Trends in the field of extraction and primary stone processing

Information Agency Credinform has prepared the review of trends in the field of extraction and primary stone processing.

The largest enterprises (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2016). The analysis was based on data of the Information and Analytical system Globas.

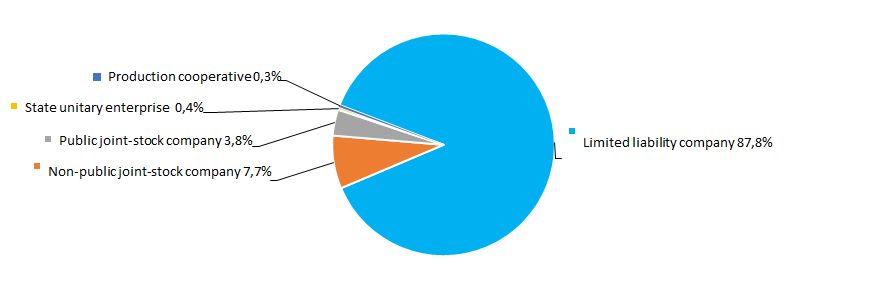

Legal forms

The most popular legal form among companies in the field of extraction and primary stone processing is Limited Liability Company. A significant place also take public and non-public joint stock companies (Picture 1).

Picture 1. Distribution of TOP-1000 companies by legal forms

Picture 1. Distribution of TOP-1000 companies by legal formsSales revenue

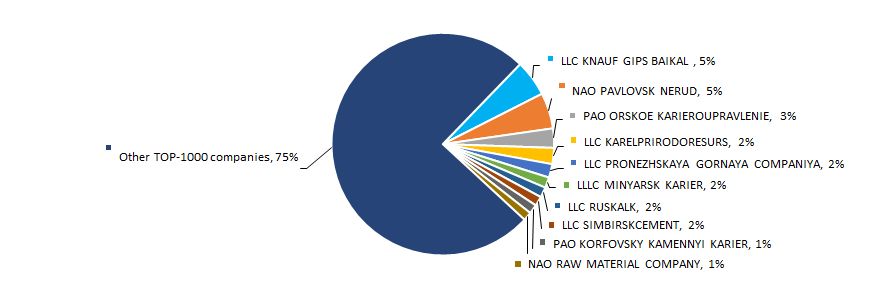

In 2016 total revenue of 10 largest companies amounted to 25% from TOP-1000 total revenue. This fact testifies rather high level of competition within the industry. In 2016, the largest company by total revenue is LLC KNAUF GIPS BAIKAL(Picture 2).

Picture 2. The shares of TOP-10 companies in TOP-1000 total revenue for 2016, %

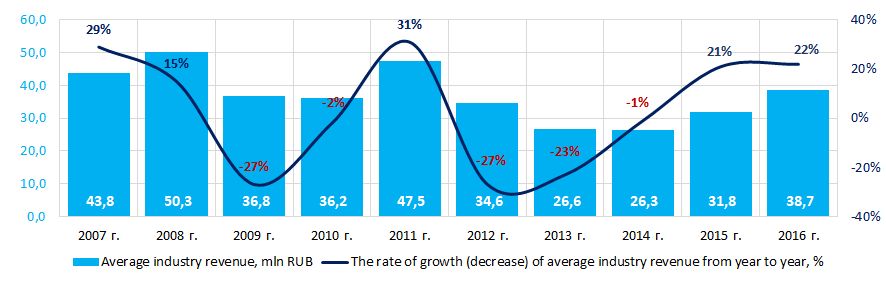

Picture 2. The shares of TOP-10 companies in TOP-1000 total revenue for 2016, %The best results by revenue among the industry for the ten-year period were achieved in 2008. The decrease in average industry indicators was observed within crisis phenomena in the economy in 2009 -2010 and 2012-2014 (Picture 3).

