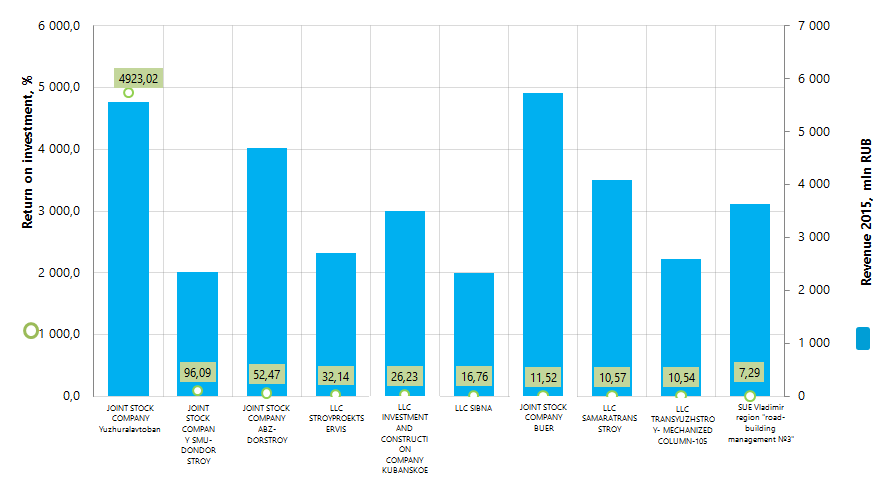

Return on investment of the largest Russian companies engaged in highway construction

Information agency Credinform prepared a ranking of the largest Russian companies engaged in highway construction.

Companies with the highest volume of revenue (Top-10), engaged in construction of roads and highways, were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2015). The enterprises were ranked by reduction of return on investment (Table 1).

Return on investment (%) is net profit to the sum of equity capital and long-term liabilities. This indicator shows the benefit from equity capital and funds attracted on a long-term basis. It also allows to assess a reasonability of attracting borrowings at a certain interest.

There is no standard value for profitability indicators, because they change in accordance with the industry the company operates in. The indicators of each particular company are reasonable to be examined in comparison with the industry indicators.

| Name, INN, region | Net profit 2015, mln RUB | Revenue, 2015, mln RUB | Revenue in 2015 to 2014, % | Return on investment, 2015, % | Solvency index Globas-i |

|---|---|---|---|---|---|

| JOINT STOCK COMPANY Yuzhuralavtoban INN 7445011899 Chelyabinsk region |

1 349,3 | 5 565,3 | 142 | 4 923,02 | 223 High |

| JOINT STOCK COMPANY SMU-DONDORSTROY INN 6164248080 Rostov region |

71,6 | 2 350,3 | 257 | 96,09 | 225 High |

| JOINT STOCK COMPANY ABZ-DORSTROY INN 7811099353 Saint-Petersburg |

68,6 | 4 702,3 | 145 | 52,47 | 231 High |

| LLC STROYPROEKTSERVIS INN 3812100526 Irkutsk region |

86,8 | 2 707,7 | 114 | 32,14 | 237 High |

| LLC INVESTMENT AND CONSTRUCTION COMPANY KUBANSKOE INN 0901050864 Karachayevo-Cherkessian Republic |

73,5 | 3 511,6 | 112 | 26,23 | 218 High |

| LLC SIBNA INN 3808047372 Irkutsk region |

77,6 | 2 330,8 | 146 | 16,76 | 247 High |

| JOINT STOCK COMPANY BUER INN 7816124109 Saint-Petersburg |

4,6 | 5 728,1 | 147 | 11,52 | 195 The highest |

| LLC SAMARATRANSSTROY INN 6376021161 Samara region |

27,6 | 4 097,2 | 127 | 10,57 | 299 High |

| LLC TRANSYUZHSTROY- MECHANIZED COLUMN-105 INN 7708811915 Belgorod region |

0,5 | 2 603,3 | 505 | 10,54 | 307 Satisfactory |

| SUE Vladimir region "road-building management №3" INN 3329000602 Vladimir region |

78,8 | 3 633,4 | 90 | 7,29 | 212 High |

The average value of return on investment for the highway construction companies of TOP-10 in 2015 amounted to 32,04. The same indicator of TOP-100 companies for the same period was 47,39 at the average, while the industry average indicator is 6,76.

