "On Amendments to Articles 86 and 102 of Part One of the Tax Code of the Russian Federation" - From January 1, 2021, digital currency (hereinafter “DC”) and digital financial assets (hereinafter “DFA”) will start operating in Russia. DFAs are kept by the operator of the information system in which they are issued. The rights to DFA arise when a record is made in the information system about their belonging to an organization or sole entrepreneur. The Bank of Russia will maintain a register of operators and determine the types of DFA that only qualified investors will be able to acquire. So far, Russian organizations are prohibited from accepting DC as payment for goods, works and services; at the same time, DCs are equated to property. The groundwork for the future is obvious: the innovation will sooner or later lead to the cancellation of paper currency, which will become a turning point in the fight against corruption and money laundering.

Source: the Federal Law from July 31, 2020 No. 259-FL

In 2021, it is planned to consider important bills related to the adopted amendments to the Constitution of the Russian Federation; transfer of employees to permanent, temporary or combined remote work; application, verification and punishment for errors in working with cash register equipment and other changes.

We will continue to inform you about these and other innovations in legislation and analyze the consequences of their application.