Picture 3. The change of average industry revenue of the companies in the field of extraction and primary stone processing in 2007-2016

Picture 3. The change of average industry revenue of the companies in the field of extraction and primary stone processing in 2007-2016Profit and loss

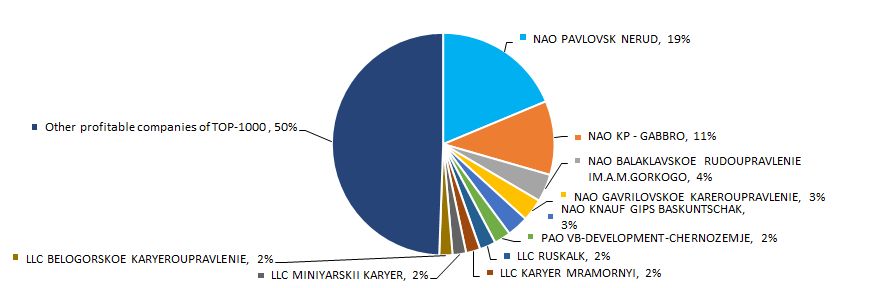

In 2016 profit of 10 largest companies amounted to 50% from TOP-1000 total profit. In 2016, the leading position by amount of profit takes NAO PAVLOVSK NERUD (Picture 4).

Picture 4. The shares of TOP-10 companies in TOP-1000 total profit for 2016, %

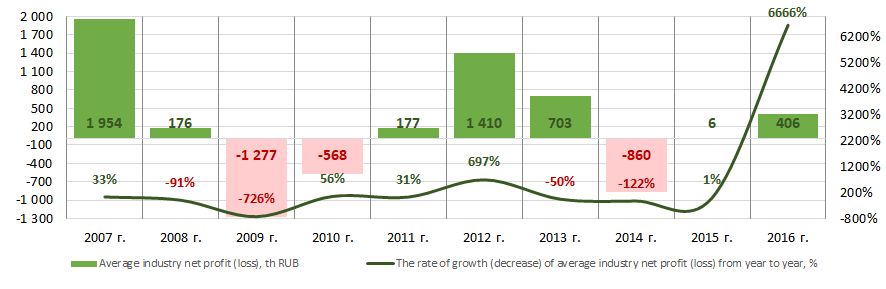

Picture 4. The shares of TOP-10 companies in TOP-1000 total profit for 2016, %For the ten-year period, the industry revenue values of companies in the field of extraction and primary stone processing are not stable. The decrease in indicators was observed in 2008 - 2009, 2013 - 2014 against the background of crisis phenomena in the economy. Thus, in 2009, 2010 and 2014 the average industry revenue was negative. The best results of the industry were in 2007 (Picture 5).

Picture 5. The change of average industry profit of the companies in the field of extraction and primary stone processing in 2007-2016

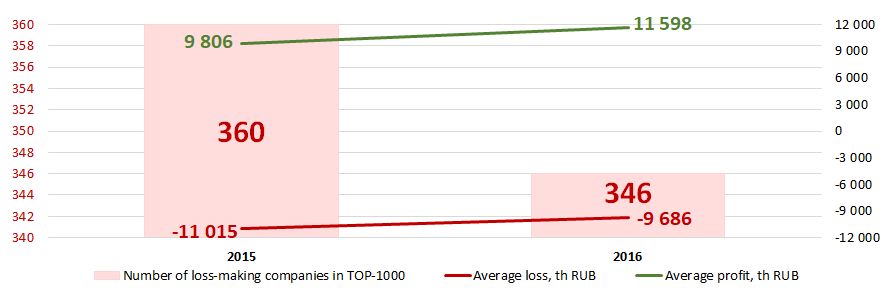

Picture 5. The change of average industry profit of the companies in the field of extraction and primary stone processing in 2007-2016In 2015, the TOP-1000 list included 360 loss-making companies. In 2016 the number of loss-making companies decreased to 346 or by 4%. Meanwhile, their average loss decreased by 12%. The average profit of other companies from TOP-1000 list increased by 18% for the same period (Picture 6).