The highest return on investment in 2015 was demonstrated by JOINT STOCK COMPANY Yuzhuralavtoban, leading in the sector by net profit and revenue. In 2015 the enterprise provided services by state and municipal contracts at the amount exceeding 2 bln RUB, and revenue was 5 565,3 mln RUB.

All companies of the ranking have positive return on investment values, that can indicates positive benefit from total volume of investment.

SUE Vladimir region "road-building management №3" with reduced net profit in 2015 is the last in the ranking. Moreover, the enterprise also decreased revenue by 10%.

Per totality of financial and non-financial indicators, nine companies have got the highest or high solvency index Globas-i, indicating their ability to timely and fully fulfill the liabilities.

LLC TRANSYUZHSTROY- MECHANIZED COLUMN-105 got satisfactory index due to the information about being a defendant in arbitration cases on collecting the debt and unclosed writs of execution.

Total revenue of TOP-10 companies in 2015 amounted to 37,2 bln RUB, that is by 79% higher than in 2014. In comparison with 2014, total net profit in 2015 was more than double increased.

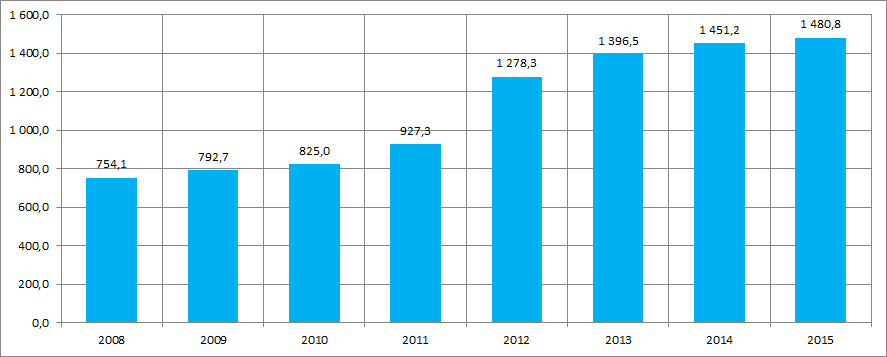

The industry in general shows positive dynamics. According to the Federal state statistics service (Rosstat), the length of general-purpose highways in 2015 was 1480,8 th km, exceeding the data of 2008 more than twice (Picture 2).

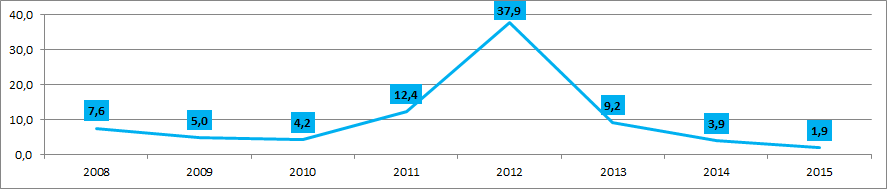

However, being at the maximum level in 2012, the growth rates begin to fall.