Picture 6. The number of loss-making companies, average loss and profit within TOP-1000 companies in 2015 – 2016

Picture 6. The number of loss-making companies, average loss and profit within TOP-1000 companies in 2015 – 2016Main financial indicators

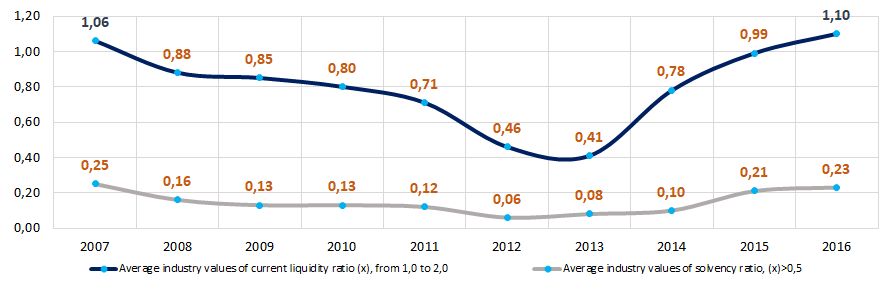

For the ten-year period, the average industry values of current liquidity ratio within 8 years were lower than recommended values - from 1,0 to 2,0. (yellow color on Picture 7).

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Solvency ratio (ratio of equity capital to total balance) shows the company’s dependence from external borrowings. The recommended value of the ratio is >0,5. The ratio value less than minimum limit signifies about strong dependence from external sources of funds.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. In 2016 the practical value of solvency ratio for companies engaged in extraction and primary stone processing is from -0,04 to 0,87.

For the ten-year period, the average industry values of the ratio were lower than recommended values and within practical values (Picture 7).

Picture 7. Changes of average industry values of current liquidity ratio and solvency ratio of companies engaged in extraction and primary stone processing in 2007 – 2016

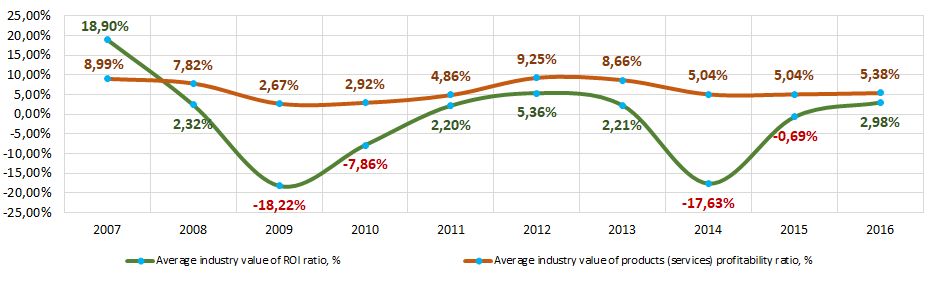

Picture 7. Changes of average industry values of current liquidity ratio and solvency ratio of companies engaged in extraction and primary stone processing in 2007 – 2016 For the last ten years, the instability of ROI ratio was observed. In the periods of crisis phenomena in the economy (2009, 2010, 2014, 2015) the ratios decreased to negative values (Picture 8). The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Within the same period, the products profitability ratio was rather stable (Picture 8). The greatest growth of indicators was observed in 2007, 2012 - 2013. Product profitability ratio is a ratio of sales profit to general expenses. In general, the profitability characterizes the production efficiency.

Picture 8. Changes of average industry values of ROI ratio and products (services) profitability ratio of companies engaged in extraction and primary stone processing in 2007 – 2016

Picture 8. Changes of average industry values of ROI ratio and products (services) profitability ratio of companies engaged in extraction and primary stone processing in 2007 – 2016 For the ten-year period, the values of assets turnover ratio were rather stable with smooth decrease and growth periods (Picture 9).

Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Equity turnover ratio is calculated as a ratio of revenue to yearly average sum of equity and demonstrates the company’s usage rate of total assets.

Within 2013 – 2016, the significant decrease in ratio values was observed (Picture 9).