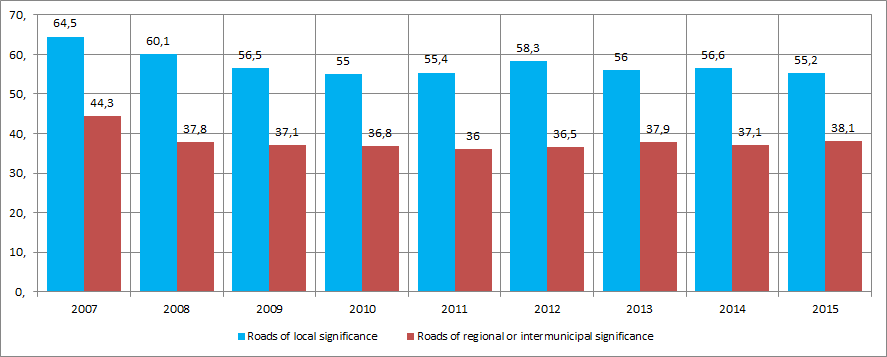

In recent years Rosstat records some growth in the share of general-purpose highways of regional significance, conforming the standards, and decrease in share of roads of local significance (Picture 4).

*) – Standards to the roads condition are specified by GOST P 50597-93 “Highways and streets. Requirements to the operational state, admissible under the terms of traffic safety” with ODN 218.0.006-2002 “Rules for diagnosis and assessment of state of the roads” approved by the order of the Ministry of Transport of the Russian Federation № IS-840-r.

Enterprises engaged in highway construction are distributed by regions quite equally. According to the Information and analytical system Globas-i, 100 companies largest in term of revenue for 2015 are registered in 43 regions. The majority of them are registered in the following regions (TOP-11 of regions):

| Region | Number of companies |

|---|---|

| Moscow | 12 |

| Saint-Petersburg | 10 |

| Rostov region | 6 |

| Samara region | 6 |

| Belgorod region | 5 |

| Altai territory | 4 |

| Republic of Tatarstan | 4 |

| Khabarovsk territory | 4 |

| Irkutsk region | 3 |

| Republic of Bashkortostan | 3 |

| Khanty-Mansi autonomous district - Yugra | 3 |

60% of companies largest in this industry are concentrated in 11 regions of the country.

Legislative amendments on the protection of competition

The legislative amendments on the protection of competition came into force in July 2016. The appropriate adjustments were added to the Federal Law №264-FZ of 03.07.2016 «On the amendments to the Federal Law «On the protection of competition and individual legislative acts of the Russian Federation» and the Federal Law №316-FZ of 03.07.2016 «On the amendments to the Code of Administrative Offences of the Russian Federation».

One of the most important innovations, decreasing the administrative burden on business activity in accordance with the Federal Law №264-FZ, is the implantation in practical use of immunities in regard to business entities in the part of possible improper use of their dominant position as well as in the part of making private anticompetitive agreements.

In particular, the position of legal entity cannot be recognized as dominant if among its founders or participants are one or more physical persons (including individual entrepreneurs) upon condition that its sales revenue for the last calendar year is not more than 400 mln RUB.

However this rule has the exceptions, according to which the immunities are not available for the following entities:

- business entities, included in the list, which is identified by Part 1 Article 9 of the Federal Law of 26.07.2006 № 135-FZ «On the protection of competition»;

- financial organizations;

- natural monopolies on goods market;

- business entities, among the founders or participants of which are legal entities;

- business entities, the share capital of which include the state participation of federal, regional or municipal level.

Besides, the border for transactions on purchase of shares, rights and property, needed for coordination with the Federal Antimonopoly Service of the Russian Federation, was raised to 400 mln RUB.

The unscheduled field checks in regard to small businesses can now only be carried out in coordination with the Prosecution Authorities at the place of business activity in accordance with the procedure established by the relevant order of The Prosecutor General's Office of the Russian Federation. Among exceptions are unscheduled field checks of natural monopolies and the same compliance verifications under cartel agreements.

For reference

According to the Federal Antimonopoly Service, as of 02.10.2015 more than 6 600 of entities were added to the Register of natural monopoly entities and more than 15 300 entities to the Registry of business entities with the market share more than 35%. To get acquainted with the list of these companies - please refer to the section Selections and lists - Lists we recommend of the Information and analytical system Globas-i.