Picture 9. Changes of average industry values of activity ratios of companies engaged in extraction and primary stone processing in 2007 – 2016

Picture 9. Changes of average industry values of activity ratios of companies engaged in extraction and primary stone processing in 2007 – 2016 Production structure

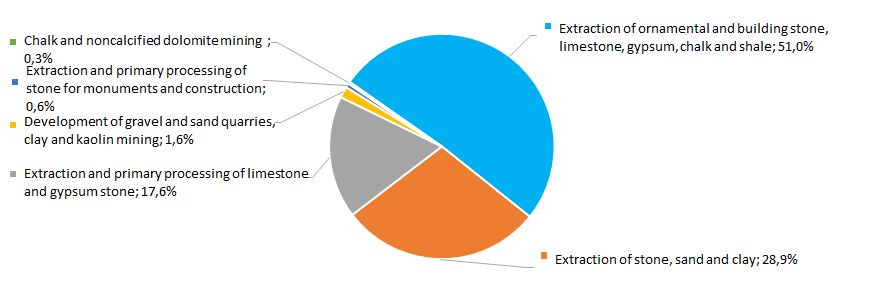

More than a half of TOP-1000 companies are engaged in extraction of ornamental and building stone, limestone, gypsum, chalk and shale (Picture 10).

Picture 10. Distribution of TOP-1000 companies by products type, %

Picture 10. Distribution of TOP-1000 companies by products type, %Dynamics of business activity

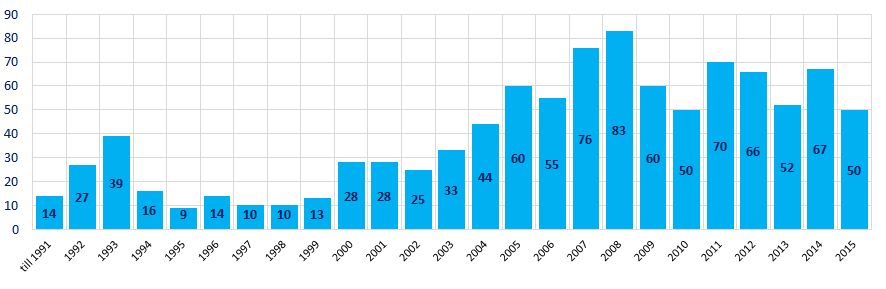

Over a 25-year period, the registered companies from TOP-1000 list are unequally distributed by the year of foundation.

Most of the companies engaged in extraction and primary stone processing were founded in 2008 (Picture 11).

Picture 11. Distribution of TOP-1000 companies by the year of foundation

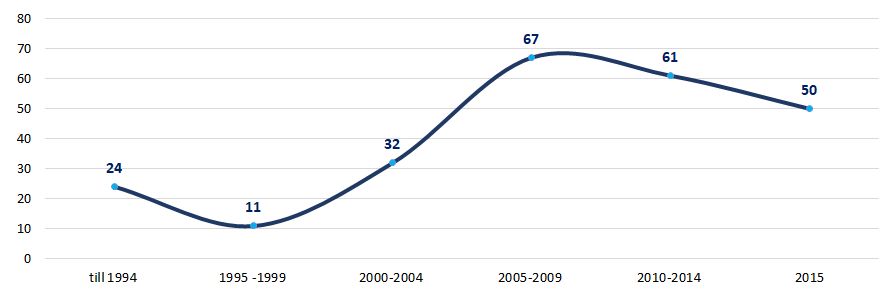

Picture 11. Distribution of TOP-1000 companies by the year of foundationThe most outstanding interest of business to extraction and primary stone processing was shown in 2005 – 2009, the average number of registered companies was 67 newly established companies (Picture 12).

Picture 12. Average number of TOP-1000 companies, registered within a year, by year of foundation

Picture 12. Average number of TOP-1000 companies, registered within a year, by year of foundation Main regions of activity

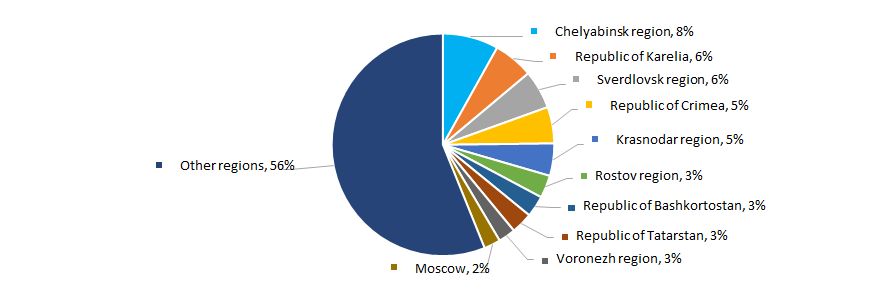

Companies engaged in extraction and primary stone processing are unequally distributed across the country. Most of them are registered in Chelyabinsk region and the Republic of Karelia in locations of the largest deposits of relevant natural resources (Picture 13). TOP-1000 companies are registered in 79 regions of the Russian Federation.

Picture 13. Distribution of TOP-1000 companies by Russian regions

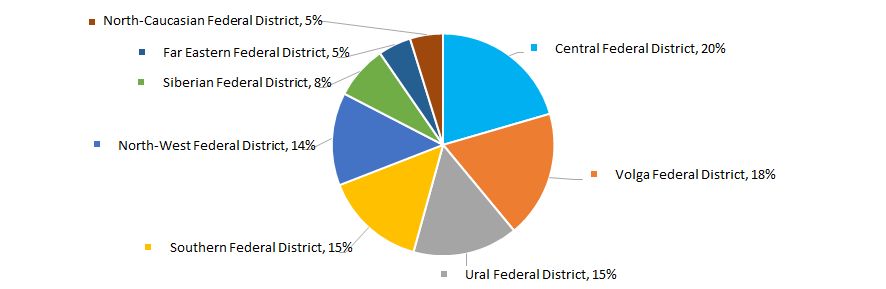

Picture 13. Distribution of TOP-1000 companies by Russian regionsMost of the companies engaged in extraction and primary stone processing are concentrated in Central Federal District (Picture 14).

Picture 14. Distribution of TOP-1000 companies by federal districts of Russia

Picture 14. Distribution of TOP-1000 companies by federal districts of RussiaThe share of companies from TOP-1000 list with branches or representative offices amounted to 2,5%.

Participation in arbitration proceedings

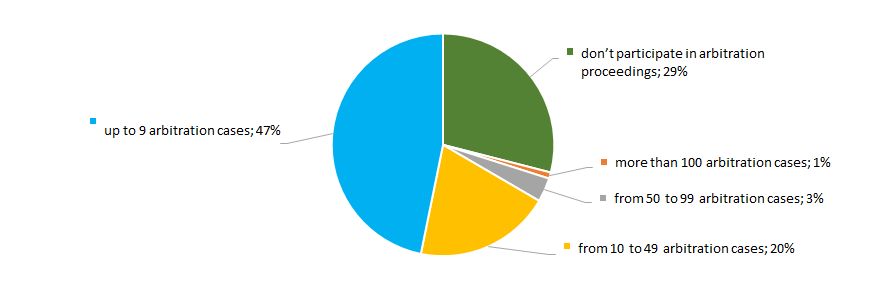

More than a quarter of industry companies don’t participate in arbitration proceedings. Most of the companies participate in arbitration proceedings inactively (Picture 15).

Picture 15. Distribution of TOP-1000 companies by participation in arbitration proceedings, %

Picture 15. Distribution of TOP-1000 companies by participation in arbitration proceedings, %Reliability index

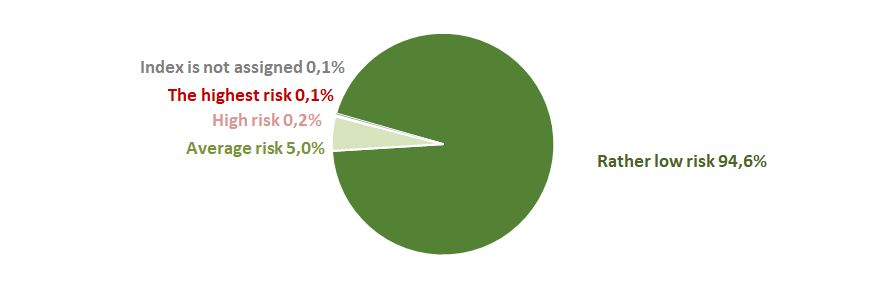

From the point of flight-by-night features or unreliable companies, the vast majority of industry companies show rather low level of cooperation (Picture 16).

Picture 16. Distribution of TOP-1000 companies by reliability index, %

Picture 16. Distribution of TOP-1000 companies by reliability index, %Financial position score

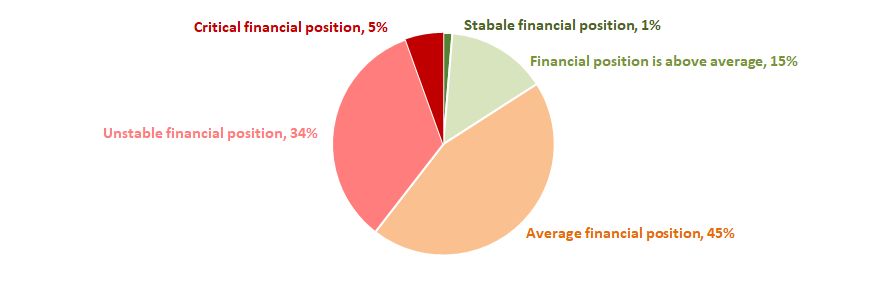

The assessment of company’s financial position shows that the greatest number of companies are in average financial position. However, more than one third of TOP-1000 companies are in unstable financial position (Picture 17).

Picture 17. Distribution of TOP-1000 companies by financial position score, %

Picture 17. Distribution of TOP-1000 companies by financial position score, %Liquidity index

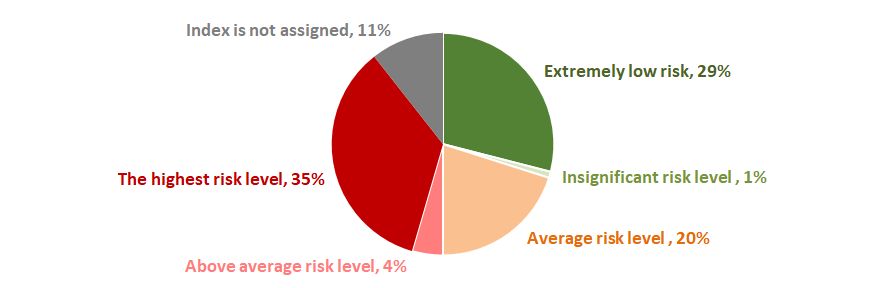

Significant part of industry companies (30%) have minimal or insignificant level of bankruptcy risk in the short-term period. However, the share of companies with risk level above average and the highest level amounted to 39% (Picture 18).

Picture 18. Distribution of TOP-1000 companies by liquidity index, %

Picture 18. Distribution of TOP-1000 companies by liquidity index, %Solvency index Globas

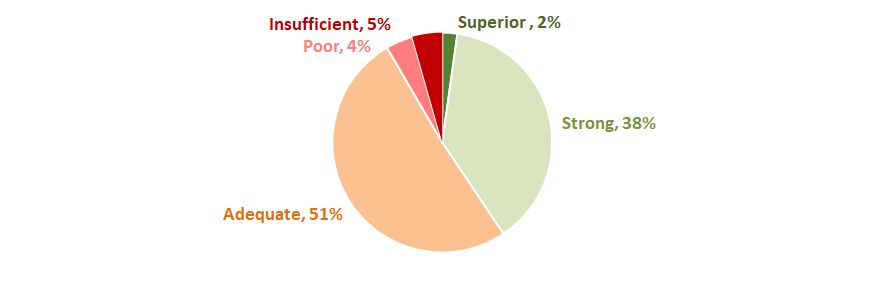

More than a half of TOP-1000 companies engaged in extraction and primary stone processing have adequate solvency index Globas (Picture 19).

In general, taking into account the main indexes, financial indicators and ratios, this may indicate about unfavorable trends in this field of activity.

Picture 19. Distribution of TOP-1000 companies by solvency index Globas

Picture 19. Distribution of TOP-1000 companies by solvency index GlobasCriminal liability for non-payment of insurance contributions was introduced

In August 2017 the Federal Law №250-FZ «On Amendments to the Criminal Code of the Russian Federation and the Criminal Procedure Code of the Russian Federation due to the improvement of legal regulation of relations connected with payment of insurance contributions to state non-budgetary funds» dated 29.07.2017 came into effect.

Evasion in payment of contributions is recognized as a crime and falls under the validity of articles of the Criminal Code 198 (Evasion of an individual from payment of taxes, fees and (or) an individual - payer of insurance contributions from payment of insurance contributions) and 199 (Evasion from payment of taxes, fees payable by an organization, and (or) insurance contributions payable by an organization - payer of insurance contributions).

Criminal liability for such crimes for enterprises and individuals occurs in cases if it is committed in a large or especially large amount. The rules of engagement to criminal responsibility and sanctions for crimes are set out in the table.

| Category of contributions’ payers | Rules of engagement to criminal responsibility | ||

| Large amount | Especially large amount | The share of unpaid taxes and fees from the amount payable to the budget | |

| Organization (Article 199 of the Criminal Code of the RF) | More than 15 million rubles or More than 5 million rubles for 3 years in a row | More than 45 million rubles or More than 15 million rubles for 3 years in a row | 25% - by large amount; 50% - by especially large amount |

| individual, including individual entrepreneur (Article 198 of the Criminal Code of the RF) | More than 2,7 million rubles or More than 900 million rubles for 3 years in a row | More than 13,5 million rubles or More than 4,5 million rubles for 3 years in a row | 10% - by large amount; 20% - by especially large amount |

| Category of contributions’ payers | Penalty (sanctions) | |

| Large amount | Especially large amount | |

| Organization, including officials or individual entrepreneurs | fine at a rate of 200 000 - 500 000 rubles or - in the amount of salary (income) for the period from 18 months up to 3 years, or forced labour up to 3 years with or without deprivation of the right to occupy determined posts (to engage in activity) up to 3 years, or deprivation of liberty up to 2 years with or without deprivation of the right to occupy determined posts (to engage in activity) up to 3 years | fine at a rate of 500 000 – 2 mln rubles or - in the amount of salary (income) for the period from 2 to 5 years, or forced labour up to 5 years with or without deprivation of the right to occupy determined posts (to engage in activity) up to 3 years, or deprivation of liberty up to 7 years with or without deprivation of the right to occupy determined posts (to engage in activity) up to 3 years |

| Individual | fine at a rate of 200 000 rubles or - in the amount of salary (income) for the period up to 2 years, or compulsory community service up to 360 hours | fine at a rate of 300 000 rubles or - in the amount of salary (income) for the period up to 3 years, or forced labour up to 1 year, or deprivation of liberty up to 1 year |

| Organizations or individuals that have committed a crime for the first time are exempted from criminal liability if they repay the amounts of arrears, penalty fees and fines in full in accordance with the Tax Code of the RF. | ||

Unpaid amounts may include arrears both in respect of insurance contributions and in respect of taxes and fees.

Thus, the responsibility for non-payment of insurance contributions is equated with responsibility for non-payment of taxes, that was predictable after the administration of insurance contributions to state non-budgetary funds was transferred to the Federal Tax Service from January 1, 2017 (s. more in the article). Such tightening of responsibility will certainly affect the increase in fees to social funds, but also the risk of excessive pressure from regulatory oversight should not be ruled out.

It should be also remembered that, in addition, since October 1, 2017, the procedure for charging penalty fees for organizations has changed. So, in cases of delay in payment up to 30 calendar days the penalty fee is calculated on account of 1/300 of the refinancing rate the Bank of Russia, and starting from the next (i.e. 31st) day, the penalty fee will be 1/150 of the discount rate.